- United States

- /

- Auto

- /

- NYSE:NIO

NIO (NIO): Evaluating Valuation After a 76% Surge in November 2025 Vehicle Deliveries

Reviewed by Simply Wall St

NIO (NIO) just posted a 76% jump in November deliveries to 36,275 vehicles, with growth spread across its NIO, ONVO, and FIREFLY brands, giving investors fresh fundamental data to weigh against the stock’s recent slump.

See our latest analysis for NIO.

Even with this jump in deliveries, NIO’s 30 day share price return of minus 18.34 percent and 90 day share price return of minus 22.50 percent show that momentum has been fading. Its 1 year total shareholder return of 11.53 percent suggests a still fragile longer term recovery.

If NIO’s latest numbers have you rethinking the EV space, it could be a good moment to scan other auto opportunities using our auto manufacturers.

With deliveries surging but the share price still lagging, investors now face a key question: Is NIO trading at a meaningful discount to its fundamentals, or is the market already pricing in the company’s next leg of growth?

Most Popular Narrative Narrative: 25.4% Undervalued

With NIO last closing at $5.03 against a narrative fair value near the mid six dollar range, the story points to sizable upside if its growth roadmap lands as expected.

In-house technological advancements, including proprietary smart driving chips and high integration 900V architecture, are reducing production costs, supporting aggressive but profitable pricing, and setting the stage for higher net margins as scale increases.

Want to see what kind of revenue climb and margin shift would justify that future earnings step change and rich profit multiple expectations? Unlock the full playbook that underpins this upside case and see how ambitious growth, margin repair, and valuation all fit together.

Result: Fair Value of $6.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net losses and intensifying EV competition could derail margin progress and could force analysts to reassess both growth assumptions and NIO’s upside case.

Find out about the key risks to this NIO narrative.

Another Lens on NIO’s Value

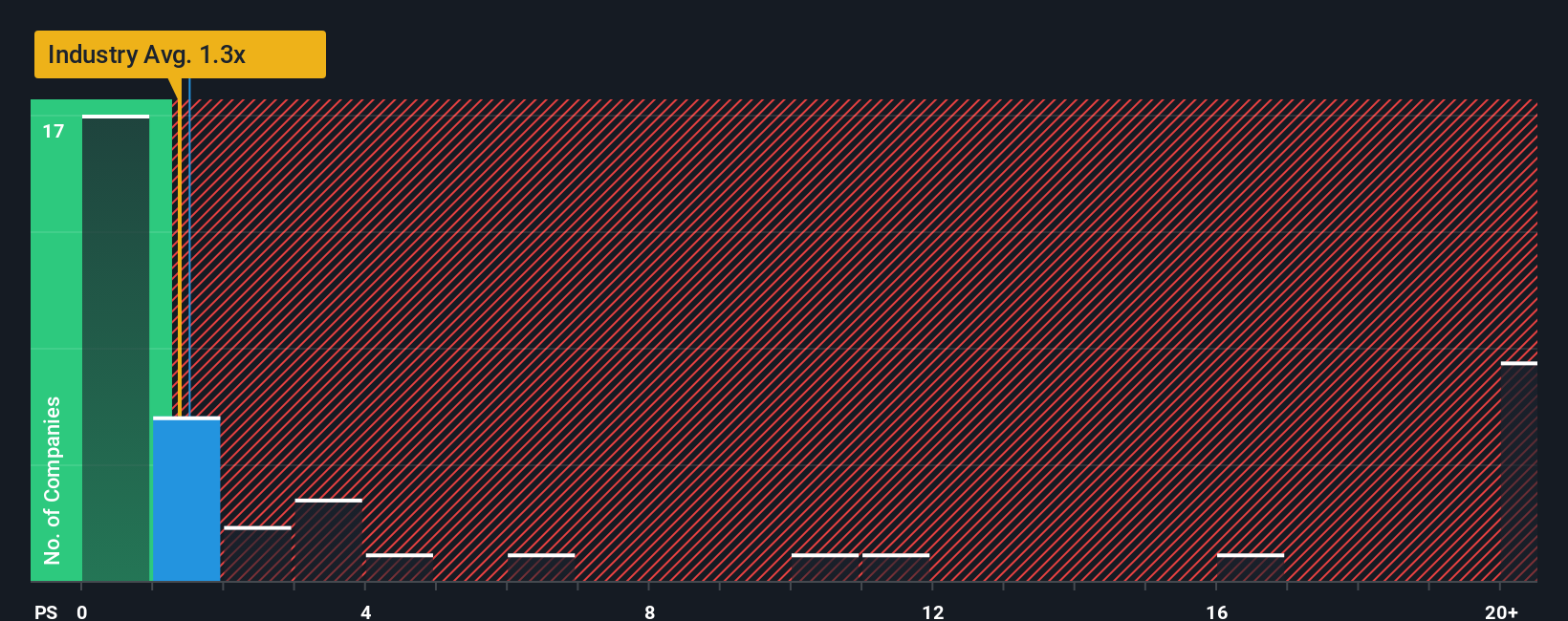

On sales, NIO looks pricey, trading at 1.3 times revenue versus 0.8 times for the US auto industry and a fair ratio of 1.1. Yet it is cheaper than peers at 1.8 times. Is this a justified premium, or a valuation risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NIO Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your NIO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put NIO in context by comparing it with fresh opportunities our screener has already filtered, so you are not guessing in the dark.

- Capture potential mispricings by scanning these 908 undervalued stocks based on cash flows that pair solid cash flows with attractive entry points.

- Target structural growth by reviewing these 30 healthcare AI stocks transforming patient care, diagnostics, and medical decision making.

- Ride early momentum by assessing these 80 cryptocurrency and blockchain stocks positioned to benefit from real world blockchain adoption and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)