- United States

- /

- Auto

- /

- NYSE:NIO

Is There Now an Opportunity in NIO After Recent 15% Price Surge?

Reviewed by Simply Wall St

Thinking about what to do with your NIO shares or wondering if now is the right time to invest? You are not alone. NIO has been on quite a ride lately, and investors across the board are eyeing the stock’s recent swings with curiosity and maybe a bit of FOMO. Over the past year, NIO has returned more than 31%. However, if you zoom out to three or five years, the picture looks less rosy with significant declines. This reminds us just how volatile growth stocks in the electric vehicle space can be.

The past thirty days have brought a nearly 15.5% bump, and year-to-date, NIO’s stock price has notched an impressive 11.4%. These moves are not random. Shifts in investor sentiment have tracked news around EV demand in China, production milestones, and the company’s ongoing battle for profitability. When the market sees stronger revenue growth, such as NIO’s 18.3% annual jump or a significant narrowing of losses, optimism increases, even if the company remains unprofitable for now.

Of course, price gains and optimism are only part of the story. Whether NIO is undervalued or overhyped is still a hot question, and that is where valuation checks come into play. On our scorecard, NIO clocks in at a modest 2 out of 6 on the undervaluation scale. So how do we get to that number, and does it really tell the whole story? Let us dive into some popular valuation methods and, at the end, explore a perspective that might offer even sharper insight.

NIO delivered 31.7% returns over the last year. See how this stacks up to the rest of the Auto industry.Approach 1: NIO Cash Flows

The Discounted Cash Flow (DCF) approach estimates what a company is worth by projecting its future free cash flows and discounting them back to today's value. This method helps investors understand the true, intrinsic value of a stock beyond short-term market swings.

Currently, NIO's last twelve months' Free Cash Flow is negative 19.4 Billion CN¥, showing the company is still burning cash as it invests in growth. Analysts anticipate this will turn positive over time, projecting a Free Cash Flow of about 23.5 Billion CN¥ by 2035. These optimistic long-term estimates reflect expectations for NIO to scale up significantly in the next decade.

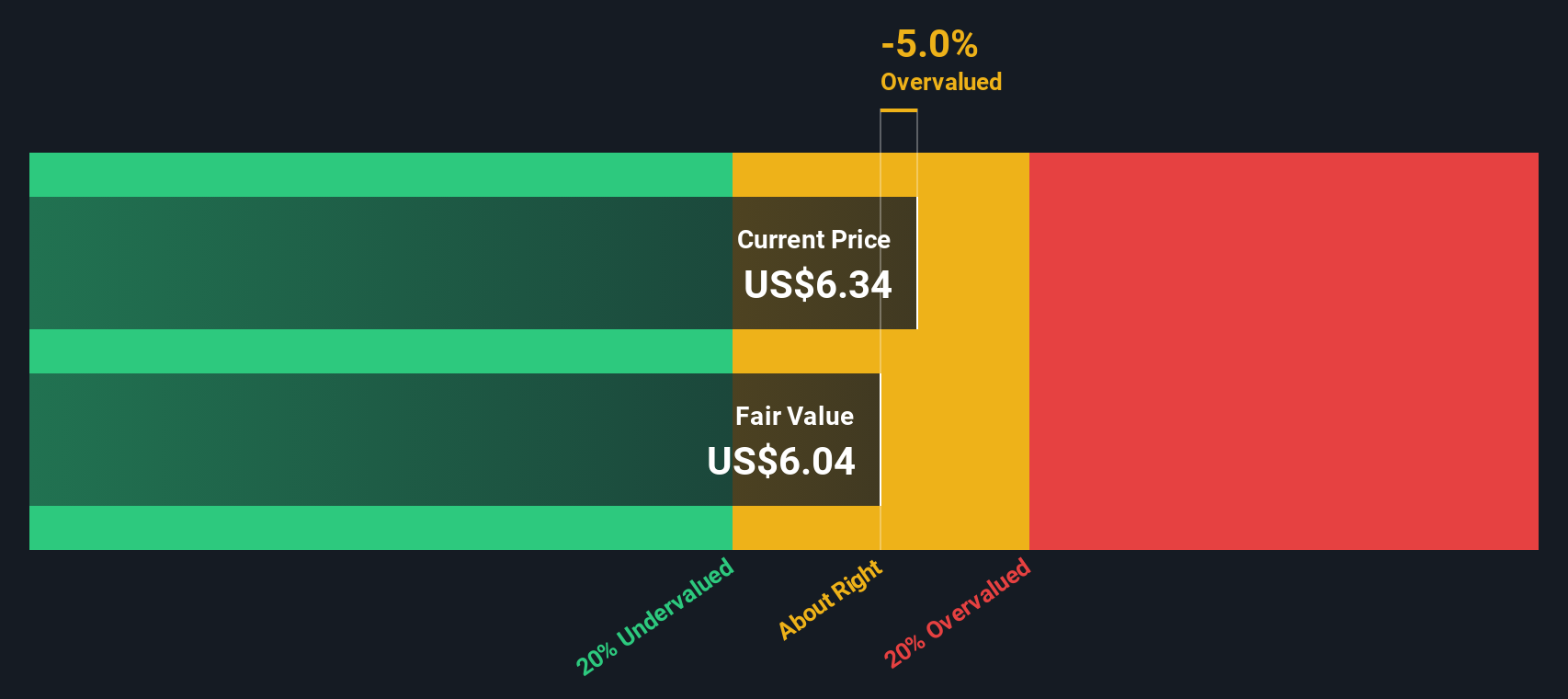

Based on this two-stage Free Cash Flow to Equity model, the DCF-derived fair value for NIO shares is $6.03. Comparing this intrinsic value to the current market price, the calculation suggests NIO is 15.9% undervalued. In other words, the stock currently trades below what its long-term cash generation potential would imply.

Result: UNDERVALUED

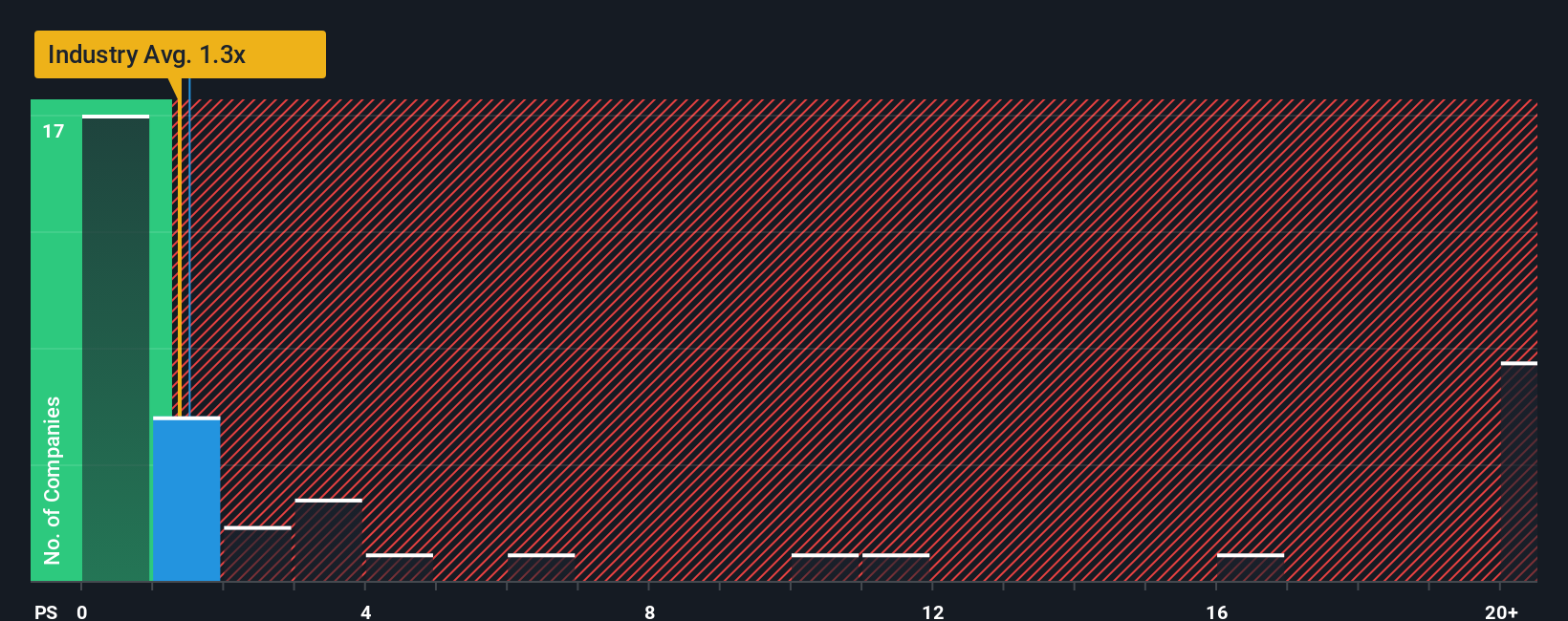

Approach 2: NIO Price vs Sales

The Price-to-Sales (P/S) ratio is often used to value companies that are not yet consistently profitable, as it focuses on revenue rather than earnings. For high-growth companies like NIO, this multiple allows investors to gauge how much they are paying for each dollar of sales. This approach is particularly useful when profits are slim or negative due to ongoing investments in growth.

Growth expectations and risk factors play a big role in determining what is considered a fair P/S ratio. When investors expect higher revenue growth or perceive lower business risk, they tend to accept a higher P/S multiple. Conversely, if a company’s growth prospects are weakening or risks are increasing, a lower multiple is typically seen as justified.

NIO’s current P/S ratio is 1.20x, which is closely in line with the Auto industry average of 1.20x and considerably below the peer group average of 3.43x. The company’s Fair Ratio, a proprietary Simply Wall St metric that blends growth, profitability, risk, and market comparisons, is 1.08x. With the P/S ratio just above the Fair Ratio and nearly matching the industry average, NIO appears reasonably valued compared to both the broader market and its own fundamentals.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your NIO Narrative

Beyond traditional valuation ratios, Narratives offer an innovative, user-friendly way to make smarter investment choices by connecting a company’s story directly with its financial forecasts and fair value.

A Narrative lets you combine your own perspective about NIO, such as beliefs about future revenue growth, margins, or market potential, with a transparent forecast. This turns your story into a data-driven valuation and clear price target.

On the Simply Wall St platform, Narratives are intuitive to create, share, and compare, making it easy for any investor to see how market news, earnings, or other updates dynamically adjust their fair value in real time.

This empowers you to make buy or sell decisions by comparing your Narrative’s Fair Value with today’s share price. You do not need complex spreadsheets and can benefit from insight provided by a global community of investors.

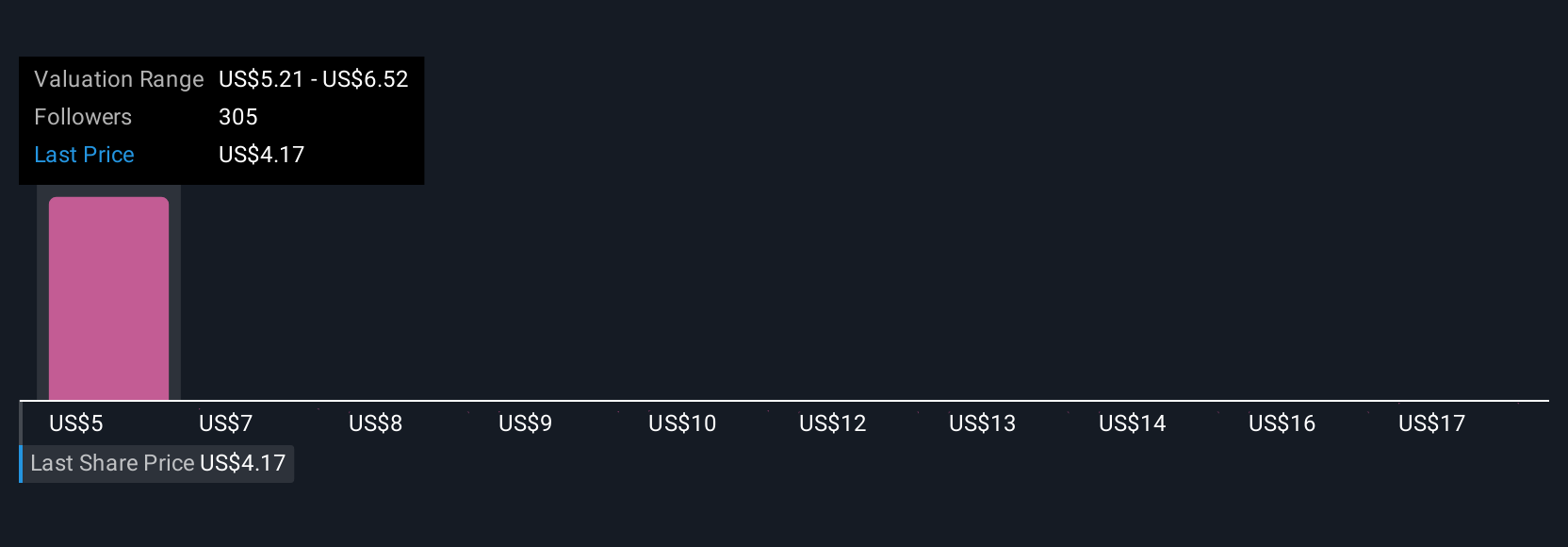

For example, while some NIO bulls see fair value as high as $8.11, reflecting optimism about premium EV growth, more cautious investors might set their price target closer to $3.00. This highlights how beliefs and new information can shape your outlook.

For NIO, we’ll make it really easy for you with previews of two leading NIO Narratives: 🐂 NIO Bull Case Fair Value: $6.24 Undervalued by: 18.8% Revenue Growth Forecast: 23.8% - NIO’s innovative battery solutions and unique Battery-as-a-Service (BaaS) model aim to drive accessibility and customer loyalty in premium EV markets. - Expansion in China and Europe is creating new growth opportunities, with vehicle deliveries expected to rise. However, the company has yet to become profitable. - The stock is seen as a potential turnaround story due to its strong brand, expansion efforts, and the ongoing shift toward electric vehicles worldwide. 🐻 NIO Bear Case Fair Value: $4.89 Overvalued by: 3.7% Revenue Growth Forecast: 26.3% - NIO’s growth is driven by new model launches, strategic partnerships, and international expansion, but it faces significant cost and competition challenges. - The narrative assumes future margin improvement and revenue growth, but also highlights execution risks, cash flow volatility, and increasing share dilution. - With the current share price close to analyst targets, consensus suggests NIO is fairly priced. However, risks could limit upside if not well managed. Do you think there's more to the story for NIO? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives