- United States

- /

- Auto

- /

- NYSE:NIO

Is NIO A Bargain After Recent Slide And DCF Value Suggesting Higher Price?

Reviewed by Bailey Pemberton

- Wondering if NIO at around $5 is a beaten down bargain or a value trap? You are not alone, and this breakdown will help you see where the upside and risks really sit.

- Despite being up 10.5% year to date and 11.5% over the last year, the stock has slid 22.0% in the last 30 days and is almost flat over the past week, a pattern that hints at shifting sentiment and uncertainty around the story.

- Recent headlines have focused on NIO's ongoing push to expand its EV lineup and partnerships around charging and battery swap infrastructure, alongside renewed discussion of how Chinese EV makers fit into global regulatory and competitive pressures. Together, these themes help explain why the market keeps reassessing NIO's long term growth runway and risk profile.

- On our checklist of 6 valuation tests, NIO scores a 3 out of 6, which suggests some metrics flag undervaluation while others still look stretched. Next we will unpack what each valuation approach says and then come back to a more powerful way to think about NIO's true worth.

Approach 1: NIO Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what NIO is worth today by projecting its future cash flows and then discounting those projections back to a present value. In NIO's case, the latest twelve month free cash flow is roughly CN¥19.7 billion outflow, reflecting heavy investment and operating losses. Analysts expect this to gradually flip into positive territory, with projections rising into the low single digit billions of CN¥ within the next few years and reaching about CN¥21.2 billion of free cash flow by 2035, based on a 2 stage Free Cash Flow to Equity model that extends analyst estimates with longer term growth assumptions.

Pulling these cash flows back to today's money suggests a fair value of about $6.42 per share for NIO, versus a current price near $5. This implies the stock trades at roughly a 21.6% discount to its DCF based intrinsic value, indicating that the shares may currently be undervalued relative to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIO is undervalued by 21.6%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: NIO Price vs Sales

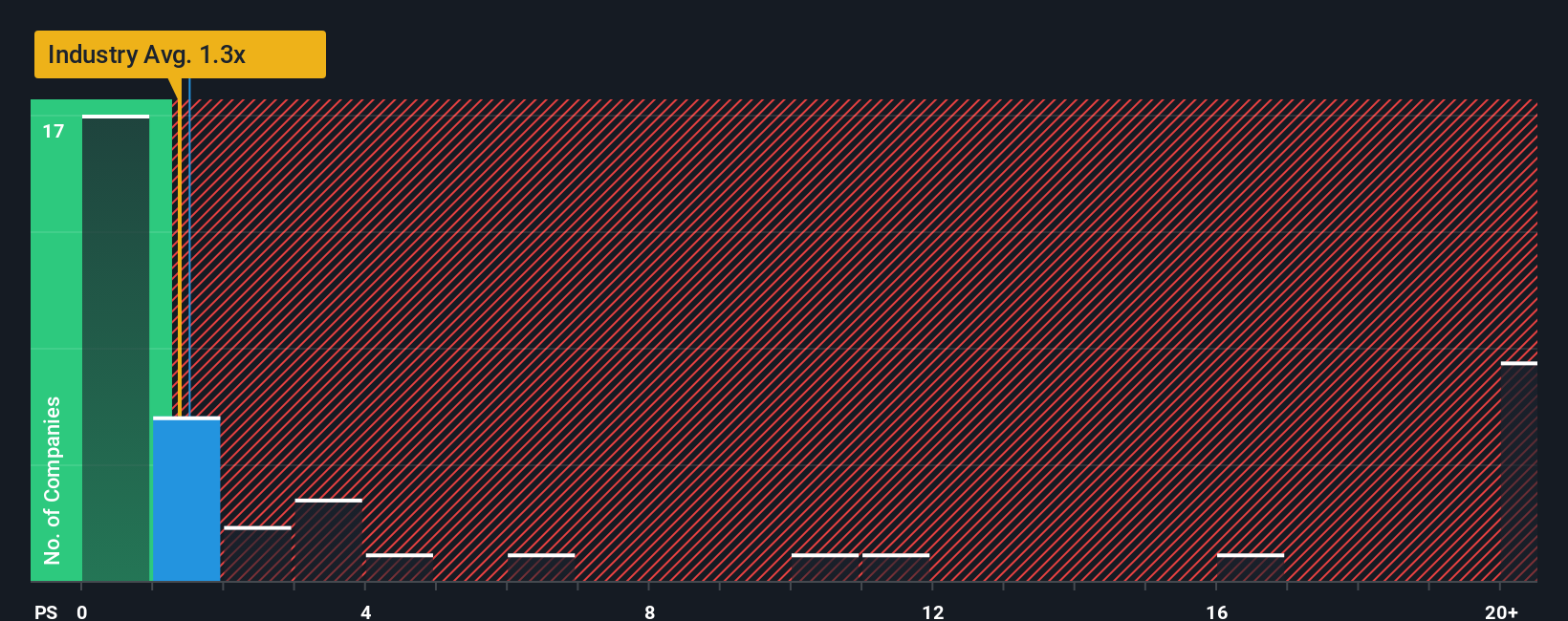

For many high growth or not yet profitable companies, the Price to Sales ratio is often a more useful yardstick than earnings based metrics, because revenue is less volatile and less distorted by early stage investment and accounting charges. In general, faster growth and lower risk warrant a higher sales multiple, while slower or more uncertain growth justifies a lower, more conservative ratio.

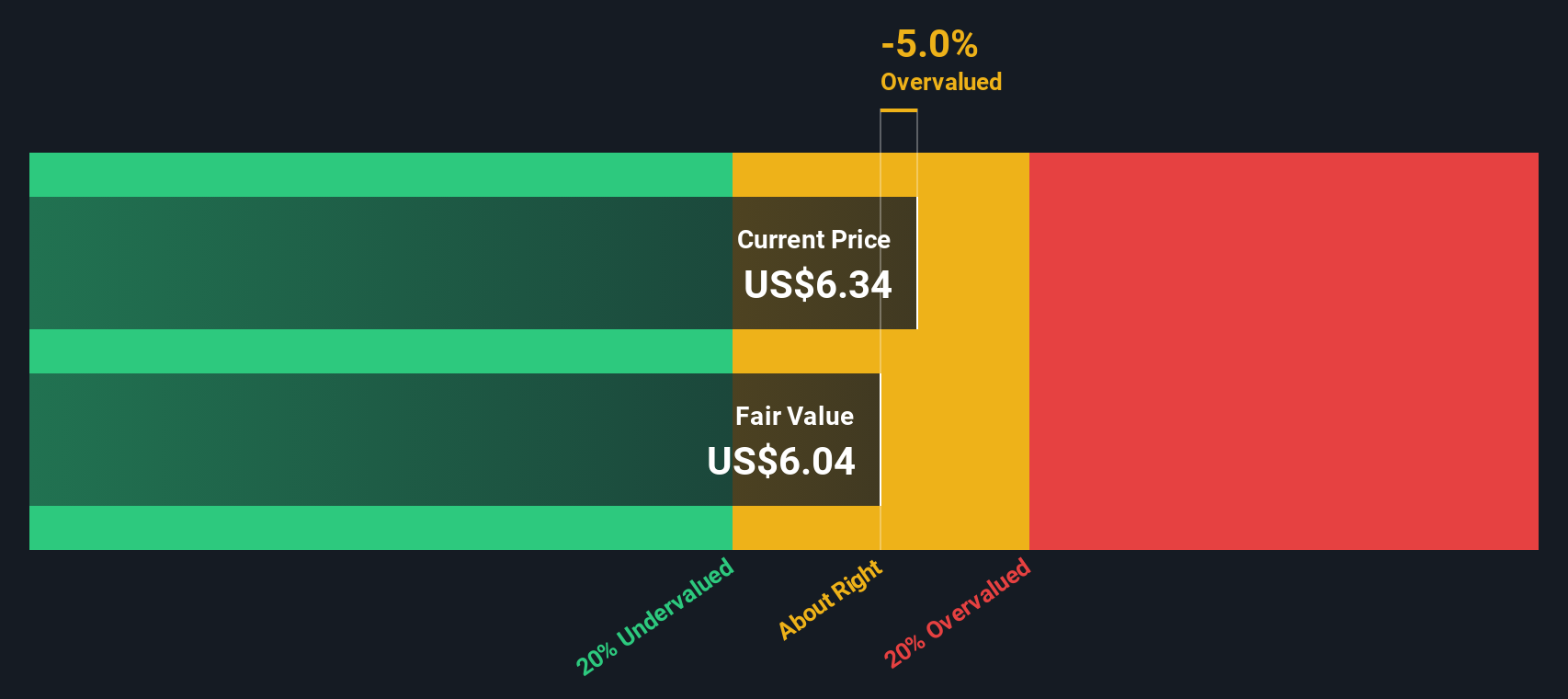

NIO currently trades on a Price to Sales ratio of about 1.34x, compared with an Auto industry average of roughly 0.85x and a broader peer group closer to 1.68x. Simply Wall St’s proprietary Fair Ratio for NIO is 1.11x, which reflects what investors might reasonably pay for each dollar of NIO’s sales once you factor in its growth outlook, margins, size and risk profile. This tailored Fair Ratio is more informative than a simple industry or peer comparison because it adjusts for the specific characteristics that make NIO different from both legacy automakers and faster growing EV peers. With the market currently valuing NIO at 1.34x sales versus a Fair Ratio of 1.11x, the shares screen as slightly expensive on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIO Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of NIO’s story with a set of numbers covering its future revenue, earnings, margins and resulting fair value. A Narrative on Simply Wall St’s Community page is your own investing storyline, where you spell out how you think NIO’s products, competitive position and execution will play out, link that story to a financial forecast, and then see what fair value that implies so you can compare it with today’s share price to decide whether NIO looks like a buy, hold, or sell. Narratives are dynamic, automatically updating your forecast and fair value when new information like earnings releases, delivery updates or major news hits. This helps keep your decision making current without you rebuilding a model from scratch. For example, one investor might build a bullish NIO Narrative that assumes revenue growth close to 30 percent a year and a fair value near the top of recent analyst targets, while a more cautious investor might lean on slower growth and thinner margins that push fair value toward the low end of the target range instead.

Do you think there's more to the story for NIO? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)