- United States

- /

- Auto

- /

- NYSE:NIO

Has NIO’s 19% Rally Missed the Mark After China’s EV Policy Shift?

Reviewed by Bailey Pemberton

If you have been keeping an eye on NIO, you already know that this stock comes with a healthy dose of excitement and risk. The past year alone saw NIO climb nearly 20%, and if you had jumped on board since January, your gains would be a striking 64%. Yet, this is not the whole story. Zoom out to the last three years, and NIO is still down 41.6%, and over the past five years, the returns sink further into negative territory at -73.4%. The short term has been a bit shaky too, with a -5.4% dip just in the past week. All of this paints a picture of a stock that is far from predictable and often a lightning rod for changing market sentiment.

These swings are not happening in a vacuum. Recent shifts in China’s electric vehicle policy and renewed optimism about supply chains have stoked fresh investor interest in EV makers like NIO, boosting its shares in the last month by 18.8%. Still, it is clear that broader market forces and concerns about competition and profitability are influencing the longer-term view. For investors trying to make sense of these signals, a closer look at valuation is essential. On a standard six-point checklist for undervaluation, NIO currently hits just 1 out of 6. This score hints at pockets of opportunity, but also some red flags.

So, before making your next move with this stock, let us dig into what these valuation measures really say, where they fall short, and most importantly, how you can take your analysis a step further to get a more complete picture.

NIO scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NIO Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. For NIO, this approach starts with its latest trailing twelve-month Free Cash Flow (FCF), which stands at a deficit of about CN¥20.2 Billion. While that figure is deep in negative territory, analyst estimates anticipate rapid improvement over the coming years. Projections show a positive FCF of roughly CN¥8.3 Billion by 2029.

NIO's cash flow projections for the next decade illustrate a dramatic turnaround. Negative FCF in the near term is expected to shift to strong gains as the company matures. Although analysts provide forecasts up to five years ahead, further estimates are extrapolated, showing FCF reaching over CN¥21 Billion by 2035. These figures highlight how aggressive the growth assumptions are underlying this model, especially considering NIO's challenging starting point.

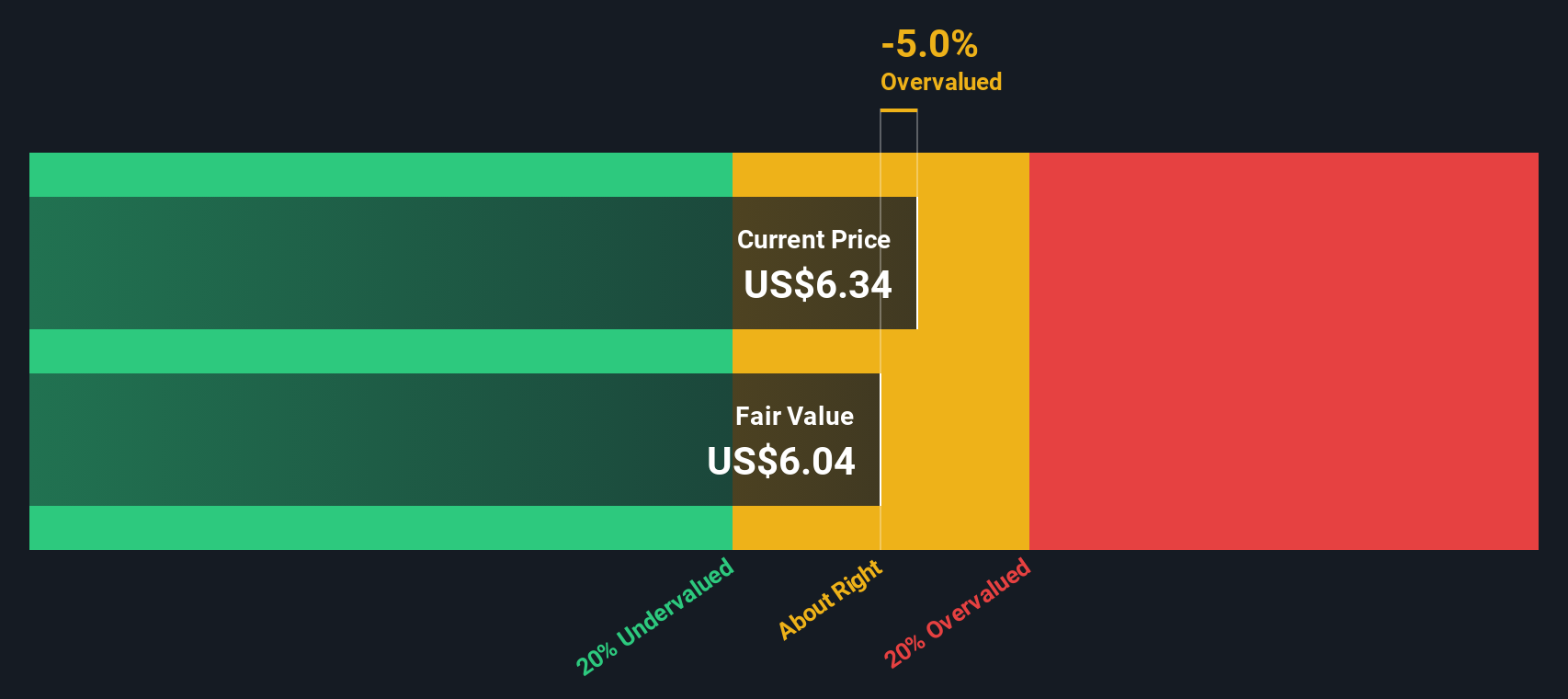

The outcome of this analysis is that the DCF model assigns NIO a fair value estimate of $6.25 per share. This places current market pricing at a 19.4% premium to the model's intrinsic value, signaling that NIO stock is overvalued according to this methodology.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NIO may be overvalued by 19.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NIO Price vs Sales

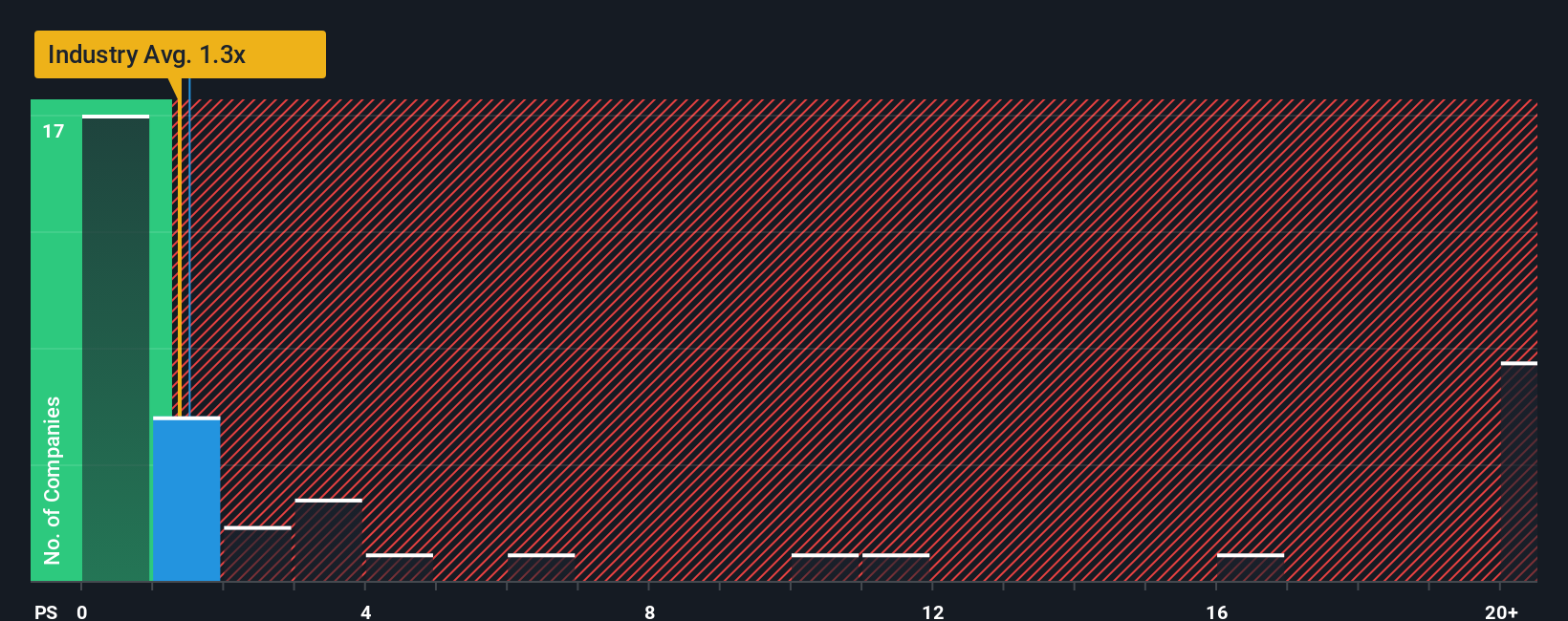

The Price-to-Sales (P/S) ratio is widely used as a valuation metric for companies like NIO that are not yet profitable. It allows investors to gauge how much they are paying for each dollar of revenue, which is especially helpful when earnings are negative or highly volatile. Growth prospects and risk factors play a major role in determining what a “fair” P/S ratio should be. Companies expected to grow rapidly or with less risk command higher multiples, while mature or riskier firms typically trade at lower ratios.

Currently, NIO trades at a P/S ratio of 1.9x. To place this in context, the industry average P/S for auto stocks is about 1.4x, while peer companies have a higher average of 3.5x. By these benchmarks, NIO looks somewhere in the middle, neither especially cheap nor obviously expensive at first glance.

However, Simply Wall St’s Fair Ratio provides a more tailored benchmark for NIO, accounting for specifics like expected growth, risk, profit margins, industry trends, and market cap. In NIO’s case, the Fair Ratio is 1.5x, a more nuanced estimate of what investors should be comfortable paying for this stock right now. Unlike generalized industry or peer comparisons, this figure is custom-fit to NIO’s current situation and future outlook.

With NIO trading at 1.9x, slightly above its Fair Ratio of 1.5x, the stock appears to be modestly overvalued on a price-to-sales basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NIO Narrative

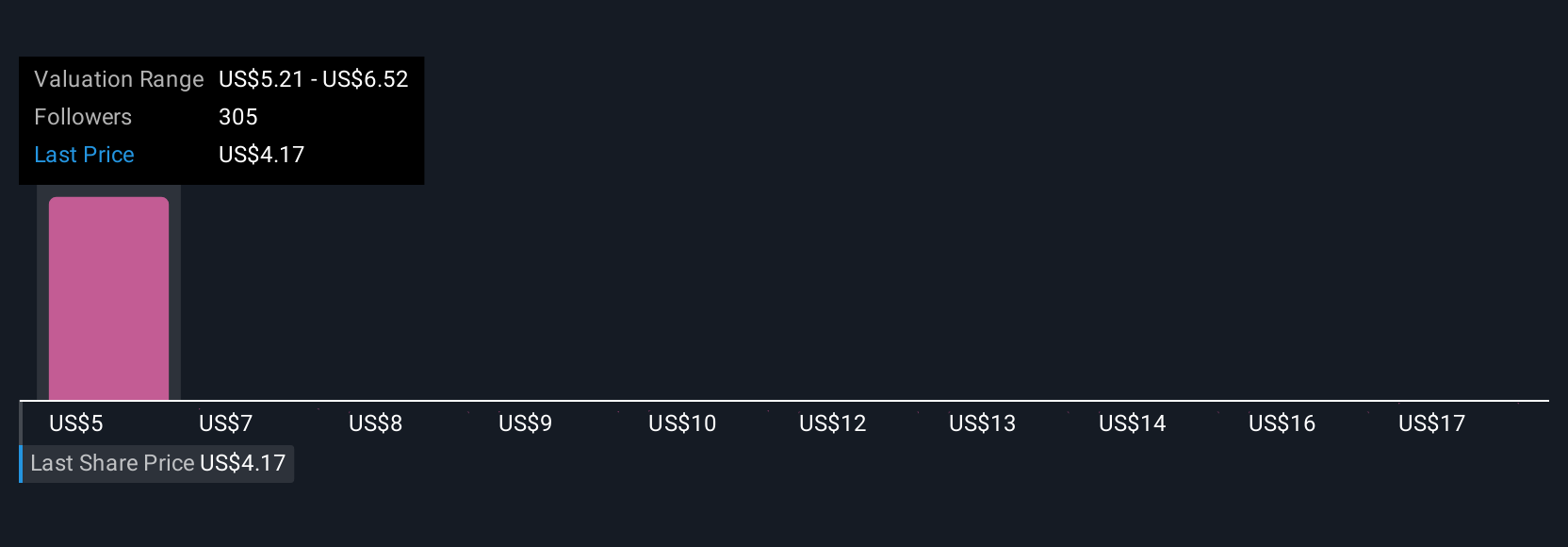

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story—your perspective on a company and its future—expressed in numbers: how you expect revenue, margins, and valuation to evolve, and what you think is a fair price. Narratives connect the company’s unique story to a financial forecast and, crucially, to an actionable fair value, making it much more than numbers alone.

Now, any investor can create, follow, or compare Narratives on Simply Wall St’s Community page, where millions gather to share their views. Narratives make it easy to see the logic behind a valuation and help you make better buy and sell decisions by comparing your Narrative’s Fair Value with today’s market price. As the facts change, so can your Narrative. These stories and forecasts update automatically with new news or earnings, so you’re never left behind.

For example, some investors believe NIO could be worth as much as $9 if it quickly captures market share and profits follow, while others see $3 as more realistic if growth stumbles. Narratives are your personal investing toolkit for turning uncertainty into well-grounded decisions.

Do you think there's more to the story for NIO? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives