- United States

- /

- Interactive Media and Services

- /

- NYSE:VTEX

3 Penny Stocks With Market Caps Exceeding $700M

Reviewed by Simply Wall St

The U.S. stock market recently experienced a mix of gains and declines, with major indices like the S&P 500 and Nasdaq facing their third consecutive weekly drop. In such fluctuating conditions, investors often seek opportunities in smaller or newer companies that might offer growth potential at lower price points. Penny stocks, despite the term's outdated feel, remain a relevant investment area; when these stocks are backed by solid financials and strong fundamentals, they can present hidden opportunities for significant returns.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7902 | $5.74M | ★★★★★★ |

| Safe Bulkers (NYSE:SB) | $3.80 | $400.14M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $126.25M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Sensus Healthcare (NasdaqCM:SRTS) | $4.60 | $75.88M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.39 | $72.49M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.68 | $137.93M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.21 | $21.46M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8945 | $80.45M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.32 | $439.55M | ★★★★☆☆ |

Click here to see the full list of 745 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

FIGS (NYSE:FIGS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FIGS, Inc., along with its subsidiary FIGS Canada, Inc., operates as a direct-to-consumer healthcare apparel and lifestyle company in the United States and internationally, with a market cap of approximately $781.72 million.

Operations: The company's revenue segment is derived from online retailers, totaling $555.56 million.

Market Cap: $781.72M

FIGS, Inc., a direct-to-consumer healthcare apparel company, has faced challenges typical of penny stocks. Despite a market cap of approximately US$781.72 million and no debt, FIGS's financial performance has been under pressure with declining net income from US$22.64 million in 2023 to US$2.72 million in 2024, alongside shrinking profit margins. The company's earnings are forecasted to grow significantly at 43.89% per year but remain volatile with recent insider selling indicating potential concerns among stakeholders. Recent strategic moves include an increased equity buyback plan and the appointment of experienced board members like Melanie Whelan to strengthen governance.

- Unlock comprehensive insights into our analysis of FIGS stock in this financial health report.

- Assess FIGS' future earnings estimates with our detailed growth reports.

NIO (NYSE:NIO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NIO Inc. designs, develops, manufactures, and sells smart electric vehicles in China with a market cap of approximately $9.40 billion.

Operations: The company's revenue is primarily derived from its Auto Manufacturers segment, totaling CN¥63.13 billion.

Market Cap: $9.4B

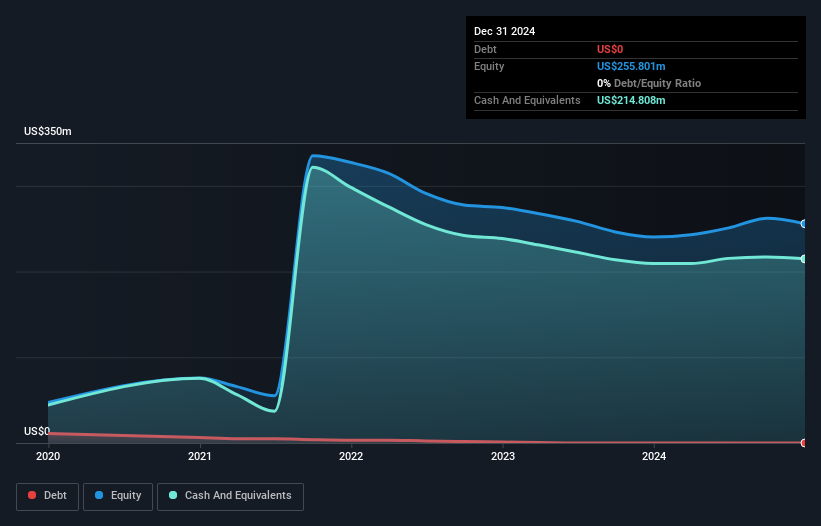

NIO Inc., a smart electric vehicle manufacturer, operates with a market cap of approximately $9.40 billion and is currently unprofitable, with losses increasing by 22.3% annually over five years. Despite this, NIO's short-term assets (CN¥60.1 billion) exceed both its short-term (CN¥57.5 billion) and long-term liabilities (CN¥30.4 billion), indicating strong asset management amidst financial challenges. Recent developments include a CN¥4 billion private placement to bolster capital and impressive vehicle delivery growth in early 2025, reflecting robust operational momentum despite ongoing profitability issues and an inexperienced board averaging 2.5 years tenure.

- Dive into the specifics of NIO here with our thorough balance sheet health report.

- Examine NIO's earnings growth report to understand how analysts expect it to perform.

VTEX (NYSE:VTEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VTEX offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $850.20 million.

Operations: The company generates $226.71 million in revenue from its Internet Software & Services segment.

Market Cap: $850.2M

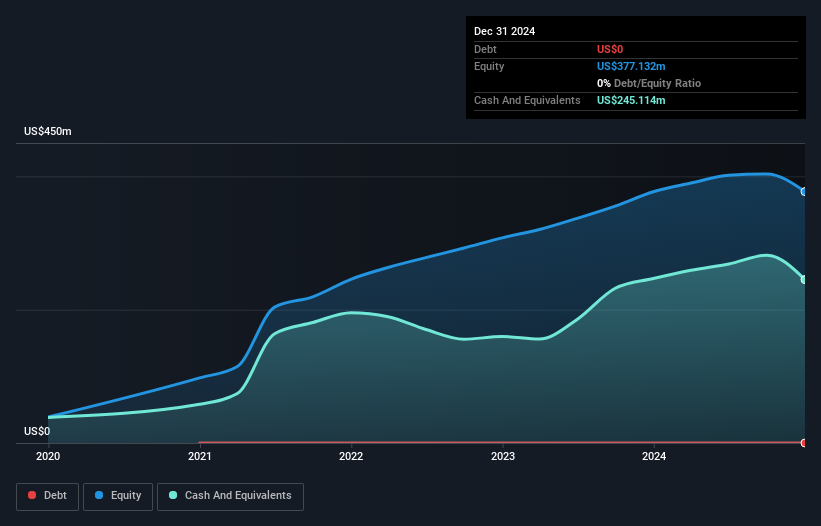

VTEX, with a market cap of US$850.20 million, has transitioned to profitability over the past year, reporting a net income of US$12 million for 2024 compared to a loss in the previous year. The company operates debt-free and has significant short-term assets (US$284.6 million) exceeding its liabilities. Recent earnings showed stable revenue growth and improved earnings per share. Despite large one-off items affecting past results, VTEX's management team is experienced with an average tenure of 3.2 years, and no meaningful shareholder dilution occurred recently. The company forecasts continued revenue growth for 2025 amidst stable volatility levels.

- Take a closer look at VTEX's potential here in our financial health report.

- Gain insights into VTEX's future direction by reviewing our growth report.

Taking Advantage

- Click through to start exploring the rest of the 742 US Penny Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VTEX, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTEX

VTEX

Provides software-as-a-service digital commerce platform for enterprise brands and retailers.

Flawless balance sheet with reasonable growth potential.