- United States

- /

- Auto

- /

- NYSE:GM

Is It Too Late To Consider GM After Its 59% Rally And DCF Upside?

Reviewed by Bailey Pemberton

- If you are wondering whether General Motors is still a value play after its big run, you are in the right place. We are going to unpack what the current price really implies.

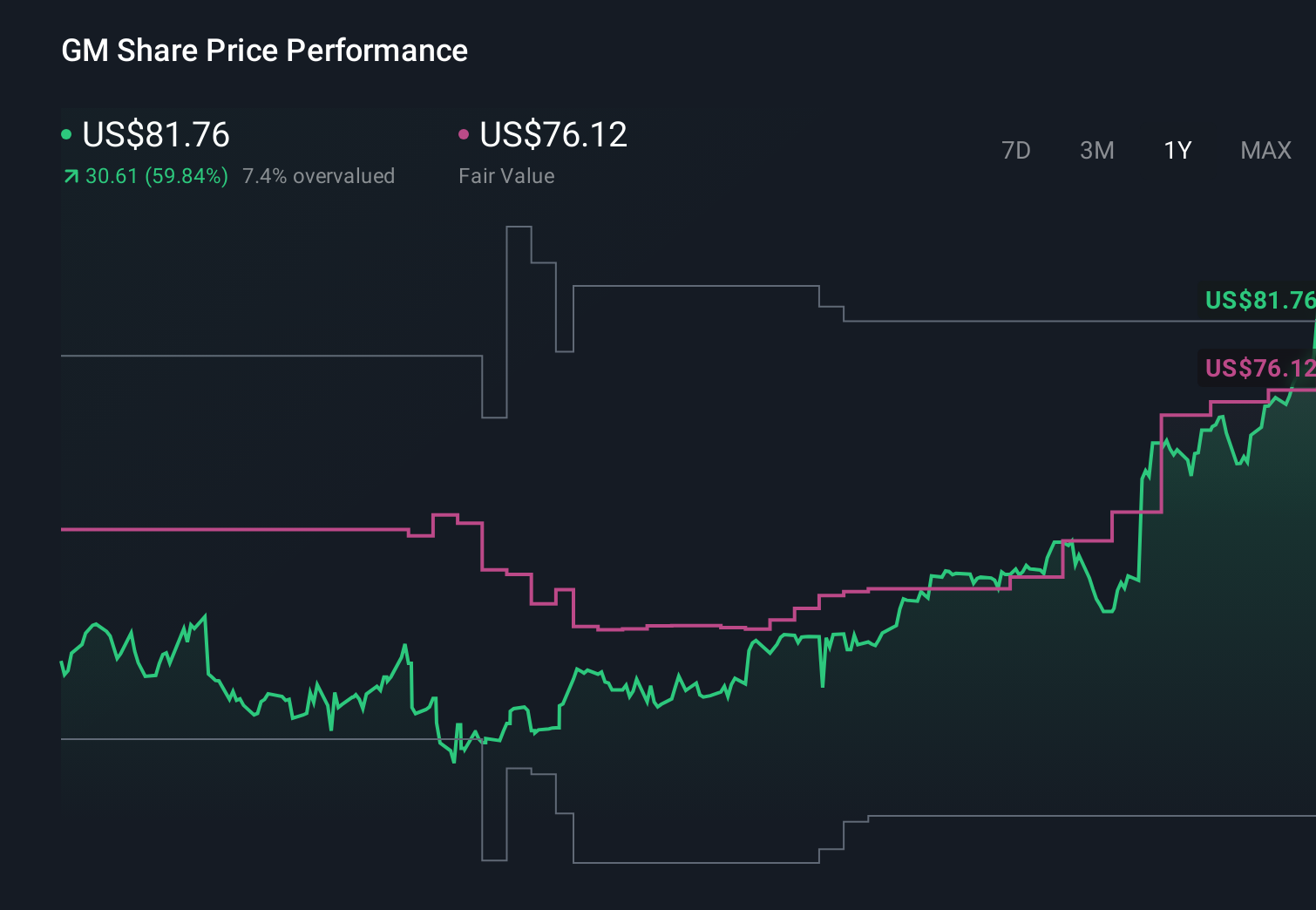

- The stock has climbed 6.0% over the last week, 15.9% over the past month, and 59.2% year to date, contributing to a 61.5% gain over the last year and more than doubling investors' money over 3 and 5 years.

- Recently, markets have focused on GM's push into electric vehicles and software defined cars, along with ongoing capital returns via buybacks and dividends, as key drivers behind the rally. At the same time, a steadier macro backdrop for autos and easing supply chain pressures have helped shift sentiment toward legacy automakers that can fund their own transition.

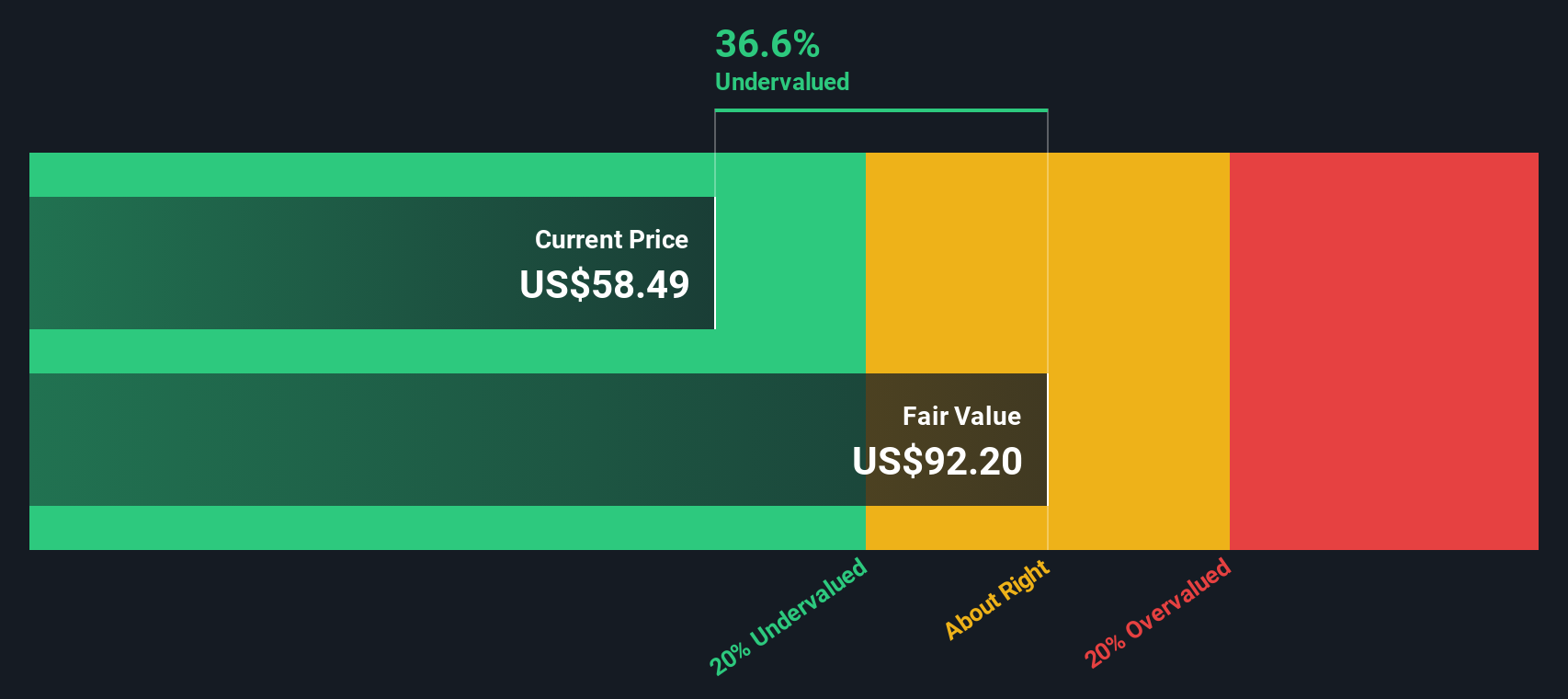

- Despite that backdrop, General Motors scores a 4 out of 6 on our valuation checks, suggesting pockets of undervaluation still exist. Next, we will walk through the main valuation approaches to see how they line up, and then finish with an additional framework to think about what GM might be worth.

Approach 1: General Motors Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For General Motors, the model uses a 2 stage Free Cash Flow to Equity approach built on cash flow projections.

GM generated roughly $13.4 billion of free cash flow over the last twelve months, and analysts expect this to remain robust, with projections around $9.5 billion by 2029. Beyond the explicit analyst horizon, Simply Wall St extrapolates cash flows through to 2035, gradually moderating growth as the business matures.

Discounting all those projected cash flows back to today produces an estimated intrinsic value of about $97.40 per share. Compared with the current market price, this implies the stock is trading at roughly a 16.1% discount, suggesting investors are still not fully pricing in GM’s cash generating ability.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests General Motors is undervalued by 16.1%. Track this in your watchlist or portfolio, or discover 911 more undervalued stocks based on cash flows.

Approach 2: General Motors Price vs Earnings

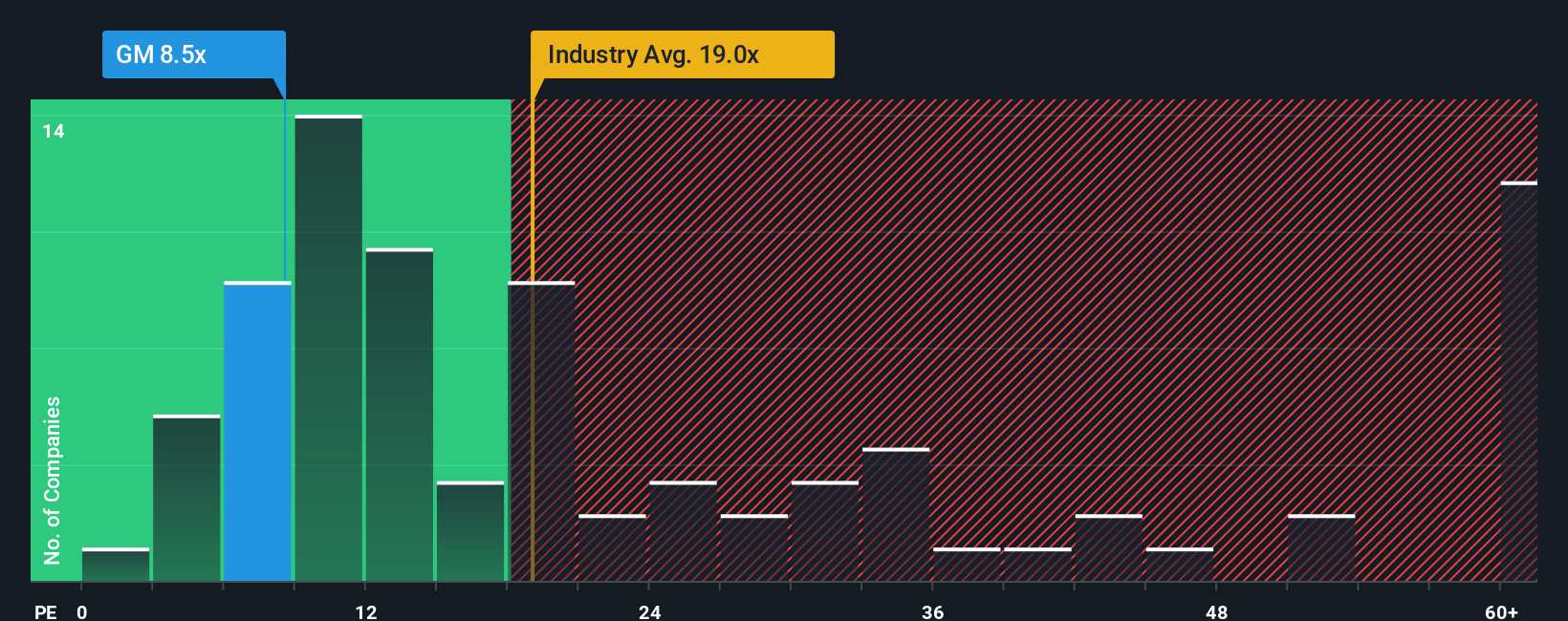

For profitable companies like General Motors, the price to earnings ratio is a useful shortcut for valuing the business because it relates what investors pay for each dollar of current earnings. The right PE level depends on how fast those earnings are expected to grow and how risky or cyclical they are, with higher growth and lower risk generally justifying a higher multiple.

GM currently trades on a PE of about 16.0x, below the broader Auto industry average of roughly 18.1x and well under the peer group average near 25.1x. Simply Wall St’s proprietary Fair Ratio framework goes a step further by estimating what PE GM should trade on, based on its earnings growth outlook, profit margins, industry positioning, market cap and specific risks. For GM, this Fair Ratio comes out around 20.9x, which is more tailored than a simple comparison against generic industry or peer averages that may have very different fundamentals.

Comparing GM’s actual PE of 16.0x with the Fair Ratio of 20.9x suggests the market is still applying a discount to its earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1457 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Motors Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about General Motors future to the numbers by setting your assumptions for fair value, and estimates for revenue, earnings, and margins so that the company’s story links directly to a financial forecast, and then to a Fair Value you can compare against today’s share price.

On Simply Wall St’s Community page, Narratives are an easy, accessible tool used by millions of investors to decide when to buy or sell by comparing their Narrative Fair Value to the live GM share price. Because Narratives update dynamically as new news, earnings and guidance arrive, your view stays in sync with the latest information.

For example, one GM Narrative on the platform might be bullish, assuming tariffs ease, EV adoption accelerates and software margins expand, leading to a Fair Value near the higher end of recent analyst targets around 80 dollars. A more cautious Narrative could focus on slower EV growth, persistent tariff costs and intense competition, producing a Fair Value closer to 38 dollars. This spread shows how different but structured perspectives can guide very different decisions using the same framework.

Do you think there's more to the story for General Motors? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)