- United States

- /

- Auto

- /

- NYSE:F

Ford (F) Valuation in Focus as Shares Show Modest Gains and Market Debates Next Moves

Reviewed by Kshitija Bhandaru

Ford Motor (F) shares edged up about 1% in the latest trading session, attracting attention as investors sort through recent market moves and look for signals in the automaker's performance. The movement comes as ongoing discussions continue about the company’s valuation and direction.

See our latest analysis for Ford Motor.

Despite a steep drop last week, Ford’s 1-year total shareholder return of nearly 14% shows there is still steady momentum behind the wheel. Recent volatility has mainly reflected shifting expectations on growth and the path ahead, but long-term holders have nearly doubled their investment over the past five years.

If the latest moves from Ford have you watching the auto sector, this is a great moment to explore other opportunities and check out See the full list for free.

But with shares trading close to analyst targets and steady gains already logged, investors are left weighing whether Ford is undervalued at these levels or if the market has already priced in its next chapter of growth.

Most Popular Narrative: 3.5% Overvalued

With Ford's latest fair value estimate coming in at $11.15 per share, just below the last close of $11.54, the question of upside potential is front and center for investors tracking the stock’s current momentum. The most followed narrative combines both the company’s next-gen strategies and key market signals to gauge its true worth right now.

Ford's ongoing transformation of its Ford Pro commercial platform, emphasizing high-margin, recurring revenues from software, telematics, and aftermarket services, continues to outperform. Paid software subscriptions are up 24% year-over-year and aftermarket is approaching 20% of Pro EBIT. This shift toward recurring digital revenues supports structurally higher net margins and enhances earnings durability.

Curious what's fueling Ford's valuation narrative? Hint: It’s not just car sales. The company is making a bold bet on digital transformation, future profit margins, and new market dynamics. Want a peek behind the assumptions driving that verdict? The numbers tell a different story when you dig deeper into the earnings and revenue outlook.

Result: Fair Value of $11.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and slower-than-expected electric vehicle adoption could quickly test Ford's profit outlook and challenge its current valuation narrative.

Find out about the key risks to this Ford Motor narrative.

Another View: What Do the Ratios Say?

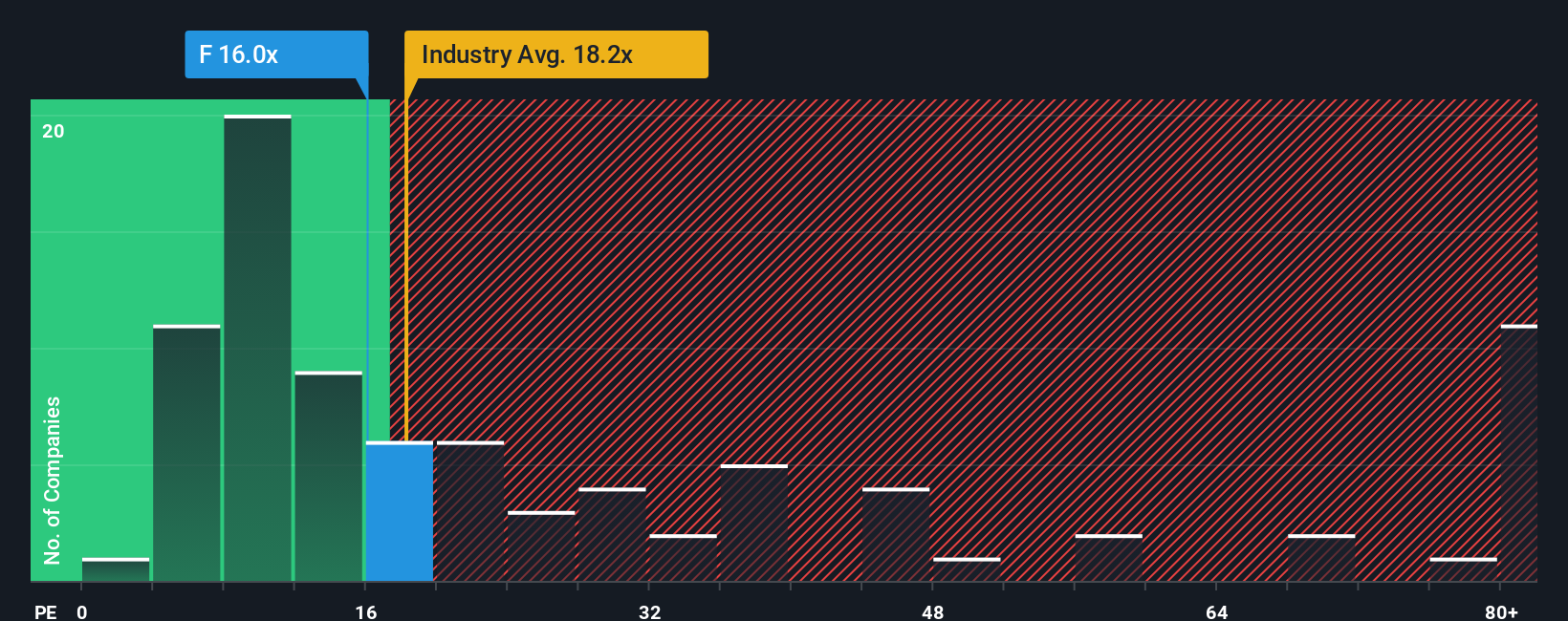

Looking through the lens of price-to-earnings, Ford’s ratio of 14.6x is lower than the industry average of 18.7x and peers at 16.7x. It is also under the fair ratio of 20.5x. This suggests the market sees more risk or less upside compared to rivals. However, will investor sentiment shift as Ford transforms?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ford Motor Narrative

If you prefer a hands-on approach or want to come to your own conclusions, you can easily shape your personal view of Ford in minutes, so why not Do it your way.

A great starting point for your Ford Motor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for their next opportunity. If you’re hungry to find tomorrow’s winners, now’s the time to take action with these powerful stock ideas:

- Tap into game-changing opportunities with these 25 AI penny stocks to see which tech-driven companies could shape our world in the next decade.

- Boost your income potential by checking out these 18 dividend stocks with yields > 3% for yields above 3 percent and consistent payout histories.

- Ride the trend of digital innovation by investigating these 79 cryptocurrency and blockchain stocks to gain exposure to blockchain, cryptocurrencies, and the businesses behind this transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:F

Ford Motor

Develops, delivers, and services Ford trucks, sport utility vehicles, commercial vans and cars, and Lincoln luxury vehicles worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives