- United States

- /

- Auto Components

- /

- NasdaqCM:XPEL

Should the Launch of Customizable Self-Healing PPF Prompt a Rethink by XPEL (XPEL) Investors?

Reviewed by Simply Wall St

- Earlier this month, XPEL, Inc. unveiled its COLOR Paint Protection Film (PPF) product line, offering vehicle owners a choice of 16 vibrant colors that combine paint protection and unique customization in a factory-quality, self-healing film.

- This launch marks a major step for XPEL, as it aims to attract drivers looking for high-quality personalization that lasts significantly longer than traditional vinyl wraps, backed by a 10-year warranty.

- We’ll now explore how this introduction of customizable, self-healing PPF could influence XPEL’s long-term outlook and growth narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

XPEL Investment Narrative Recap

To be a shareholder in XPEL, you need to believe in the company's ability to sustain growth through innovative products and global expansion, while successfully navigating a rapidly evolving competitive landscape. The COLOR Paint Protection Film launch enhances XPEL's product differentiation, strengthening its most important near-term catalyst, expanding higher-margin personalization solutions, but does not fundamentally shift the key risk of rising competition from lower-cost Asian manufacturers.

Among recent company announcements, the expanded collaboration with Rivian stands out as highly relevant. This partnership deepens XPEL’s direct-to-consumer reach and integrates its offerings with a fast-growing EV brand, echoing the significance of product and distribution innovation as central growth drivers for the business.

However, investors should also be aware that, in contrast to these advances, the ongoing threat of pricing pressure due to increased competition remains a serious consideration...

Read the full narrative on XPEL (it's free!)

XPEL's outlook anticipates $644.9 million in revenue and $100.3 million in earnings by 2028. This scenario assumes a 12.8% annual revenue growth rate and a $51.6 million increase in earnings from the current $48.7 million.

Uncover how XPEL's forecasts yield a $47.67 fair value, a 33% upside to its current price.

Exploring Other Perspectives

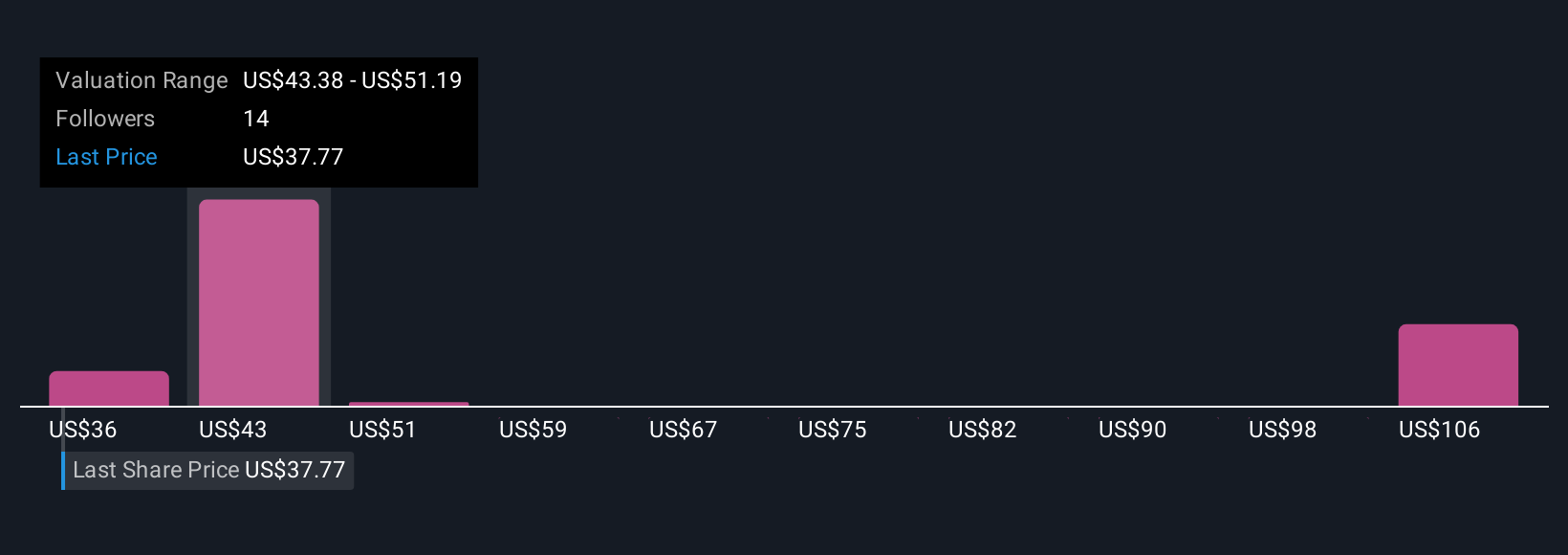

Fair value estimates from four Simply Wall St Community members for XPEL range broadly from US$35.58 to US$63.29, showing wide variation in expectations. While many see long-term global expansion as a strong catalyst, opinions differ and it pays to consider multiple viewpoints before making any investment decision.

Explore 4 other fair value estimates on XPEL - why the stock might be worth as much as 77% more than the current price!

Build Your Own XPEL Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPEL research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free XPEL research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPEL's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XPEL

XPEL

Manufactures, installs, sells, and distributes protective films, coatings and related services.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)