- United States

- /

- Auto

- /

- NasdaqGS:TSLA

The Bull Case for Tesla (TSLA) Could Change Following Launch of Cheaper Models Amid Regulatory Scrutiny

Reviewed by Sasha Jovanovic

- Tesla recently launched new, more affordable "Standard" variants of its Model Y SUV and Model 3 sedan in the U.S., designed to boost demand after the expiration of key federal EV tax credits and amid intensifying competition.

- This shift was met with mixed reactions, as investors weighed concerns over the potential impact on higher-end model sales and the growing regulatory scrutiny of Tesla's Full Self-Driving technology by U.S. safety authorities.

- We'll explore how Tesla's focus on accessible models and regulatory challenges could shape its long-term investment narrative and earnings potential.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Tesla Investment Narrative Recap

For investors to remain optimistic about Tesla, they need to believe in the company's ability to scale both its core EV production and its emerging software and autonomy businesses despite wavering near-term demand and mounting regulatory challenges. The recent unveiling of lower-cost Model Y and Model 3 trims is targeted at boosting volume after the expiration of the U.S. EV tax credit, but the move has delivered only a modest impact to the biggest short-term catalyst, growth in Full Self-Driving subscriptions, while regulatory scrutiny over autonomy remains the chief near-term risk.

Amidst these developments, Tesla’s announcement of record Q3 deliveries, 497,000 vehicles, up 7% year-over-year, stands out as highly relevant. This production result demonstrates underlying demand resilience and supports the narrative that Tesla’s success in the near term will depend just as much on its ability to convert delivery growth into recurring software revenue as it will on expanding its addressable market.

By contrast, regulatory headwinds over Tesla’s Full Self-Driving system could present headwinds that investors should not underestimate, especially as…

Read the full narrative on Tesla (it's free!)

Tesla's narrative projects $148.1 billion in revenue and $15.4 billion in earnings by 2028. This requires 16.9% yearly revenue growth and a $9.5 billion earnings increase from the current $5.9 billion.

Uncover how Tesla's forecasts yield a $350.50 fair value, a 15% downside to its current price.

Exploring Other Perspectives

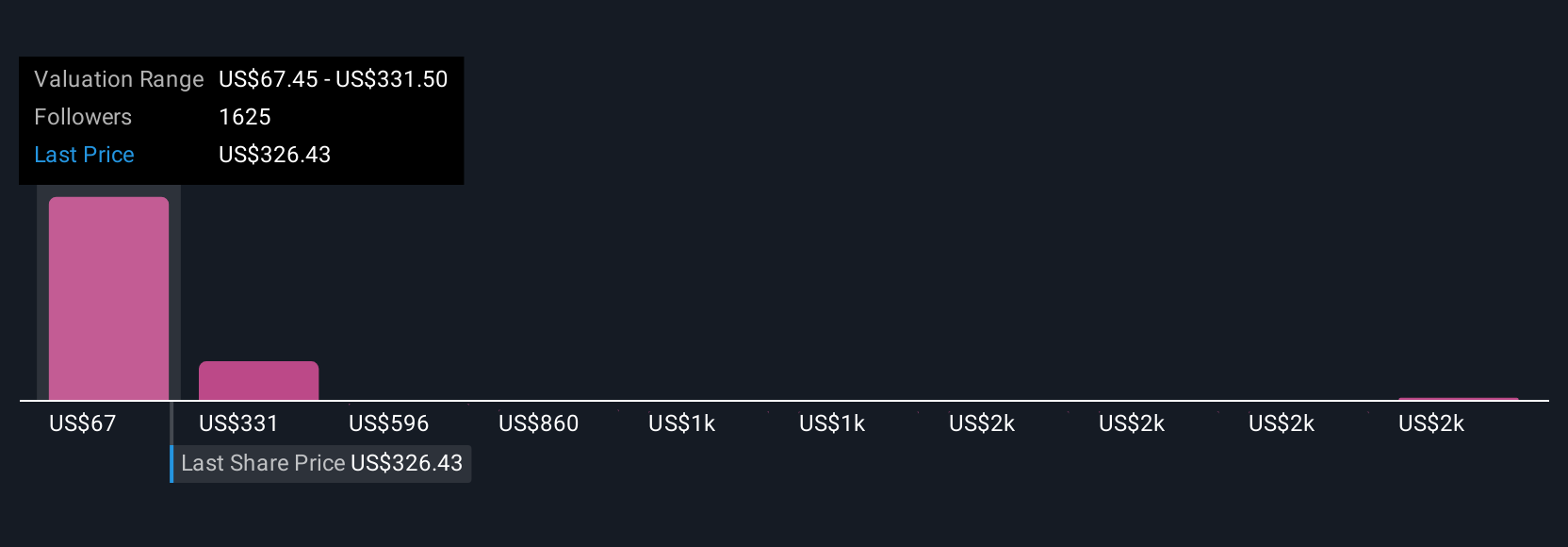

244 members of the Simply Wall St Community estimate Tesla's fair value anywhere from US$67.45 to US$2,707.91 per share. As debate continues around regulatory risks to Tesla’s software-driven ambitions, readers can explore these varying viewpoints for a fuller picture of what may lie ahead.

Explore 244 other fair value estimates on Tesla - why the stock might be worth over 6x more than the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tesla's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026