- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla's (NASDAQ:TSLA) Fundamental Snapshot: A High Performer with Justified Revenue Growth

While Tesla, Inc. (NASDAQ:TSLA) shareholders are probably generally happy, the stock hasn't had a particularly good run recently, with the share price falling 20% in the last quarter. The market has been quite turbulent recently, which is why we will take a step back and evaluate the big picture based on the fundamentals.

Tesla Stock Performance

Tesla is currently worth US$792b and the stock is one of the top performers with a return of 1,363% over five years. Arguably, the recent fall is to be expected after such a strong rise.

When looking at a 3-year chart, it seems the stock is back to a steady growth track, but in order to justify future price increases, it must also grow the fundamentals at a similar rate. A deceleration in growth, margins, and future outlook can prompt investors to adjust their valuation and the stock may suffer.

Click the chart below to see an interactive view along with key events.

That is why we must at least make sure that the fundamentals are in-line with the long-term stock price growth. So let's take a look at its longer term fundamental trends and see if they've driven returns.

Fundamental Snapshot

In the last 5 years, Tesla, Inc. has increased its revenue by 668.9%, going from US$7b in December 2016 to US$53.8b in December 2021.

This amounts to a CAGR of 50.4% over the last 5 years. Arguably a very high revenue growth rate, and part of the optimism surrounding the company.

Last year, the company's revenues increased by 70.7%, which is more than the 3-year average growth rate of 43.1%. Showing, that at least in the past, revenues were accelerating.

Given how much the company is reinvesting, this seems to be outside the expected fundamental growth rate, indicating that the stock price may be temporarily propped up by external factors, such as enthusiasm for the new technology, and a vision for a company that will have monopolistic characteristics.

Check out our latest analysis for Tesla

Fundamental growth is the long term growth we expect to see, based on how much and how well management reinvests in a company. Think "spend money in order to make money" - cliché but true.

We can see how much, based on items in the cash flows section, such as total outflows from investing, CapEx etc. For Tesla, Inc. we can see that in the last 12 months, the company invested some US$5.1b as Net CapEx. We add this on top of the current invested capital of US$23.4b and compare it to how much revenue the company is expected to get from its total invested capital. We utilize the Sales to Capital ratio of 2.3 - This is the "quality of investing ratio". Finally, the resulting long term fundamental growth rate is up to 30.6% for revenues, and 37.3% for EBIT. We will use these rates to compare them to what analysts estimate for the company.

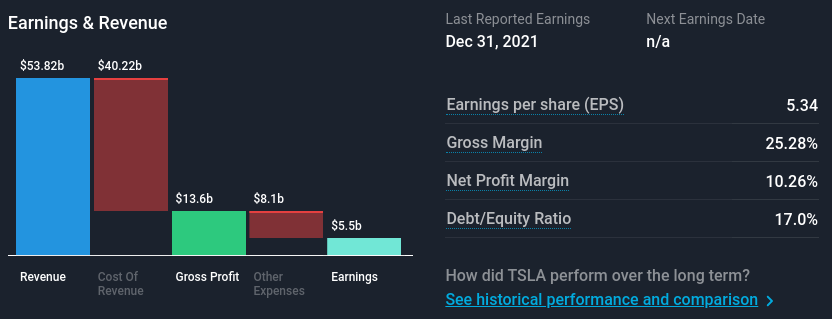

In the picture above, we have a snapshot of the latest fundamentals of the company. It is great to see that the company is profitable and has a gross margin of 25%. While it varied a bit in the past, the gross margin has not made significant improvements - once the company slows down expansion, they can focus more on profitability and optimize margins in the future.

Future Estimates

As Tesla is growing, analysts make their predictions for the future. These are important for investors, since the stock price is based on the expected performance in the future.

Tesla's 34 analysts are now forecasting revenues of US$81.8b in 2022. This would be a huge 52% improvement in sales compared to the last 12 months. Statutory earnings per share are also predicted to grow 64% to US$8.78.

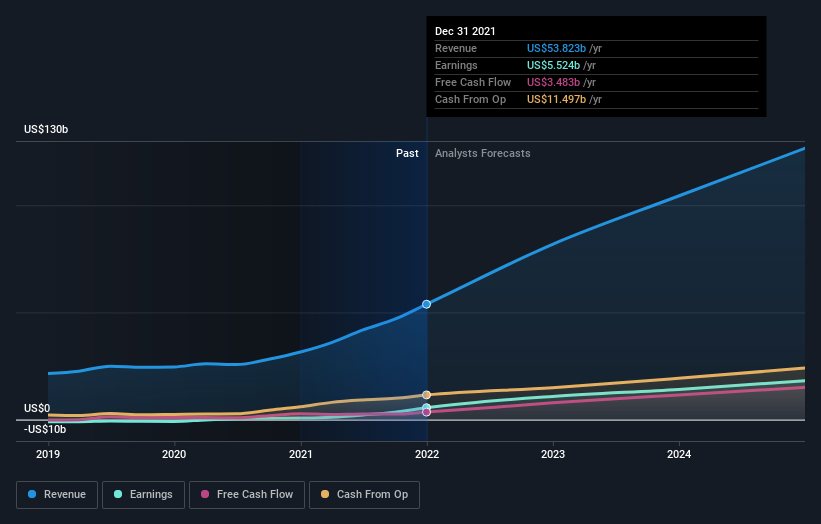

While analysts are expecting a strong growth next year, their long term revenue growth estimate is 20.9%, which is a deceleration. This is in line with the 30% (average) long term fundamental revenue growth rate that we got from analyzing how much Tesla reinvests into the business (and how well). On one hand, our analysis shows that this growth is achievable, but on the other, a slowing down of growth may make analysts revise their targets in the future.

Keep in mind, that at the end of the day, people are the ones making the trading decisions, and sometimes market volatility may be the perfect excuse that investors needed to downgrade previous estimates. External factors give people the opportunity to shift the blame, for what they otherwise would double down on.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Tesla is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

Conclusion

Looking at the bigger picture, we see that Tesla stock is reverting to a historical growth slope.

Revenue growth and gross margins are still strong and fundamentally justified, but can start decelerating after 2023 and analysts may revise their forecasts.

We did not cover the pricing and value metrics in this article, so we are not analyzing whether the stock is trading above or below value.

We're pleased to report that Tesla shareholders have received a total shareholder return of 8.3% over one year. Having said that, the five-year Total Stock Return of 71% a year, is even better. The pessimistic view would be that the stock has its best days behind it, but on the other hand, the price might simply be moderating while the business itself continues to execute.

Looking for some good ideas? Check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.