- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (TSLA): Reevaluating Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

There’s a lot of chatter around Tesla (TSLA) lately, and for good reason. The stock has moved noticeably, even without a clear news event or single trigger. For many investors, this recent action might spark questions about whether a bigger signal is in play or if the market is simply re-evaluating the company’s prospects. When markets move like this without a headline catalyst, it often brings valuation back to the spotlight.

Looking at where Tesla stands, both short- and long-term trends paint an intriguing picture. While the stock rolled up an impressive 26% growth over the past month and is up 69% over the past year, it’s worth noting performance momentum has picked back up in recent weeks after a somewhat quieter stretch earlier in the year. Some key moves over the past year and ongoing buzz around Tesla’s expansion plans continue to factor into how the market prices its shares.

With these recent gains now baked into current levels, the question investors face is whether Tesla is trading at a discount or if the market is already pricing in all the growth to come.

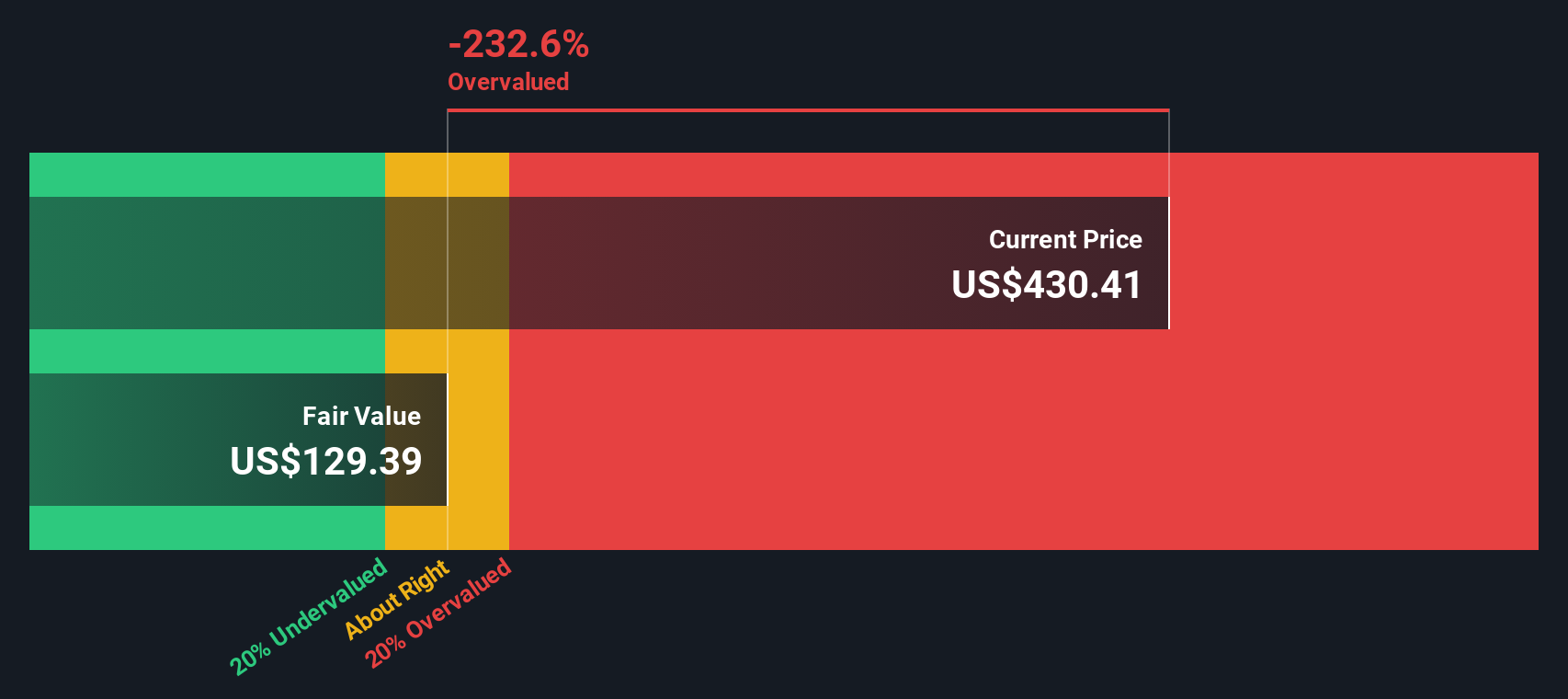

Most Popular Narrative: 32.4% Overvalued

According to the most popular narrative, Tesla’s current market price is seen as significantly overvalued when compared to its calculated fair value, based on future growth assumptions and sector trends.

“Based on current projections and Tesla’s ambitious plans, revenue in five years (2029) could potentially reach around $150 billion. This estimate considers several factors: Growth in EV Sales. Tesla’s continuous expansion in production capacity and new models like the Cybertruck and Model 2 could significantly boost vehicle sales.”

Want to see what’s firing up this bullish growth story? There is one assumption that is powering these sky-high forecasts, and it is not just about new products. Curious which financial bets set the stage for this outsized valuation? Dive into the narrative for the full breakdown of the projected moves that put Tesla’s potential on another level.

Result: Fair Value of $332.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain issues and the potential for new regulatory hurdles could quickly shift momentum away from Tesla’s current growth story.

Find out about the key risks to this Tesla narrative.Another View: Our DCF Model’s Perspective

To challenge the narrative above, we can look at what our DCF model suggests. This approach examines Tesla’s expected future cash flows and finds the shares are trading well above what the fundamentals appear to support. Are market expectations too ambitious, or is there something the model just cannot see coming?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tesla for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tesla Narrative

If you are looking to take a different view or want to draw your own conclusions from the numbers, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that widening their search uncovers the most exciting opportunities. Don’t just stop at Tesla; expand your horizons with these handpicked ideas on Simply Wall Street.

- Uncover rare value opportunities among undervalued companies whose prices do not match their real potential by using our undervalued stocks based on cash flows.

- Tap into the earnings power of companies rewarding shareholders with robust income streams through our dividend stocks with yields > 3%.

- Get ahead of the curve by focusing on breakthrough innovations from companies transforming the future of medicine with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives