- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla (NasdaqGS:TSLA) Shows 13% Fall As Earnings Report Reveals Decline In Profitability

Reviewed by Simply Wall St

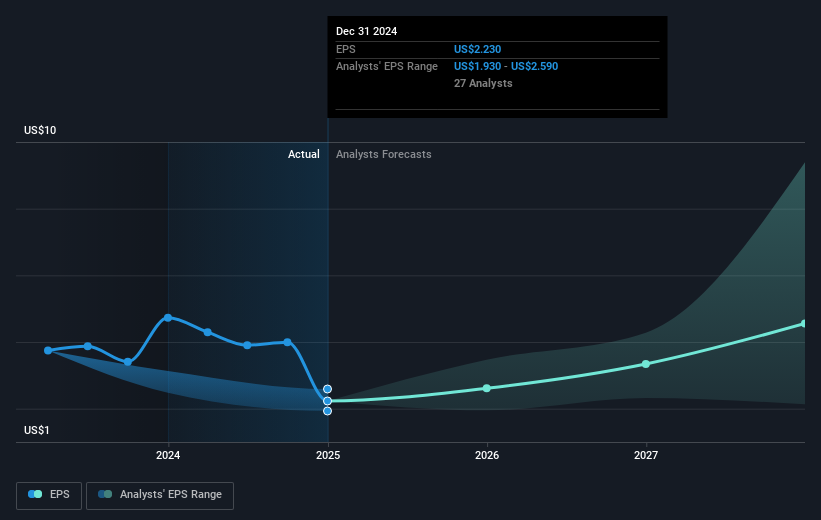

Amidst significant recent developments, Tesla (NasdaqGS:TSLA) exhibited a sharp 12.64% decline in its share price over the last quarter. The company faced headwinds from a series of challenges, including a decline in profitability as reported in its earnings, despite revenue growth. Legal issues also emerged when Matthews International secured arbitration victory over Tesla, impacting its competitive positioning in battery technology. Additionally, speculation around potential investments in Nissan stirred the market, contributing to volatility, although Elon Musk publicly dismissed the rumors. Within the broader market, economic concerns loomed with mixed performance across major indices; the Nasdaq Composite fell 0.6%, adding pressure on tech stocks like Tesla. President Trump's tariff announcements further unsettled investors. This combination of internal performance issues and external economic pressures influenced Tesla's quarterly share price trajectory.

Dig deeper into the specifics of Tesla here with our thorough analysis report.

Over the past five years, Tesla has delivered an impressive total shareholder return of 482%. This period has been marked by the company cementing its position in the electric vehicle market. Despite recent profitability challenges, a key driver of its long-term success has been Tesla's significant earnings growth, averaging 43% annually over the five-year span. This, alongside its profitability, which contrasted sharply against its less resilient peers, provided a strong foundation for shareholder returns.

Throughout this period, Tesla's strategic partnerships have also played an important role in its growth trajectory. Noteworthy is Subaru’s plan to adopt Tesla’s Supercharger network, announced in November 2023. This development bodes well for expanding Tesla's ecosystem. Moreover, the company exceeded industry performance with a greater one-year return than both the US auto industry, which achieved 30.7%, and the broader US market, which delivered 16.9%. Such performance metrics have reinforced Tesla as a formidable player in the market.

- See how Tesla measures up with our analysis of its intrinsic value versus market price.

- Assess the downside scenarios for Tesla with our risk evaluation.

- Already own Tesla? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives