- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Tesla, Inc.'s (NASDAQ:TSLA) Fundamentals are Improving but Valuation Remains a Risk

Tesla, Inc.'s (NASDAQ:TSLA) second quarter results this week gave investors quite a few reasons to be pleased. Record quarterly net income of $1.1 billion was well ahead of estimates and 813% higher than the second quarter in 2020. Even more impressive is the fact that there was less reliance on regulatory credits. Tesla earns emissions credits for selling environmentally friendly vehicles, and can then sell these credits to other automakers. In the past, revenue from regulatory credit sales have been higher than net income, meaning Tesla was technically not profitable without them. This changed in the second quarter as Tesla earned $354 million, or roughly a third of net income, from regulatory credits.

Tesla has a goal of increasing production by 50% each year. So far the company is on track to do that in 2021, and new factories should be coming online over the next six months. Also, free cash flow is now above $4 billion for the last 12 months. This is significant as Tesla may now be able to fund its growth without diluting shareholders with new stock sales.

There’s also evidence that the company is maturing. In the last two earnings calls Elon Musk has resisted the temptation to set targets that Tesla may struggle to achieve. Instead, he has focused on what the company is doing to ramp up production. Musk even suggested he may skip earnings calls in the future, unless he has something important to announce.

While Tesla’s fundamentals are steadily improving, the valuation is still a potential risk that shareholders and investors should be aware about.

Priced for Perfection?

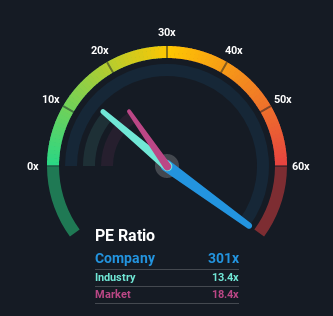

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Tesla as a stock to avoid entirely with its 301x P/E ratio.Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Tesla certainly has been doing a good job lately as it's been growing earnings more than most other companies.It seems that many are expecting the strong earnings performance to persist, which has raised the P/E.You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Tesla

Want the full picture on analyst estimates for the company? Then our free report on Tesla will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About the High P/E?

In order to justify its P/E ratio, Tesla would need to produce outstanding growth well in excess of the market.

As mentioned, Tesla's growth has been phenomenal over the last year, and the company is becoming less reliant on regulatory credits. Growth is expected to slow next year, and average 54% over the next three years. This is still well ahead of the market, so there is still some justification for a higher ratio.

The average analyst forecast for EPS at the end of 2023 is $7.58. If Tesla achieves that, and the share price is still at $700, the PE ratio would be 93. That would still be reasonable provided the outlook was optimistic at that point. However, if the outlook deteriorates a PE of 93 would be hard to justify. Of course, if the share price was higher than $700, the PE ratio would also be higher.

The Final Word

A high PE ratio doesn't necessarily mean a stock is overvalued. Many of the best growth companies trade on very high PE ratios for years, with the PE ratio eventually falling as earnings rise. But a high PE ratio does indicate that the market has high expectations for a company. The valuation becomes a risk if the company can't deliver on the market's expectations.

Investors are clearly very optimistic about Tesla's future. As long as they remain optimistic, the PE ratio is likely to remain high. But if that changes, the stock price may fall until the PE ratio reflects the outlook.

It is also worth noting that we have found 1 warning sign for Tesla that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:TSLA

Tesla

Designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>