- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian (RIVN) Valuation Revisited as R2 Buzz, Partnerships, and Revenue Spark Investor Optimism

Reviewed by Simply Wall St

Rivian Automotive (RIVN) has found itself back in the investor spotlight after the latest wave of R2 midsize SUV buzz and new updates on key partnerships. With persistent consumer interest in the upcoming R2 and anticipations running high for a broader market reach, Rivian’s roadmap is getting a fresh look from both Wall Street and retail investors who want to make sure they are not missing the next chapter in electric vehicles. Add in a stronger relationship with Volkswagen and ongoing collaboration with Amazon, and it is easy to see why opinions are swirling around the company’s growth outlook.

Against this backdrop of strategic moves, the share price has seen renewed momentum. The stock jumped nearly 8% recently, lifted by hopes of possible rate cuts from the Federal Reserve and a revenue beat that surpassed expectations, even as operational headwinds such as supply chain challenges lingered. Over the past twelve months, RIVN is still down around 3%, while the year-to-date return sits in positive territory, hinting that sentiment may be shifting in favor of growth names like Rivian as the company readies its next big launch.

With all these signals flashing for Rivian, the question now is whether the current share price is still playing catch-up to the company’s long-term potential or if the market is already factoring in bold growth scenarios.

Most Popular Narrative: 2.2% Undervalued

According to community narrative, Rivian Automotive is considered moderately undervalued based on the latest analyst consensus. The valuation reflects expectations of rapid revenue expansion, improving margins, and the impacts of vertical integration and strategic partnerships.

The launch of the R2 platform represents a significant improvement in Rivian's cost structure. Management has secured supplier contracts and component sourcing that reduce the bill of materials by nearly 50% compared to the R1, significantly lowering per-unit costs. This operational overhaul is expected to improve gross margins and Rivian’s path to profitability as scale is achieved.

Curious how Rivian's next big move could transform its financial future? The narrative’s fair value depends on bold growth estimates and a forward-looking profit formula more often seen in breakthrough tech stories. Wondering what undisclosed numbers fuel this bullish price target? The real surprise lies in the financial trajectory that analysts are projecting for this EV challenger.

Result: Fair Value of $13.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high cash burn and possible shifts in regulatory support could quickly undermine Rivian’s positive outlook and valuation story.

Find out about the key risks to this Rivian Automotive narrative.Another View: DCF Model Suggests a Different Story

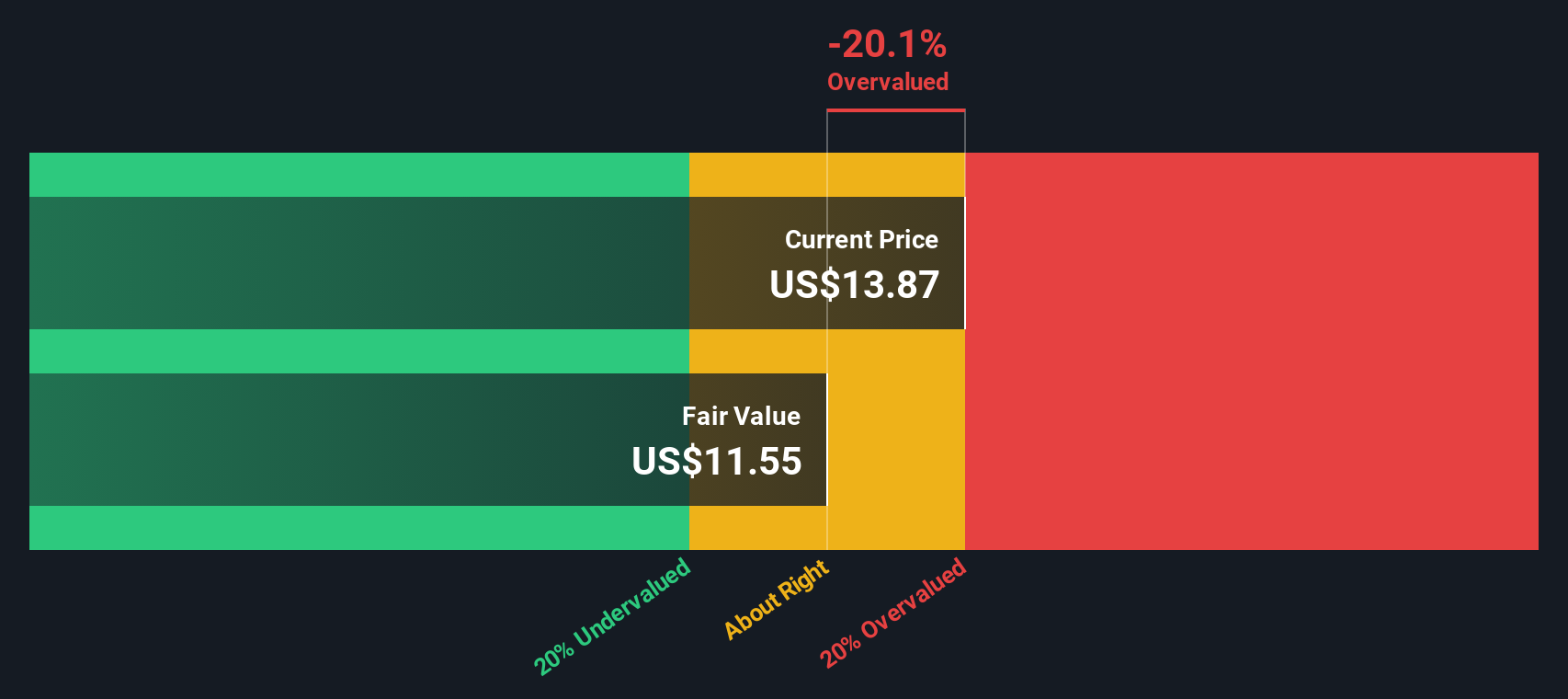

While analyst consensus leans bullish based on forward projections, our SWS DCF model tells a different story. It suggests the stock appears expensive relative to its fair value. Are assumptions about future growth too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rivian Automotive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rivian Automotive Narrative

If you see things differently or want to dig into the details yourself, you can quickly shape your own take on Rivian’s story. Do it your way

A great starting point for your Rivian Automotive research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Your next great stock opportunity could be just a few clicks away. Don’t let the chance to strengthen your portfolio slip by. Tap into powerful strategies that go beyond the obvious. Here are three exciting routes that could put you ahead of the curve:

- Boost your search for future growth potential by targeting penny stocks with strong financials using penny stocks with strong financials. Capture early gains from tomorrow’s leaders.

- Find companies making health breakthroughs at the intersection of healthcare and artificial intelligence by starting with healthcare AI stocks. This gives you a front-row seat to medical innovation.

- Fuel your quest for solid passive income by checking out dividend stocks with yields above 3%. Use dividend stocks with yields > 3% to explore reliable income opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion