- United States

- /

- Auto

- /

- NasdaqGS:RIVN

Rivian Automotive (NasdaqGS:RIVN) Stock Surges 17% Over Last Week

Reviewed by Simply Wall St

Rivian Automotive (NasdaqGS:RIVN) appointed Aidan Gomez, a data scientist with a strong background in AI from Google, to its board. This appointment highlights the company's focus on enhancing technological capabilities. Over the last week, Rivian's stock saw a robust 17% rise. This significant increase stands out against a background of broader market movements that resulted in a 5% gain. While there has been an overall positive sentiment across the market, Rivian's appointment of Gomez potentially added positive sentiment, aligning with its long-term strategic technological goals.

Be aware that Rivian Automotive is showing 2 possible red flags in our investment analysis.

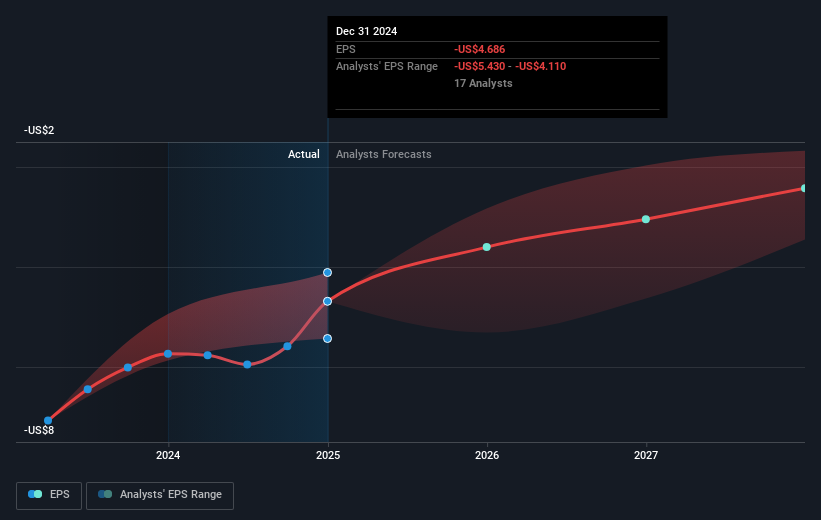

The recent addition of Aidan Gomez to Rivian Automotive's board may bolster the company's ambitions in AI, potentially enhancing its revenue and earnings forecasts. As Rivian focuses on integrating advanced technologies, these developments could unlock new revenue streams, particularly through its anticipated R2 platform launch and AI-driven advancements. Analysts are optimistic, projecting a robust 29.1% annual revenue growth, significantly higher than the US market average of 8.2% per year. Despite the potential, Rivian remains unprofitable, with earnings forecasts indicating it could take several more years before turning positive.

Over the past year, Rivian's total shareholder return of 49.44% reflects strong market performance, significantly surpassing the US market's 9.9% and the US Auto industry's 45.7% gains. This exceptional return highlights investor confidence in Rivian's long-term potential, even as the company experiences growing pains commonly associated with new ventures. The short-term share price rise of 17% following the board appointment further aligns with bullish analyst sentiments, although it remains slightly below the consensus price target of US$14.30, indicating room for growth. The current share price of US$11.36 suggests upside potential as analysts foresee a potential fair value increase of approximately 20.6% in the near future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Rivian Automotive, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives