Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Rivian Automotive, Inc. (NASDAQ:RIVN) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Rivian Automotive

What Is Rivian Automotive's Debt?

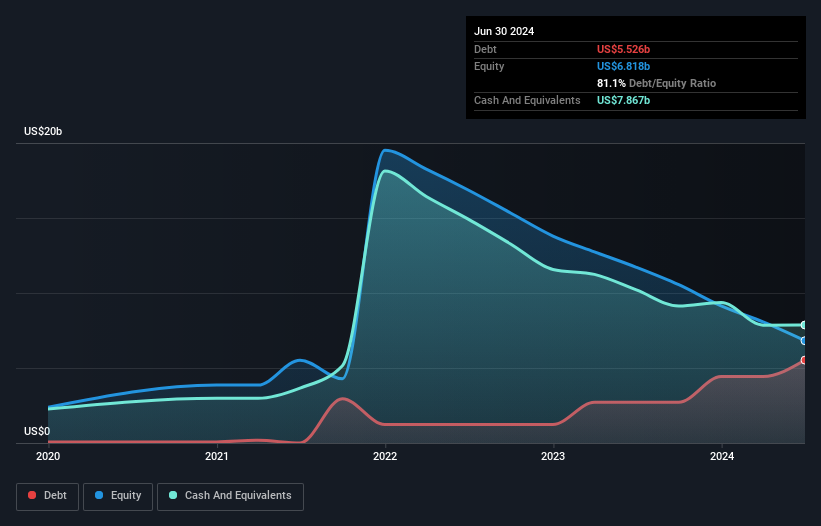

You can click the graphic below for the historical numbers, but it shows that as of June 2024 Rivian Automotive had US$5.53b of debt, an increase on US$2.72b, over one year. But on the other hand it also has US$7.87b in cash, leading to a US$2.34b net cash position.

A Look At Rivian Automotive's Liabilities

According to the last reported balance sheet, Rivian Automotive had liabilities of US$2.09b due within 12 months, and liabilities of US$6.45b due beyond 12 months. On the other hand, it had cash of US$7.87b and US$249.0m worth of receivables due within a year. So it has liabilities totalling US$420.0m more than its cash and near-term receivables, combined.

Of course, Rivian Automotive has a titanic market capitalization of US$13.6b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Rivian Automotive also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Rivian Automotive's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Rivian Automotive reported revenue of US$5.0b, which is a gain of 68%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Rivian Automotive?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Rivian Automotive lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of US$5.0b and booked a US$5.8b accounting loss. However, it has net cash of US$2.34b, so it has a bit of time before it will need more capital. With very solid revenue growth in the last year, Rivian Automotive may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Rivian Automotive you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RIVN

Rivian Automotive

Designs, develops, manufactures, and sells electric vehicles and accessories.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives