- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto (NasdaqGS:LI): Evaluating Valuation After Lower Third Quarter Guidance and Recent Delivery Trends

Reviewed by Simply Wall St

Li Auto (NasdaqGS:LI) is back in the spotlight after its recent earnings results and third quarter guidance signaled a tougher road ahead, with lower expected vehicle deliveries and revenue compared to last year. In addition, the monthly delivery figures for August showed that while the company delivered 28,529 vehicles, momentum is not as strong as some investors had hoped. For anyone holding or considering Li Auto stock, this combination of flat results and downward guidance has likely triggered a fresh round of debate about what comes next.

It is not just the latest statements raising questions. Over the past year, Li Auto’s share price has climbed 26%, even as the last month saw a drop of nearly 4%. That softer short-term performance follows an annual run that puts Li ahead of many EV rivals, but also makes it clear that optimism is being tempered by new risks. Recent moves to launch the Li i6 electric SUV and roll out new technology updates show that the company is doubling down on innovation, though the bigger story remains whether these efforts can reignite growth in a competitive and shifting market.

With all this in play, the real question is whether Li Auto is now trading at a discount that reflects the tougher environment, or if the market is already setting the stage for a rebound in future growth.

Most Popular Narrative: 18.6% Undervalued

The current consensus projects Li Auto as significantly undervalued, with the fair value estimate based on a strong outlook for the company’s future earnings and expansion plans.

The company's ongoing transition from extended-range vehicles (EREVs) to pure battery electric vehicles (BEVs), including successful launches of the Li MEGA and Li i8, and the upcoming Li i6, positions Li Auto to capture expanding market share as Chinese middle-class consumers upgrade and EV adoption accelerates. This directly supports long-term revenue growth and total addressable market expansion.

Curious about what is driving such a bullish valuation for Li Auto? Surging future revenues, ambitious technology bets, and bold market moves lie at the heart of this call, but the biggest surprise is how analysts are calculating the future profit potential. Ready to uncover the underestimated factors powering these forecasts? The real numbers behind this fair value might just change your perspective on the company’s upside.

Result: Fair Value of $29.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy R&D spending and intensifying competition could pressure Li Auto’s margins and threaten future growth if sales fall short of forecasts.

Find out about the key risks to this Li Auto narrative.Another View: Higher Valuation by Industry Standards

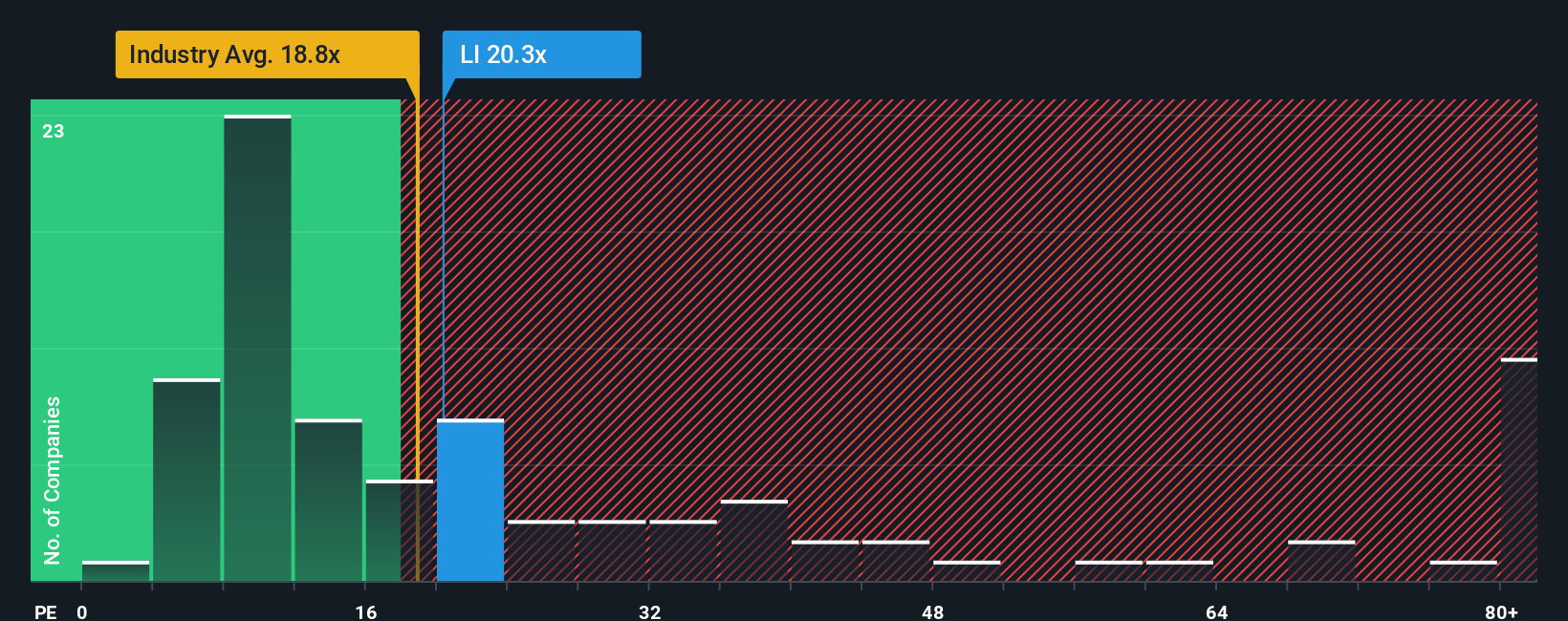

While our earlier discussion highlights Li Auto’s discounted price based on future cash flows, a look at valuation relative to global industry standards tells a different story. By this measure, Li Auto appears somewhat expensive. Which view will prove right as the market evolves?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Li Auto to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Li Auto Narrative

If you see the story unfolding differently or like to form your own conclusions from the numbers, you can shape your own analysis in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Li Auto.

Looking for More Smart Investment Opportunities?

Don’t let a single stock limit your portfolio’s potential. The Simply Wall Street Screener uncovers powerful ideas designed to help you make confident moves and stay ahead of the curve, before the market catches on.

- Accelerate your portfolio with under-the-radar opportunities by tapping into penny stocks with strong financials for stocks boasting strong financial foundations.

- Capitalize on tech’s next leap by tracking AI penny stocks, where artificial intelligence innovators are redefining what’s possible in the markets.

- Boost your income stream by locking in reliable returns from dividend stocks with yields > 3%, featuring stocks with dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)