- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (NasdaqGS:LCID) Gains Nearly 4% Amid CEO Transition

Reviewed by Simply Wall St

Lucid Group (NasdaqGS:LCID) saw a share price increase of nearly 4% over the last quarter, a period marked by significant internal events. Notably, the transition of Peter Rawlinson from CEO to Strategic Technical Advisor and Marc Winterhoff's interim CEO appointment were key executive changes. Additionally, Lucid's release of the fourth quarter earnings report showed improved sales and reduced net losses year-on-year, potentially bolstering investor sentiment. The production guidance for approximately 20,000 vehicles in 2025 suggests strategic planning aligned with market demand. Meanwhile, the broader market faced mixed results, with high-profile tech companies declining amidst tariff concerns and market volatility. Despite a shaky market, Lucid’s favorable developments could have supported its recent share price performance. The Nasdaq's overall decline of 3.6% provided a challenging backdrop, making Lucid's relative gains noteworthy within this context.

Navigate through the intricacies of Lucid Group with our comprehensive report here.

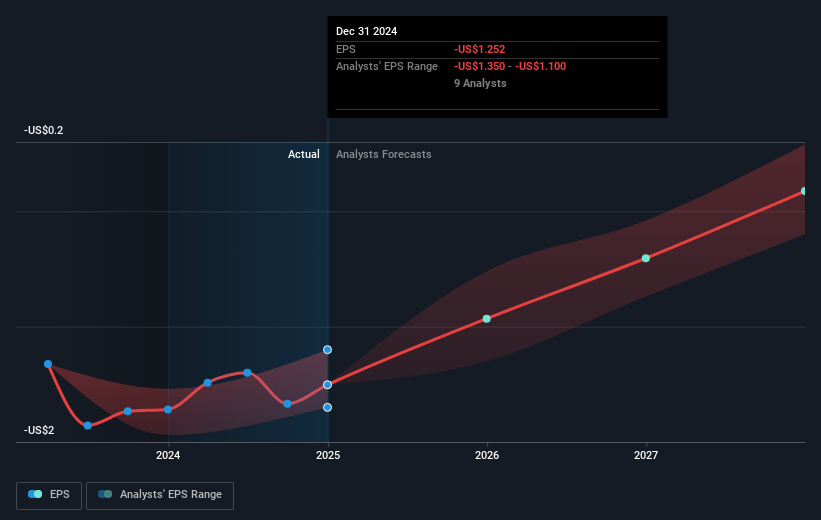

Lucid Group experienced a total return decline of 30.19% over the last year, juxtaposed against the US Auto industry's gain of 30.7% and the broader market's 16.9% rise. This underperformance can be partly attributed to the significant shareholder dilution following an equity offering that raised approximately US$680 million. Additionally, the company’s heavy net losses, including a US$2.71 billion net loss in 2024, persist despite improved sales figures.

Executive transitions, like the appointment of Taoufiq Boussaid as CFO and Marc Winterhoff as interim CEO, might have added uncertainty. On a positive note, the strategic partnership with Four Seasons Hotel Silicon Valley to offer Lucid Air vehicles highlights efforts to enhance brand visibility. However, the market's assessment of Lucid's high Price-To-Sales Ratio at 8.5x compared to the US Auto industry average of 0.6x indicates concerns about the stock’s valuation amid its current unprofitability.

- See whether Lucid Group's current market price aligns with its intrinsic value in our detailed report

- Assess the downside scenarios for Lucid Group with our risk evaluation.

- Hold shares in Lucid Group? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives