- New Zealand

- /

- Software

- /

- NZSE:GTK

High Growth Tech Stocks To Watch In December 2025

Reviewed by Simply Wall St

As global markets enter December 2025, investor optimism is buoyed by hopes of an interest rate cut from the Federal Reserve, with major U.S. stock indexes, particularly the technology-heavy Nasdaq Composite and small-cap Russell 2000 Index, posting gains. Amid this backdrop of cautious economic indicators such as a contracting manufacturing sector and fluctuating employment figures, high-growth tech stocks remain a focal point for investors seeking opportunities in sectors poised to benefit from technological advancements and market shifts.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.90% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Gentrack Group (NZSE:GTK)

Simply Wall St Growth Rating: ★★★★☆☆

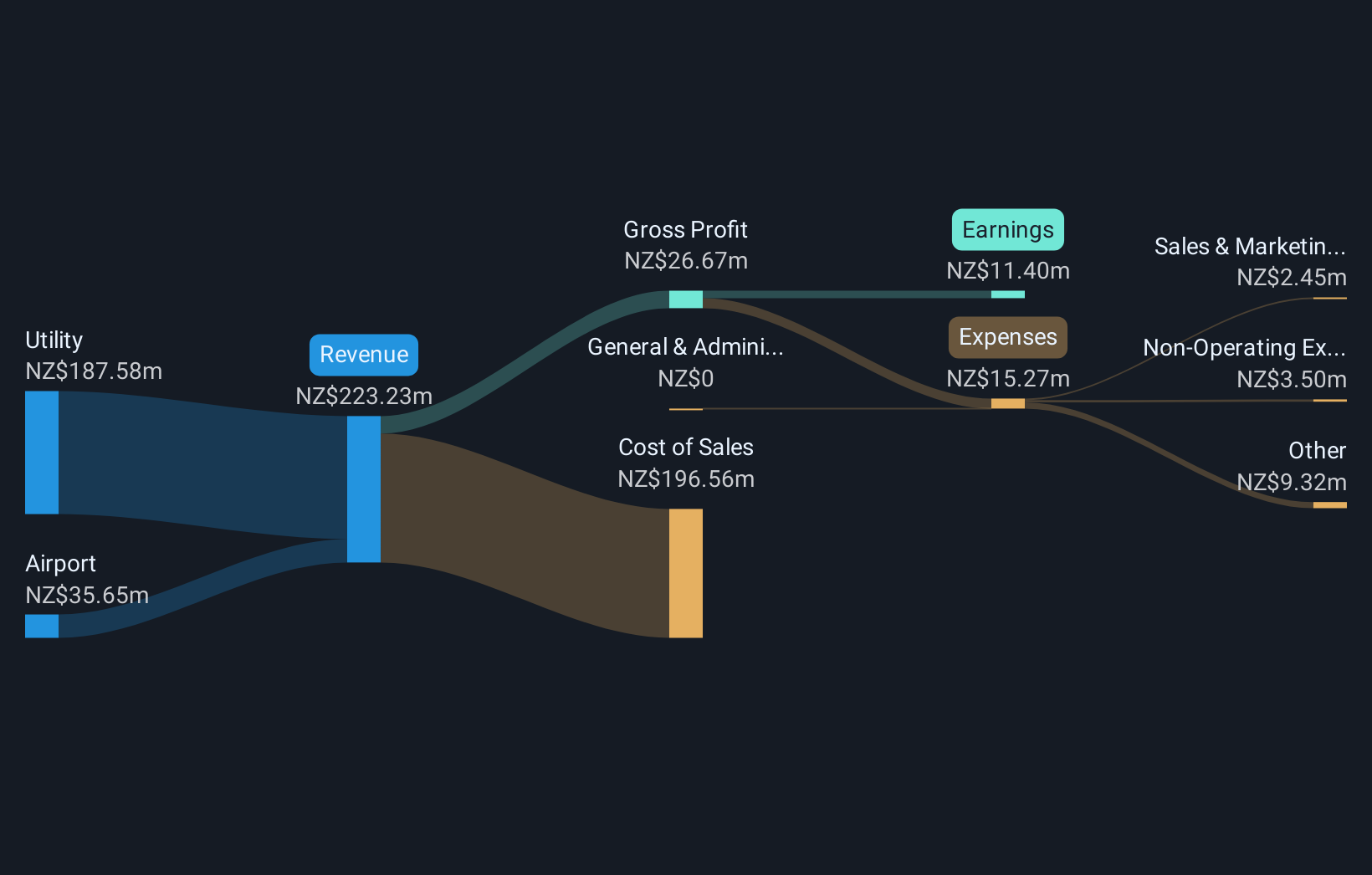

Overview: Gentrack Group Limited develops, integrates, and supports enterprise billing and customer management software solutions for the energy, water utility, and airport industries with a market cap of NZ$998.66 million.

Operations: The company derives its revenue primarily from the utility segment, contributing NZ$193.40 million, while the airport segment adds NZ$36.79 million.

Gentrack Group has demonstrated a robust performance with its annual earnings growing by 118.6%, significantly outpacing the software industry's average of 20.3%. This growth is underpinned by strategic client acquisitions, such as Pennon Water Services and Genesis Energy, leveraging its advanced g2 platform to enhance B2B customer experiences. With a revenue increase from NZ$213.24 million to NZ$230.19 million and net income more than doubling to NZ$20.87 million this year, Gentrack is positioning itself well within high-growth tech sectors. The company's focus on expanding its g2 platform across EMEA and APAC regions indicates promising future prospects, despite a forecasted low return on equity of 12.5% in three years' time and ongoing share price volatility.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

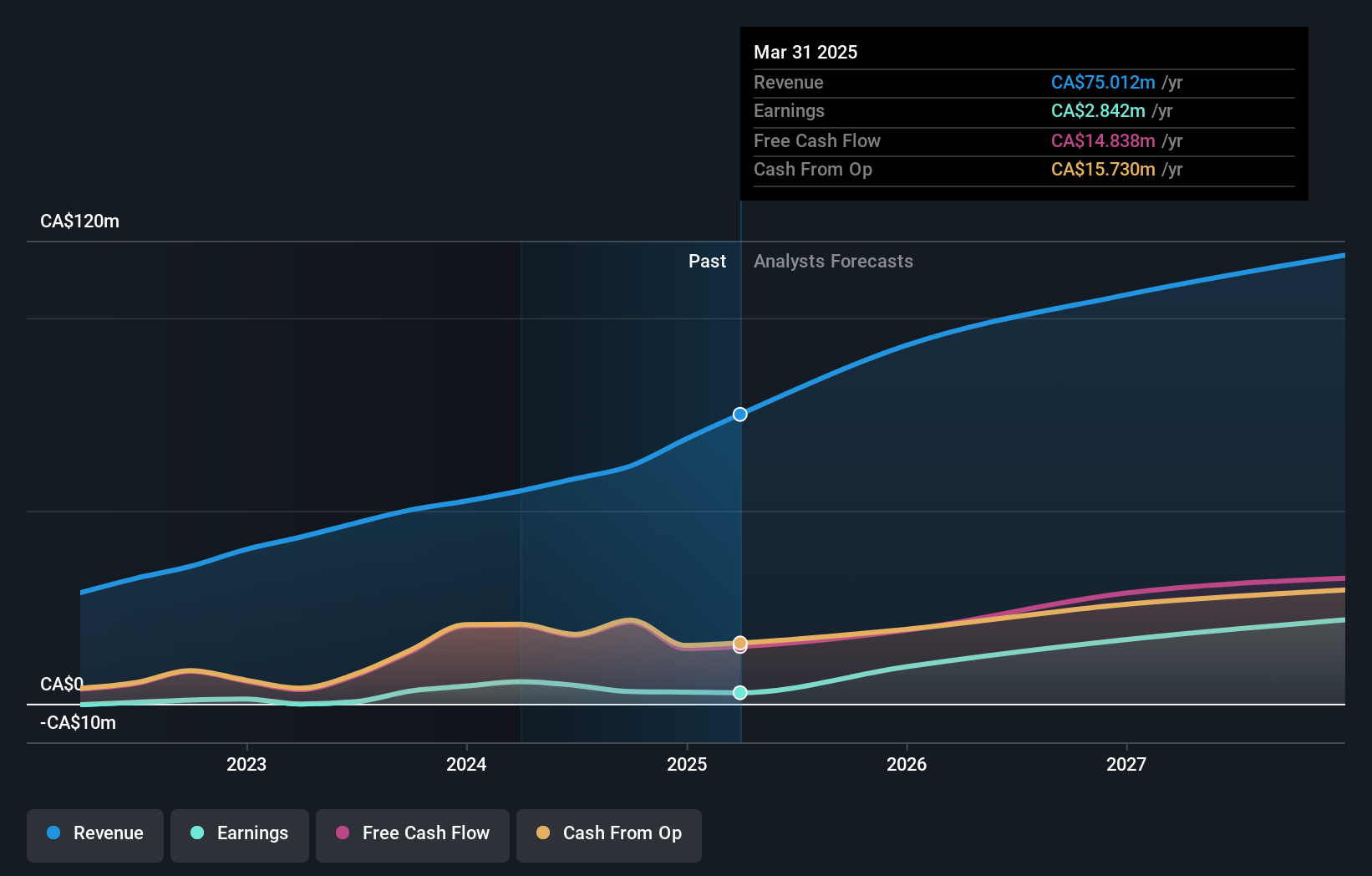

Overview: Vitalhub Corp. develops technology and software solutions for health and human service providers across multiple countries, with a market cap of CA$567.46 million.

Operations: Vitalhub Corp., along with its subsidiaries, generates revenue primarily from healthcare software solutions, amounting to CA$98.17 million.

Vitalhub, amid a landscape of aggressive acquisition strategies and significant revenue jumps from CAD 48 million to CAD 77.58 million year-over-year, is navigating through a transformative phase with its eyes set on expansion. Despite experiencing a net loss this quarter, the company's annual revenue growth forecast at 16.8% outstrips the Canadian market average of 5.2%. This performance is bolstered by Vitalhub's proactive pursuit of acquisitions to enhance its technological offerings and market footprint, signaling robust potential for future growth despite current profitability challenges marked by a recent net loss of CAD 0.89 million for Q3 2025.

- Delve into the full analysis health report here for a deeper understanding of Vitalhub.

Examine Vitalhub's past performance report to understand how it has performed in the past.

Sercomm (TWSE:5388)

Simply Wall St Growth Rating: ★★★★☆☆

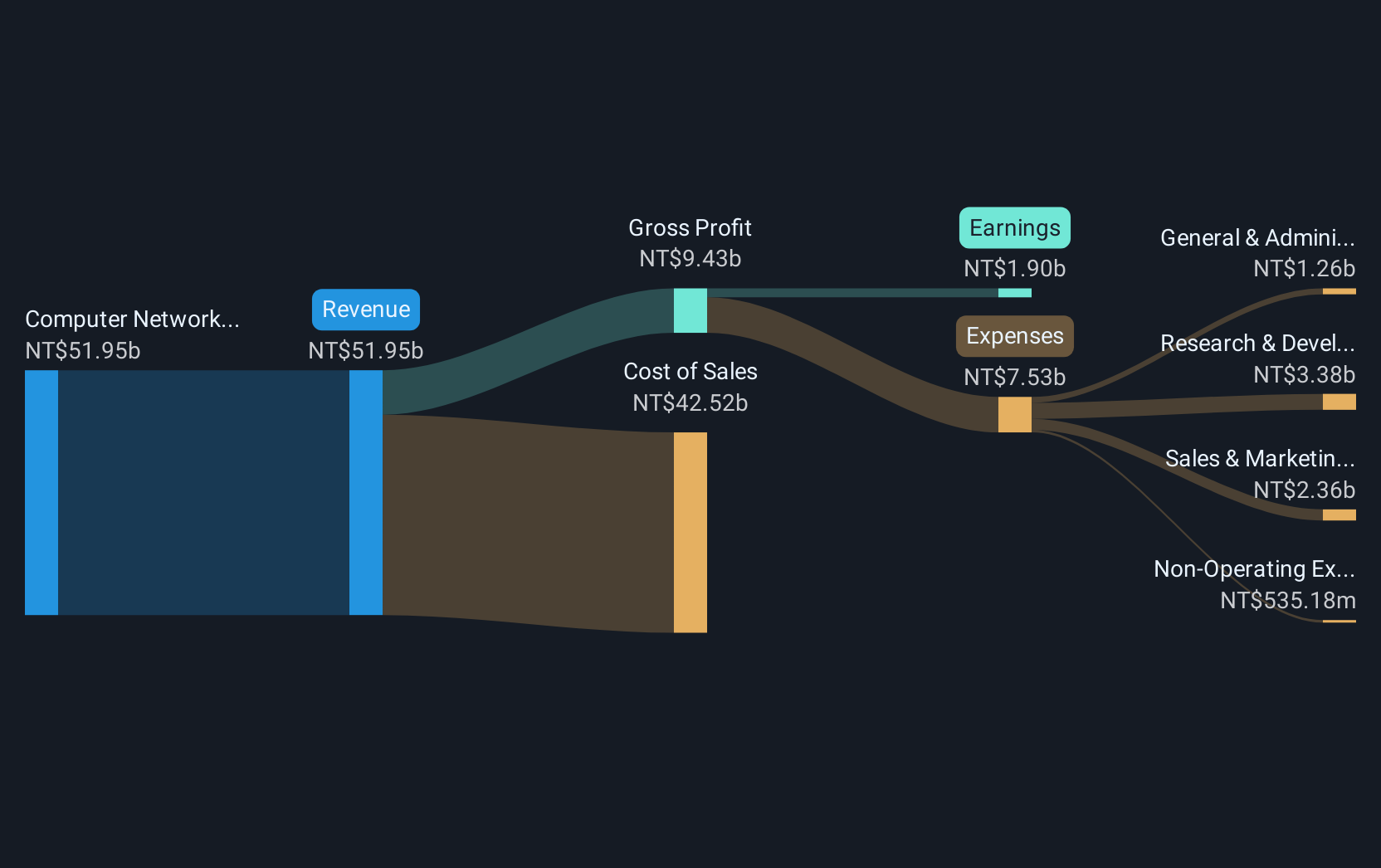

Overview: Sercomm Corporation engages in the research, development, manufacturing, and sale of networking communication software and equipment across North America, Europe, and the Asia Pacific with a market capitalization of NT$24.34 billion.

Operations: The company generates revenue primarily from its Computer Networks segment, amounting to NT$51.74 billion.

Sercomm, despite a challenging year with net earnings dropping 41.5% to TWD 935.24 million from TWD 1,765.55 million, is strategically positioning itself for recovery and innovation. The opening of the Denver Test House underscores its commitment to enhancing product testing and development capabilities in real-world settings, reflecting a proactive approach to meeting evolving consumer demands in connectivity technology. This facility not only boosts Sercomm's operational efficiency but also solidifies its role as a pivotal player in driving forward technological advancements within the industry. Furthermore, their recent product launch at the RDK Global Summit highlights Sercomm's focus on integrating cutting-edge software with hardware solutions to accelerate market responsiveness and service excellence—key factors likely contributing to their projected annual revenue growth of 14.3%.

- Take a closer look at Sercomm's potential here in our health report.

Explore historical data to track Sercomm's performance over time in our Past section.

Next Steps

- Navigate through the entire inventory of 246 Global High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GTK

Gentrack Group

Engages in the development, integration, and support of enterprise billing and customer management software solutions for the energy and water utility, and airport industries.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026