Discover Fixstars And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and economic adjustments, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop of fluctuating market sentiment and economic indicators, identifying promising investment opportunities requires a keen eye for companies that demonstrate resilience and growth potential despite broader market trends. In this context, discovering stocks like Fixstars offers investors insights into lesser-known companies that may hold strong potential in today's dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Fixstars (TSE:3687)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fixstars Corporation is a software company with operations in Japan and internationally, and it has a market capitalization of approximately ¥58.70 billion.

Operations: Fixstars generates revenue primarily from its Solution Business, contributing ¥7.70 billion, and its SaaS business, which adds ¥487.52 million.

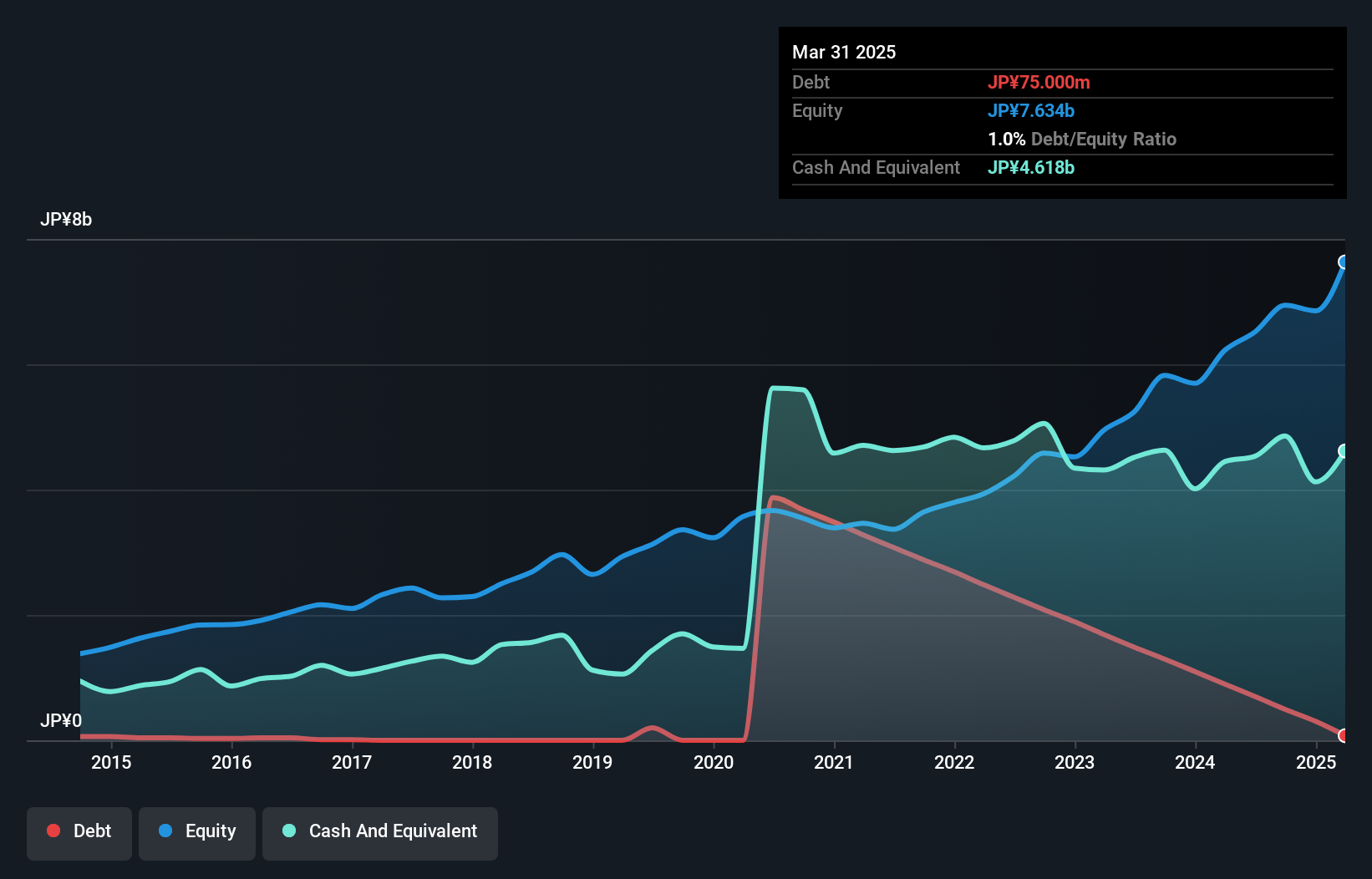

Fixstars, a nimble player in the tech space, has seen its earnings grow at a healthy clip of 20.2% annually over the past five years. Despite this growth, its recent performance lagged behind the broader software industry with only a 3.2% increase in earnings last year compared to the industry's 13.5%. The company’s financial health appears robust with EBIT covering interest payments an impressive 1152 times and more cash than total debt on hand. However, potential investors should note its share price volatility over recent months and an increased debt-to-equity ratio from zero to 7.1% over five years.

- Click here and access our complete health analysis report to understand the dynamics of Fixstars.

Gain insights into Fixstars' historical performance by reviewing our past performance report.

Inaba Denki SangyoLtd (TSE:9934)

Simply Wall St Value Rating: ★★★★★★

Overview: Inaba Denki Sangyo Co., Ltd. operates in Japan, offering electrical equipment and materials, industrial automation solutions, and proprietary products with a market capitalization of ¥218.11 billion.

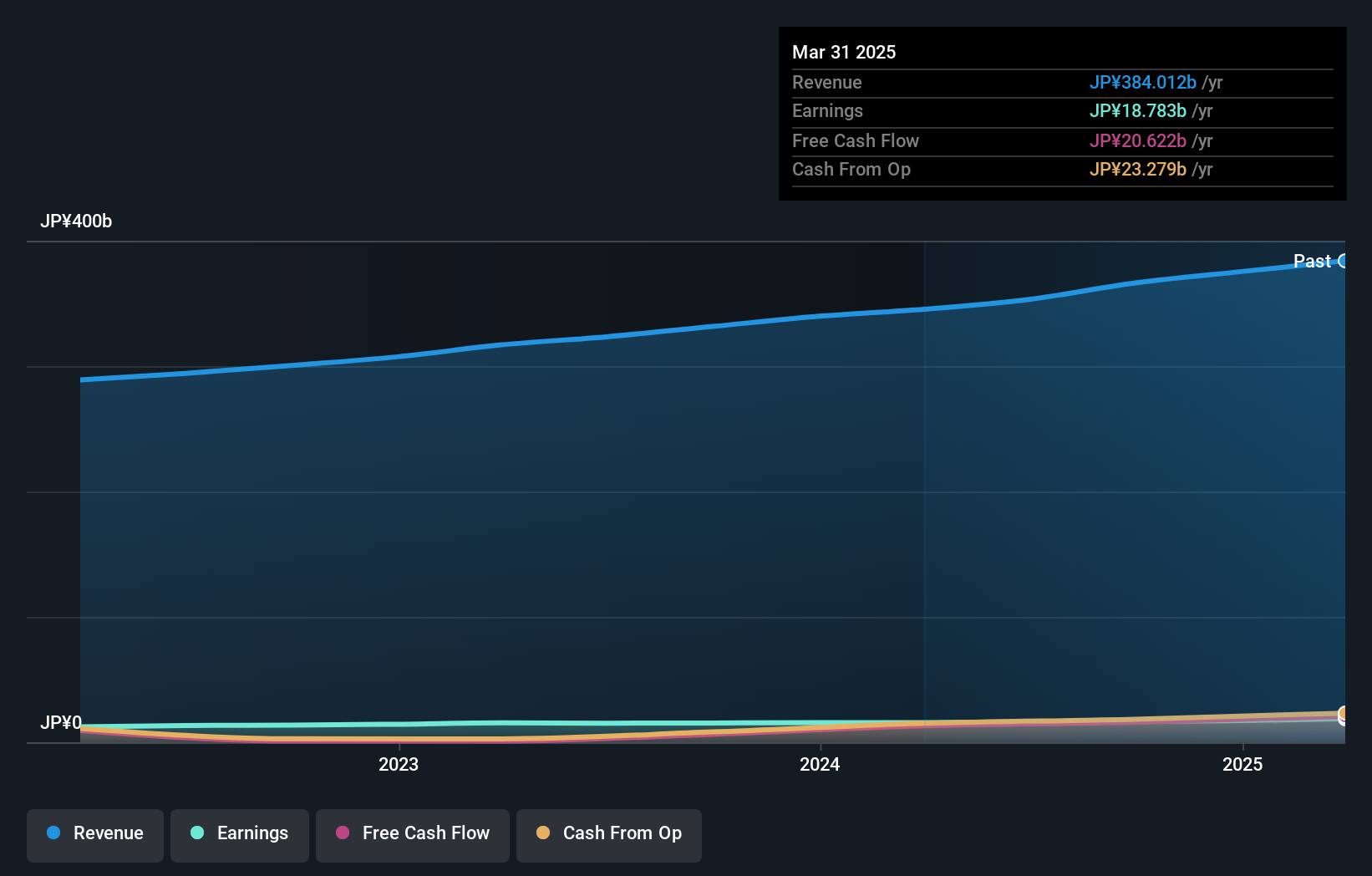

Operations: Inaba generates revenue primarily from three segments: Electrical Equipment Materials (¥258.02 billion), In-House Product Business (¥78.12 billion), and Industrial Equipment Business (¥37.46 billion). The Electrical Equipment Materials segment is the largest contributor to its total revenue.

Inaba Denki Sangyo, a nimble player in the trade distributors sector, showcases robust financial health with its earnings growth of 7.6% outpacing the industry average of 0.6%. The company is trading at an attractive valuation, reportedly 84% below estimated fair value, which could catch the eye of savvy investors. Its debt management appears prudent with a stable debt-to-equity ratio over five years and more cash than total debt. Recent news highlights its upcoming earnings release on October 31, offering potential insights into future performance and confirming its commitment to transparency in financial reporting.

- Navigate through the intricacies of Inaba Denki SangyoLtd with our comprehensive health report here.

Wah Lee Industrial (TWSE:3010)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wah Lee Industrial Corporation operates in Taiwan, focusing on the manufacturing of materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards, with a market cap of NT$32.95 billion.

Operations: Wah Lee Industrial generates revenue primarily from its Taiwan operations, contributing NT$45.19 billion, alongside significant income from China and Hong Kong at NT$13.60 billion and Shanghai Yikang at NT$15.02 billion.

Wah Lee Industrial, a smaller player in the electronics sector, has shown resilience with its earnings growing by 6.4% over the past year, outpacing the industry average of 5.3%. The company's net debt to equity ratio stands at a satisfactory 32.5%, reflecting prudent financial management. Its price-to-earnings ratio of 15.6x is appealing compared to the TW market's 21.3x, suggesting potential value for investors looking for opportunities outside mainstream picks. Recent earnings reports indicate stable performance with third-quarter sales rising to TWD 21,412 million from TWD 19,019 million last year and net income slightly up at TWD 712 million from TWD 712 million previously.

- Click here to discover the nuances of Wah Lee Industrial with our detailed analytical health report.

Evaluate Wah Lee Industrial's historical performance by accessing our past performance report.

Next Steps

- Reveal the 4502 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3687

Excellent balance sheet with reasonable growth potential.