Exploring High Growth Tech Stocks Including Guangzhou Haige Communications Group

Reviewed by Simply Wall St

Recent market dynamics have seen U.S. equities face headwinds, with small-cap stocks underperforming and the Russell 2000 Index dipping into correction territory amid inflation concerns and political uncertainty. As investors navigate these choppy waters, identifying high growth tech stocks like Guangzhou Haige Communications Group can be crucial, as such companies often demonstrate resilience through innovation and adaptability in fluctuating economic climates.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Guangzhou Haige Communications Group (SZSE:002465)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Haige Communications Group Incorporated Company operates in the wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors in China, with a market cap of approximately CN¥24.84 billion.

Operations: Haige Communications Group generates revenue primarily from its operations in wireless communications, Beidou navigation, aerospace, and digital intelligence ecology sectors. The company focuses on leveraging advanced technologies to offer comprehensive solutions across these industries in China.

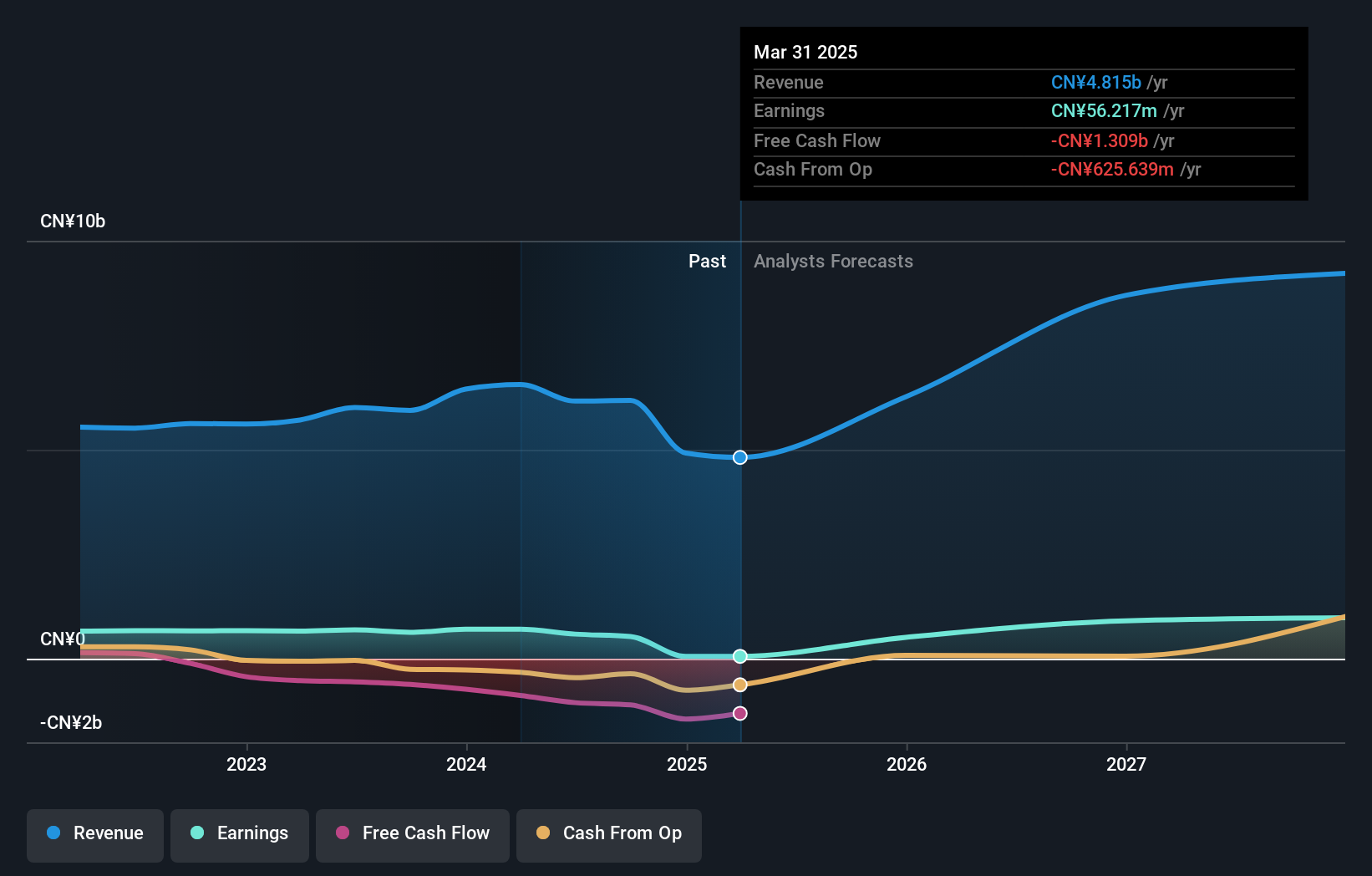

Guangzhou Haige Communications Group has demonstrated a robust annual revenue growth rate of 21%, outpacing the broader Chinese market's average of 13.9%. Despite facing a challenging period with earnings declining by 16.2% over the past year, the company is positioned for a strong recovery with projected earnings growth of 37.3% annually. This forecast is notably higher than the market average of 25.3%. The firm's recent financial performance was impacted by significant one-off gains totaling CN¥118.1M, which skewed last year’s results but are not expected to recur, suggesting a return to more stable operations ahead. Recent strategic moves include an extraordinary shareholders meeting scheduled for January 14, 2025, aimed at electing new non-independent directors and potentially steering corporate governance in a direction that supports sustained growth and innovation in communications technology. While current R&D expenditures are not specified, ongoing investment in innovation is critical for maintaining competitive advantage in this rapidly evolving industry sector.

- Get an in-depth perspective on Guangzhou Haige Communications Group's performance by reading our health report here.

Learn about Guangzhou Haige Communications Group's historical performance.

Finatext Holdings (TSE:4419)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Finatext Holdings Ltd. operates in Japan, focusing on fintech solutions, big data analysis, and financial infrastructure businesses, with a market cap of ¥46.89 billion.

Operations: The company generates revenue primarily through its Financial Infrastructure Business, which accounts for ¥3.81 billion, followed by Big Data Analysis at ¥1.56 billion and Fintech Solutions at ¥1.38 billion.

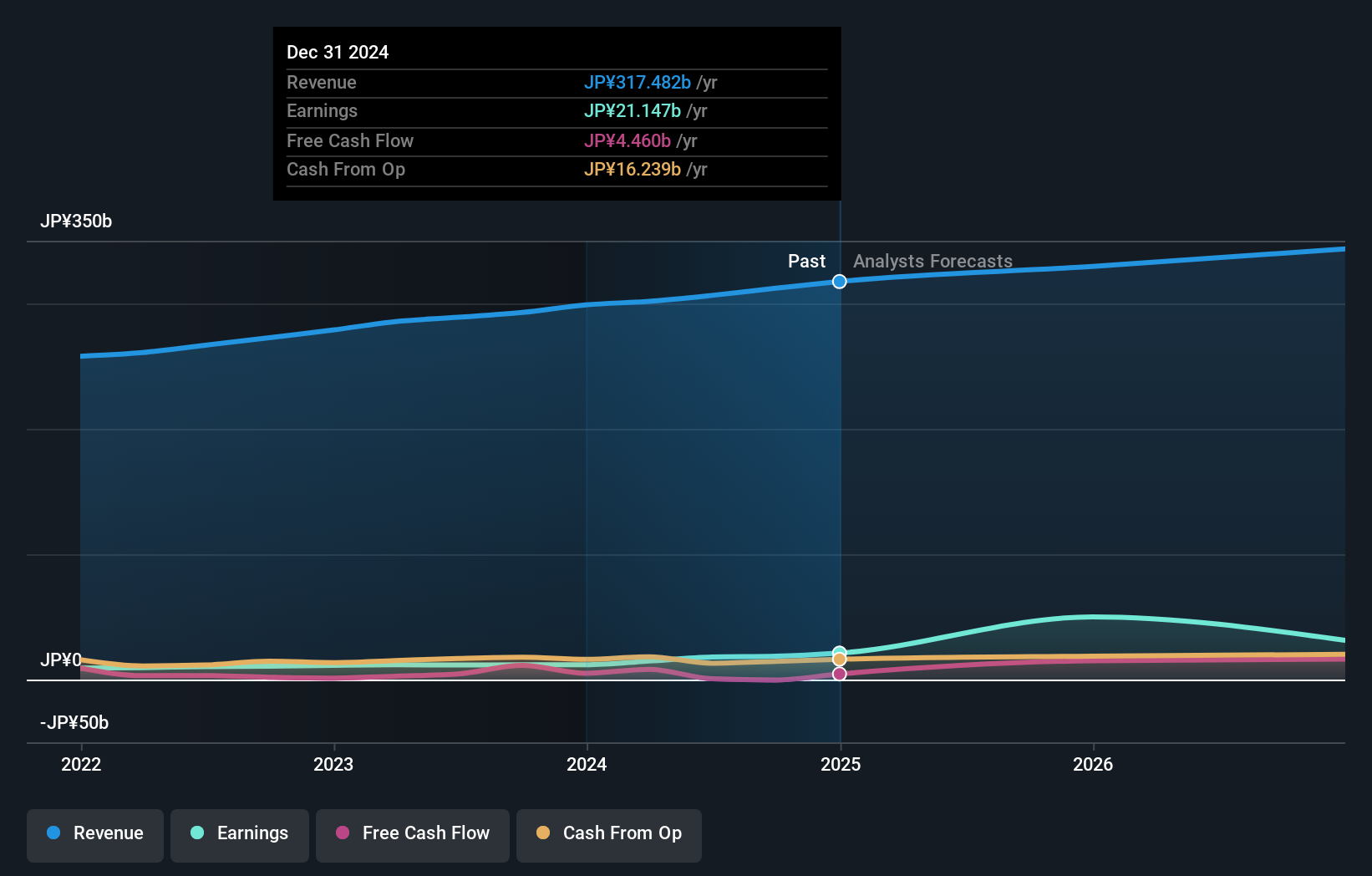

Finatext Holdings, amidst a dynamic tech landscape, has shown promising growth with an annual revenue increase of 25.5%, significantly outpacing the Japanese market's average of 4.3%. Its earnings trajectory is even more impressive, with an anticipated annual growth rate of 48.7%, dwarfing the broader market's expectation of just 8%. This financial vigor is backed by strategic R&D investments, crucial for sustaining its competitive edge in a rapidly evolving sector. The recent Q2 earnings call highlighted these efforts and underscored the company’s commitment to innovation and market expansion, setting a robust foundation for future prospects in high-tech industries.

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fuji Soft Incorporated, with a market cap of ¥613.42 billion, specializes in providing system and control software solutions across various industries in Japan.

Operations: The company generates revenue primarily from its SI Business, which accounts for ¥295.53 billion, and also engages in the Facility Business with a contribution of ¥3.01 billion.

Fuji Soft has demonstrated robust financial performance, with a notable earnings growth of 57.1% over the past year, far surpassing the software industry's average of 12.1%. This growth trajectory is supported by strategic R&D investments that are essential for maintaining a competitive edge in the evolving tech landscape. Additionally, Fuji Soft's revenue is expected to grow at 4.5% annually, slightly above Japan's market average of 4.3%. Amidst recent M&A activities, KKR’s acquisition proposal at ¥9,451 per share underscores confidence in Fuji Soft’s value and potential for further expansion and innovation within its sector.

- Click here and access our complete health analysis report to understand the dynamics of Fuji Soft.

Examine Fuji Soft's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Embark on your investment journey to our 1227 High Growth Tech and AI Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9749

Fuji Soft

Provides system/control software for various industries in Japan.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives