As global markets grapple with inflation fears and political uncertainties, U.S. equities have experienced a decline, with small-cap stocks underperforming their larger counterparts. Amid this volatility, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate choppy market waters.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.55% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.58% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.07% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.93% | ★★★★★★ |

Click here to see the full list of 2004 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Zhejiang Jiaxin SilkLtd (SZSE:002404)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Zhejiang Jiaxin Silk Corp., Ltd. engages in the research and development, production, and sales of silk products both in China and internationally, with a market cap of CN¥3.39 billion.

Operations: Zhejiang Jiaxin Silk Corp., Ltd. generates revenue through its research and development, production, and sales of silk products across domestic and international markets.

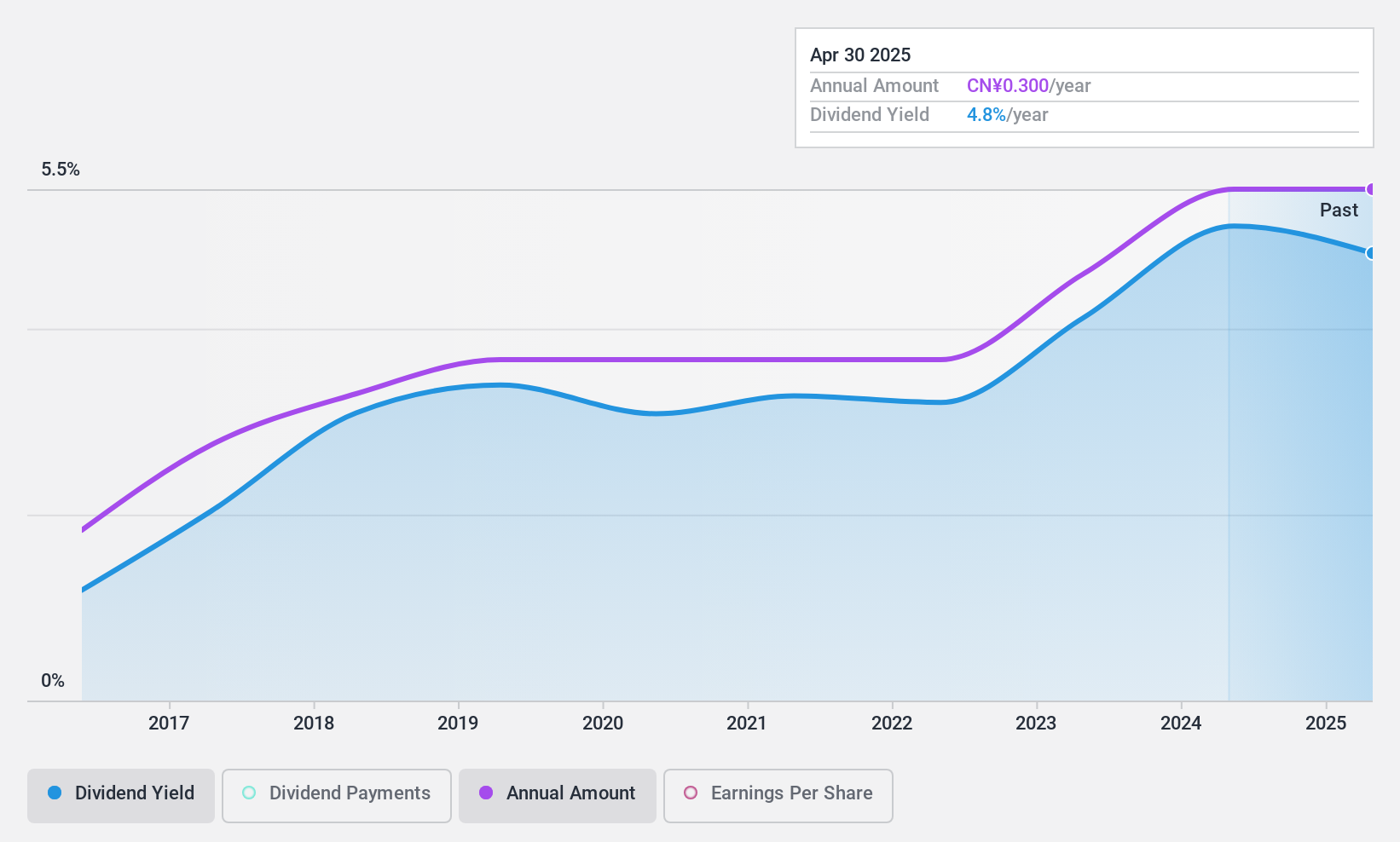

Dividend Yield: 4.8%

Zhejiang Jiaxin Silk Ltd. offers a compelling dividend profile with stable and reliable payments over the past decade, supported by a high yield of 4.81%, placing it in the top 25% of dividend payers in China. Despite recent earnings declining to CNY 151.86 million for the nine months ending September 2024, dividends remain well-covered by both earnings and cash flows, with payout ratios at sustainable levels (earnings: 85.6%, cash: 39.7%).

- Delve into the full analysis dividend report here for a deeper understanding of Zhejiang Jiaxin SilkLtd.

- Our valuation report here indicates Zhejiang Jiaxin SilkLtd may be undervalued.

Proto (TSE:4298)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Proto Corporation offers automobile-related information services focusing on new and used cars, parts, and supplies, with a market cap of ¥49.58 billion.

Operations: Proto Corporation's revenue is primarily derived from its Commerce segment, which accounts for ¥77.14 million, followed by the Pratt Form segment contributing ¥32.30 million.

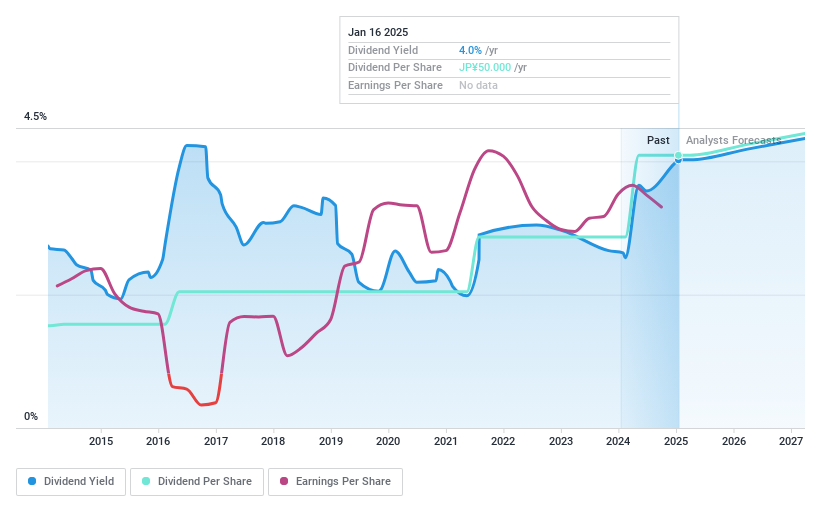

Dividend Yield: 4%

Proto Corporation's dividend profile is robust, with stable and growing payments over the past decade. Its dividend yield of 4.02% ranks in the top 25% of Japanese payers, supported by sustainable payout ratios (earnings: 41%, cash: 51.4%). Despite modest earnings growth of 0.9% annually over five years, dividends remain well-covered by both earnings and cash flows. Recent board meetings focused on executive remuneration and financial reporting adjustments may influence future performance assessments.

- Click here to discover the nuances of Proto with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Proto is priced lower than what may be justified by its financials.

SuperAlloy Industrial (TWSE:1563)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SuperAlloy Industrial Co., Ltd. specializes in engineering and manufacturing lightweight metal products for the automotive industry, with a market cap of NT$13.72 billion.

Operations: SuperAlloy Industrial Co., Ltd. generates revenue primarily from its Automotive Rim segment, which accounts for NT$6.76 billion.

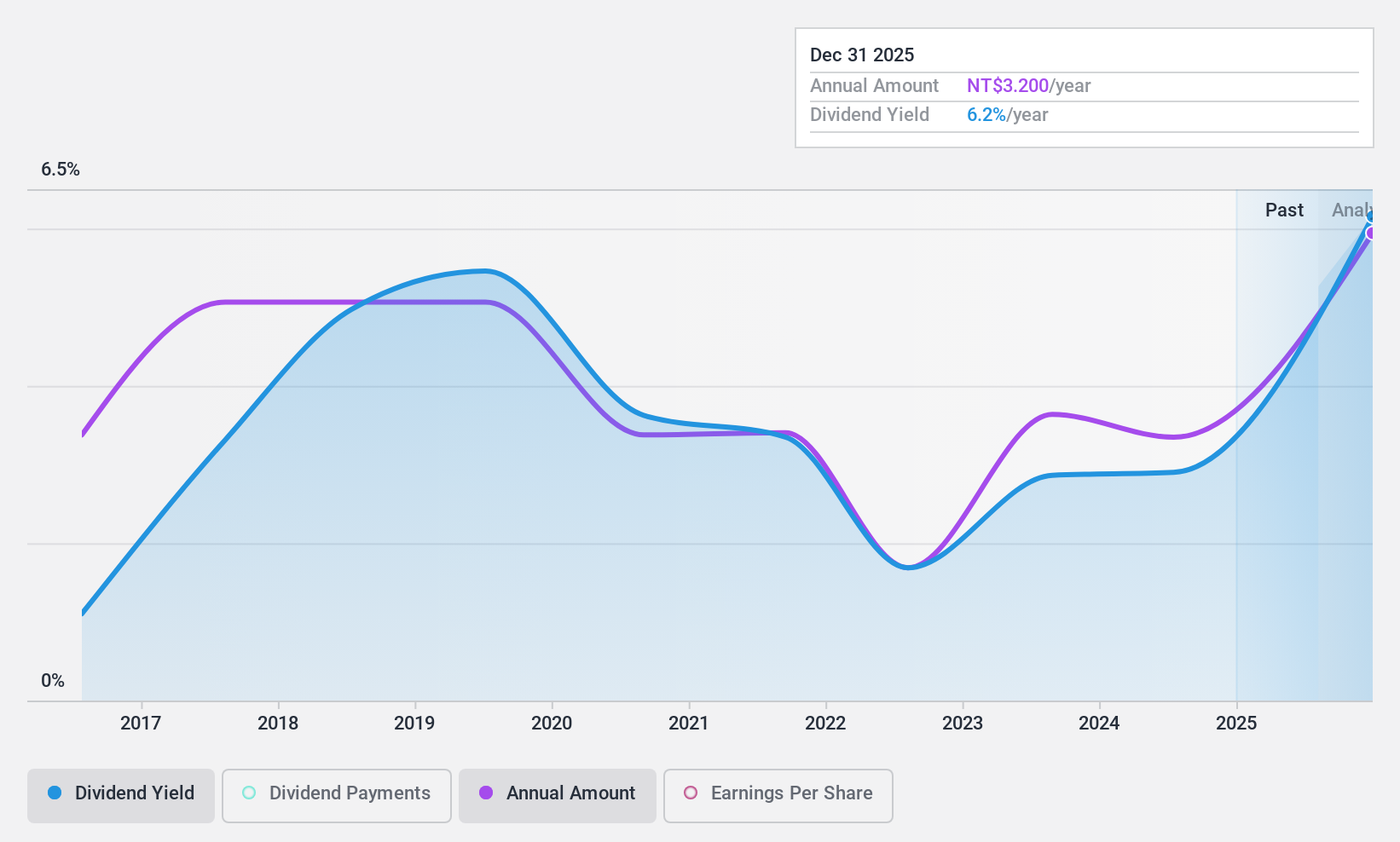

Dividend Yield: 3.1%

SuperAlloy Industrial's dividend profile presents a mixed picture, with payments increasing over the past decade but remaining volatile. The current yield of 3.11% is below the top tier in Taiwan, and dividends have been unreliable historically. Despite this, the payout ratios are sustainable, with earnings and cash flows covering dividends at 59.2% and 20.3%, respectively. Recent buyback announcements may impact future distributions as shares are repurchased for employee transfers.

- Take a closer look at SuperAlloy Industrial's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that SuperAlloy Industrial is trading beyond its estimated value.

Summing It All Up

- Access the full spectrum of 2004 Top Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4298

Proto

Provides automobile-related information services on new and used cars, parts, and supplies.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion