As global markets face a turbulent start to the year, with small-cap stocks underperforming and inflation concerns persisting, investors are closely monitoring economic indicators and Federal Reserve policies for guidance. In such an environment, identifying high-growth tech stocks requires careful consideration of companies that demonstrate resilience in challenging market conditions while showing potential for innovation and expansion.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| AVITA Medical | 33.33% | 51.81% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

Click here to see the full list of 1227 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Fixstars (TSE:3687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fixstars Corporation is a software company with international operations, and it has a market cap of ¥55.83 billion.

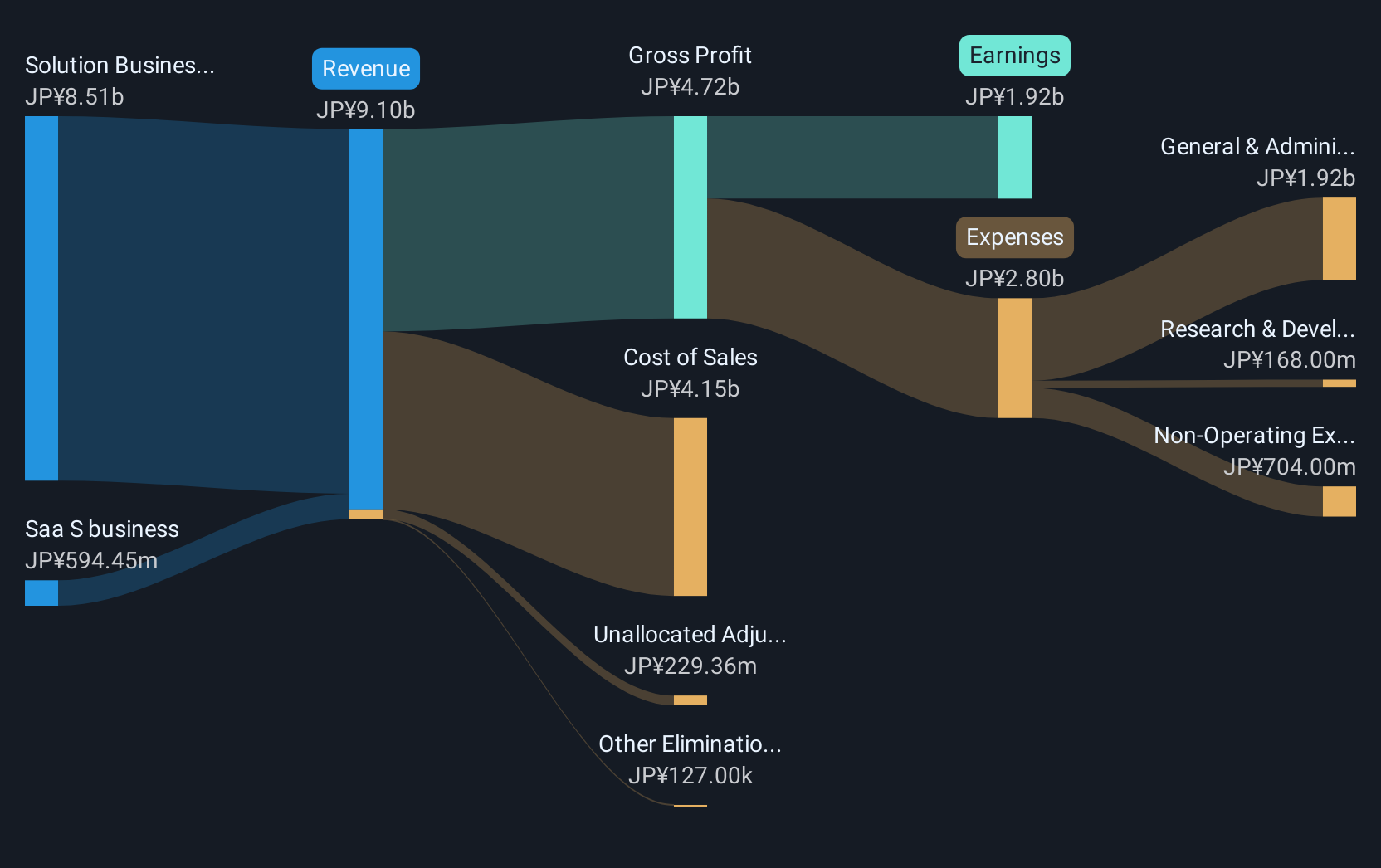

Operations: Fixstars Corporation focuses on software development, leveraging its expertise to provide solutions across various industries. The company's revenue streams are diversified, with a significant portion derived from international markets. The cost structure is primarily influenced by research and development expenses, reflecting its commitment to innovation. Net profit margin trends indicate fluctuations over recent periods, highlighting the dynamic nature of its financial performance.

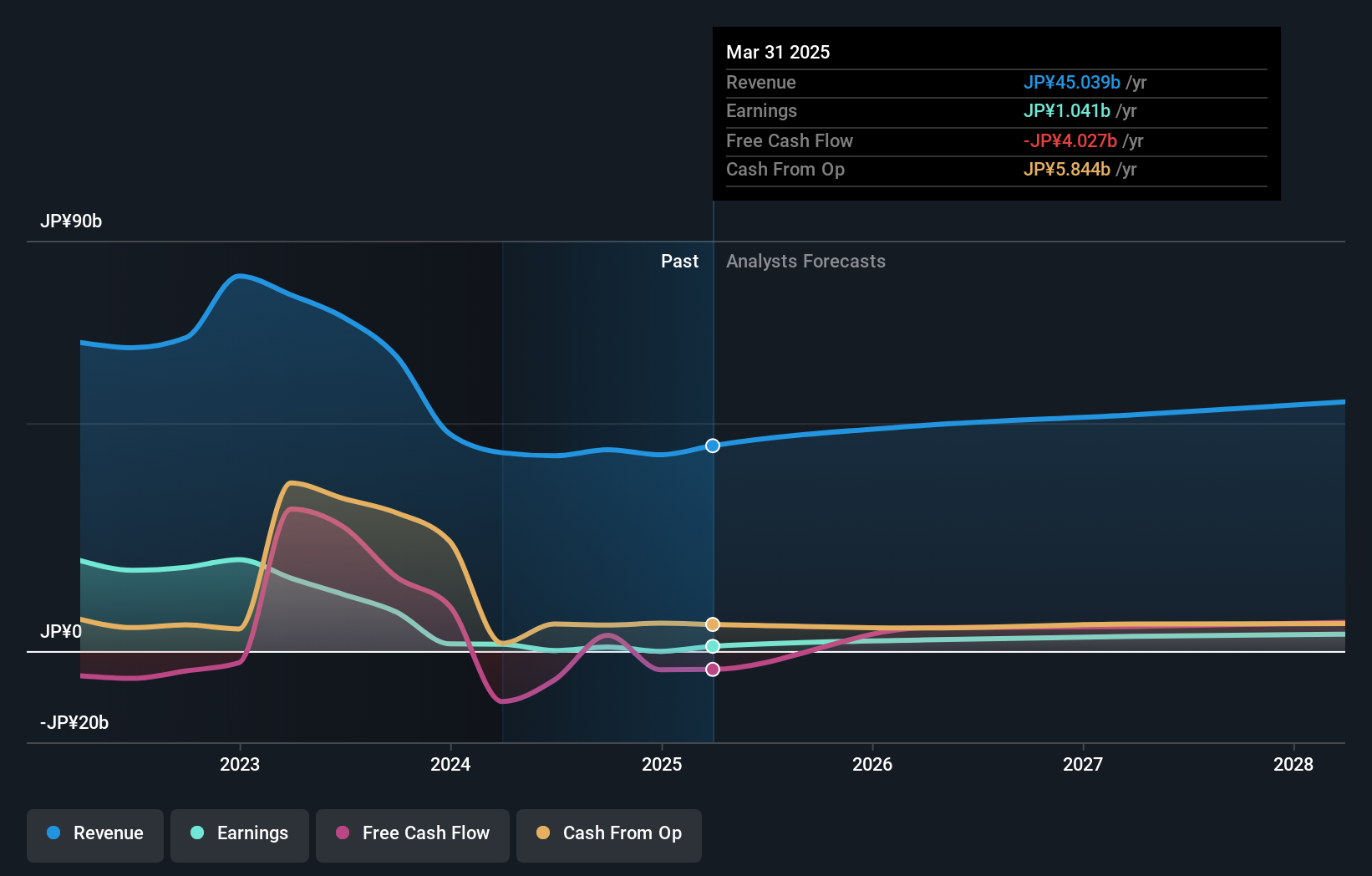

Fixstars' recent unveiling of AI Booster marks a significant stride in AI technology, optimizing performance across various GPU environments which could reshape cost structures and efficiency metrics in tech deployments. This innovation aligns with their financial trajectory, as evidenced by a robust 20.5% forecasted annual earnings growth and an impressive 14.7% expected revenue increase per year, outpacing the Japanese market's average. However, despite these promising figures, Fixstars has experienced high share price volatility recently, which might concern risk-averse investors. The company's commitment to enhancing AI capabilities through R&D investments is crucial for maintaining its competitive edge in the rapidly evolving tech landscape.

- Click here to discover the nuances of Fixstars with our detailed analytical health report.

Examine Fixstars' past performance report to understand how it has performed in the past.

Takara Bio (TSE:4974)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, other parts of Asia, the United States, Europe, and internationally with a market capitalization of ¥119.57 billion.

Operations: The company generates revenue primarily through its drug discovery operations, which contribute ¥44.15 billion. The business spans multiple regions including Japan, China, Asia, the United States, and Europe.

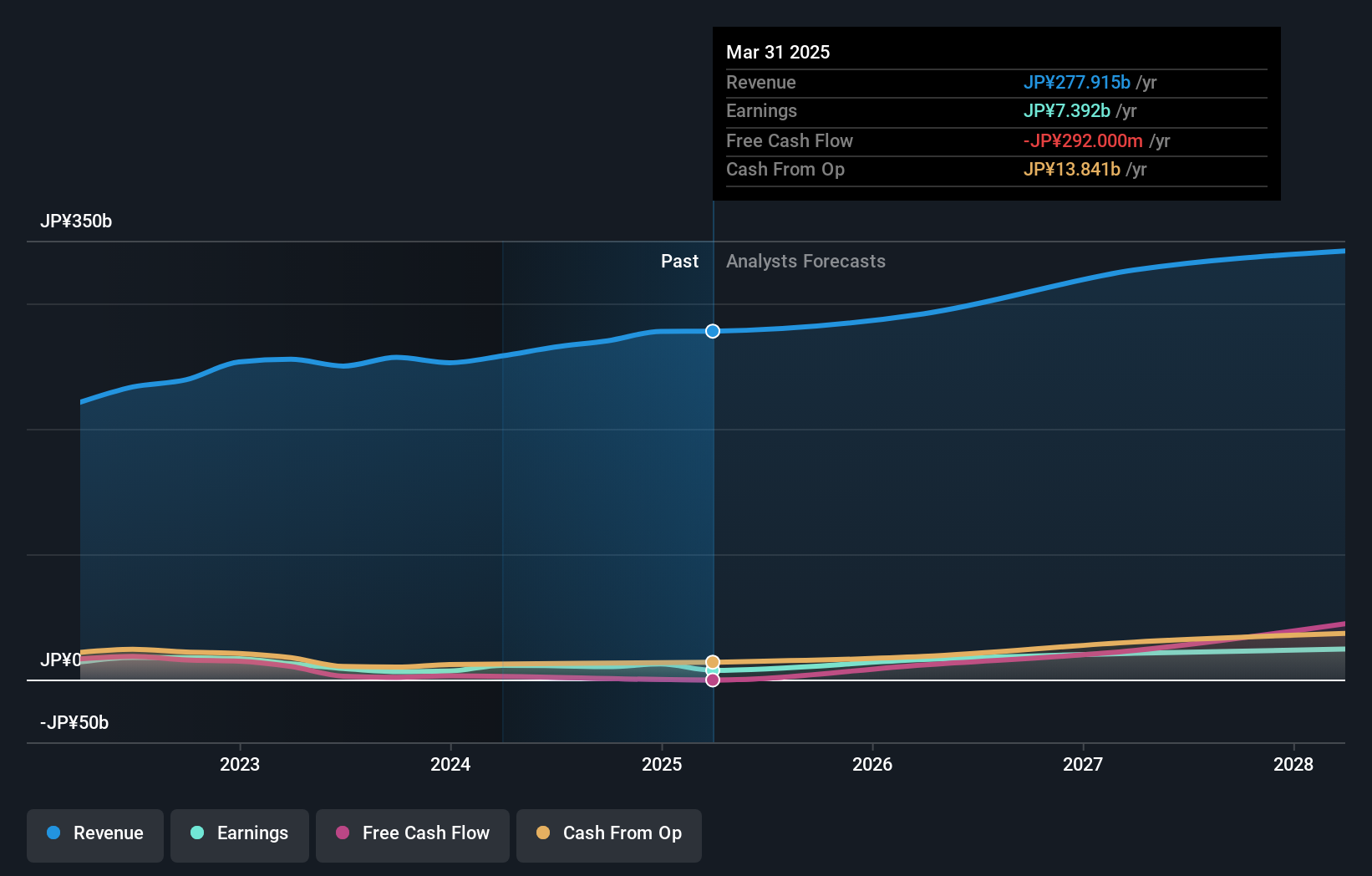

Takara Bio stands out with a notable 26% anticipated annual earnings growth, surpassing the Japanese market's average of 8%. This growth trajectory is supported by robust R&D investments, which are crucial for maintaining competitiveness in biotechnology. Despite recent challenges, including a significant one-off loss of ¥662M last year affecting financial results, the company has managed to maintain a positive free cash flow. Moreover, Takara Bio’s revenue growth at 5.3% per year is set to outpace the broader market's 4.3%, indicating potential resilience and adaptability in a rapidly evolving industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Takara Bio.

Gain insights into Takara Bio's past trends and performance with our Past report.

Kadokawa (TSE:9468)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kadokawa Corporation operates as an entertainment company in Japan with a market capitalization of ¥429.61 billion.

Operations: Kadokawa generates revenue primarily from Publishing and IP Creation, contributing ¥146 billion, followed by Animation and Live-Action Footage at ¥49.40 billion. The company also earns from Game, Web Service, and Education/Edtech segments with revenues of ¥29.66 billion, ¥18.47 billion, and ¥14.34 billion respectively.

Kadokawa, a diversified media company, is positioning itself robustly within the tech-driven entertainment landscape. Recently, it announced a strategic alliance with Kakao piccoma to enhance its e-book business, leveraging the growing demand for digital content. This move aligns with Kadokawa's ambitious goal to boost its publication segment's net sales by 15.3% annually. Moreover, amidst rumors of acquisition talks with Sony—a stakeholder in Kadokawa—the potential deal could significantly amplify its market presence and technological capabilities, underscoring its strategic initiatives to innovate and expand globally.

- Get an in-depth perspective on Kadokawa's performance by reading our health report here.

Assess Kadokawa's past performance with our detailed historical performance reports.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1227 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadokawa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9468

Flawless balance sheet with solid track record.

Market Insights

Community Narratives