- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6510

Asian Market's December 2025 Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate the implications of interest rate adjustments and economic uncertainties, Asian markets are drawing attention with their unique challenges and opportunities. In this environment, discerning investors are on the lookout for stocks that may be trading below their intrinsic value, offering potential entry points in a market characterized by cautious optimism.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.30 | CN¥161.03 | 48.3% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.96 | CN¥25.25 | 48.7% |

| Wacom (TSE:6727) | ¥788.00 | ¥1535.49 | 48.7% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.11 | HK$16.17 | 49.9% |

| KIYO LearningLtd (TSE:7353) | ¥694.00 | ¥1379.70 | 49.7% |

| IbidenLtd (TSE:4062) | ¥11375.00 | ¥22045.81 | 48.4% |

| Global Security Experts (TSE:4417) | ¥2926.00 | ¥5782.32 | 49.4% |

| Daiichi Sankyo Company (TSE:4568) | ¥3406.00 | ¥6544.37 | 48% |

| Cowell e Holdings (SEHK:1415) | HK$28.02 | HK$55.59 | 49.6% |

| Andes Technology (TWSE:6533) | NT$250.00 | NT$486.30 | 48.6% |

We'll examine a selection from our screener results.

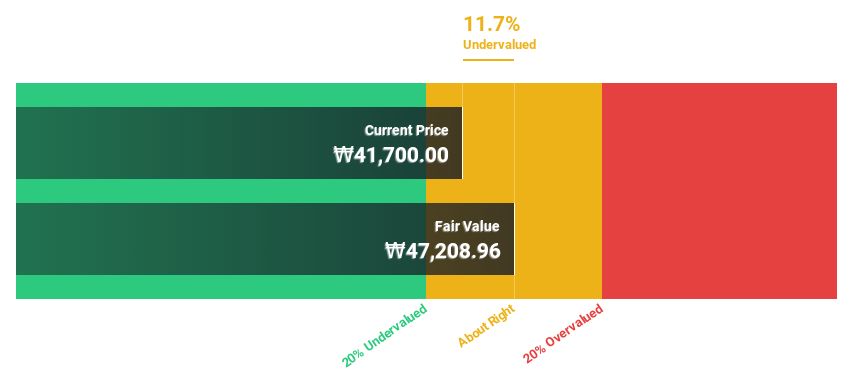

DEAR U (KOSDAQ:A376300)

Overview: DEAR U Co., LTD. is a communication platform company operating in South Korea and internationally, with a market cap of ₩852.21 billion.

Operations: The company generates revenue primarily from its Bubble segment, amounting to ₩77.80 billion.

Estimated Discount To Fair Value: 13.2%

DEAR U is trading at ₩35,900, approximately 13.2% below its estimated fair value of ₩41,365.53. Although profit margins have declined from 31.9% to 17.8%, the company's earnings are projected to grow significantly at an annual rate of 54.86% over the next three years, outpacing the Korean market's average growth rate of 30.5%. Analysts anticipate a stock price increase of around 46.2%, reflecting optimism despite lower forecasted return on equity and revenue growth rates below 20%.

- Our earnings growth report unveils the potential for significant increases in DEAR U's future results.

- Dive into the specifics of DEAR U here with our thorough financial health report.

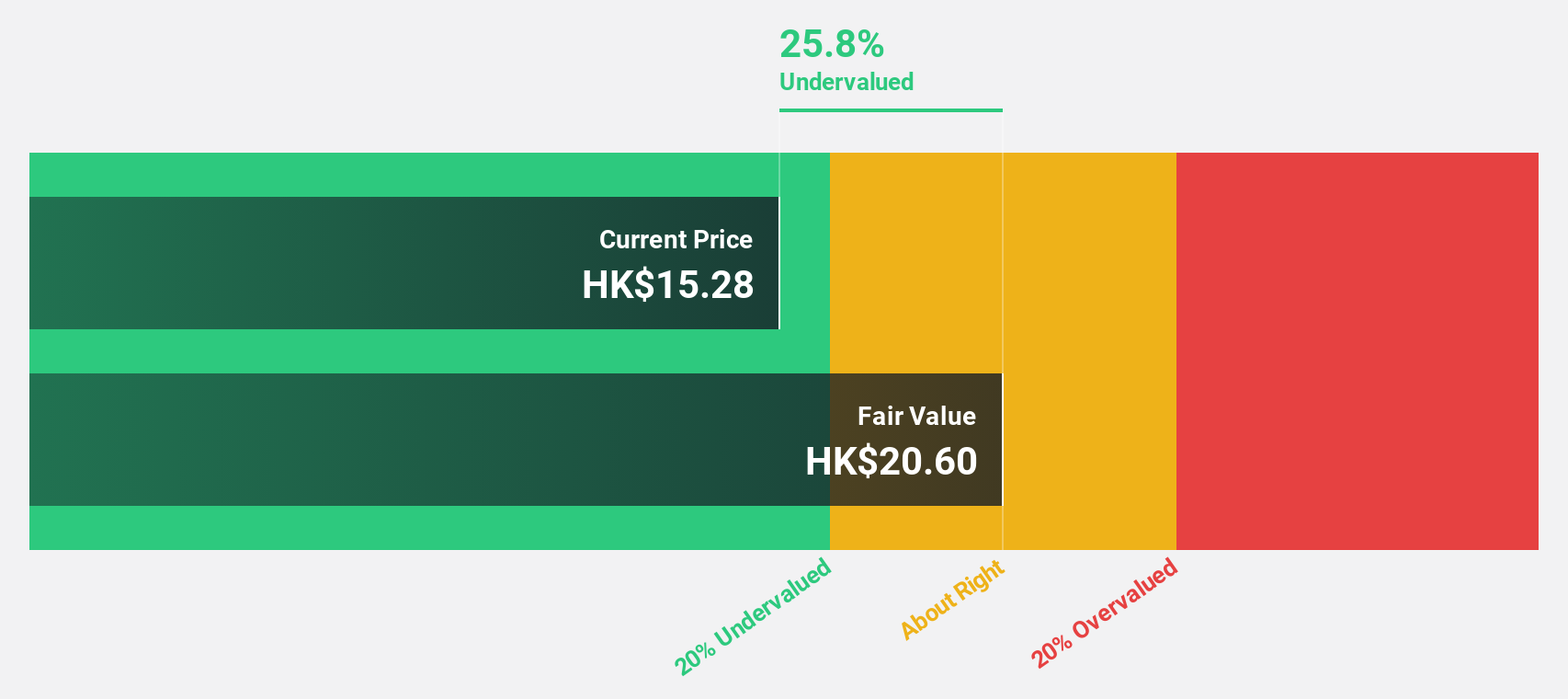

Ping An Healthcare and Technology (SEHK:1833)

Overview: Ping An Healthcare and Technology Company Limited operates an online healthcare services platform in China, with a market cap of HK$31.54 billion.

Operations: The company's revenue segments include Health Services generating CN¥2.43 billion, Medical Services contributing CN¥2.38 billion, and Senior Care Services providing CN¥407.65 million.

Estimated Discount To Fair Value: 41.3%

Ping An Healthcare and Technology is trading at HK$14.59, significantly below its estimated fair value of HK$24.86, highlighting potential undervaluation based on cash flows. Although recent executive changes could impact strategic direction, the company is advancing its Health and Senior Care initiatives under new leadership. Despite past shareholder dilution and large one-off items affecting earnings quality, projected annual earnings growth of 34% suggests robust future performance compared to the broader Hong Kong market's average growth rate.

- The analysis detailed in our Ping An Healthcare and Technology growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Ping An Healthcare and Technology stock in this financial health report.

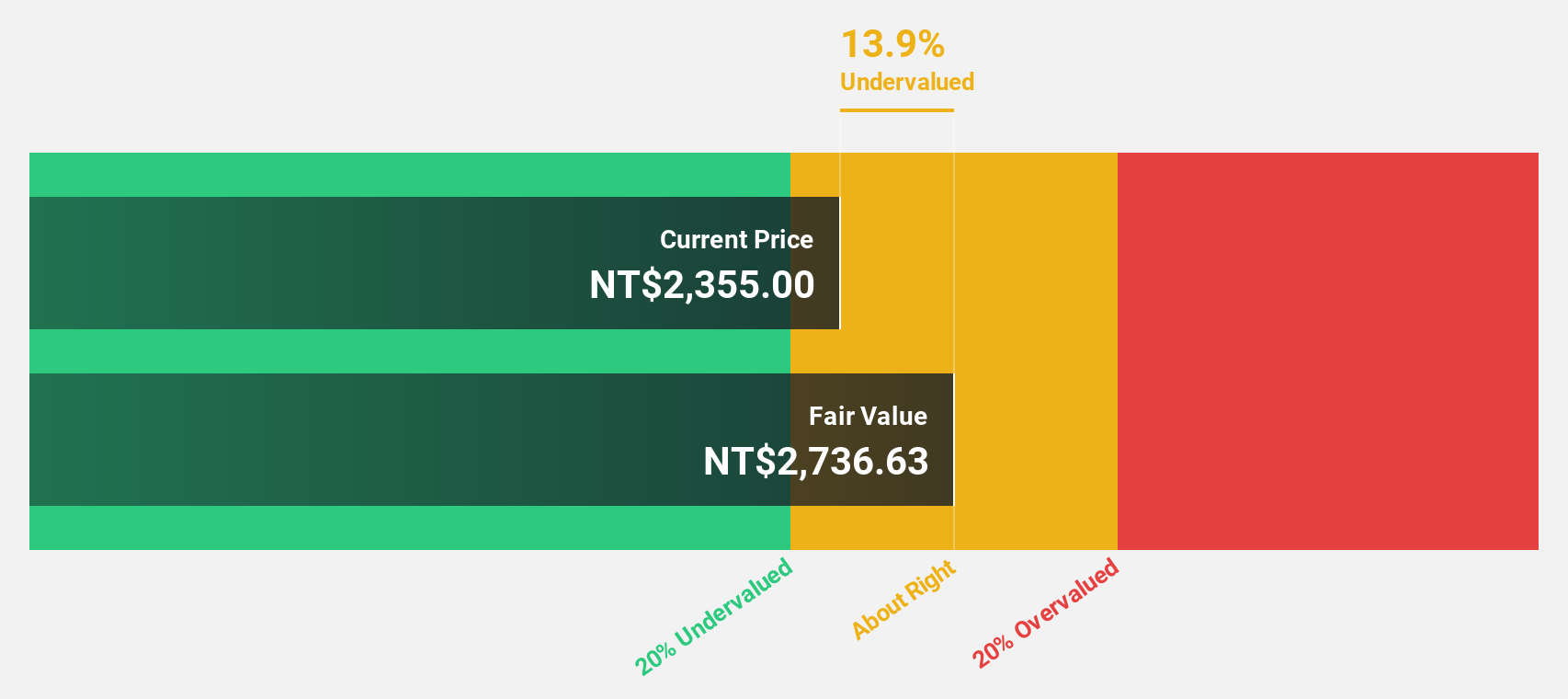

Chunghwa Precision Test Tech (TPEX:6510)

Overview: Chunghwa Precision Test Tech. Co., Ltd. operates in the testing of semiconductor components both in Taiwan and internationally, with a market cap of NT$77.22 billion.

Operations: The company generates revenue from its Electronic Components & Parts segment, amounting to NT$4.90 billion.

Estimated Discount To Fair Value: 13.9%

Chunghwa Precision Test Tech is trading at NT$2,355, below its estimated fair value of NT$2,736.63. Recent earnings show strong growth, with third-quarter sales rising to TWD 1.24 billion and net income reaching TWD 275.6 million year-over-year. A strategic alliance with Yokowo Co., Ltd., starting November 2025, aims to enhance competitiveness in the semiconductor market through mutual investments and product development collaboration, though immediate financial impact is minimal.

- According our earnings growth report, there's an indication that Chunghwa Precision Test Tech might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Chunghwa Precision Test Tech.

Where To Now?

- Reveal the 274 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6510

Chunghwa Precision Test Tech

Engages in the testing of semiconductor components in Taiwan, Republic of China, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)