- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6462

Bearish: Analysts Just Cut Their Egis Technology Inc. (GTSM:6462) Revenue and EPS estimates

The analysts covering Egis Technology Inc. (GTSM:6462) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

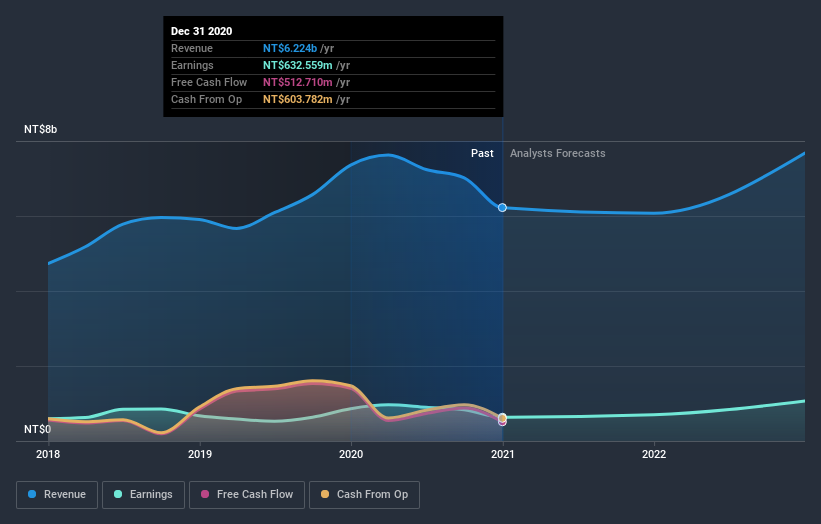

Following the downgrade, the consensus from three analysts covering Egis Technology is for revenues of NT$6.1b in 2021, implying a small 2.4% decline in sales compared to the last 12 months. Per-share earnings are expected to increase 6.9% to NT$9.78. Before this latest update, the analysts had been forecasting revenues of NT$7.5b and earnings per share (EPS) of NT$15.45 in 2021. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a pretty serious decline to earnings per share numbers as well.

See our latest analysis for Egis Technology

It'll come as no surprise then, to learn that the analysts have cut their price target 17% to NT$147. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Egis Technology at NT$165 per share, while the most bearish prices it at NT$117. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Egis Technology's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 2.4% by the end of 2021. This indicates a significant reduction from annual growth of 32% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 9.4% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Egis Technology is expected to lag the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Egis Technology. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Egis Technology.

In light of the downgrade, our automated discounted cash flow valuation tool suggests that Egis Technology could now be moderately overvalued. Find out why, and see how we estimate the valuation for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Egis Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Egis Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6462

Egis Technology

Engages in the IC design, research, development, and sales of data security software, and biometric identification software and hardware in the United States, Taiwan, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)