- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:700

3 Stocks That Might Be Undervalued By Up To 49.3%

Reviewed by Simply Wall St

In a week marked by significant rebounds in U.S. stocks and rate cuts from the European Central Bank, investors are keenly watching for opportunities amid fluctuating market conditions. With core inflation slightly higher than expected and Treasury yields reaching year-to-date lows, the landscape is ripe for identifying potentially undervalued stocks. Finding a good stock often involves looking beyond current market volatility to identify companies with strong fundamentals that may be temporarily underpriced. In this context, we explore three stocks that might be undervalued by up to 49.3%.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$180.44 | CA$360.64 | 50% |

| IMAGICA GROUP (TSE:6879) | ¥502.00 | ¥1000.43 | 49.8% |

| Shanghai Baolong Automotive (SHSE:603197) | CN¥32.08 | CN¥63.98 | 49.9% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥22.93 | CN¥45.73 | 49.9% |

| Biotage (OM:BIOT) | SEK181.00 | SEK361.08 | 49.9% |

| California Resources (NYSE:CRC) | US$52.31 | US$104.32 | 49.9% |

| Progress Software (NasdaqGS:PRGS) | US$57.52 | US$114.90 | 49.9% |

| ChromaDex (NasdaqCM:CDXC) | US$3.55 | US$7.10 | 50% |

| NFI Group (TSX:NFI) | CA$18.57 | CA$37.11 | 50% |

| Distribuidora Internacional de Alimentación (BME:DIA) | €0.0128 | €0.026 | 49.9% |

Let's review some notable picks from our screened stocks.

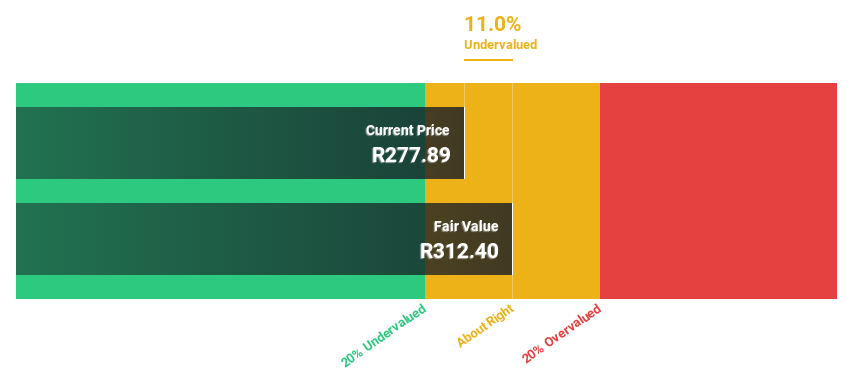

Gold Fields (JSE:GFI)

Overview: Gold Fields Limited is a gold producer with operations in Chile, South Africa, Ghana, Canada, Australia, and Peru and has a market cap of ZAR229.84 billion.

Operations: Gold Fields Limited generates its revenue from mine operations, amounting to $4.36 billion.

Estimated Discount To Fair Value: 20.8%

Gold Fields is trading 20.8% below its estimated fair value of ZAR324.23, with forecasted earnings growth of 36.2% per year, outpacing the ZA market's 20.5%. Revenue is expected to grow at 13.3% per year, faster than the market's 3.3%. Despite recent executive changes and a decline in H1 earnings to US$389 million from US$457.8 million, the company remains undervalued based on discounted cash flow analysis and robust future profit projections.

- Insights from our recent growth report point to a promising forecast for Gold Fields' business outlook.

- Dive into the specifics of Gold Fields here with our thorough financial health report.

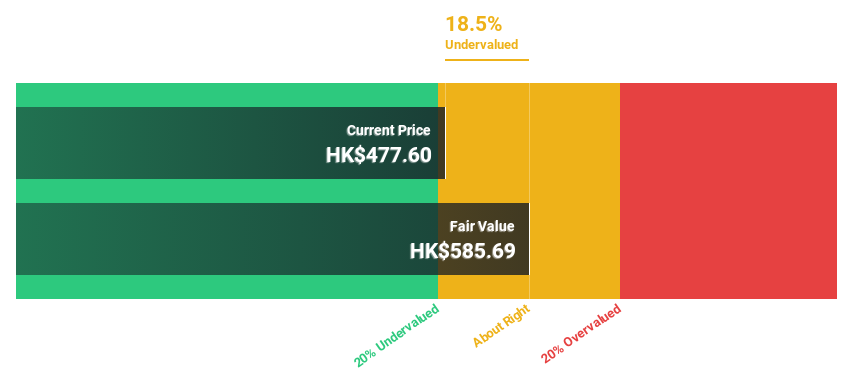

Tencent Holdings (SEHK:700)

Overview: Tencent Holdings Limited, an investment holding company with a market cap of HK$34.97 billion, provides value-added services, online advertising, fintech, and business services in China and internationally.

Operations: The company generates revenue from value-added services (CN¥302.28 billion), online advertising (CN¥111.89 billion), and fintech and business services (CN¥209.17 billion).

Estimated Discount To Fair Value: 49.3%

Tencent Holdings reported strong Q2 2024 earnings, with revenue rising to CNY 161.12 billion and net income surging to CNY 47.63 billion. Trading at HK$388.8, the stock is significantly undervalued based on a discounted cash flow analysis, with an estimated fair value of HK$766.45. Analysts forecast annual earnings growth of 12.8%, outpacing the Hong Kong market's 11.7%, and expect a return on equity of 20.2% in three years, indicating robust future performance potential.

- Our expertly prepared growth report on Tencent Holdings implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Tencent Holdings with our detailed financial health report.

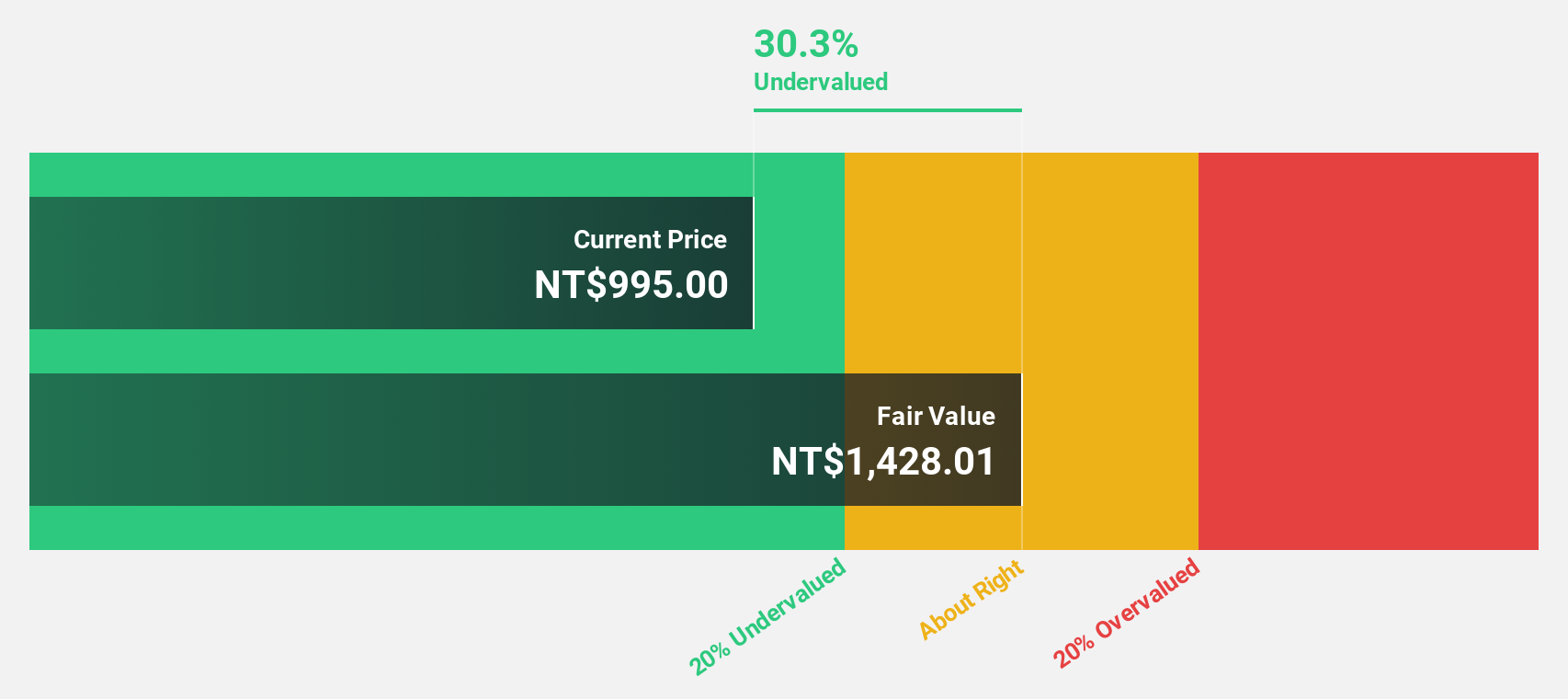

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited manufactures, packages, tests, and sells integrated circuits and other semiconductor devices globally, with a market cap of NT$24.40 trillion.

Operations: The company generates NT$2.44 billion in revenue from its Foundry segment.

Estimated Discount To Fair Value: 27.4%

Taiwan Semiconductor Manufacturing is trading 27.4% below its estimated fair value of NT$1316.27, with analysts expecting a 30.7% price increase. Earnings are forecast to grow at 19.1% annually, outpacing the TW market's 18.4%. Recent revenue reports show strong growth, with August net revenues reaching TWD 250,866 million compared to TWD 188,686 million last year. A significant joint venture in Germany further highlights its expansion and commitment to innovation and sustainability in semiconductor manufacturing.

- Upon reviewing our latest growth report, Taiwan Semiconductor Manufacturing's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Taiwan Semiconductor Manufacturing.

Key Takeaways

- Reveal the 934 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tencent Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:700

Tencent Holdings

An investment holding company, offers value-added services (VAS), online advertising, fintech, and business services in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives