- Taiwan

- /

- Entertainment

- /

- TPEX:3293

3 Growth Companies Insiders Own With Earnings Growth Up To 37%

Reviewed by Simply Wall St

As global markets continue to navigate through economic complexities, with U.S. stock indexes nearing record highs and inflation data impacting rate expectations, investors are increasingly focused on growth opportunities that can withstand volatility. In this environment, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them appealing candidates for those seeking robust earnings growth amidst the current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 118.4% |

Here we highlight a subset of our preferred stocks from the screener.

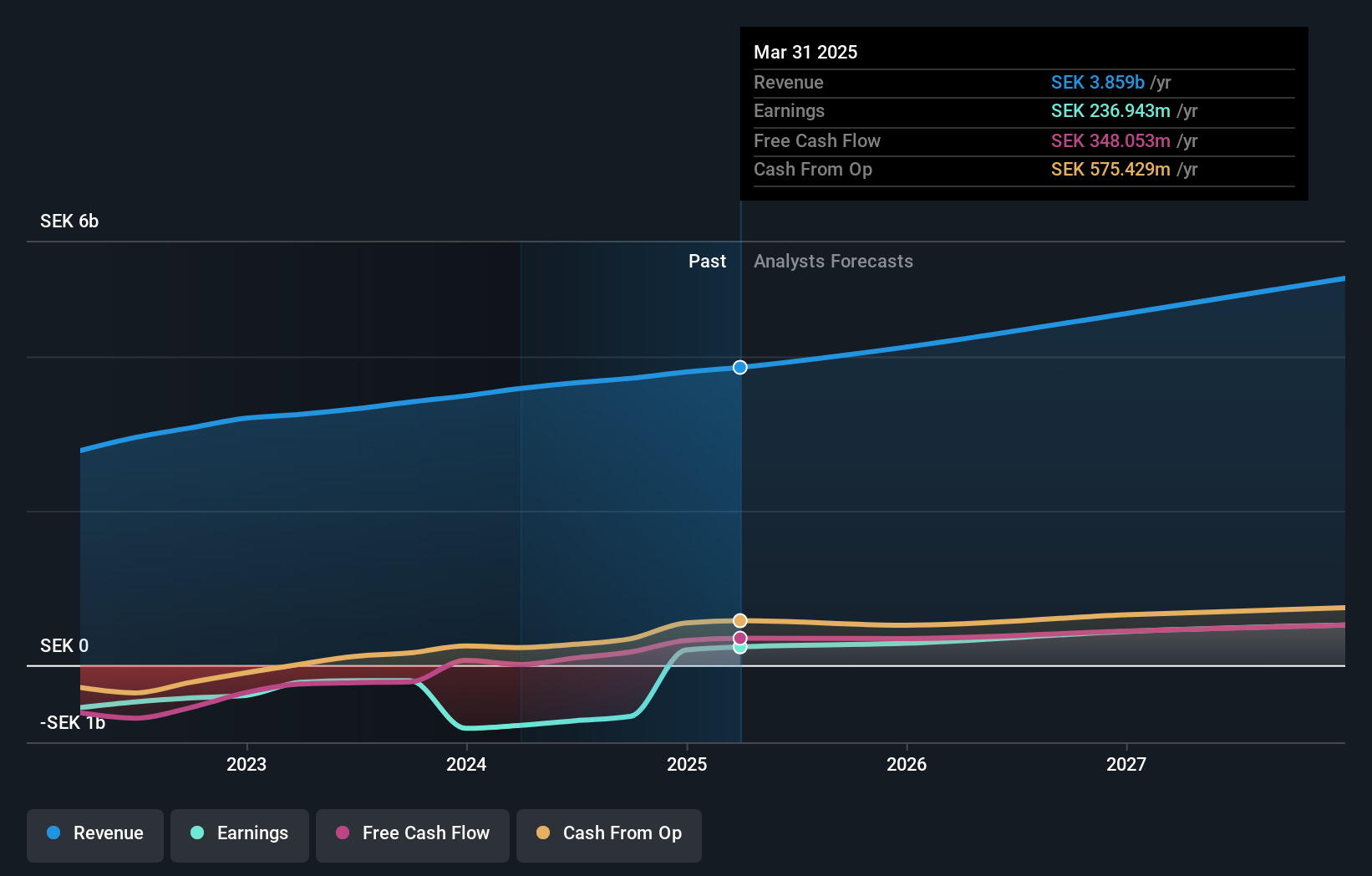

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK7.70 billion.

Operations: The company's revenue primarily comes from its streaming services, generating SEK3.38 billion, and book sales, contributing SEK1.13 billion.

Insider Ownership: 18.7%

Earnings Growth Forecast: 38% p.a.

Storytel's insider ownership aligns with its growth trajectory, as insiders have been buying more shares recently. The company's earnings are expected to grow significantly at 38% per year, outpacing the Swedish market. Storytel became profitable this year and reported a net income of SEK 196.71 million for 2024, reversing last year's losses. A partnership with Vodafone Turkey expands its reach to over 20 million subscribers, bolstering revenue prospects despite slower revenue growth forecasts of 9.9% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Storytel.

- Our valuation report unveils the possibility Storytel's shares may be trading at a discount.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market cap of approximately HK$59.52 billion.

Operations: The company's revenue is primarily derived from its Online Games and Others segment, generating CN¥4.93 billion, and its Office Software and Services segment, contributing CN¥4.91 billion.

Insider Ownership: 20%

Earnings Growth Forecast: 23.8% p.a.

Kingsoft's insider ownership supports its growth potential, with earnings projected to grow significantly at 23.8% annually, surpassing the Hong Kong market average. Despite recent substantial insider selling, the company reported a strong third-quarter net income of CNY 413.45 million compared to CNY 28.49 million last year. Revenue is expected to increase by 14.1% per year, although this is below the high-growth threshold of 20%. Return on Equity remains forecasted low at 8.7%.

- Click here to discover the nuances of Kingsoft with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Kingsoft's share price might be too optimistic.

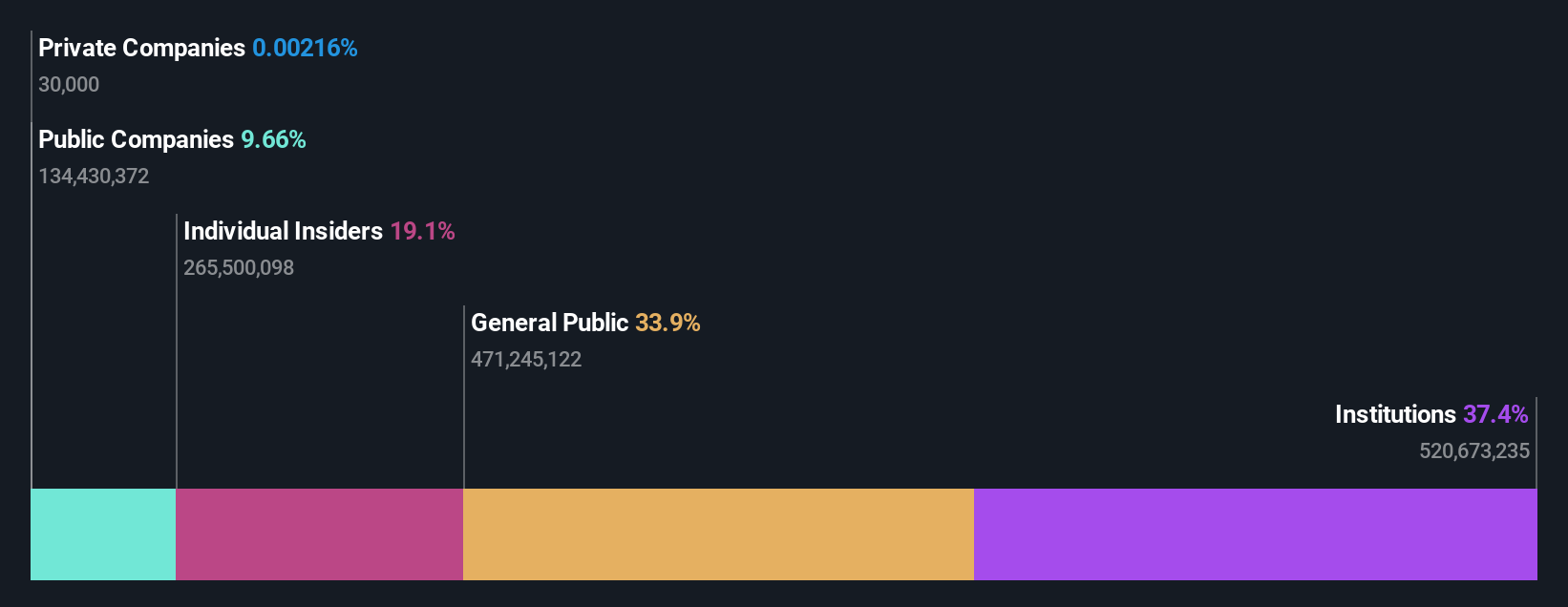

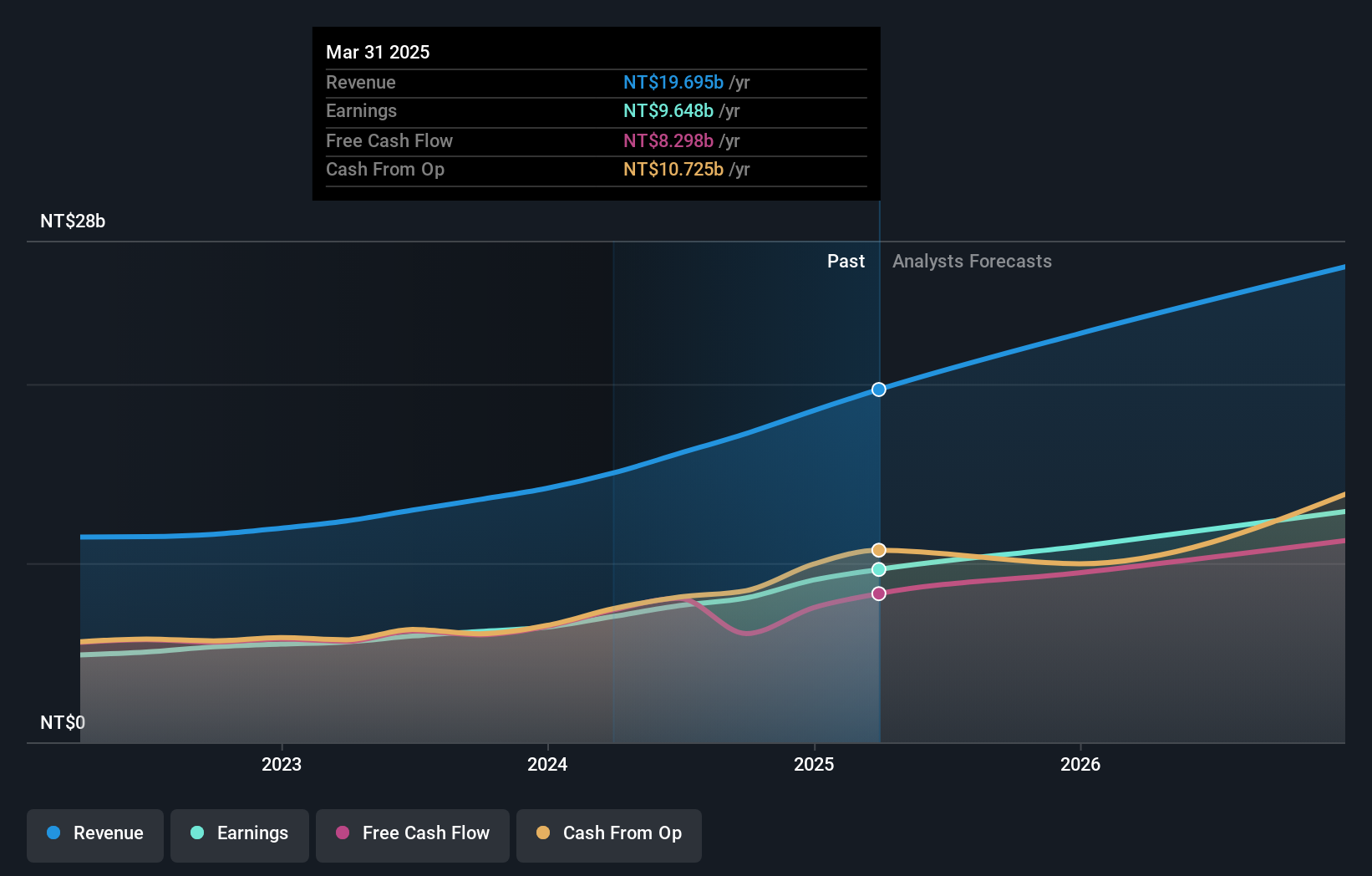

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

Overview: International Games System Co., Ltd. is engaged in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$262.08 billion.

Operations: The company generates revenue from its Online Games Division, which accounts for NT$10.11 billion, and its Business Game Division, contributing NT$7.13 billion.

Insider Ownership: 11.3%

Earnings Growth Forecast: 21.2% p.a.

International Games System Ltd. demonstrates strong growth potential with earnings expected to increase significantly at 21.2% annually, outpacing the Taiwanese market average of 17.9%. Revenue is projected to grow at a robust rate of 20.9% per year, also exceeding the market's 11.3%. The company maintains high-quality earnings but lacks recent insider trading data, which could provide further insights into insider confidence in its growth trajectory.

- Navigate through the intricacies of International Games SystemLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility International Games SystemLtd's shares may be trading at a premium.

Next Steps

- Gain an insight into the universe of 1466 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade International Games SystemLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3293

International Games SystemLtd

Plans, designs, researches, develops, manufactures, markets, services, and licenses arcade, online, and mobile games principally in Taiwan, the United Kingdom, and China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives