Does Feng Tay Enterprises (TWSE:9910) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Feng Tay Enterprises Co., Ltd. (TWSE:9910) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Feng Tay Enterprises

How Much Debt Does Feng Tay Enterprises Carry?

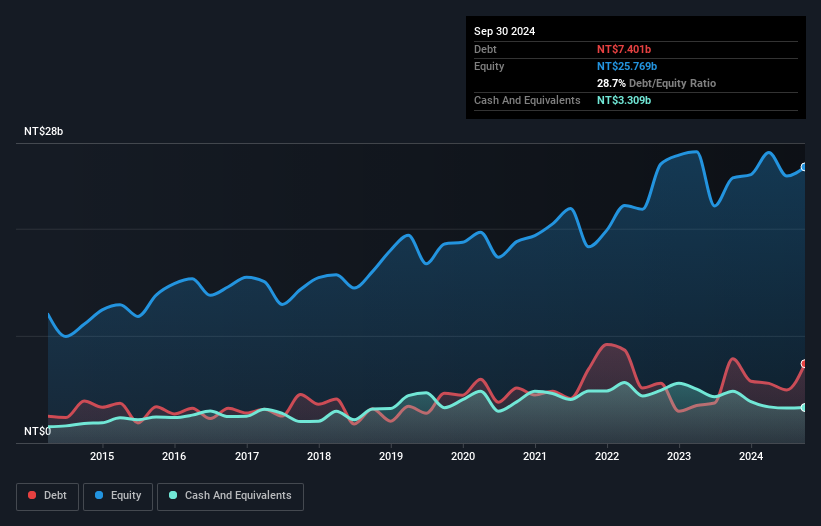

The image below, which you can click on for greater detail, shows that Feng Tay Enterprises had debt of NT$7.40b at the end of September 2024, a reduction from NT$7.86b over a year. However, because it has a cash reserve of NT$3.31b, its net debt is less, at about NT$4.09b.

A Look At Feng Tay Enterprises' Liabilities

The latest balance sheet data shows that Feng Tay Enterprises had liabilities of NT$15.4b due within a year, and liabilities of NT$10.8b falling due after that. On the other hand, it had cash of NT$3.31b and NT$9.76b worth of receivables due within a year. So it has liabilities totalling NT$13.1b more than its cash and near-term receivables, combined.

Of course, Feng Tay Enterprises has a market capitalization of NT$134.3b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Feng Tay Enterprises has a low net debt to EBITDA ratio of only 0.37. And its EBIT covers its interest expense a whopping 39.1 times over. So we're pretty relaxed about its super-conservative use of debt. And we also note warmly that Feng Tay Enterprises grew its EBIT by 13% last year, making its debt load easier to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Feng Tay Enterprises can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Feng Tay Enterprises produced sturdy free cash flow equating to 59% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Feng Tay Enterprises's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Looking at the bigger picture, we think Feng Tay Enterprises's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Feng Tay Enterprises is showing 1 warning sign in our investment analysis , you should know about...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9910

Feng Tay Enterprises

Manufactures and sells athletic shoes in Singapore, the United States, Mainland China, Switzerland, Mexico, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)