- Taiwan

- /

- Electrical

- /

- TWSE:1513

Discover 3 Stocks Including Eaglerise Electric & Electronic (China) That Might Be Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of consumer confidence dips and moderate stock index gains, investors are increasingly seeking opportunities amid fluctuating economic indicators. In this context, identifying undervalued stocks can be particularly appealing, as these investments may offer potential value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| Wasion Holdings (SEHK:3393) | HK$7.13 | HK$14.19 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7288.65 | 49.9% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| GlobalData (AIM:DATA) | £1.875 | £3.74 | 49.8% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.70 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 49.9% |

| ASMPT (SEHK:522) | HK$74.90 | HK$149.66 | 50% |

| Merus Power Oyj (HLSE:MERUS) | €3.71 | €7.39 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.05 | US$129.48 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Eaglerise Electric & Electronic (China) (SZSE:002922)

Overview: Eaglerise Electric & Electronic (China) Co., Ltd. operates in the electrical and electronic manufacturing industry with a market cap of CN¥7.47 billion.

Operations: Eaglerise Electric & Electronic (China) Co., Ltd. generates its revenue from various segments within the electrical and electronic manufacturing industry.

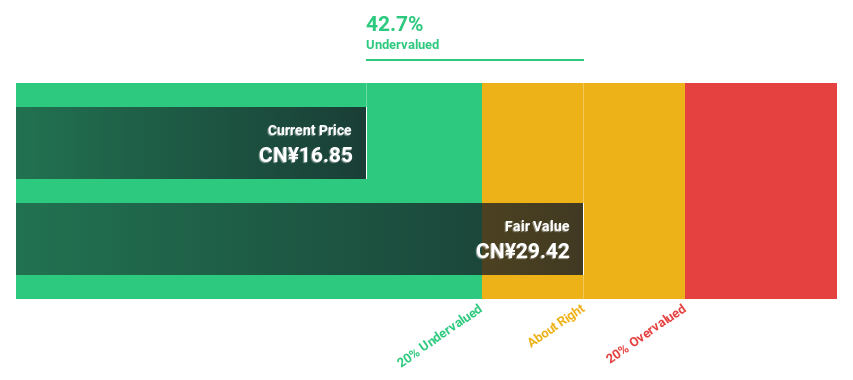

Estimated Discount To Fair Value: 41.1%

Eaglerise Electric & Electronic (China) is trading at CN¥17.82, significantly below its estimated fair value of CN¥30.27, suggesting potential undervaluation based on cash flows. The company's earnings are forecast to grow at 35.7% annually, outpacing the Chinese market's growth rate of 25.4%. Despite a recent share buyback totaling CN¥92.68 million, the dividend yield remains inadequately covered by free cash flows, highlighting a potential risk for investors focusing on dividends.

- In light of our recent growth report, it seems possible that Eaglerise Electric & Electronic (China)'s financial performance will exceed current levels.

- Navigate through the intricacies of Eaglerise Electric & Electronic (China) with our comprehensive financial health report here.

Strike CompanyLimited (TSE:6196)

Overview: Strike Company, Limited offers mergers and acquisitions brokerage services for small and medium-sized companies in Japan, with a market cap of ¥70.19 billion.

Operations: Strike Company, Limited generates its revenue primarily through providing brokerage services for mergers and acquisitions involving small and medium-sized enterprises within Japan.

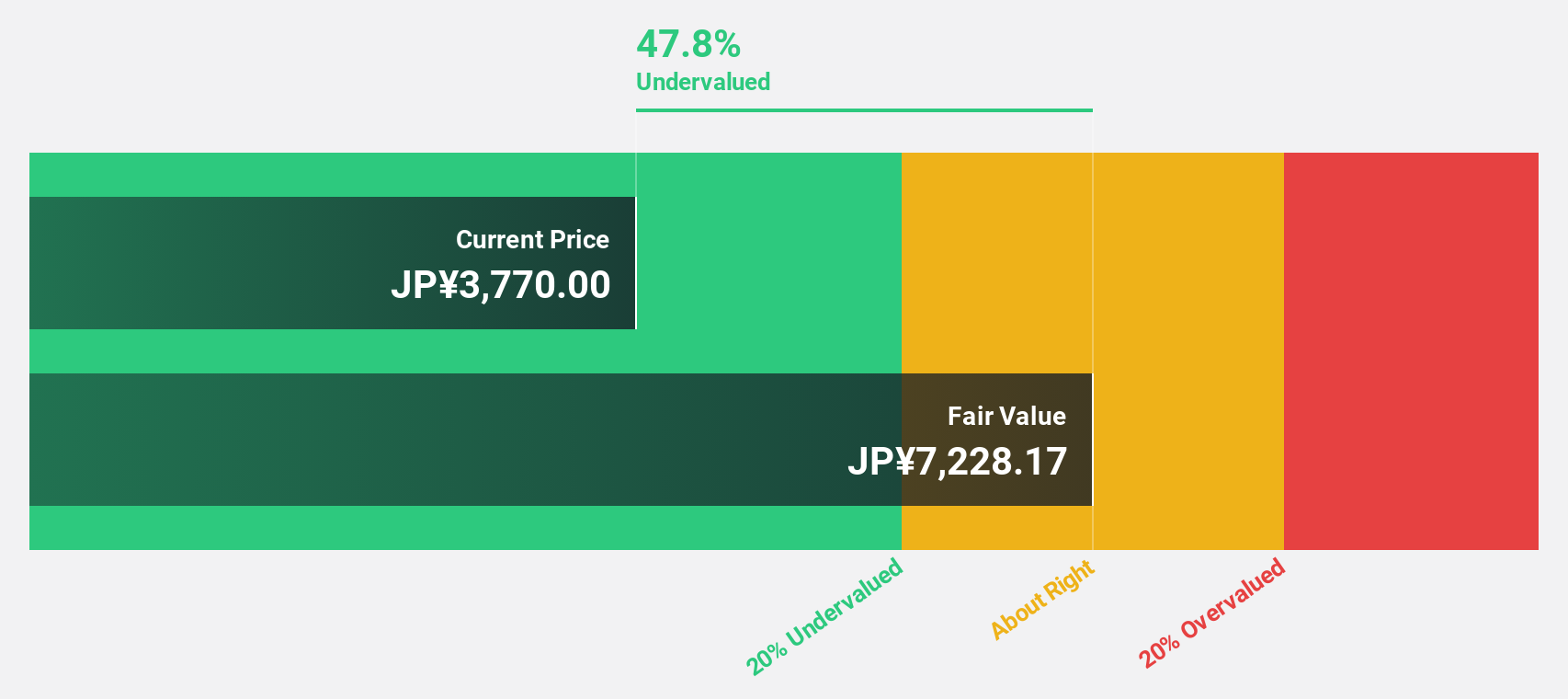

Estimated Discount To Fair Value: 49.9%

Strike Company Limited is trading at ¥3,655, below its estimated fair value of ¥7,288.65, indicating potential undervaluation based on cash flows. Earnings are expected to grow 13.7% annually, surpassing the Japanese market's 7.9% growth rate. The company announced a significant dividend increase and forecasts robust revenue growth of 16.5% per year. However, recent share price volatility may concern risk-averse investors despite strong financial projections and high return on equity expectations.

- Upon reviewing our latest growth report, Strike CompanyLimited's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Strike CompanyLimited stock in this financial health report.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical and machinery manufacturing sector, with a market cap of NT$75.35 billion.

Operations: The company generates revenue from three main segments: Service Business (NT$5.06 billion), Engineering and Other (NT$2.52 billion), and Motor Energy Business (NT$18.87 billion).

Estimated Discount To Fair Value: 38.4%

Chung-Hsin Electric and Machinery Manufacturing is trading at NT$154.5, significantly below its estimated fair value of NT$250.71, highlighting potential undervaluation based on cash flows. Recent earnings showed substantial growth, with net income rising to TWD 2.77 billion for the first nine months of 2024 from TWD 794.49 million a year ago. Earnings are projected to grow at 19.06% annually, slightly outpacing the Taiwanese market's growth rate, despite high debt levels.

- Our growth report here indicates Chung-Hsin Electric and Machinery Manufacturing may be poised for an improving outlook.

- Take a closer look at Chung-Hsin Electric and Machinery Manufacturing's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 889 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1513

Chung-Hsin Electric and Machinery Manufacturing

Chung-Hsin Electric and Machinery Manufacturing Corp.

Very undervalued with solid track record and pays a dividend.