- Taiwan

- /

- Metals and Mining

- /

- TPEX:5009

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a holiday-shortened week, U.S. stocks have shown moderate gains despite a dip in consumer confidence and mixed economic indicators. In this environment, dividend stocks can offer stability and potential income, making them an attractive option for investors looking to weather market fluctuations while benefiting from consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1949 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

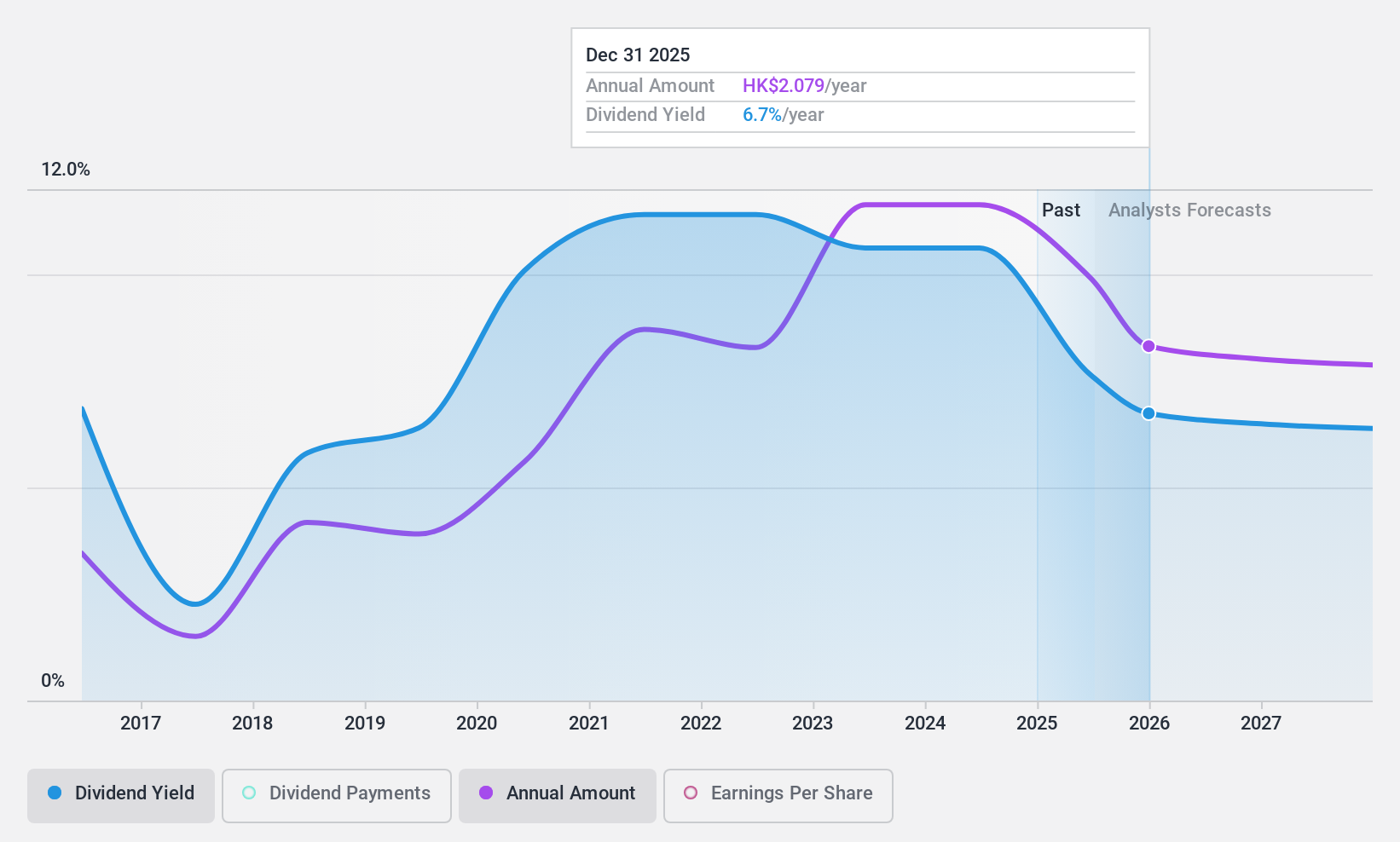

China Shenhua Energy (SEHK:1088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shenhua Energy Company Limited operates in the production and sale of coal and power, as well as providing railway, port, and shipping transportation services both within the People’s Republic of China and internationally, with a market cap of HK$860.42 billion.

Operations: China Shenhua Energy Company Limited's revenue segments include CN¥274.49 billion from coal, CN¥94.73 billion from power, CN¥42.65 billion from railway, CN¥6.90 billion from port operations, CN¥5.65 billion from coal chemical products, and CN¥4.98 billion from shipping services.

Dividend Yield: 7.2%

China Shenhua Energy's dividend is supported by a payout ratio of 77.7%, indicating coverage by earnings, and a cash payout ratio of 68%, suggesting sustainability through cash flows. However, the dividend track record has been volatile over the past decade, with instances of significant drops. Recent leadership changes may influence strategic directions affecting dividends, but current sales figures show steady coal production and power generation growth year-to-date compared to last year.

- Take a closer look at China Shenhua Energy's potential here in our dividend report.

- According our valuation report, there's an indication that China Shenhua Energy's share price might be on the expensive side.

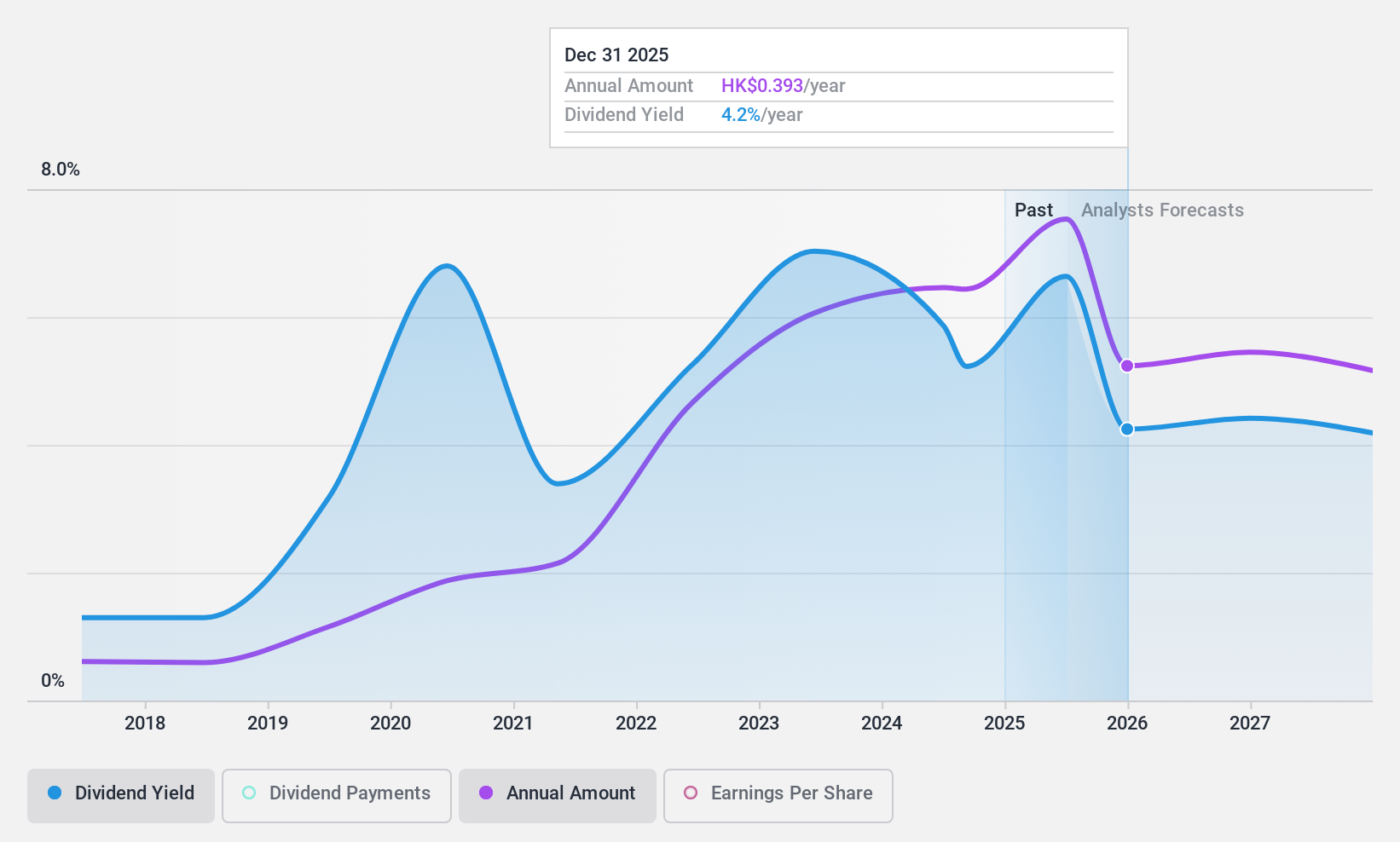

China Coal Energy (SEHK:1898)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited engages in the mining, production, processing, trading, and sale of coal both within the People's Republic of China and internationally, with a market cap of approximately HK$154.90 billion.

Operations: China Coal Energy Company Limited generates revenue through its operations in coal mining, production, processing, trading, and sales both domestically in China and on an international scale.

Dividend Yield: 5.1%

China Coal Energy's dividend is covered by earnings with a payout ratio of 52.4% and cash flows at 31.2%, indicating sustainability. However, its dividend history has been unstable over the past decade, with volatility in payments. The recent inclusion in the SSE 180 Index may enhance investor visibility, but the dividend yield of 5.06% remains lower than top-tier Hong Kong market payers (7.92%). Recent production growth in coal and chemicals supports operational stability amidst fluctuating sales volumes year-on-year.

- Dive into the specifics of China Coal Energy here with our thorough dividend report.

- Our valuation report here indicates China Coal Energy may be undervalued.

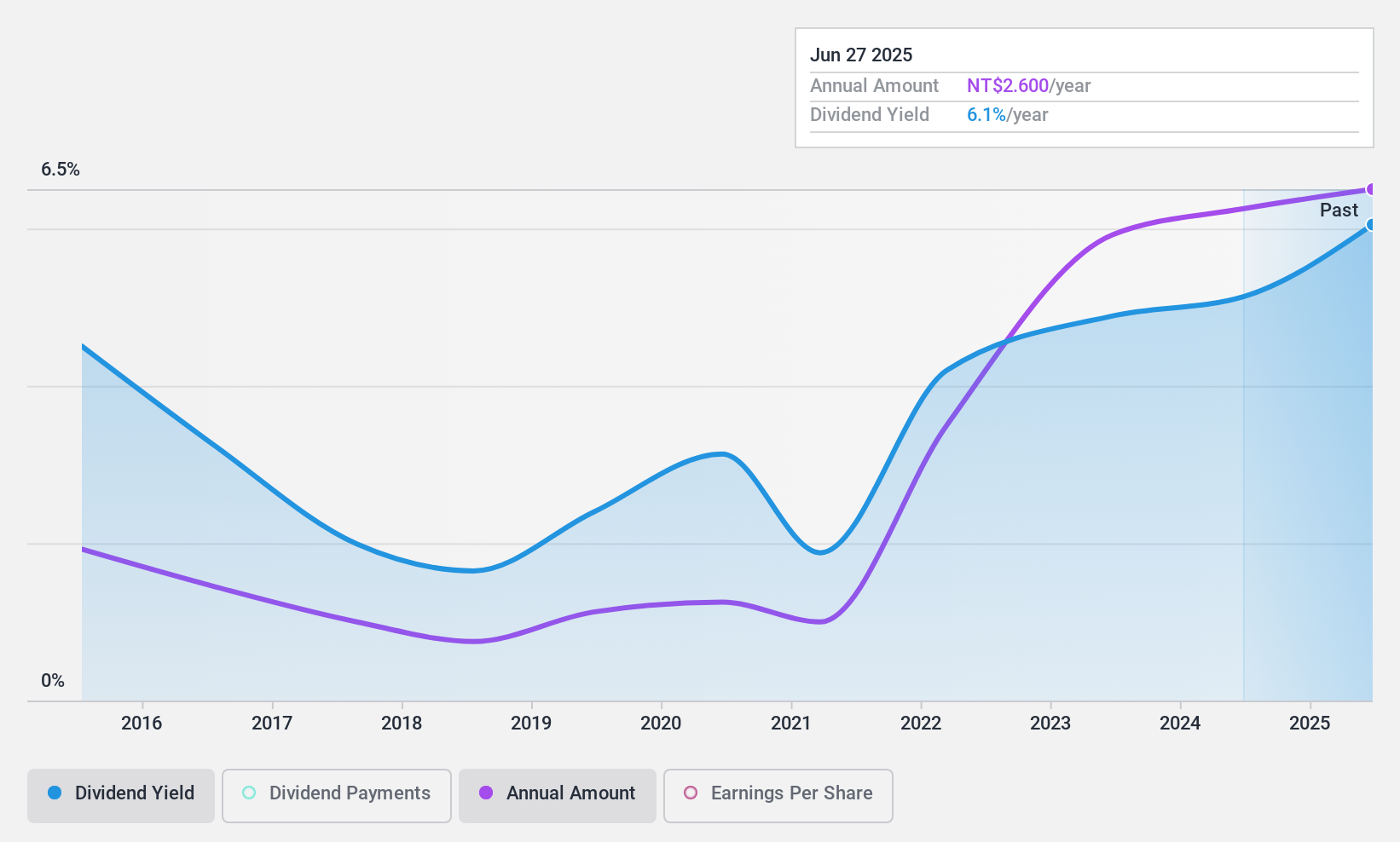

Gloria Material Technology (TPEX:5009)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Gloria Material Technology Corp. produces and sells alloy steel in Taiwan, the United States, China, and internationally with a market cap of NT$27.14 billion.

Operations: Gloria Material Technology Corp.'s revenue segments include contributions of NT$12.04 billion from Gloria Material Technology Corp., NT$1.11 billion from Jinyun Iron and Steel Co., LTD, and NT$1.27 billion from Ouying Enterprises Co., Limited.

Dividend Yield: 5.4%

Gloria Material Technology's dividend yield of 5.4% ranks among the top 25% in Taiwan but lacks coverage by free cash flows, indicating potential sustainability issues. Despite a low payout ratio of 48.7%, dividends have been volatile over the past decade, with significant fluctuations. Recent earnings growth of 31.2% is tempered by large one-off items and shareholder dilution in the past year, suggesting caution for dividend reliability despite trading below estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Gloria Material Technology.

- Insights from our recent valuation report point to the potential undervaluation of Gloria Material Technology shares in the market.

Seize The Opportunity

- Gain an insight into the universe of 1949 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5009

Gloria Material Technology

Engages in smelting, manufacturing, processing and sales of steel in Taiwan, the United States, China, and internationally.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives