- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3583

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, with major stock indices like the Nasdaq Composite experiencing both gains and subsequent declines in a holiday-shortened week. In this environment, high growth tech stocks stand out for their potential to capitalize on technological advancements and innovation-driven sectors, making them intriguing options to monitor closely as investors seek opportunities that align with evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Systena (TSE:2317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Systena Corporation operates in the solution and framework design, IT service, business solution, and cloud sectors within Japan, with a market capitalization of approximately ¥129.76 billion.

Operations: Systena Corporation generates revenue primarily from its Business Solution and Solution Design segments, with the Business Solution segment contributing ¥28.61 billion and the Solution Design segment adding ¥19.77 billion. The Framework Design segment also plays a role, bringing in ¥7.46 billion.

Systena Corporation, amidst a competitive tech landscape, has demonstrated robust financial agility with its latest earnings guidance projecting significant revenue and profit increases for FY 2025. The company's commitment to shareholder returns is evident from its increased dividend payout and strategic share repurchases totaling ¥1.93 billion, enhancing investor confidence. Moreover, Systena’s R&D investment aligns with industry demands for innovation in software solutions, securing its growth trajectory in a rapidly evolving market where technological advancement is paramount.

- Take a closer look at Systena's potential here in our health report.

Gain insights into Systena's historical performance by reviewing our past performance report.

Simplex Holdings (TSE:4373)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥145.28 billion.

Operations: Simplex Holdings, Inc. generates revenue through its strategic consulting, design and development, and operation and maintenance services targeted at financial institutions, corporations, and public sectors worldwide. The company's market cap stands at ¥145.28 billion.

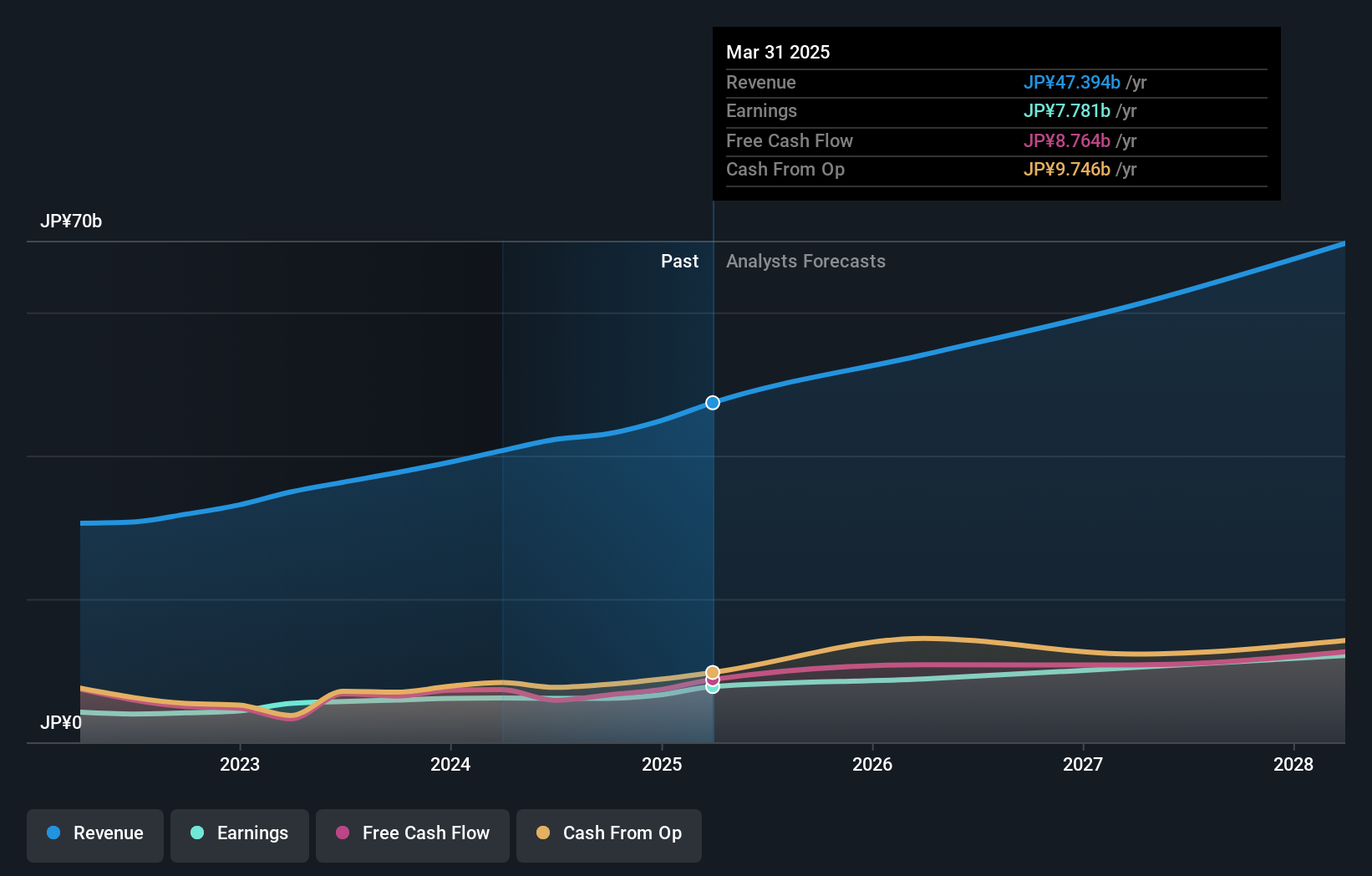

Simplex Holdings, navigating a dynamic tech environment, recently projected a robust financial outlook for FY 2025 with expected revenue reaching ¥46.8 billion and profits at ¥7.28 billion. This guidance reflects an earnings growth of 21% annually, outpacing the Japanese market's average of 7.9%. Significantly, the company's R&D investments are pivotal in fostering innovation, aligning with its strategic focus on enhancing software solutions to meet evolving industry needs. Despite not leading in high-growth metrics compared to some peers—its revenue growth forecast at 13.6% lags behind the sector’s top performers—Simplex maintains a competitive edge through quality earnings and positive free cash flow, positioning it well for sustained advancements in tech development.

- Unlock comprehensive insights into our analysis of Simplex Holdings stock in this health report.

Gain insights into Simplex Holdings' past trends and performance with our Past report.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

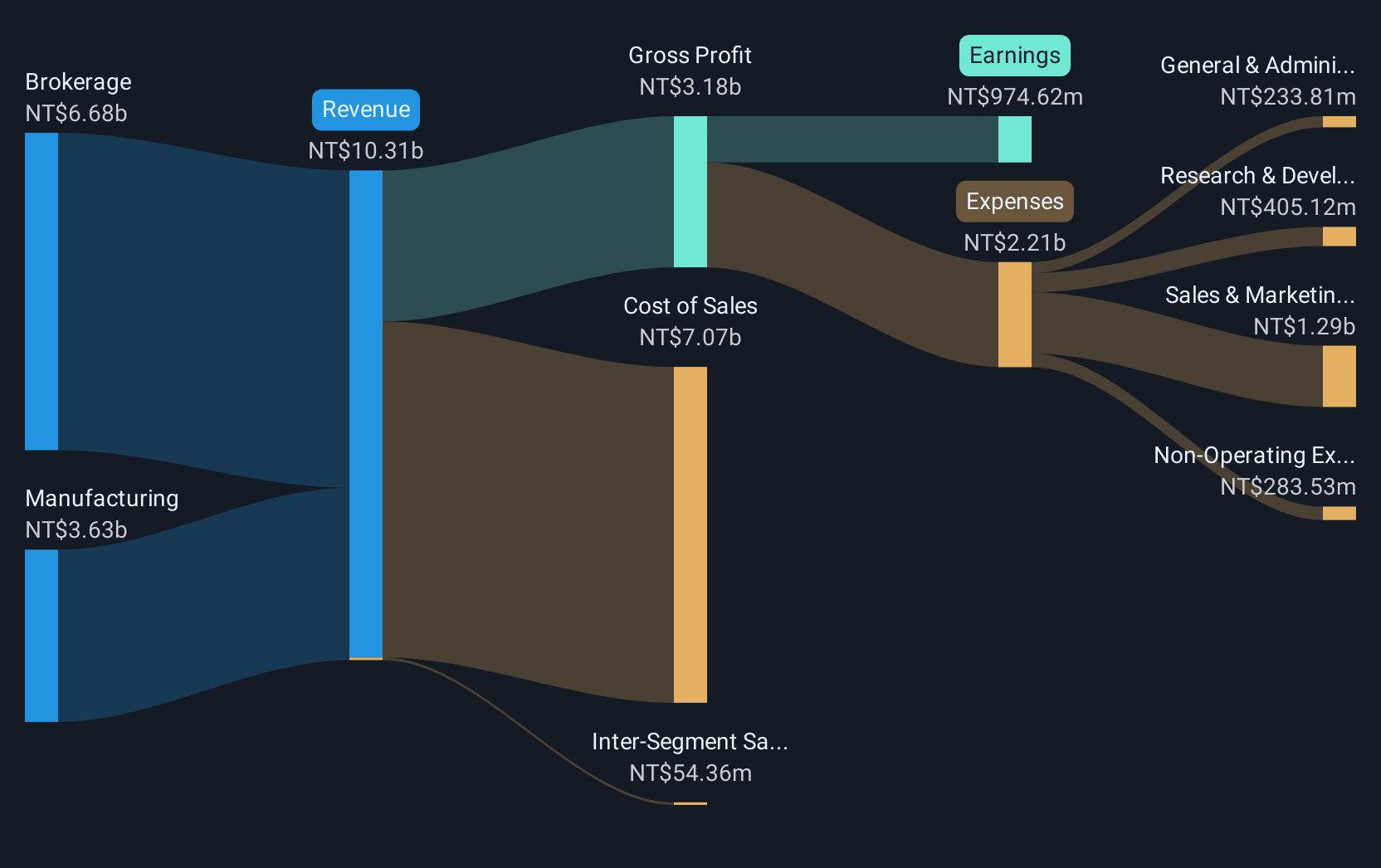

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$31.65 billion.

Operations: The company generates revenue primarily from brokerage and manufacturing, with NT$6.01 billion and NT$3.10 billion respectively.

Scientech, amid a competitive tech landscape, has demonstrated robust growth with a 42.5% increase in quarterly revenue year-over-year, reaching TWD 2.5 billion. This surge is underpinned by significant R&D investments that accounted for approximately 15% of its revenue, emphasizing its commitment to innovation and market leadership in software development. Additionally, the company's recent strategic acquisitions are set to enhance its technological capabilities and expand its market footprint, aligning with industry trends towards integrated tech solutions. With earnings growing by an impressive 50.4% annually and a positive free cash flow, Scientech is well-positioned to capitalize on emerging opportunities within the tech sector while continuing to deliver high-quality earnings.

- Delve into the full analysis health report here for a deeper understanding of Scientech.

Review our historical performance report to gain insights into Scientech's's past performance.

Taking Advantage

- Reveal the 1267 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3583

Scientech

Engages in the research and development, production, sale, and maintenance of process equipment for semiconductors, liquid crystal displays (LCDs), light-emitting diodes (LEDs), and solar power generation industries.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives