- Taiwan

- /

- Basic Materials

- /

- TWSE:2504

Three Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

As we approach the end of 2024, global markets have experienced a mix of moderate gains and setbacks, with major indices like the Nasdaq Composite and S&P 500 showing strong performance earlier in December before encountering some volatility. Despite fluctuations in consumer confidence and economic indicators, opportunities remain for investors to explore potential growth within small-cap stocks, particularly those that may be overlooked by broader market trends. In this context, identifying promising stocks involves looking beyond current headlines to consider companies with solid fundamentals and unique value propositions that can thrive even amid shifting economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Union Coop (DFM:UNIONCOOP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Union Coop operates hypermarkets and consumer cooperatives in the United Arab Emirates, with a market capitalization of AED4.05 billion.

Operations: Union Coop generates revenue primarily through its retail segment, which accounts for AED1.72 billion, while its e-commerce operations contribute AED125.72 million.

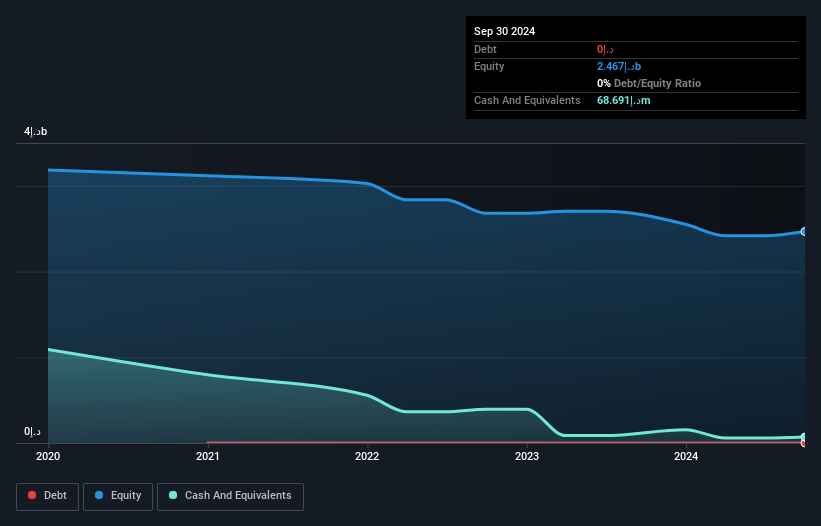

Union Coop, a smaller player in the consumer retailing sector, offers high-quality earnings and operates debt-free. The company trades at 5.3% below its estimated fair value and has shown impressive earnings growth of 32% over the last year, outpacing its industry peers. Despite a historical annual decline of 14.1% in earnings over five years, recent performance is promising with net income for Q3 2024 reaching AED 49.56 million compared to AED 42.38 million the previous year. With positive free cash flow and no debt concerns, Union Coop's financial health supports potential future growth opportunities.

Qinghai Jinrui Mining Development (SHSE:600714)

Simply Wall St Value Rating: ★★★★★★

Overview: Qinghai Jinrui Mining Development Co., Ltd focuses on the production and sale of strontium salt products in China, with a market capitalization of approximately CN¥2.55 billion.

Operations: The primary revenue stream for Qinghai Jinrui Mining Development comes from its chemical industry segment, generating CN¥341.06 million. The company's market capitalization stands at approximately CN¥2.55 billion.

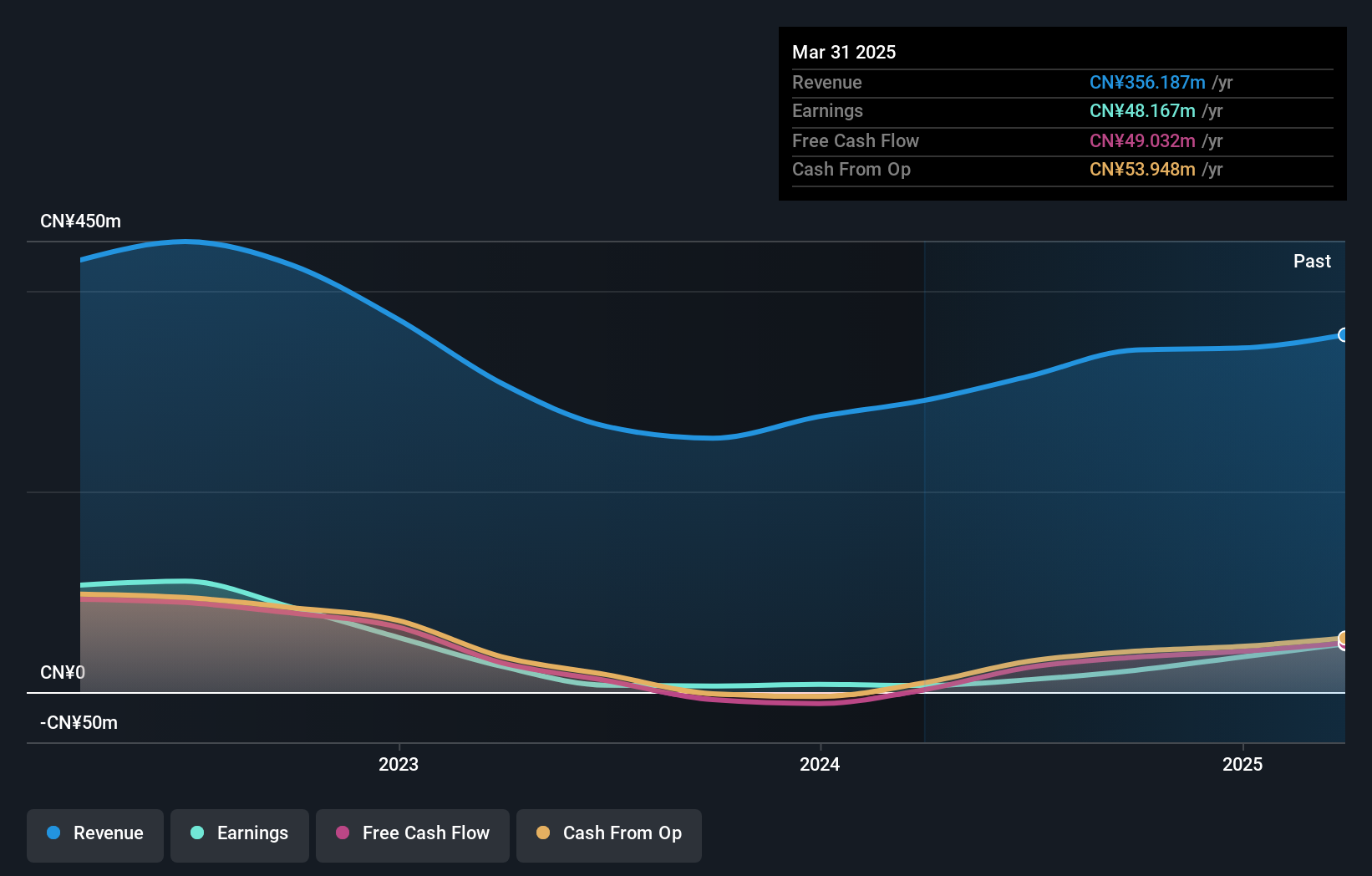

Qinghai Jinrui Mining Development, a smaller player in the mining sector, has shown impressive financial performance recently. The company reported earnings growth of 253%, significantly outpacing the industry average of -16.6%. Over the last year, net income rose to CN¥24.04 million from CN¥10.01 million previously, while sales increased to CN¥253.75 million from CN¥187.38 million a year earlier. Despite being debt-free and having no interest coverage concerns, its recent results were impacted by a one-off gain of CN¥5.8M over the past 12 months ending September 2024, suggesting potential volatility in earnings quality moving forward.

Goldsun Building Materials (TWSE:2504)

Simply Wall St Value Rating: ★★★★★★

Overview: Goldsun Building Materials Co., Ltd. operates in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China, with a market capitalization of approximately NT$59.20 billion.

Operations: Goldsun generates revenue primarily from its Taiwan ready-mixed business, contributing NT$18.78 billion, and its Ready-Mixed Cement Business in Mainland China, which adds NT$1.06 billion.

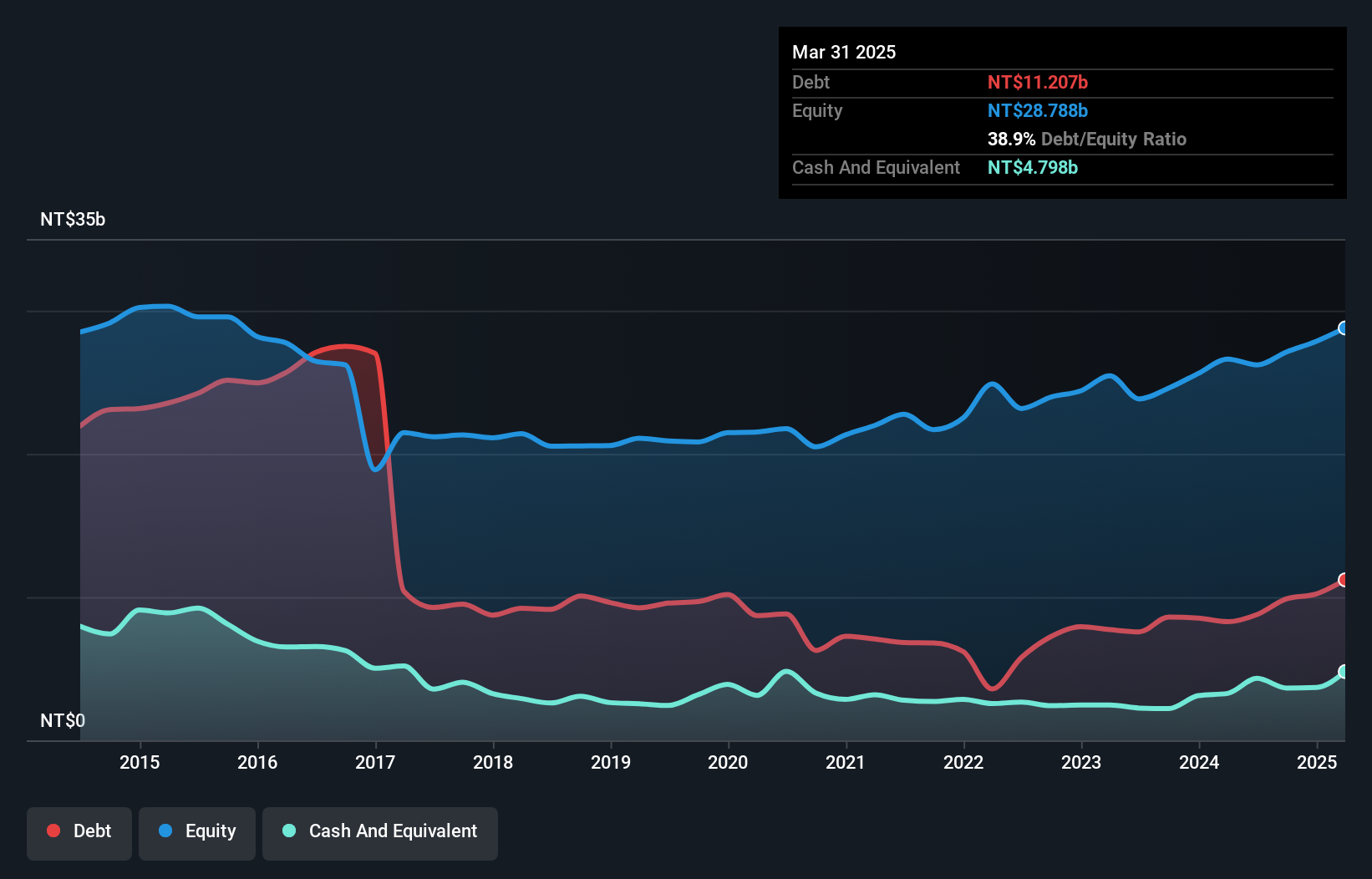

Goldsun Building Materials, a smaller player in its field, has shown impressive growth with earnings surging by 59% over the past year, significantly outpacing the industry's 5.8%. Trading at 61.5% below its estimated fair value suggests potential undervaluation. The company's net debt to equity ratio stands at a satisfactory 23%, reflecting prudent financial management. Recent results show third-quarter sales of TWD 5.37 billion and net income of TWD 860 million, both up from last year’s figures. However, future prospects appear challenging with earnings expected to decrease annually by an average of 19% over the next three years.

Summing It All Up

- Navigate through the entire inventory of 4627 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2504

Goldsun Building Materials

Engages in the production and sale of premixed concrete, cement, and calcium silicate board in Taiwan and Mainland China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives