As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, small-cap stocks have been particularly affected, with indices like the S&P 600 reflecting broader declines. Despite these challenges, opportunities remain for discerning investors who focus on companies with strong fundamentals and resilience in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★★

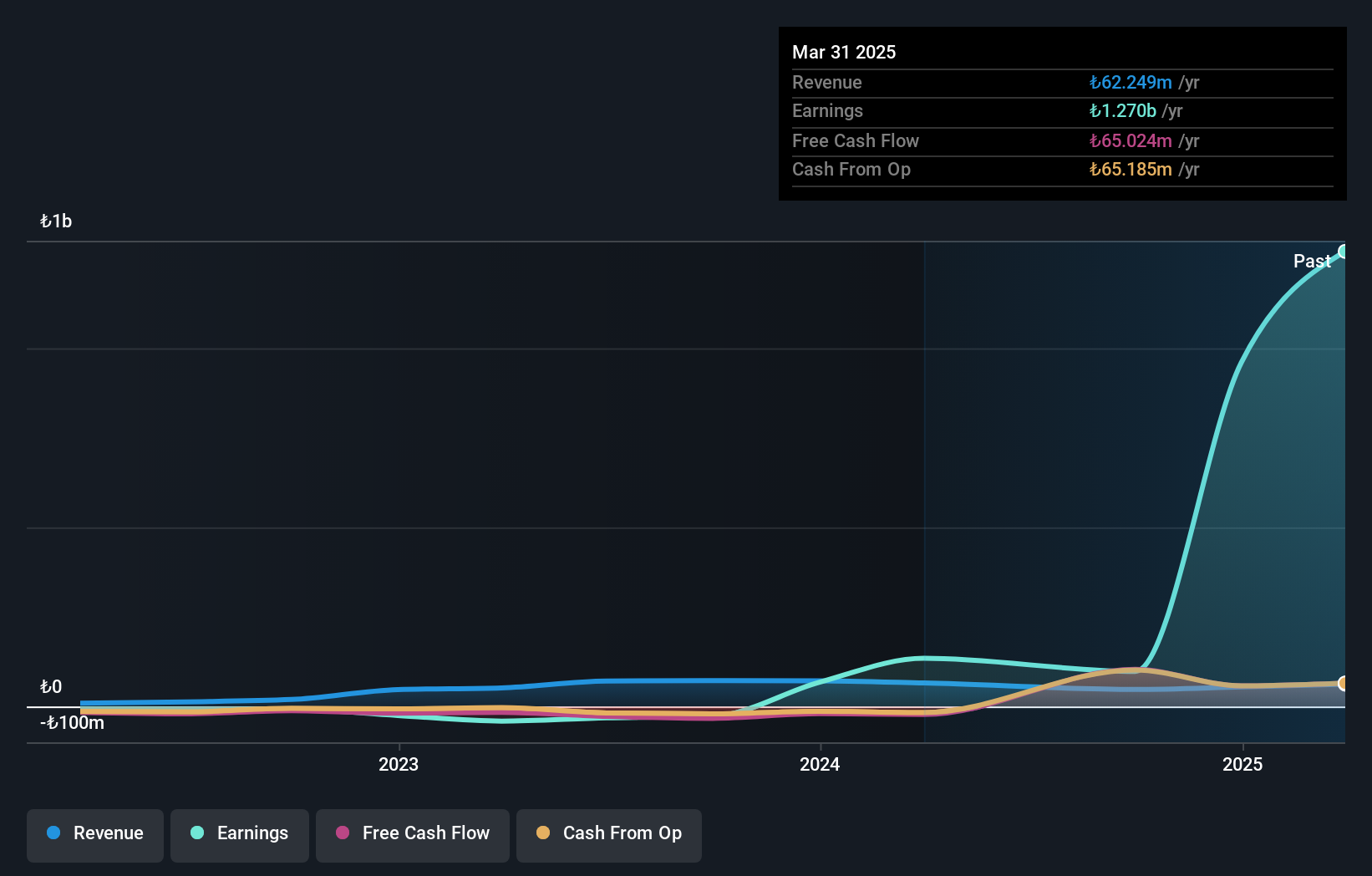

Overview: Lydia Yesil Enerji Kaynaklari A.S. focuses on the production and sale of electricity and heat energy in Turkey, with a market capitalization of TRY23.83 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from its electricity and heat energy production and sales. The company's food processing segment contributes TRY47.53 million to its revenue.

Lydia Yesil Enerji Kaynaklari, a smaller player in the energy sector, has recently turned profitable with high-quality earnings. Despite its volatility over the past three months, the company is debt-free and boasts a significant improvement from a 423.8% debt-to-equity ratio five years ago. However, revenue remains modest at TRY48 million. Recent financials show third-quarter sales of TRY33.7 million but a net loss of TRY39.2 million compared to last year's net income of TRY1.31 million; yet for nine months, it achieved net income of TRY43.53 million versus last year’s loss of TRY8.06 million, indicating potential growth prospects despite challenges.

Yuan High-Tech Development (TPEX:5474)

Simply Wall St Value Rating: ★★★★★★

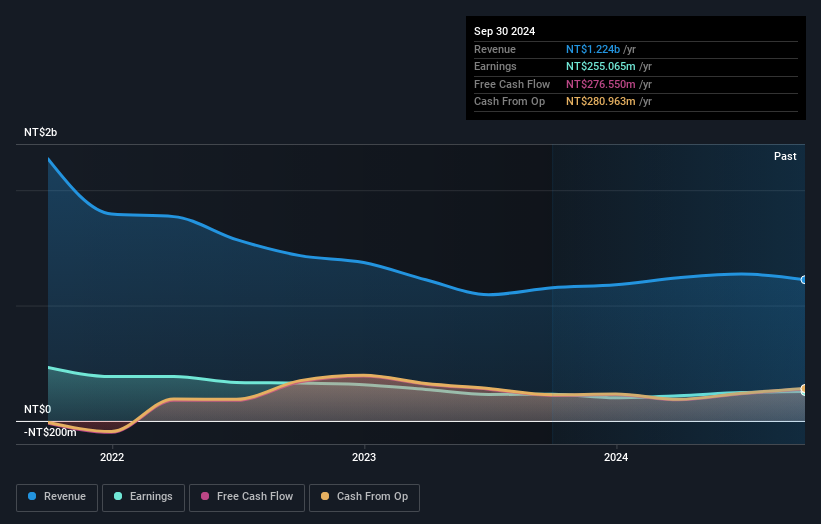

Overview: Yuan High-Tech Development Co., Ltd. specializes in providing video and audio products for system integrators and ODM customers in Taiwan, with a market cap of approximately NT$8.31 billion.

Operations: Yuan High-Tech Development generates revenue primarily from its computer peripherals segment, totaling NT$1.22 billion. The company has a market capitalization of approximately NT$8.31 billion.

Yuan High-Tech Development shows promise with its debt-free status and high-quality earnings, although it faces challenges like a volatile share price. Recent reports reveal third-quarter sales of TWD 279.58 million, down from TWD 328.38 million last year, yet net income increased to TWD 76 million from TWD 66.33 million, indicating improved profitability despite revenue dips. Over nine months, sales reached TWD 904.58 million compared to the previous year's TWD 861.42 million, while net income rose significantly to TWD 198.42 million from TWD 144.89 million, suggesting potential for sustained growth amidst industry volatility.

- Delve into the full analysis health report here for a deeper understanding of Yuan High-Tech Development.

Understand Yuan High-Tech Development's track record by examining our Past report.

Tokuyama (TSE:4043)

Simply Wall St Value Rating: ★★★★★★

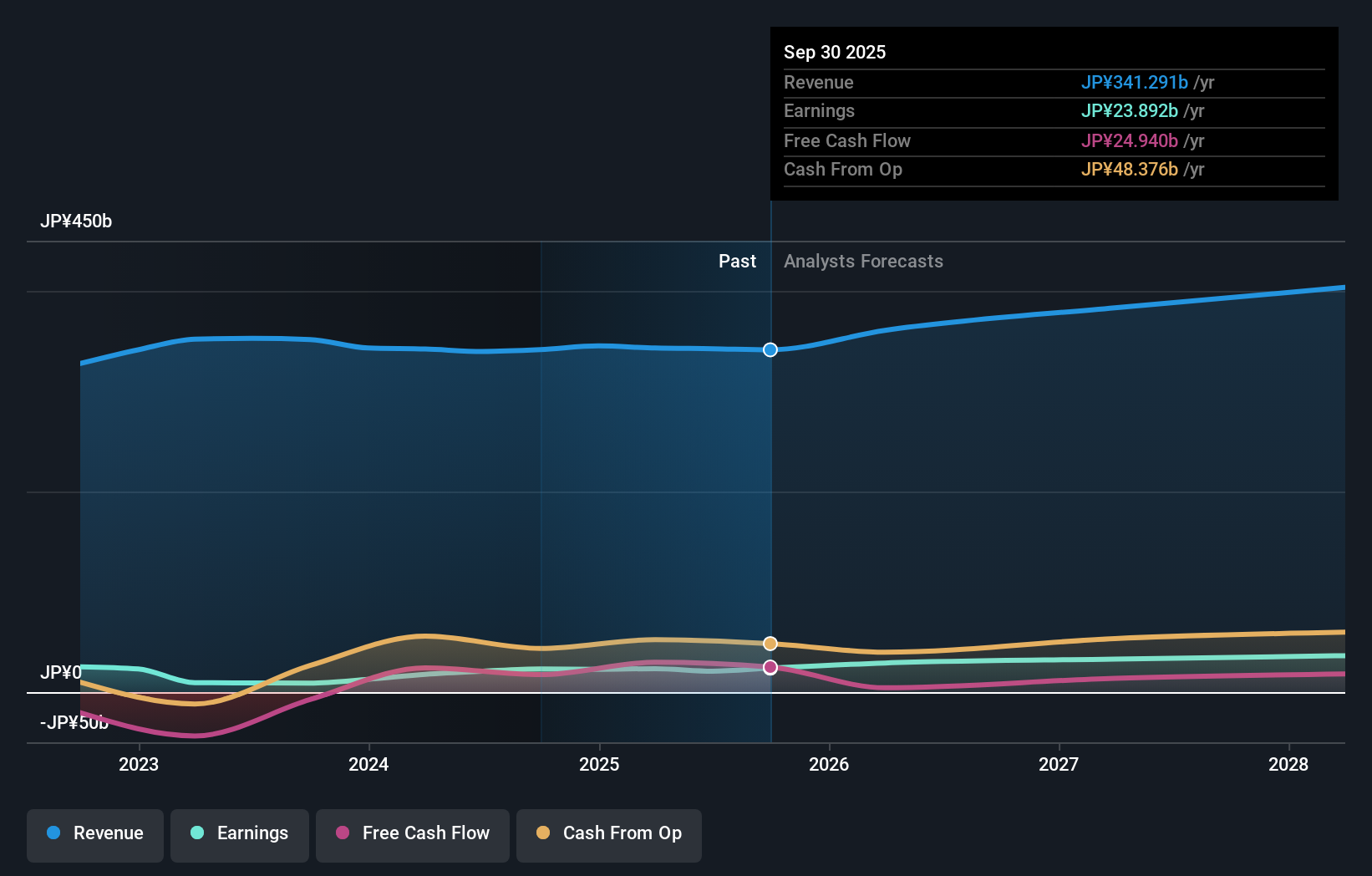

Overview: Tokuyama Corporation is a Japanese company that specializes in the production and sale of various chemical products, with a market capitalization of ¥187.67 billion.

Operations: Tokuyama Corporation's primary revenue streams are derived from its Chemical Products and Electronic & Advanced Materials segments, generating ¥117.09 billion and ¥81.82 billion respectively. The Cement segment contributes significantly as well, with revenue of ¥66.89 billion.

Tokuyama, a promising player in the chemicals sector, seems to be trading at 55.4% below its estimated fair value, indicating potential undervaluation. Over the past five years, Tokuyama's debt-to-equity ratio has improved from 70.2% to 39%, reflecting better financial health. The company boasts high-quality earnings with an impressive EBIT coverage of interest payments at 378 times, suggesting robust profitability management. Despite recent downsizing in China due to market challenges and declining profitability, Tokuyama's earnings growth of 156.6% last year outpaced the industry average significantly and is projected to grow by about 14% annually moving forward.

- Click here and access our complete health analysis report to understand the dynamics of Tokuyama.

Gain insights into Tokuyama's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 4633 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:LYDYE

Lydia Yesil Enerji Kaynaklari

Engages in the production and sale of electricity and heat energy in Turkey.

Flawless balance sheet with proven track record.