- Turkey

- /

- Basic Materials

- /

- IBSE:BTCIM

Three Undiscovered Gems And Their Potential For Growth

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by cooling inflation and robust bank earnings, major U.S. stock indexes have shown resilience, with value stocks outperforming growth shares significantly. Amid this backdrop of economic optimism and potential rate cuts on the horizon, investors are increasingly seeking opportunities in lesser-known small-cap stocks that may offer substantial growth potential. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals, innovative business models, or unique market positions that can capitalize on emerging trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi (IBSE:BTCIM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi operates in the cement industry both in Turkey and internationally, with a market cap of TRY26.07 billion.

Operations: Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi generates revenue primarily from Stone and Soil Based Products at TRY4.84 billion, followed by Ready Mixed Concrete at TRY2.93 billion. Additional revenue streams include Electricity Production and Port Services, contributing TRY1.21 billion and TRY837.89 million respectively.

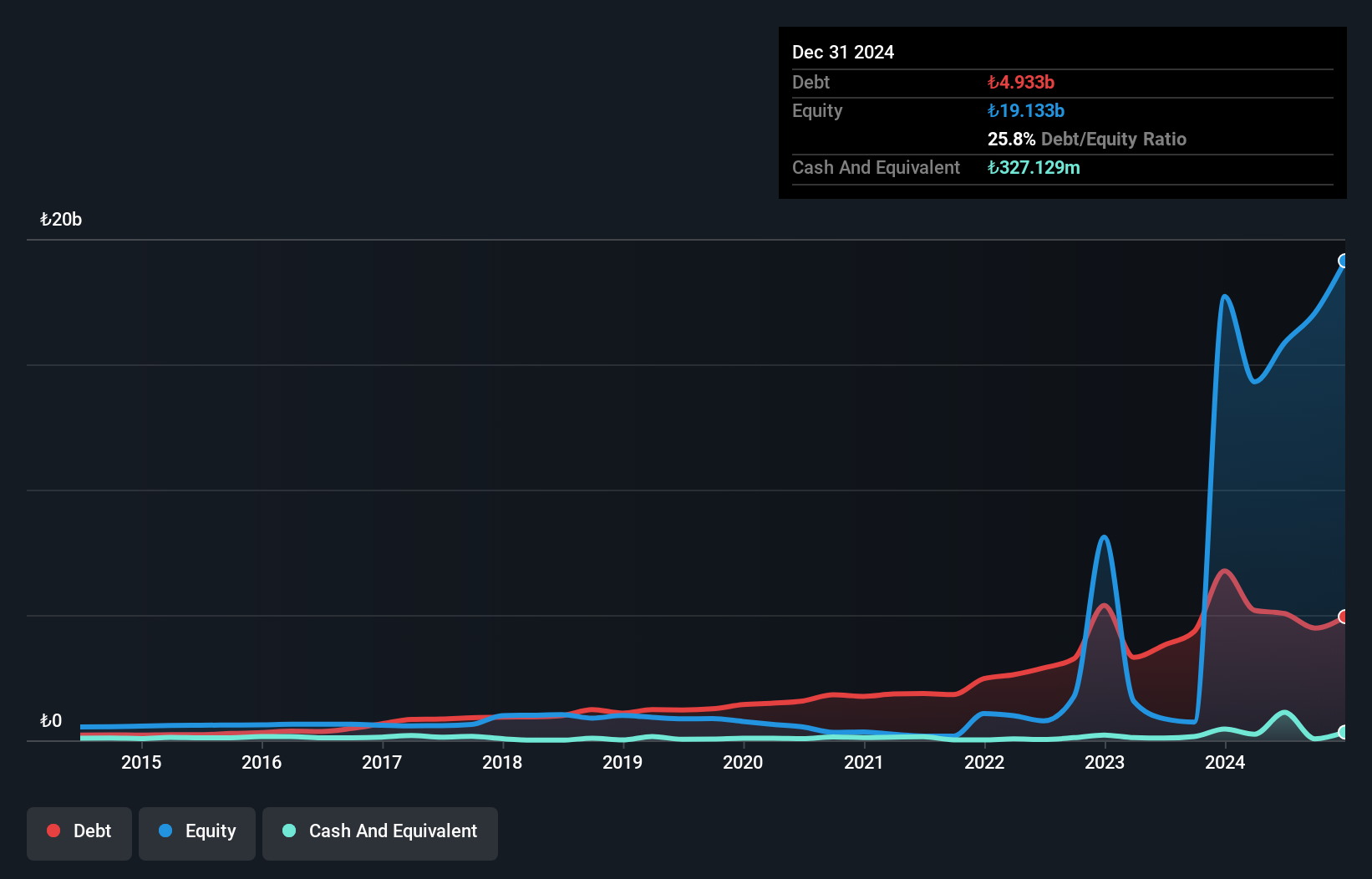

Batiçim Bati Anadolu Çimento Sanayii, a smaller player in the cement industry, has shown a significant turnaround with earnings growth of 547% over the past year, outpacing the broader Basic Materials sector. Despite reporting a net loss of TRY 198 million for Q3 2024 compared to a profit last year, its nine-month performance improved with net income reaching TRY 298.72 million. The company's financial health appears robust with a satisfactory net debt to equity ratio at 25.9%, and it boasts positive free cash flow and high-quality earnings. However, recent share price volatility could be worth monitoring for potential investors.

Sky ICT (SET:SKY)

Simply Wall St Value Rating: ★★★★☆☆

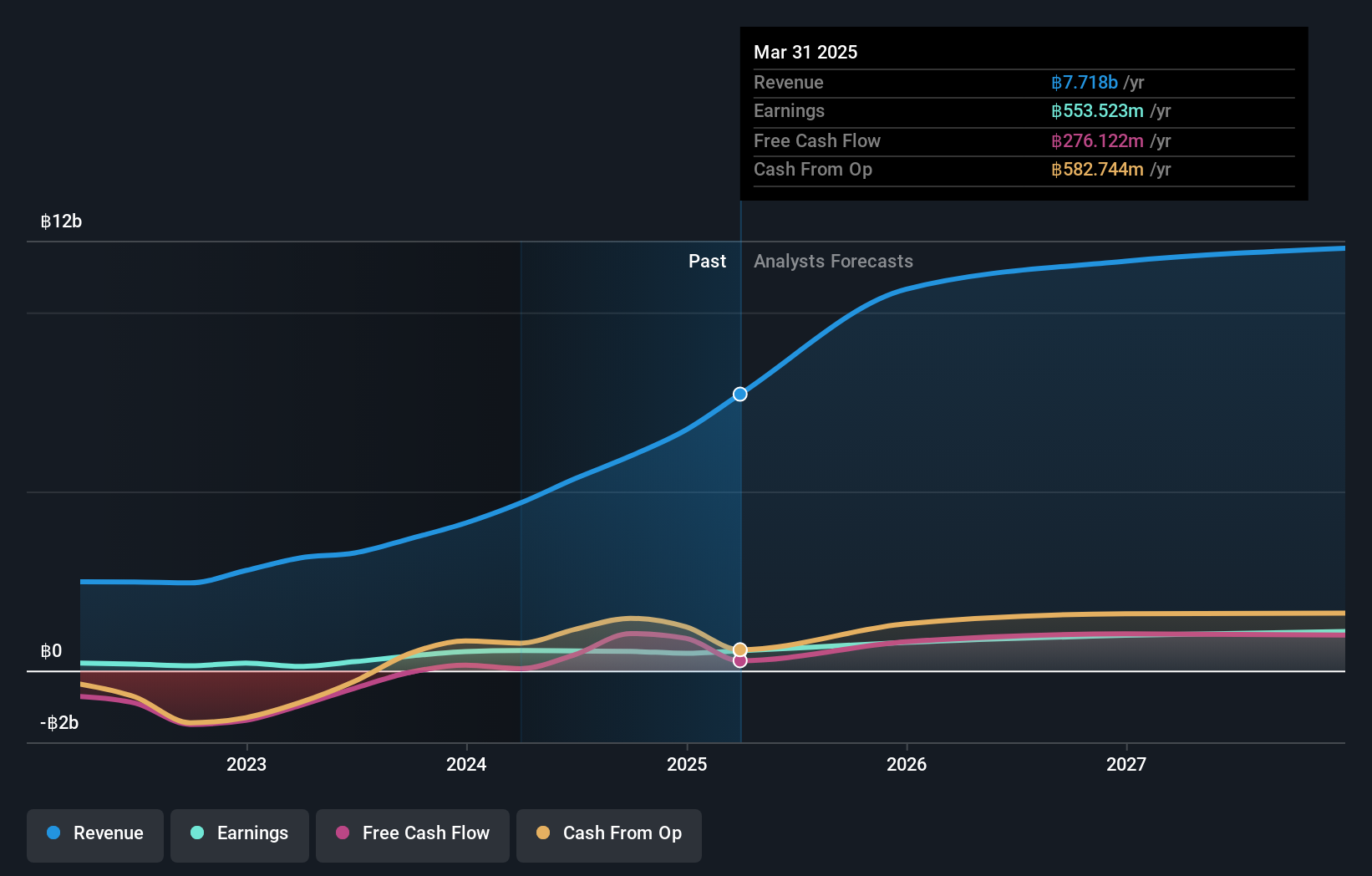

Overview: Sky ICT Public Company Limited operates in the information and communication technology (ICT) and system integration sectors in Thailand, with a market capitalization of THB16.03 billion.

Operations: Sky ICT generates revenue primarily from two segments: System Integration Services, contributing THB972.20 million, and Sales and Services (excluding System Integration but including Finance Lease Contracts), amounting to THB5.02 billion.

Sky ICT, a relatively small player in the IT sector, has shown impressive earnings growth of 35.8% over the past year, outpacing the industry average of 1.3%. Despite high-quality earnings and profitability, its financial position is strained with interest payments not well covered by EBIT at only 1.8x coverage. The company's debt to equity ratio has improved from 108.7% to 88.9% over five years but remains high at a net level of 86.3%. Recent results for Q3 show revenue climbing to THB 1,708 million from THB 1,080 million last year; however, net income slightly dipped to THB 112 million from THB 123 million previously.

- Click here and access our complete health analysis report to understand the dynamics of Sky ICT.

Assess Sky ICT's past performance with our detailed historical performance reports.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

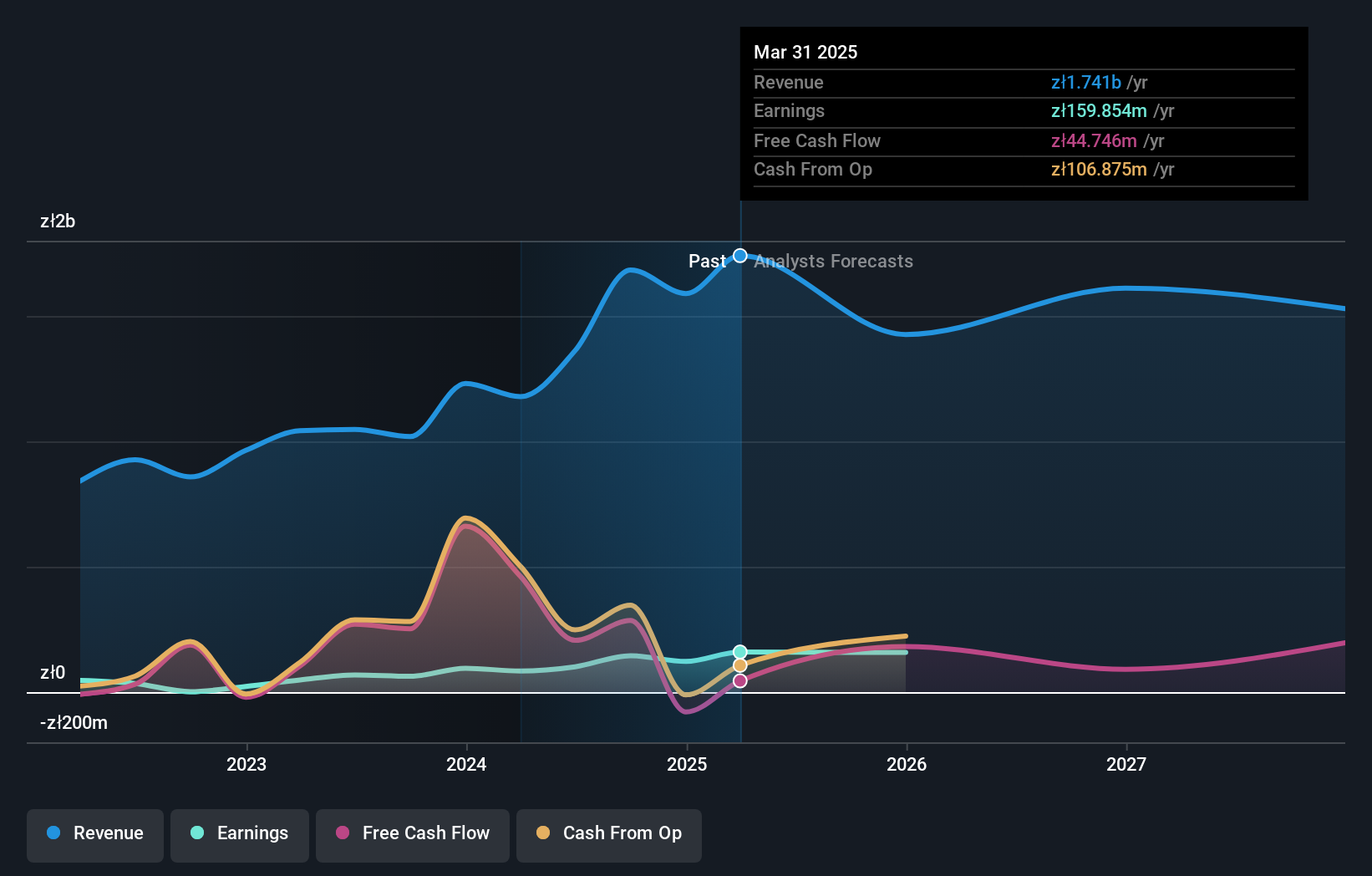

Overview: Newag S.A. is a Polish company that focuses on the production and sale of railway locomotives and rolling stock, with a market capitalization of PLN 2.18 billion.

Operations: Newag S.A. generates revenue primarily from repair services, modernization of rolling stock, and production of rolling stock and control systems, amounting to PLN 1.77 billion. The company also earns from activities of financial holdings contributing PLN 85.93 million to its revenue streams.

Newag's recent performance highlights its potential as an undiscovered gem. Over the past five years, the company has significantly reduced its debt to equity ratio from 82% to 13.2%, showcasing improved financial stability. In the third quarter of 2024, Newag reported sales of PLN 564.97 million, a substantial increase from PLN 243.32 million in the previous year, with net income jumping to PLN 45.14 million from PLN 0.725 million a year ago. Impressively, earnings growth over the past year reached an astounding 130.9%, outpacing industry averages and reflecting high-quality earnings and strong financial health with EBIT covering interest payments by over thirty-four times.

- Delve into the full analysis health report here for a deeper understanding of Newag.

Examine Newag's past performance report to understand how it has performed in the past.

Where To Now?

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4651 more companies for you to explore.Click here to unveil our expertly curated list of 4654 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:BTCIM

Batiçim Bati Anadolu Çimento Sanayii Anonim Sirketi

Operates in the cement industry in Turkey and internationally.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives