Tofas Türk Otomobil Fabrikasi Anonim Sirketi And 2 Other Stocks Believed To Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As global markets experience a resurgence, driven by cooling inflation and robust earnings reports from major banks, investors are increasingly on the lookout for stocks that may be trading below their intrinsic value. In this environment, identifying undervalued stocks can be particularly rewarding as they offer potential opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.96 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥1809.00 | ¥3611.35 | 49.9% |

| Atlantic Union Bankshares (NYSE:AUB) | US$37.87 | US$75.40 | 49.8% |

| Fevertree Drinks (AIM:FEVR) | £6.575 | £13.12 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1112.30 | ₹2216.41 | 49.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK92.60 | DKK184.75 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5875.00 | ¥11690.54 | 49.7% |

| St. James's Place (LSE:STJ) | £9.315 | £18.60 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.82 | CA$3.63 | 49.8% |

| Coeur Mining (NYSE:CDE) | US$6.36 | US$12.67 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

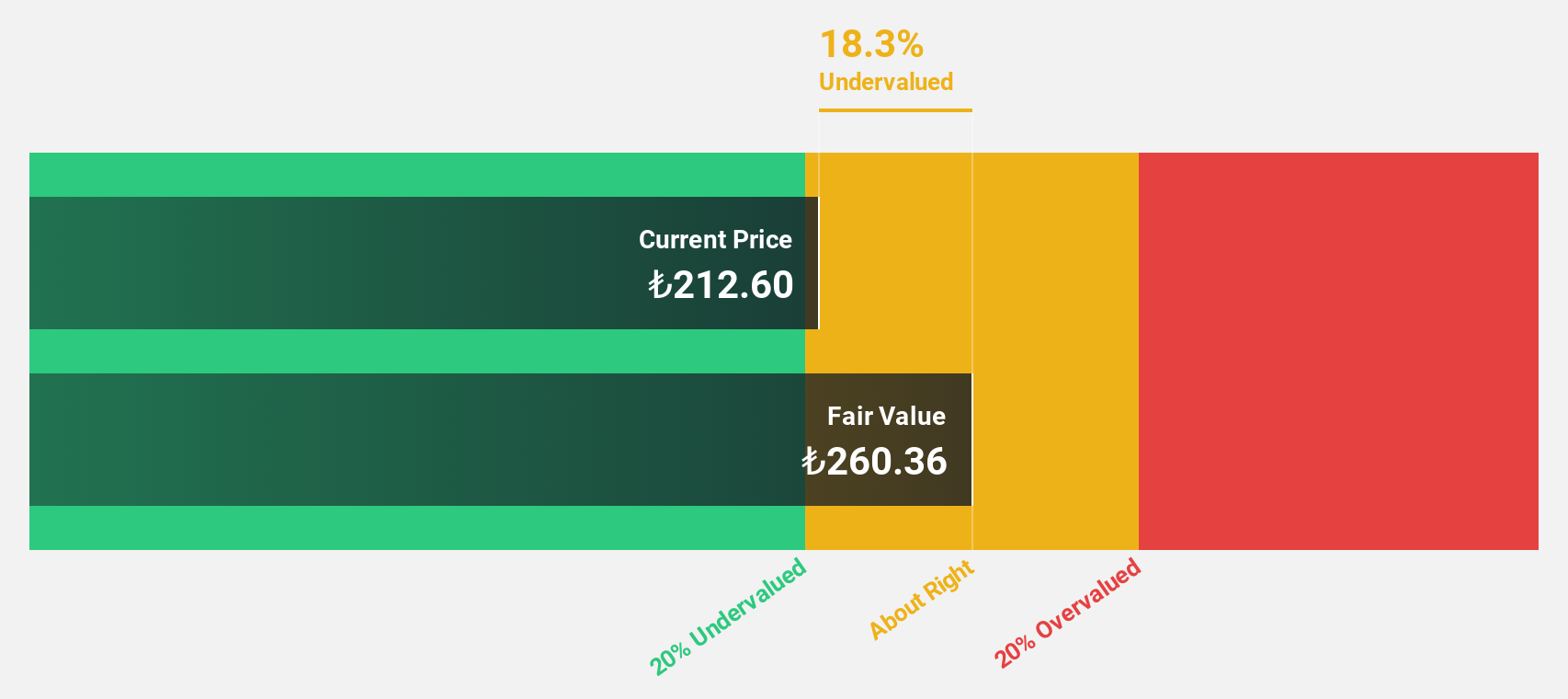

Tofas Türk Otomobil Fabrikasi Anonim Sirketi (IBSE:TOASO)

Overview: Tofas Türk Otomobil Fabrikasi Anonim Sirketi is a Turkish company that manufactures and sells passenger cars and light commercial vehicles, with a market cap of TRY108.20 billion.

Operations: The company's revenue is primarily derived from trading spare parts and automobiles, amounting to TRY89.17 billion, and consumer financing, which contributes TRY6.53 billion.

Estimated Discount To Fair Value: 17.5%

Tofas Türk Otomobil Fabrikasi Anonim Sirketi is trading at TRY 218, which is 17.5% below its estimated fair value of TRY 264.28, indicating potential undervaluation based on cash flows. Despite a challenging year with third-quarter sales and net income declining to TRY 21,447.66 million and TRY 312.01 million respectively, earnings are forecast to grow significantly at 46% annually over the next three years, outpacing the Turkish market's growth rate of 33.4%.

- According our earnings growth report, there's an indication that Tofas Türk Otomobil Fabrikasi Anonim Sirketi might be ready to expand.

- Click here to discover the nuances of Tofas Türk Otomobil Fabrikasi Anonim Sirketi with our detailed financial health report.

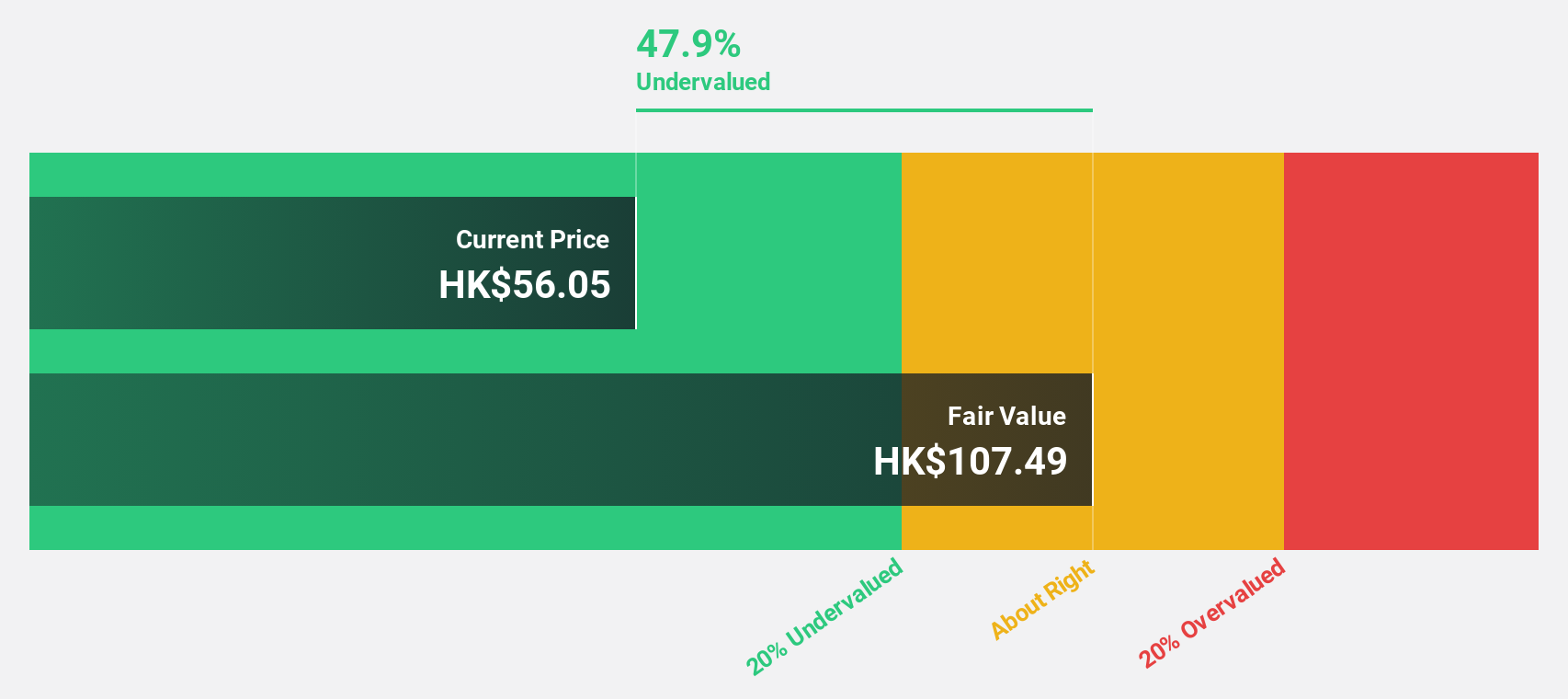

Shenzhou International Group Holdings (SEHK:2313)

Overview: Shenzhou International Group Holdings Limited is an investment holding company involved in the manufacture, printing, and sale of knitwear products across Mainland China, the European Union, the United States, Japan, and other international markets with a market cap of approximately HK$86.66 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of knitwear products, totaling CN¥26.38 billion.

Estimated Discount To Fair Value: 38.2%

Shenzhou International Group Holdings is trading at HK$57.65, significantly below its estimated fair value of HK$93.31, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at 12.3% annually, outpacing the Hong Kong market's 11.5%. However, its dividend history remains unstable despite a strong past year's earnings growth of 24%. Recent participation in the Macquarie Asia Conference underscores its active engagement with investors globally.

- Our growth report here indicates Shenzhou International Group Holdings may be poised for an improving outlook.

- Take a closer look at Shenzhou International Group Holdings' balance sheet health here in our report.

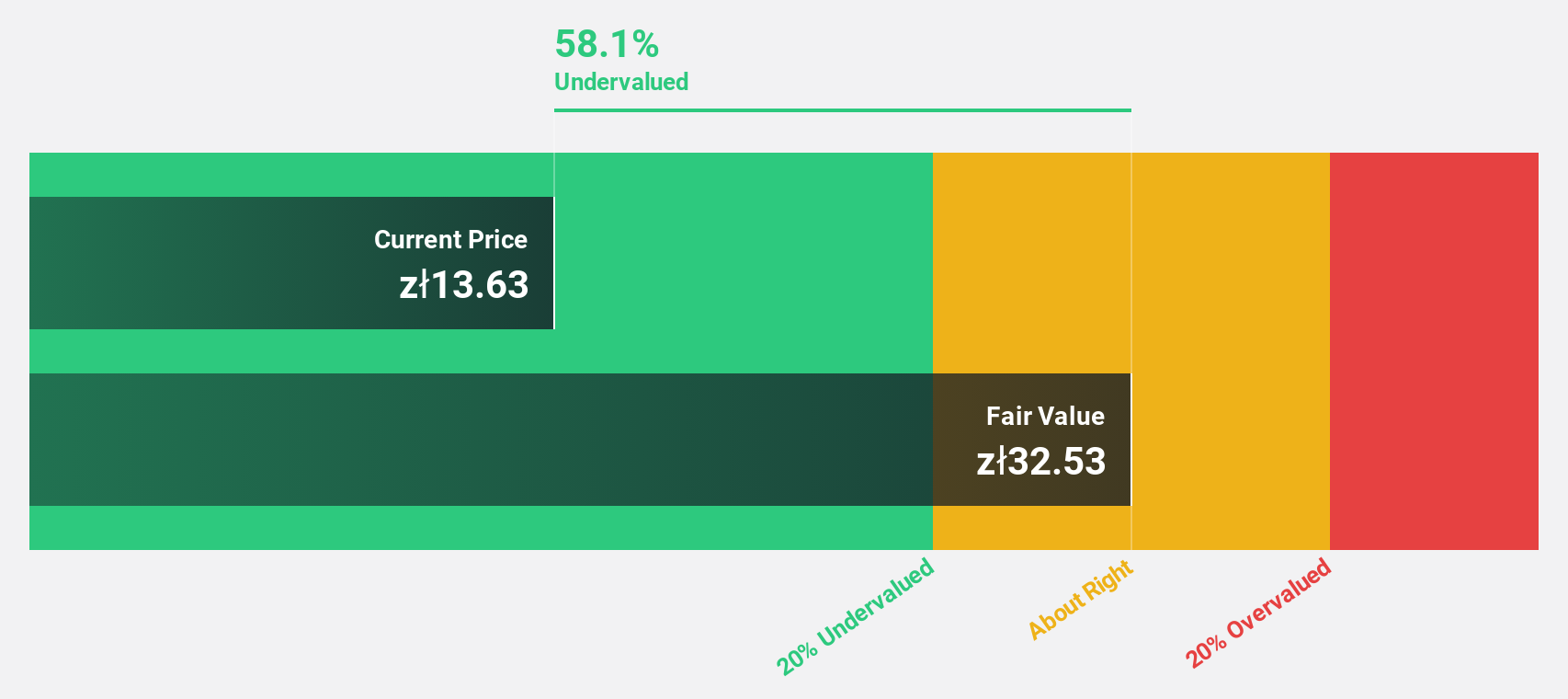

Bank Millennium (WSE:MIL)

Overview: Bank Millennium S.A. offers a range of banking products and services in Poland and has a market capitalization of PLN11.72 billion.

Operations: The company's revenue segments include Corporate Banking at PLN913.52 million, Retail Banking (excluding FX Mortgage) at PLN5.05 billion, and Treasury, ALM (Assets and Liabilities Management) at PLN90.27 million.

Estimated Discount To Fair Value: 48.8%

Bank Millennium is trading at PLN 10.04, significantly below its estimated fair value of PLN 19.62, indicating potential undervaluation based on cash flows. The bank's earnings have shown robust growth, with net income for the third quarter rising to PLN 189.76 million from PLN 102.7 million a year ago. Despite a high bad loans ratio of 4.7%, earnings are forecast to grow at an impressive rate of over 40% annually, outpacing the Polish market's growth expectations.

- In light of our recent growth report, it seems possible that Bank Millennium's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Bank Millennium stock in this financial health report.

Summing It All Up

- Navigate through the entire inventory of 863 Undervalued Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tofas Türk Otomobil Fabrikasi Anonim Sirketi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:TOASO

Tofas Türk Otomobil Fabrikasi Anonim Sirketi

Manufactures and sells passenger cars and light commercial vehicles in Turkey.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives