- Turkey

- /

- Basic Materials

- /

- IBSE:NUHCM

3 Reliable Dividend Stocks Yielding Up To 3.3%

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings in the U.S., investors are increasingly looking for stable income sources amid economic optimism. In this environment, dividend stocks stand out as attractive options for those seeking consistent returns, offering a blend of income generation and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

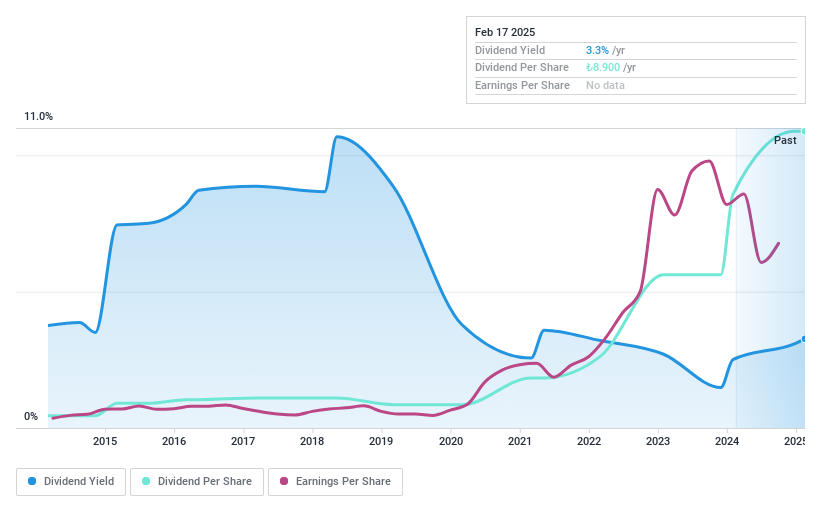

Nuh Çimento Sanayi (IBSE:NUHCM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nuh Çimento Sanayi A.S. is a Turkish company that produces and sells cement, clinker, and mineral additives, with a market capitalization of TRY43.56 billion.

Operations: The company's revenue segments include Energy at TRY50.35 million and Construction and Construction Materials at TRY12.62 billion.

Dividend Yield: 3%

Nuh Çimento Sanayi's dividend yield of 3.01% places it in the top 25% of Turkish market payers, yet its dividends are not covered by free cash flows and have been volatile over the past decade. Despite an increase in dividends over ten years, payments remain unreliable with a high payout ratio of 80.3%. Recent earnings show decreased sales but increased third-quarter net income to TRY 705.59 million, highlighting potential volatility for dividend sustainability.

- Click here to discover the nuances of Nuh Çimento Sanayi with our detailed analytical dividend report.

- Our valuation report here indicates Nuh Çimento Sanayi may be overvalued.

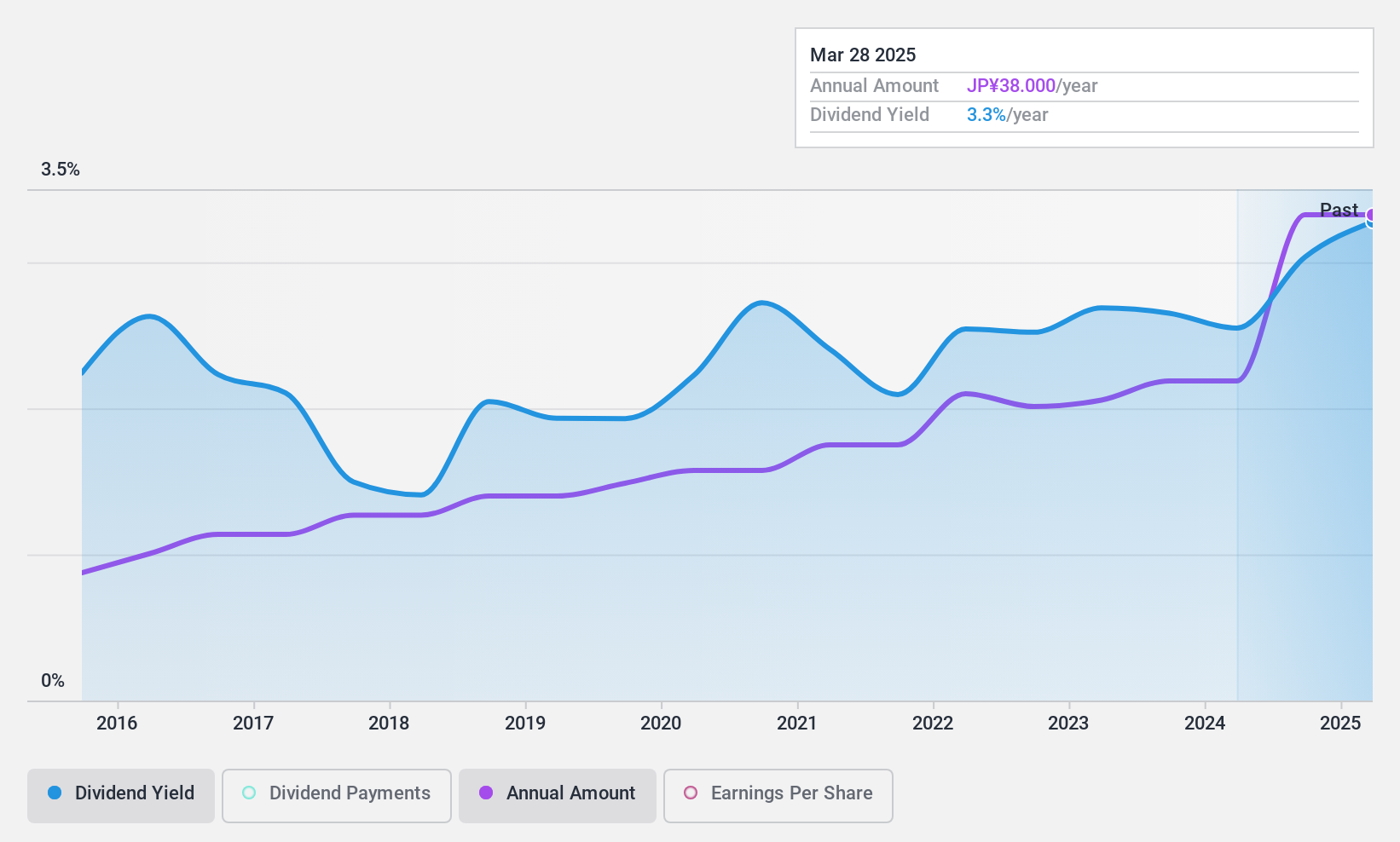

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides information technology services and digital solutions in Japan, with a market cap of approximately ¥47.01 billion.

Operations: Cresco Ltd.'s revenue segments include the Digital Solution Business generating ¥3.83 billion, IT Service Business - Finance at ¥16.15 billion, IT Service Business - Enterprise contributing ¥21.15 billion, and IT Service Business - Manufacturing with ¥14.50 billion in revenue.

Dividend Yield: 3.3%

Cresco's dividends, covered by earnings (34.3% payout ratio) and cash flows (36% cash payout ratio), have increased over the past decade but remain volatile, with drops exceeding 20%. The dividend yield of 3.33% is below the top tier in Japan, and despite trading at a significant discount to its estimated fair value, the unstable dividend track record may concern income-focused investors. Earnings growth of 9.9% annually supports potential future stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Cresco.

- The valuation report we've compiled suggests that Cresco's current price could be quite moderate.

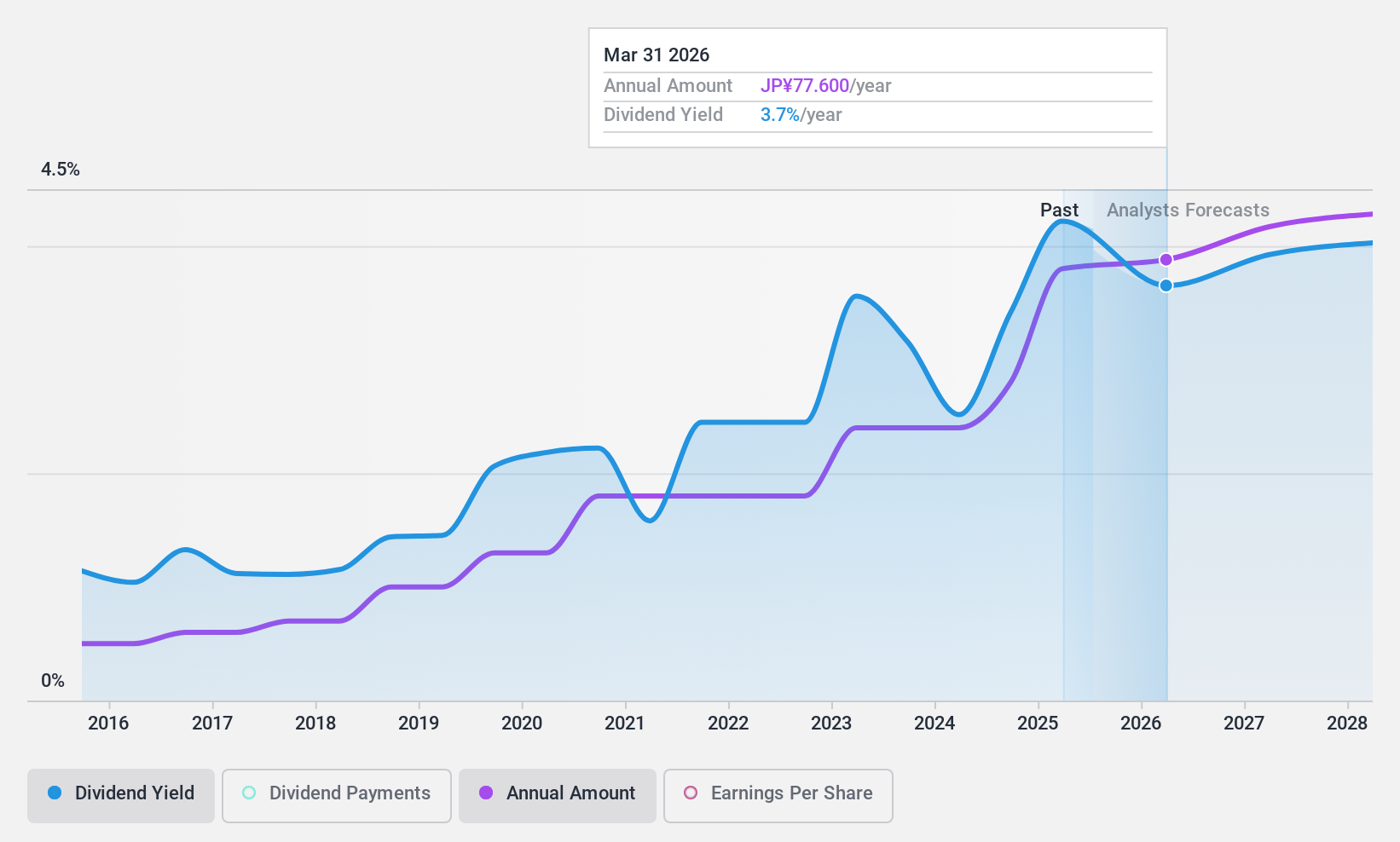

Takuma (TSE:6013)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. specializes in the design, construction, and supervision of boilers, plant machinery, pollution prevention and environmental equipment plants, as well as heating, cooling, and sanitation facilities in Japan with a market cap of approximately ¥128.18 billion.

Operations: Takuma Co., Ltd.'s revenue segments include the Domestic Environment and Energy Business at ¥119.62 billion, the Package Boiler Business at ¥18.61 billion, the Equipment and Systems Business at ¥10.62 billion, and the Overseas Environment and Energy Business at ¥2.89 billion.

Dividend Yield: 3.4%

Takuma's dividends have been stable and growing over the past decade, supported by a low payout ratio of 37.9%, yet they are not covered by free cash flows, raising sustainability concerns. The recent buyback completion of ¥3,999.94 million reflects strong capital management but doesn't enhance dividend coverage. Trading at a significant discount to its fair value and with earnings growth of 50.9% last year, Takuma offers potential for income investors despite its modest 3.4% yield in Japan's market context.

- Get an in-depth perspective on Takuma's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Takuma's share price might be too pessimistic.

Summing It All Up

- Investigate our full lineup of 1979 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuh Çimento Sanayi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:NUHCM

Nuh Çimento Sanayi

Produces and sells cement, clinker, and mineral additives in Turkey.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives