- United Arab Emirates

- /

- Banks

- /

- ADX:NBQ

3 Middle Eastern Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

Gulf markets have shown mixed reactions recently, influenced by easing U.S.-China trade tensions and tepid corporate earnings. While the term "penny stock" may seem outdated, it continues to highlight smaller or newer companies that can offer substantial value when grounded in solid financials. This article will explore three Middle Eastern penny stocks that exhibit strong balance sheets and potential for growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.58 | SAR1.43B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.921 | ₪352.76M | ✅ 3 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.08 | AED2.14B | ✅ 5 ⚠️ 3 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.49 | AED225M | ✅ 2 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.39 | AED703.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.20 | AED369.6M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.29 | AED14.03B | ✅ 2 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.812 | AED3.46B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.834 | AED507.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.717 | ₪213.28M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 76 stocks from our Middle Eastern Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates, with a market capitalization of AED5.90 billion.

Operations: The company's revenue is primarily derived from Retail and Corporate Banking, contributing AED423.61 million, and Treasury and Investments, adding AED413.01 million.

Market Cap: AED5.9B

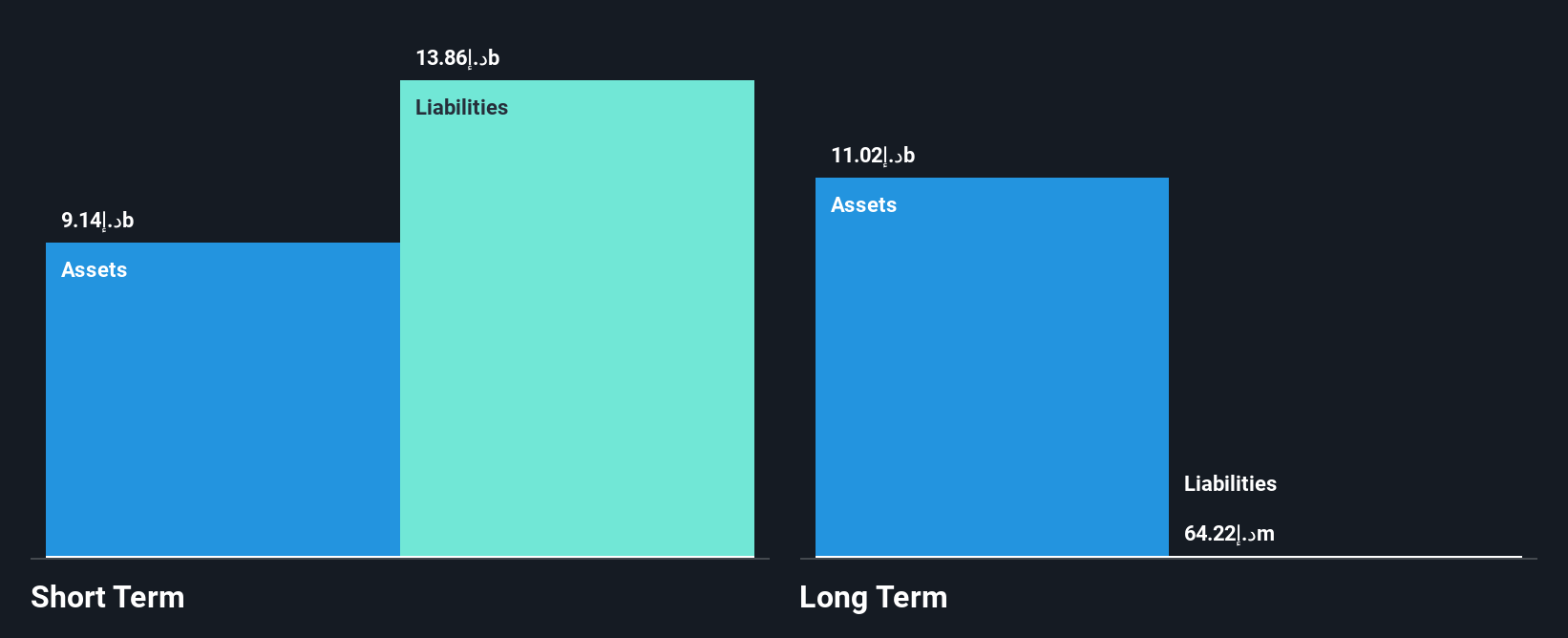

National Bank of Umm Al-Qaiwain (PSC) has demonstrated a stable financial performance, with net income rising to AED 150.75 million in Q3 2025 from AED 114.56 million a year prior, despite a slight decline in profit margins. The bank's Price-To-Earnings ratio of 10.3x suggests it is valued attractively compared to the broader AE market. While earnings growth has decelerated recently, its loan and asset management remain sound with appropriate ratios, and it benefits from primarily low-risk funding sources. However, the stock exhibits high volatility and an unstable dividend history may concern risk-averse investors.

- Get an in-depth perspective on National Bank of Umm Al-Qaiwain (PSC)'s performance by reading our balance sheet health report here.

- Examine National Bank of Umm Al-Qaiwain (PSC)'s past performance report to understand how it has performed in prior years.

Hub Girisim Sermayesi Yatirim Ortakligi (IBSE:HUBVC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates as a venture capital investment trust, focusing on investing in growth-oriented companies, with a market capitalization of TRY910 million.

Operations: Hub Girisim Sermayesi Yatirim Ortakligi A.S. has not reported any specific revenue segments.

Market Cap: TRY910M

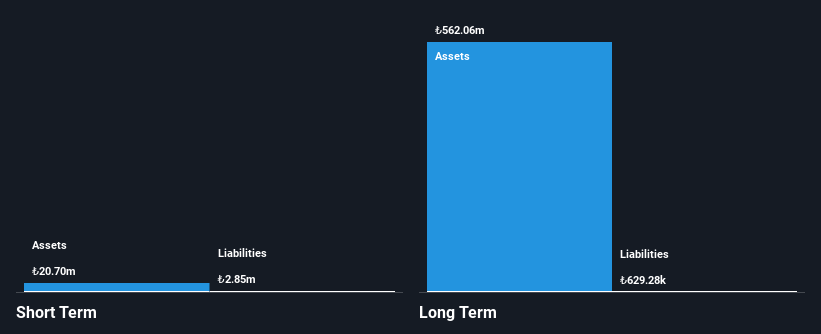

Hub Girisim Sermayesi Yatirim Ortakligi A.S. operates without debt and maintains a strong cash position, with short-term assets of TRY604.1 million covering both short- and long-term liabilities. Despite being pre-revenue with sales under US$1 million, the company has faced increasing losses, reporting a net loss of TRY373.1 million for the first half of 2025. Its share price is highly volatile, which may concern risk-averse investors. However, its substantial cash runway supports operations for over three years even as it navigates profitability challenges and high volatility compared to other Turkish stocks.

- Unlock comprehensive insights into our analysis of Hub Girisim Sermayesi Yatirim Ortakligi stock in this financial health report.

- Understand Hub Girisim Sermayesi Yatirim Ortakligi's track record by examining our performance history report.

Neft Alsharq For Chemical Industry (SASE:9605)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neft Alsharq For Chemical Industry Company specializes in the production and sale of industrial motor oils and lithium and calcium greases, with a market capitalization of SAR91 million.

Operations: The company's revenue primarily comes from its Oil Sales Sector, generating SAR74.96 million.

Market Cap: SAR91M

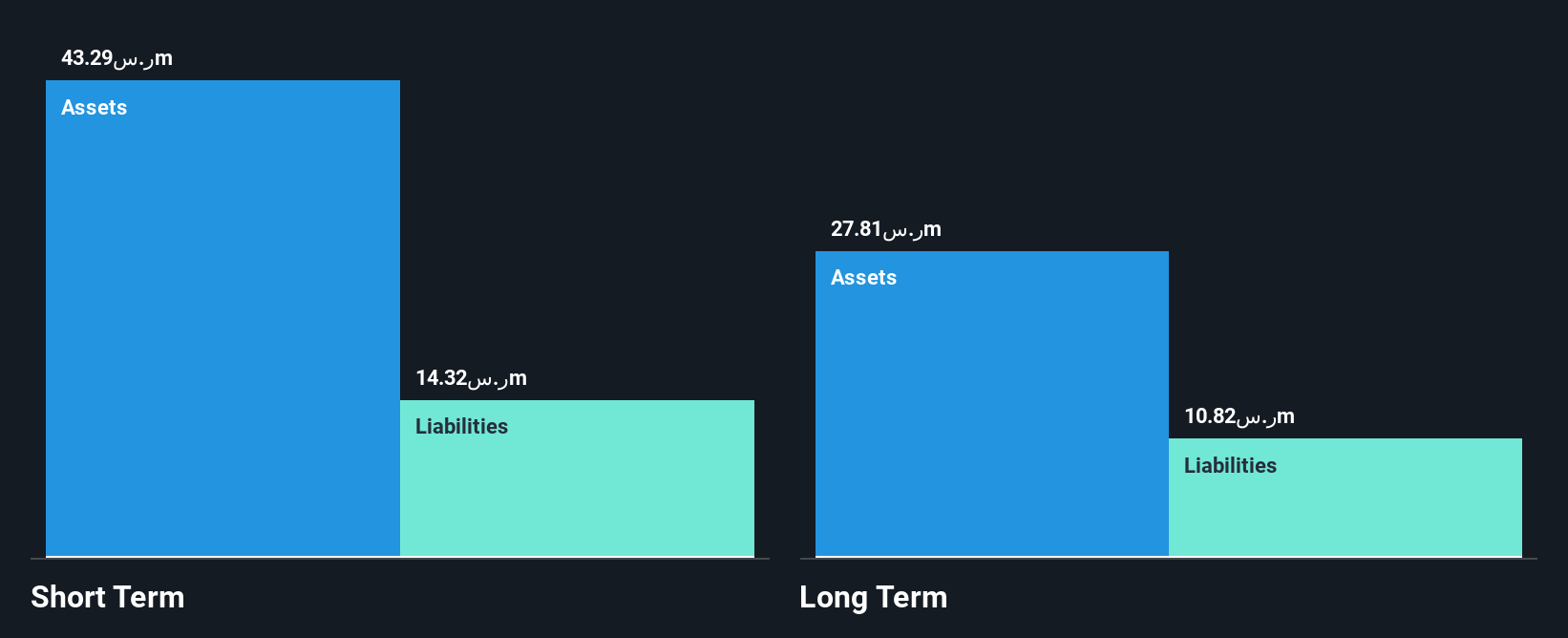

Neft Alsharq For Chemical Industry, with a market cap of SAR91 million, has shown significant revenue growth in its Oil Sales Sector, reaching SAR74.96 million. Despite this, the company reported a net loss of SAR1.91 million for the first half of 2025 due to declining profit margins and high non-cash earnings. The recent launch of Petro Neft service centers marks an effort to expand consumer services and diversify income streams. While short-term liabilities are well covered by assets (SAR43.3M), negative operating cash flow raises concerns about debt coverage despite satisfactory net debt levels (4.4%).

- Click to explore a detailed breakdown of our findings in Neft Alsharq For Chemical Industry's financial health report.

- Gain insights into Neft Alsharq For Chemical Industry's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Click through to start exploring the rest of the 73 Middle Eastern Penny Stocks now.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Bank of Umm Al-Qaiwain (PSC) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:NBQ

National Bank of Umm Al-Qaiwain (PSC)

Engages in the provision of retail and corporate banking services in the United Arab Emirates.

Flawless balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)