- Australia

- /

- Specialty Stores

- /

- ASX:SUL

3 Undervalued Asian Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

As Asian markets navigate a challenging landscape marked by global trade tensions and economic uncertainties, small-cap stocks in the region are capturing attention for their potential resilience and growth opportunities. In this environment, companies demonstrating solid fundamentals and recent insider activity can offer intriguing prospects for investors seeking to explore undervalued assets.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Infomedia | 31.5x | 3.5x | 35.00% | ★★★★★★ |

| Security Bank | 4.8x | 1.1x | 31.06% | ★★★★★☆ |

| Champion Iron | 18.9x | 1.6x | 43.71% | ★★★★★☆ |

| Puregold Price Club | 8.8x | 0.4x | 27.77% | ★★★★★☆ |

| Hansen Technologies | 291.0x | 2.8x | 26.50% | ★★★★★☆ |

| Autosports Group | 10.5x | 0.1x | 26.69% | ★★★★★☆ |

| Hong Leong Asia | 8.6x | 0.2x | 47.48% | ★★★★☆☆ |

| Dicker Data | 19.6x | 0.7x | -24.17% | ★★★☆☆☆ |

| Yixin Group | 8.8x | 0.8x | -264.99% | ★★★☆☆☆ |

| HBM Holdings | 24.1x | 7.1x | 13.24% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Champion Iron (ASX:CIA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Champion Iron is a mining company focused on the production and exploration of high-grade iron ore concentrate, with a market cap of approximately CA$3.28 billion.

Operations: The company primarily generates revenue from the sale of iron ore concentrate, with a recent revenue figure of CA$1.51 billion. The cost of goods sold (COGS) is reported at CA$1.02 billion, resulting in a gross profit margin of 32.94%. Operating expenses include general and administrative costs and depreciation, which impact net income margins that have recently been recorded at 8.50%.

PE: 18.9x

Champion Iron, a smaller player in the Asian market, showcases potential despite challenges. Recent earnings reveal a drop in net income to CAD 1.74 million for Q3 2024 from CAD 126.46 million the previous year, hinting at operational hurdles like shipping disruptions at Bloom Lake. However, insider confidence is evident with share purchases over recent months. The promising Kami Project partnership with Nippon Steel and Sojitz Corporation could bolster future growth as it progresses towards significant financial contributions and project development milestones by mid-2026.

- Click here and access our complete valuation analysis report to understand the dynamics of Champion Iron.

Gain insights into Champion Iron's historical performance by reviewing our past performance report.

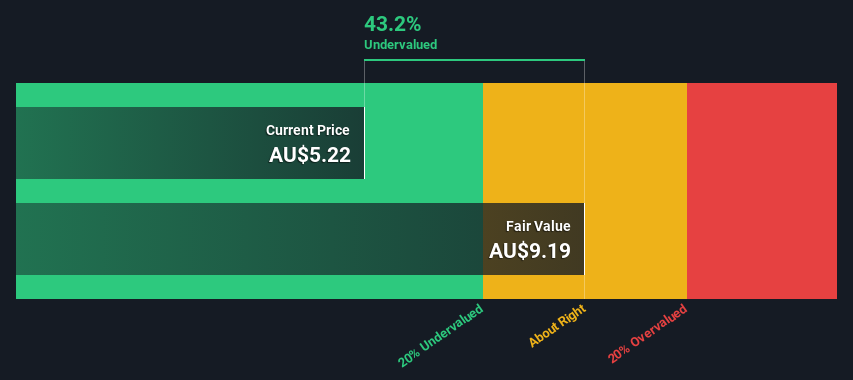

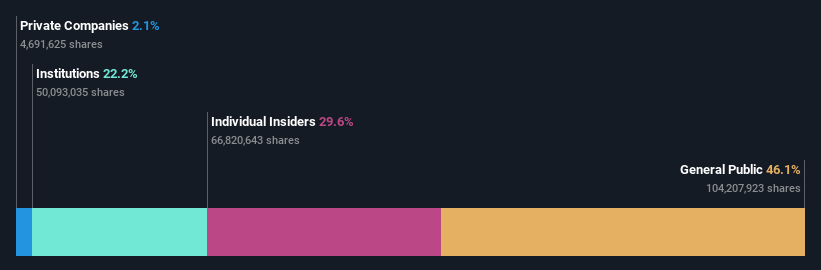

Super Retail Group (ASX:SUL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Super Retail Group operates a diverse portfolio of retail brands including Rebel, Macpac, Super Cheap Auto, and Boating, Camping and Fishing (BCF), with a focus on automotive parts and accessories, sporting equipment, outdoor products, and apparel; it has a market capitalization of approximately A$2.5 billion.

Operations: Super Retail Group's revenue is primarily driven by its segments, including SCA and Rebel. The company's gross profit margin has shown a trend of increase from 44.55% in March 2014 to a peak of 47.96% in June 2021, before declining to 45.93% by March 2025. Operating expenses have consistently risen over the years, with significant allocations towards sales and marketing as well as general and administrative expenses.

PE: 14.0x

Super Retail Group, a player in the Asian market, has seen consistent insider confidence with share purchases over the past year. Despite a dip in net income to A$129.8 million for H1 2025 from A$143.4 million last year, sales increased to A$2.11 billion from A$2.03 billion, indicating potential growth momentum. The company declared a fully franked dividend of A$0.32 per share for H1 2025, reflecting stable cash flow management amidst its reliance on external borrowing as funding sources remain riskier without customer deposits involvement.

- Navigate through the intricacies of Super Retail Group with our comprehensive valuation report here.

Explore historical data to track Super Retail Group's performance over time in our Past section.

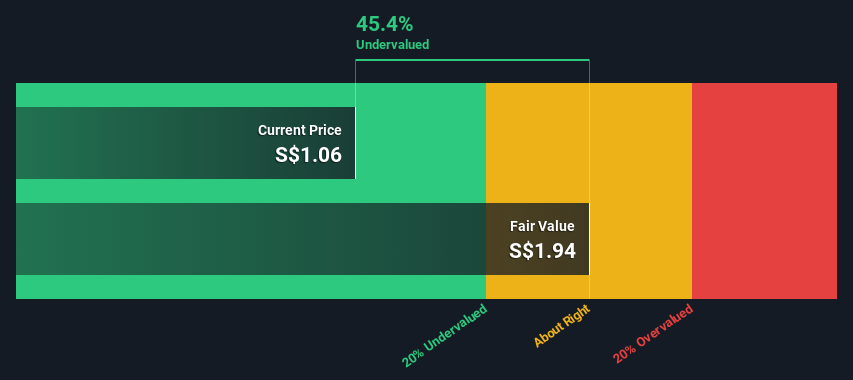

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hong Leong Asia operates in the building materials and powertrain solutions sectors, with a market cap of S$0.94 billion.

Operations: The company's primary revenue stream is derived from Powertrain Solutions, contributing significantly to its overall earnings. The gross profit margin has shown a fluctuating trend, reaching 19.04% by mid-2024 before declining to 17.20% at the end of the same year. Operating expenses and non-operating expenses have varied over time, impacting net income margins which peaked at 2.06% in late 2024.

PE: 8.6x

Hong Leong Asia, a smaller player in the Asian market, recently showcased strong financial performance with 2024 sales reaching S$4.25 billion and net income climbing to S$87.78 million from S$64.88 million the previous year. Earnings per share rose to S$0.1174, indicating improved profitability despite reliance on external borrowing for funding. Insider confidence is evident through recent share purchases, suggesting belief in future growth potential amid earnings projected to grow annually by 13.87%.

- Click here to discover the nuances of Hong Leong Asia with our detailed analytical valuation report.

Assess Hong Leong Asia's past performance with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 44 Undervalued Asian Small Caps With Insider Buying by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SUL

Super Retail Group

Engages in the retail of auto, sports, and outdoor leisure products in Australia and New Zealand.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives