United Overseas Bank (SGX:U11) Reports Q3 Earnings Growth and Expands into New Markets for Future Gains

Reviewed by Simply Wall St

United Overseas Bank (SGX:U11) recently announced its third-quarter earnings, showcasing a slight dip in net interest income to SGD 7,223 million, while net income rose to SGD 4,522 million, reflecting its operational resilience. Despite facing cost management challenges and economic headwinds, UOB's strategic focus on innovation, evidenced by its AI-driven platform, and its expansion into Europe and North America, highlight its commitment to growth. The following discussion will explore UOB's competitive advantages, strategic gaps, and areas for expansion, providing insights into its current market position and future prospects.

Take a closer look at United Overseas Bank's potential here.

Competitive Advantages That Elevate United Overseas Bank

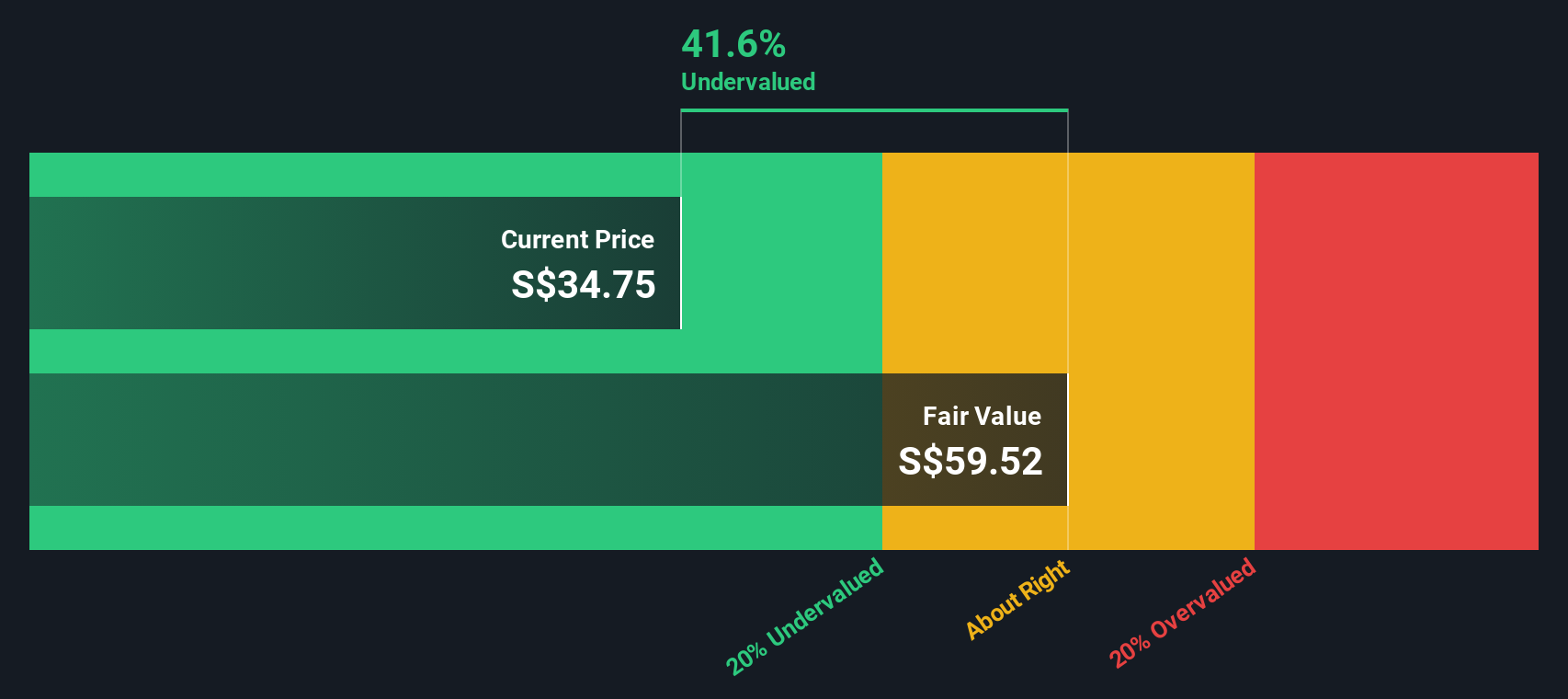

United Overseas Bank (UOB) has demonstrated strong financial performance, with earnings growing at an impressive 11.4% annually over the past five years. The company's net profit margin increased to 43.4% from 42.3% last year, underscoring its operational efficiency. Additionally, UOB's commitment to innovation is evident in the successful launch of its AI-driven platform, which significantly contributed to its Q3 results. CEO Ee Cheong Wee highlighted the strong customer loyalty, with retention rates exceeding 90%, reflecting the bank's focus on customer satisfaction. Moreover, UOB's current trading price of SGD35.53 is significantly below its estimated fair value of SGD72.28, suggesting it may be undervalued.

Strategic Gaps That Could Affect United Overseas Bank

UOB faces challenges with cost management, as rising operational costs have slightly pressured margins. COO Wai Fai Lee acknowledged these inflationary pressures during the latest earnings call. Furthermore, the bank's earnings growth of 6.4% over the past year falls short of its five-year average and lags behind the banking industry's 11%. The return on equity, at 12.5%, is also below the desired 20% threshold, indicating room for improvement. Additionally, UOB's dividend payments have been volatile over the past decade, posing a potential risk to investor confidence.

Areas for Expansion and Innovation for United Overseas Bank

UOB is actively exploring new markets, particularly in Europe and North America, as part of its growth strategy. This expansion could diversify its geographical footprint and mitigate risks associated with regional economic downturns. The bank's focus on technological investments, such as AI and machine learning, aims to enhance product offerings and operational efficiency. Strategic partnerships with tech firms are also being pursued to integrate innovative solutions into UOB's platform, further strengthening its market position.

Market Volatility Affecting United Overseas Bank's Position

Economic headwinds remain a concern, as any downturn could impact UOB's growth trajectory. The leadership is closely monitoring economic indicators to navigate these challenges. Regulatory complexities also pose a threat, with new regulations potentially increasing operational costs. Additionally, supply chain vulnerabilities have been acknowledged, prompting UOB to take proactive steps to mitigate risks and ensure continuity in operations.

Conclusion

United Overseas Bank's impressive earnings growth of 11.4% over the past five years, coupled with a net profit margin increase to 43.4%, highlights its operational efficiency and strong customer loyalty, which is further evidenced by retention rates exceeding 90%. The bank faces challenges such as rising operational costs and a return on equity below the desired threshold, which may impact future profitability. However, UOB's strategic expansion into new markets and focus on technological innovation position it well for long-term growth. Given its current trading price of SGD35.53, significantly below the estimated fair value of SGD72.28, there is potential for substantial appreciation, suggesting a favorable outlook for investors willing to navigate the associated risks.

Taking Advantage

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SGX:U11

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives