Should You Be Adding United Overseas Bank (SGX:U11) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in United Overseas Bank (SGX:U11). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for United Overseas Bank

How Fast Is United Overseas Bank Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that United Overseas Bank has managed to grow EPS by 19% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

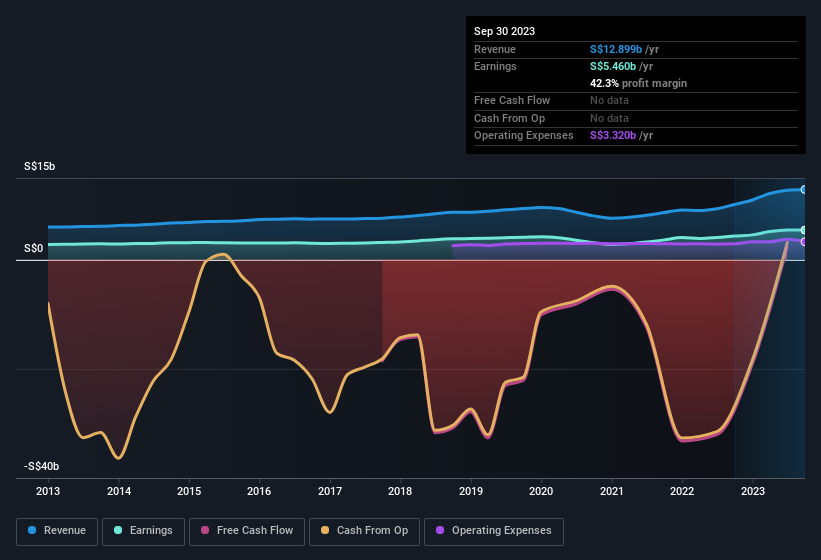

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of United Overseas Bank's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. United Overseas Bank maintained stable EBIT margins over the last year, all while growing revenue 27% to S$13b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for United Overseas Bank?

Are United Overseas Bank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent S$3.0m buying United Overseas Bank shares, over the last year, without reporting any share sales whatsoever. Knowing this, United Overseas Bank will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Deputy Chairman & CEO, Ee Cheong Wee, who made the biggest single acquisition, paying S$3.0m for shares at about S$29.57 each.

The good news, alongside the insider buying, for United Overseas Bank bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at S$7.3b. Coming in at 16% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Does United Overseas Bank Deserve A Spot On Your Watchlist?

You can't deny that United Overseas Bank has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. It is worth noting though that we have found 1 warning sign for United Overseas Bank that you need to take into consideration.

Keen growth investors love to see insider buying. Thankfully, United Overseas Bank isn't the only one. You can see a a curated list of Singaporean companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:U11

Excellent balance sheet, good value and pays a dividend.