Is There Now an Opportunity in UOB After Steady 18% Rise Over the Past Year?

Reviewed by Bailey Pemberton

Thinking about what to do with United Overseas Bank stock? You are not alone. Whether you are eyeing a new entry or considering holding through market swings, there is a lot to unpack beneath the latest numbers. United Overseas Bank has put together a mixed bag of returns lately, with a modest 2.5% gain over the past week, but a slip of 1.6% for the month. Zoom out a bit more, and the longer-term performance truly stands out: up 18% over the past year, a strong 57.5% across three years, and an impressive 134% over the last five years. Clearly, this is a stock that has rewarded patient investors.

Some of that long-term growth can be traced back to rising investor confidence in regional banking and consistent market developments that have favored the sector. Still, short-term moves remind us that risks and shifting sentiment have not disappeared entirely. That brings us back to the central question: how do we know what this stock is really worth?

For a quick pulse check, United Overseas Bank scores a 4 out of 6 on our valuation scale, reflecting that it appears undervalued by four of six major measures we track. But numbers only tell part of the story. Let us break down these valuation methods next, and stick around because, by the end, you will see an even more powerful way to think about what United Overseas Bank is really worth.

Why United Overseas Bank is lagging behind its peers

Approach 1: United Overseas Bank Excess Returns Analysis

The Excess Returns valuation model focuses on how much profit United Overseas Bank generates over and above the expected returns for its equity capital. In other words, this approach looks at whether the company is making more than it "should" for shareholders given its cost of equity. This model is particularly valuable for banks, as it zeroes in on return on invested capital and ongoing growth projections.

According to the latest estimates, United Overseas Bank has a Book Value of SGD28.62 per share, with a Stable Earnings Per Share (EPS) of SGD3.76. These projections are informed by the weighted future Return on Equity estimates from 14 analysts. The bank's Cost of Equity is SGD2.28 per share, resulting in an annual Excess Return of SGD1.48 per share. This indicates the company is delivering solid returns above its capital cost. The average Return on Equity stands at 11.67%, while the Stable Book Value is projected to reach SGD32.23 per share, based on forecasts from 12 analysts.

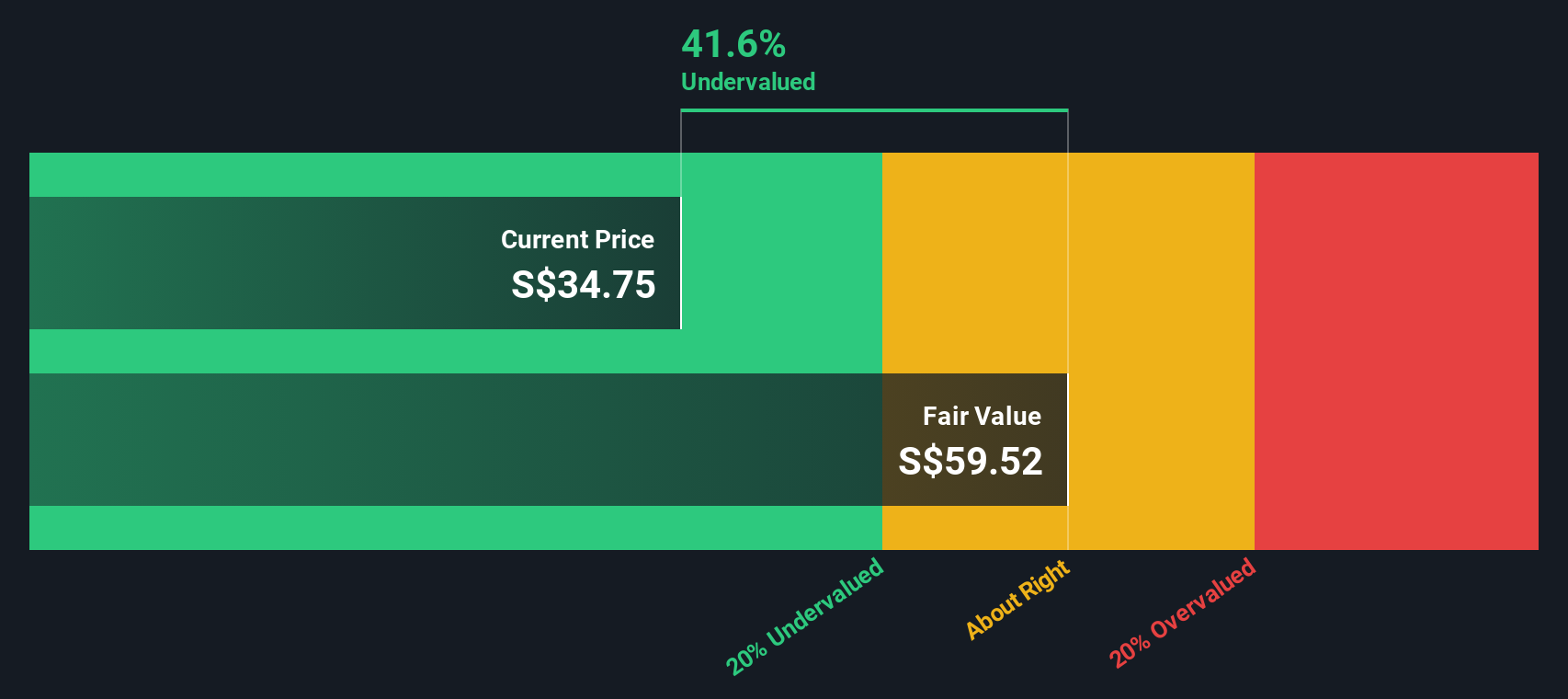

With these figures, the Excess Returns model estimates that United Overseas Bank shares are 44.8% undervalued relative to their intrinsic worth. At current levels, the share price appears to offer a significant margin of safety for prospective investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests United Overseas Bank is undervalued by 44.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Overseas Bank Price vs Earnings

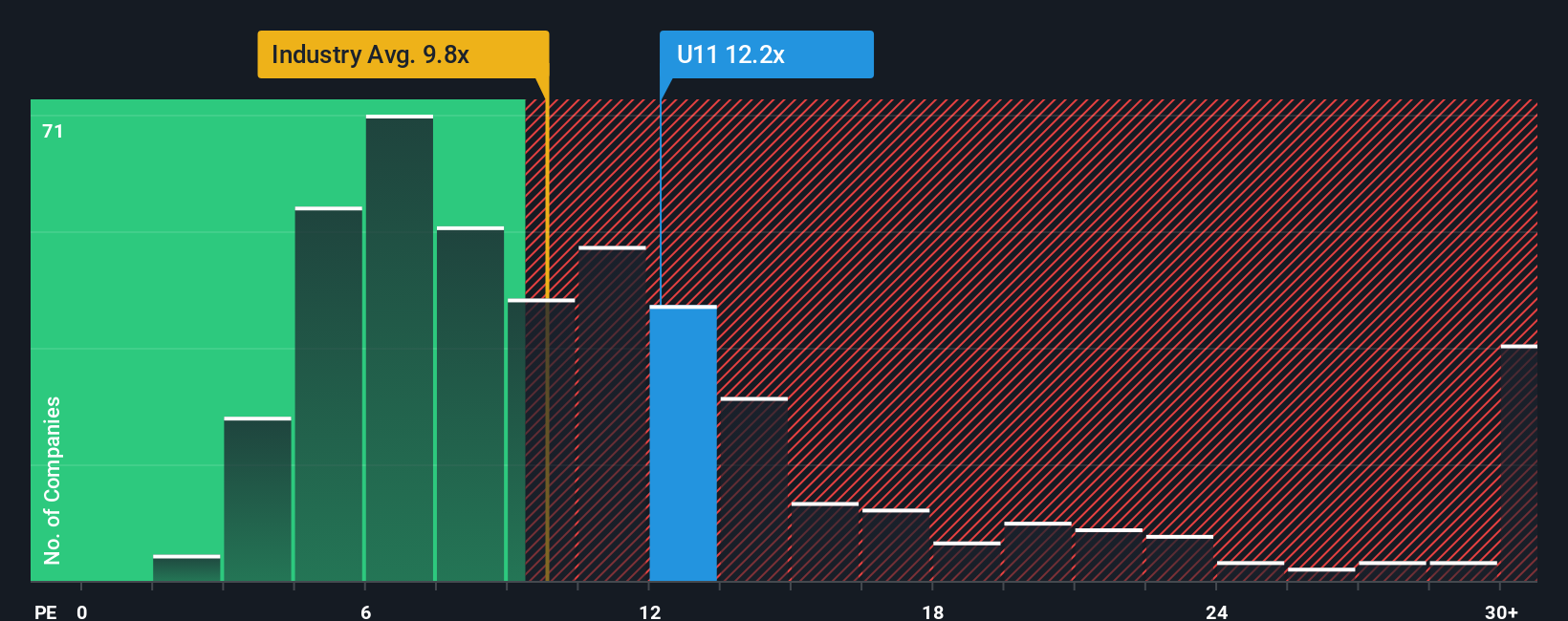

The Price-to-Earnings (PE) ratio is a popular valuation method for profitable companies like United Overseas Bank because it directly reflects how much investors are willing to pay for each dollar of earnings. This metric is especially meaningful for banks that generate stable profits, as it allows investors to compare returns relative to share price in a standardized way across the sector.

When evaluating what a “normal” or fair PE ratio should be, it is essential to factor in growth prospects and risk. Companies growing earnings quickly or consistently may deserve higher PE multiples, while those with more risk or sluggish growth should trade at a discount. For United Overseas Bank, the current PE ratio stands at 10.0x. This is slightly below the average for both its peers (11.1x) and the broader banking industry (10.4x). This suggests a more cautious investor sentiment or a perceived modest growth outlook.

To provide deeper context, Simply Wall St calculates a “Fair Ratio” for each stock, which is a custom measure tuned to the company’s unique earnings growth, profit margins, size, industry conditions, and risks. This approach gives a more individualized picture than simply comparing with peers or industry averages alone. For United Overseas Bank, the Fair Ratio is calculated at 10.8x. Comparing this with its current PE ratio of 10.0x implies the stock is modestly undervalued against the level investors might reasonably expect when considering all key fundamentals together.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

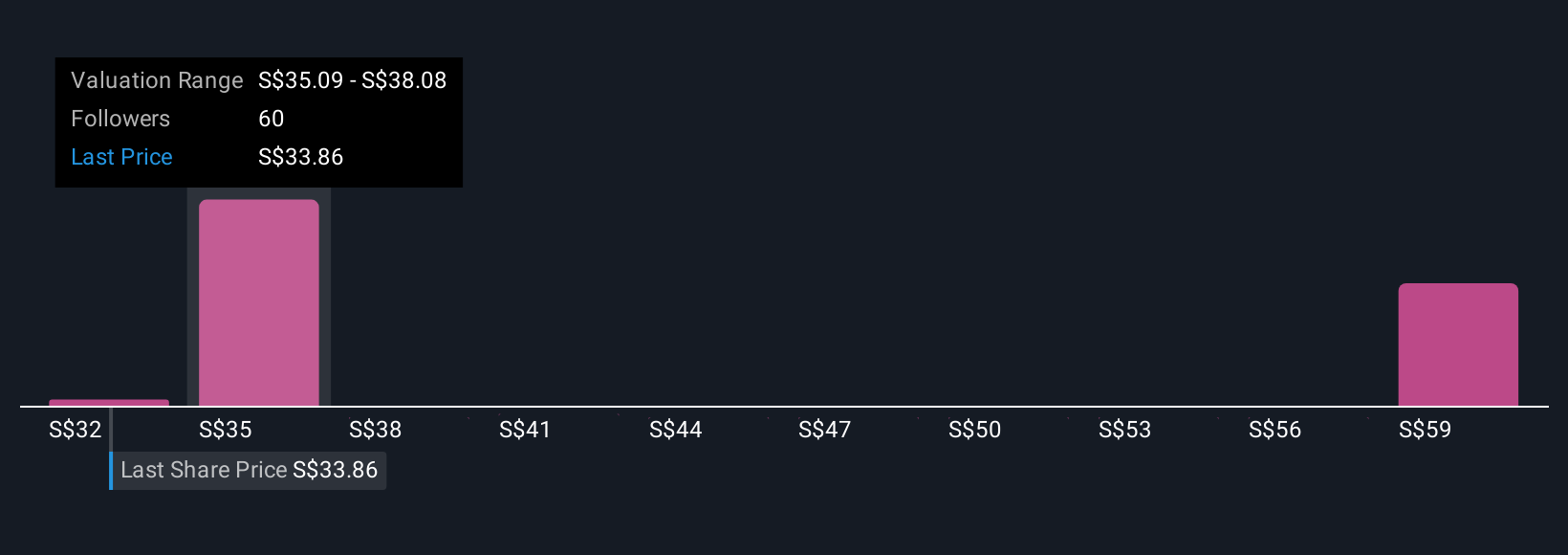

Upgrade Your Decision Making: Choose your United Overseas Bank Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative provides the story behind the numbers, allowing you to lay out your assumptions about United Overseas Bank's future revenue, earnings, and margins, and connect them directly to your own fair value estimate. Narratives turn complex financial forecasts into relatable and actionable investment theses that reflect your real-world perspective, not just market averages. On Simply Wall St’s Community page, millions of investors leverage Narratives as a simple and accessible tool to compare their fair value to the current price and decide when to buy or sell. What makes Narratives so powerful is that they update dynamically whenever new news or earnings data comes out, keeping your analysis current and relevant. For example, with United Overseas Bank, some investors believe digital transformation and regional expansion will drive the fair value as high as SGD42.7. Others are more cautious, setting it closer to SGD30.17. With Narratives, you can see and share your view, empowering smarter and more personalized investment decisions.

Do you think there's more to the story for United Overseas Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:U11

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion