3 Swedish Dividend Stocks With Yields Ranging From 3% To 4.4%

Reviewed by Simply Wall St

As global markets navigate through a landscape of moderate gains and shifting investor sentiments, Sweden's market remains an interesting area for those interested in dividend stocks. In the current economic environment, selecting stocks with reliable dividend yields could be a prudent strategy for investors looking to generate steady income.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.44% | ★★★★★★ |

| Betsson (OM:BETS B) | 6.00% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.58% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.36% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.06% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.00% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.32% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.50% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.47% | ★★★★★☆ |

| Husqvarna (OM:HUSQ B) | 3.51% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

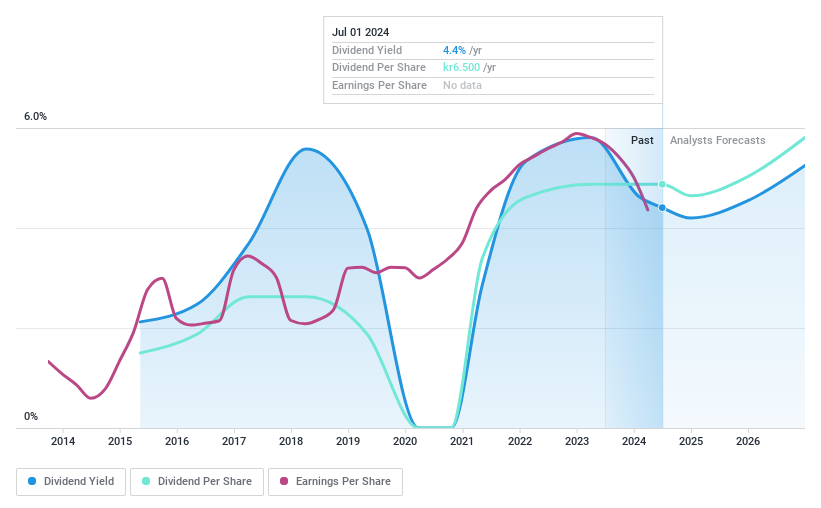

Bahnhof (OM:BAHN B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector primarily in Sweden and other parts of Europe, with a market capitalization of approximately SEK 5.43 billion.

Operations: Bahnhof AB generates revenue through its Retail Market segment, which brought in SEK 1.30 billion, and the Corporate Market segment (excluding Typhoon), which contributed SEK 606.24 million.

Dividend Yield: 4%

Bahnhof AB's dividend sustainability is questionable with a high payout ratio of 97.5%, indicating dividends are not well covered by earnings, despite a stable 10-year history and recent growth. The cash payout ratio at 76.9% suggests dividends are supported by cash flow. Recent financials show a revenue increase to SEK 491.38 million and net income rise to SEK 56.17 million in Q1 2024, reflecting some operational strength, but its dividend yield at 3.96% remains below the top Swedish payers' average.

- Click here to discover the nuances of Bahnhof with our detailed analytical dividend report.

- Our expertly prepared valuation report Bahnhof implies its share price may be lower than expected.

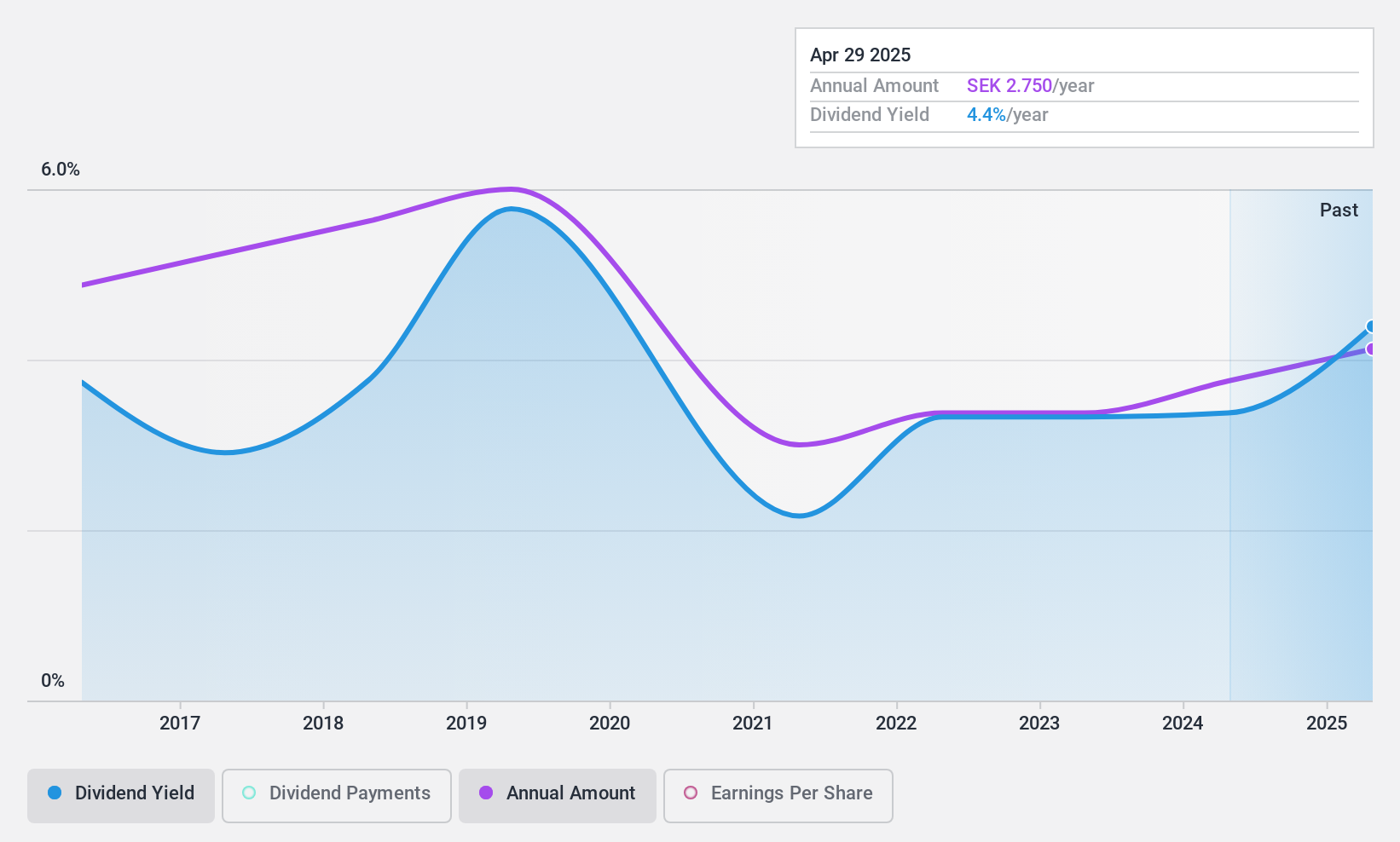

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) is a global manufacturer and distributor of fasteners, providing services and solutions for industries including light and heavy vehicles, automotive suppliers, and consumer electronics, with a market capitalization of SEK 1.75 billion.

Operations: Bulten AB generates its revenue primarily from the manufacture and distribution of fasteners, accumulating SEK 5.90 billion in sales.

Dividend Yield: 3%

Bulten's dividend profile shows a mixed performance with a reasonable payout ratio of 54.7% suggesting earnings cover dividends adequately, yet the company has experienced volatility in its dividend payments over the past decade. Despite this, dividends have grown within this period. Bulten's dividend yield at 3% is lower than the top quartile of Swedish dividend stocks. Additionally, recent financial results indicate a slight decline in net income from SEK 75 million to SEK 68 million year-over-year, with sales increasing to SEK 1.53 billion from SEK 1.39 billion.

- Get an in-depth perspective on Bulten's performance by reading our dividend report here.

- According our valuation report, there's an indication that Bulten's share price might be on the expensive side.

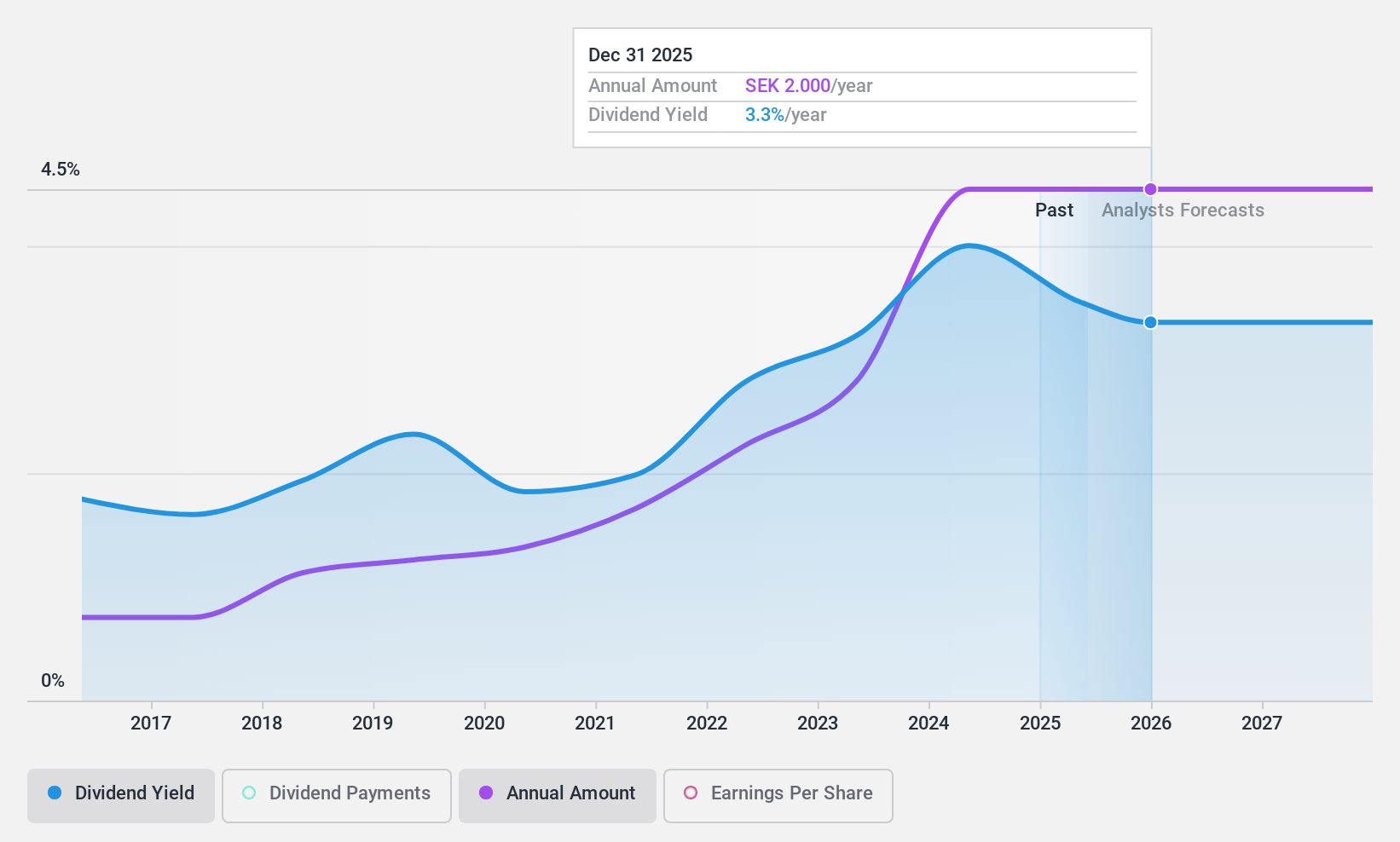

Inwido (OM:INWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) specializes in the development, manufacturing, and sale of windows and doors, with a market capitalization of approximately SEK 8.42 billion.

Operations: Inwido AB generates revenue through its e-commerce platform and regional sales across Scandinavia, Eastern Europe, and Western Europe, with respective revenues of SEK 1.04 billion, SEK 4.21 billion, and SEK 1.92 billion in Eastern Europe, while Western Europe contributed SEK 1.54 billion.

Dividend Yield: 4.5%

Inwido's dividend profile is supported by a cash payout ratio of 62.8% and an earnings payout ratio of 63.9%, indicating that both cash flows and earnings sufficiently cover its dividends. Despite trading at 58.7% below its estimated fair value, Inwido has a relatively short and unstable dividend history with only nine years of payments that have shown volatility. However, the dividend yield stands at a competitive 4.48%, higher than the Swedish market average of 4.18%. Recent corporate activities include appointing Ernst & Young as auditors and electing Mikael Jonson to the board during their AGM on May 16, 2024.

- Navigate through the intricacies of Inwido with our comprehensive dividend report here.

- Our valuation report here indicates Inwido may be undervalued.

Taking Advantage

- Access the full spectrum of 25 Top Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives