- Canada

- /

- Oil and Gas

- /

- TSX:AAV

Three Companies That May Be Trading Below Their Estimated Value In December 2024

Reviewed by Simply Wall St

In December 2024, global markets have been grappling with cautious Federal Reserve commentary and political uncertainties, leading to broad-based declines in U.S. stocks and heightened volatility across major indices. Amidst this challenging environment, investors are increasingly seeking opportunities in stocks that may be trading below their estimated value, as these can potentially offer attractive entry points when market sentiment stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$265.50 | NT$530.93 | 50% |

| Wasion Holdings (SEHK:3393) | HK$7.03 | HK$14.06 | 50% |

| Kuaishou Technology (SEHK:1024) | HK$42.45 | HK$84.87 | 50% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.11 | 49.8% |

| GlobalData (AIM:DATA) | £1.87 | £3.74 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.90 | 50% |

| T'Way Air (KOSE:A091810) | ₩2520.00 | ₩5038.37 | 50% |

| Medley (TSE:4480) | ¥3835.00 | ¥7639.79 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.61 | 49.9% |

| GRCS (TSE:9250) | ¥1415.00 | ¥2820.34 | 49.8% |

Let's dive into some prime choices out of the screener.

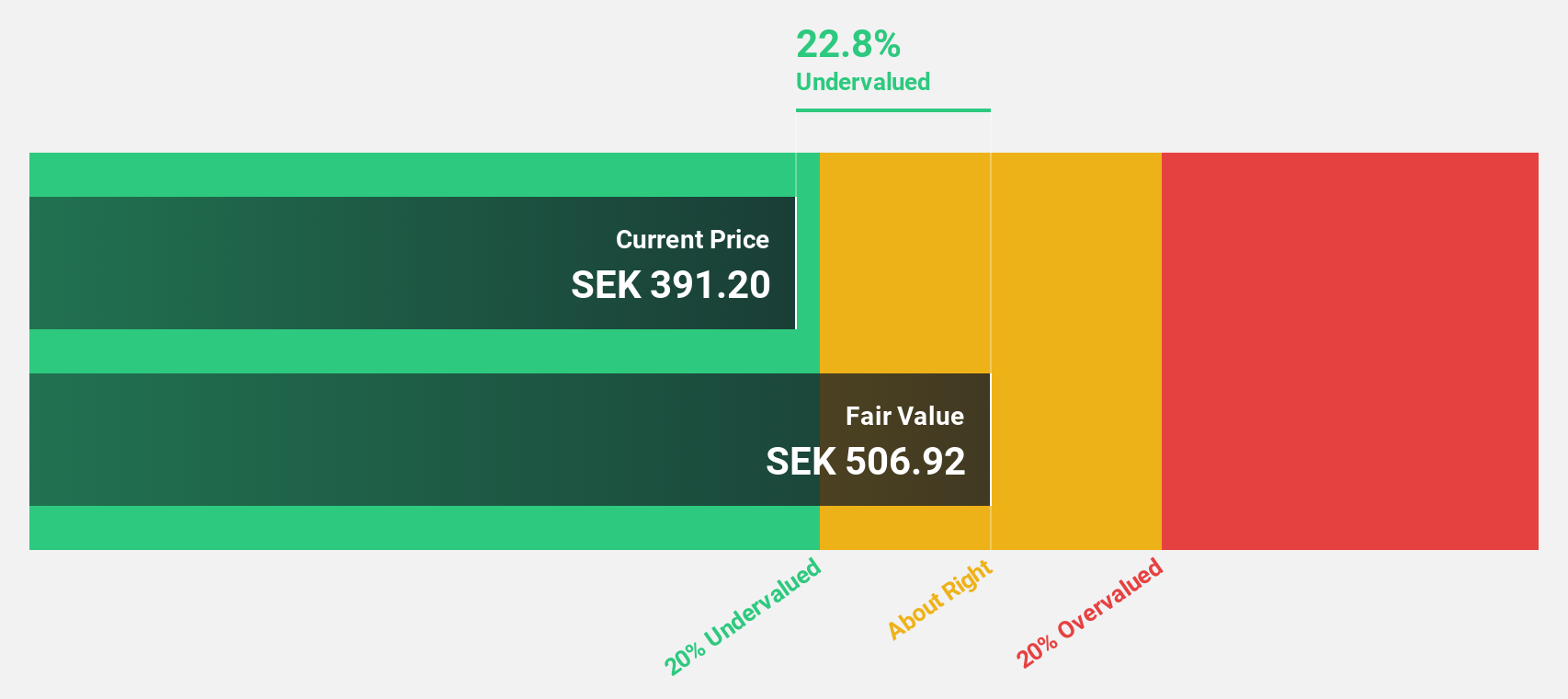

HMS Networks (OM:HMS)

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing among industrial equipment globally, with a market cap of SEK22.04 billion.

Operations: The company's revenue segment includes Wireless Communications Equipment, generating SEK3.01 billion.

Estimated Discount To Fair Value: 20.9%

HMS Networks is trading at SEK 439.2, significantly below its estimated fair value of SEK 554.98, making it highly undervalued based on discounted cash flow analysis. Despite a decline in net profit margins to 11.5% from last year's 20.2%, the company's earnings are expected to grow at a robust rate of over 40% annually, outpacing both its revenue growth and the broader Swedish market's earnings growth forecast of 14.7%.

- Our earnings growth report unveils the potential for significant increases in HMS Networks' future results.

- Click here to discover the nuances of HMS Networks with our detailed financial health report.

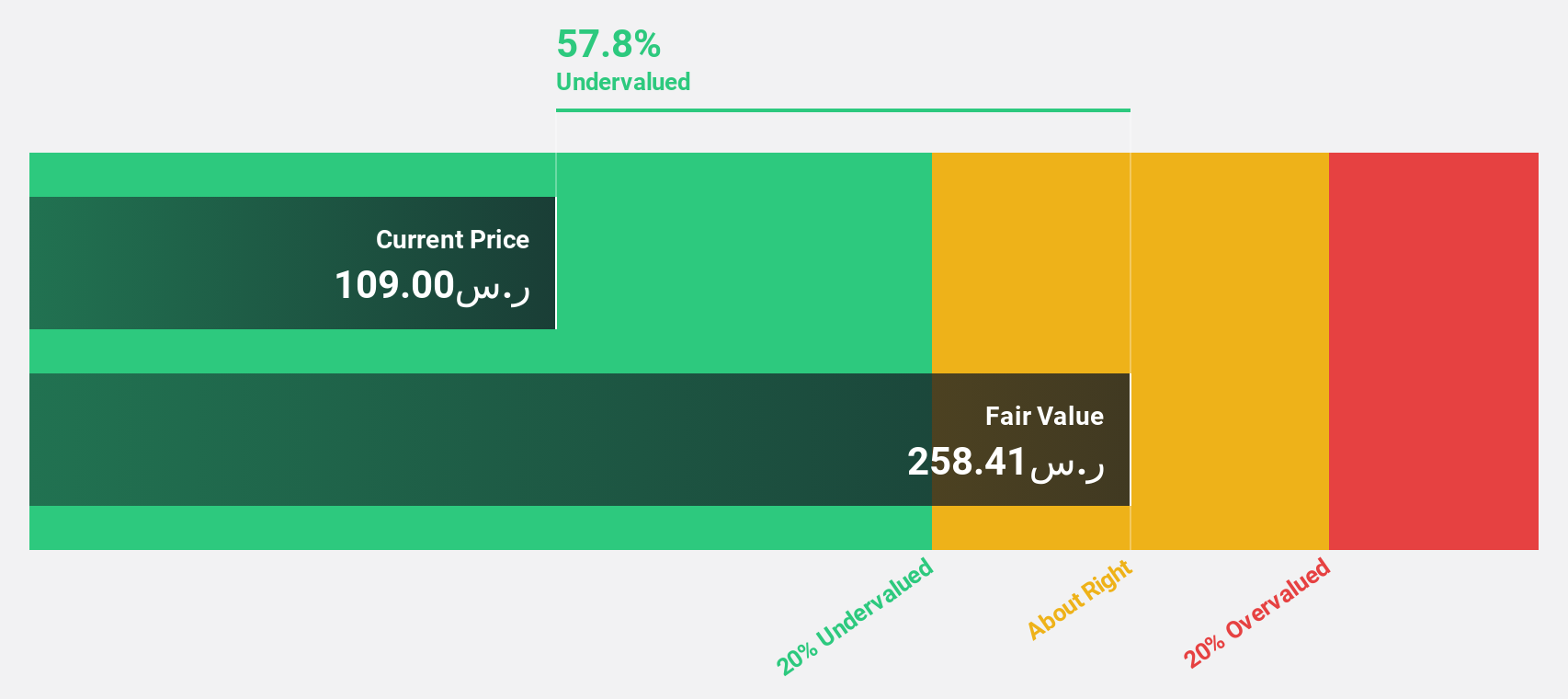

Arabian Contracting Services (SASE:4071)

Overview: Arabian Contracting Services Company, along with its subsidiaries, operates in the printing business in Saudi Arabia and Egypt, with a market cap of SAR7.20 billion.

Operations: The company generates revenue primarily from its Advertising Segment, which amounts to SAR1.52 billion.

Estimated Discount To Fair Value: 42.6%

Arabian Contracting Services is trading at SAR 144, well below its estimated fair value of SAR 250.65, indicating significant undervaluation based on discounted cash flow analysis. Despite a drop in net profit margins from 26.6% to 17.8%, earnings are projected to grow substantially at over 31% annually, surpassing the Saudi Arabian market's growth forecast of 6%. However, interest payments remain inadequately covered by earnings, posing a financial challenge.

- Our growth report here indicates Arabian Contracting Services may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Arabian Contracting Services.

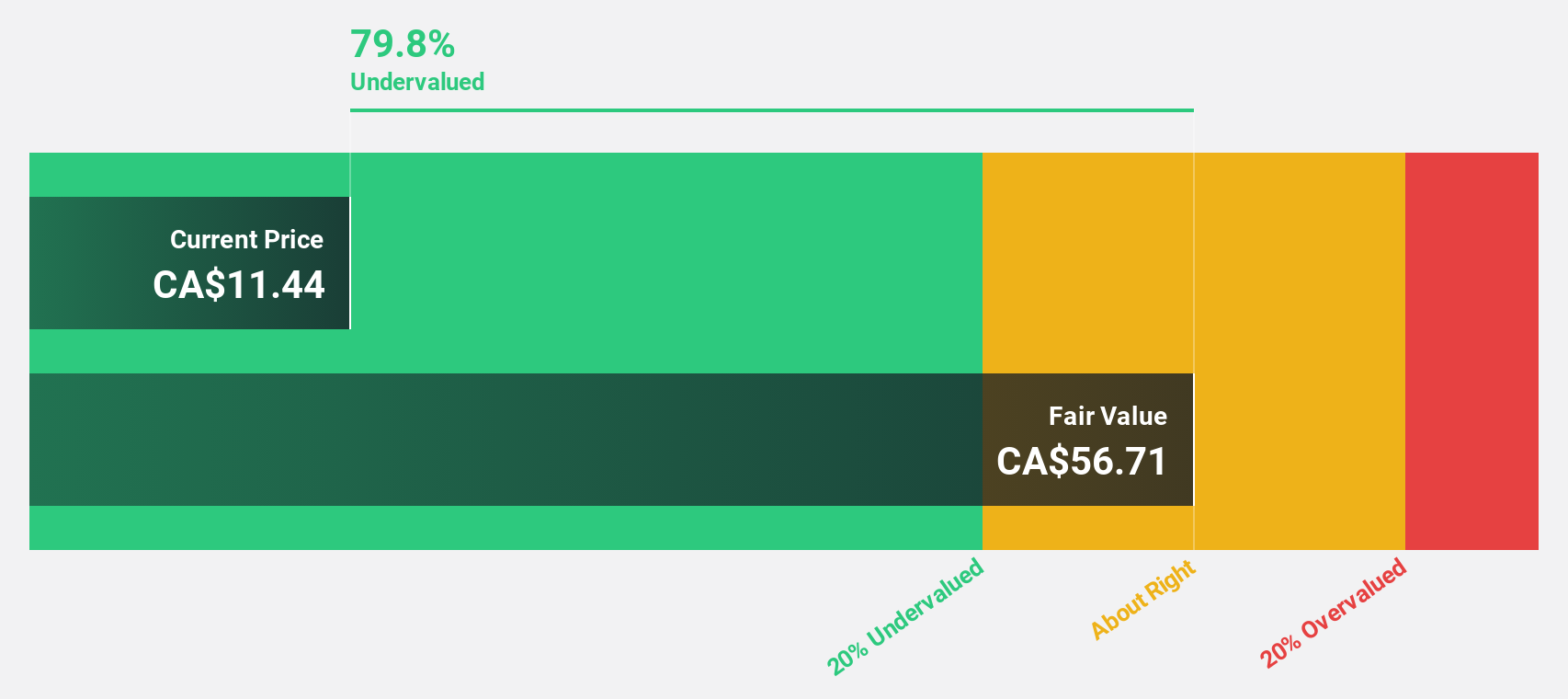

Advantage Energy (TSX:AAV)

Overview: Advantage Energy Ltd. operates in Alberta, Canada, focusing on the acquisition, exploitation, development, and production of natural gas, crude oil, and natural gas liquids (NGLs), with a market cap of CA$1.42 billion.

Operations: The company's revenue segment is comprised of CA$488.84 million from Advantage Oil & Gas Ltd.

Estimated Discount To Fair Value: 44.9%

Advantage Energy, trading at CA$8.94, is significantly undervalued with an estimated fair value of CA$16.22 based on discounted cash flow analysis. Despite a recent net loss and reduced profit margins from 30.7% to 9.3%, its earnings are forecast to grow substantially at 45% annually, outpacing the Canadian market's growth of 15.5%. However, a high debt level poses financial risks despite robust production increases and revenue growth projections exceeding market averages.

- In light of our recent growth report, it seems possible that Advantage Energy's financial performance will exceed current levels.

- Navigate through the intricacies of Advantage Energy with our comprehensive financial health report here.

Seize The Opportunity

- Delve into our full catalog of 872 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AAV

Advantage Energy

Engages in the acquisition, exploitation, development, and production natural gas, crude oil, and natural gas liquids (NGLs) in the Province of Alberta, Canada.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)