- United Kingdom

- /

- Luxury

- /

- LSE:COA

European Undervalued Small Caps With Insider Action To Explore In July 2025

Reviewed by Simply Wall St

As European markets navigate a landscape marked by mixed performances across major indices and persistent inflationary pressures, small-cap stocks present intriguing opportunities for investors seeking growth potential amidst economic fluctuations. In this context, identifying companies with strong fundamentals and insider activity can offer valuable insights into promising investment avenues within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 13.1x | 0.3x | 45.00% | ★★★★★☆ |

| Hoist Finance | 9.2x | 1.9x | 15.64% | ★★★★☆☆ |

| CVS Group | 44.1x | 1.3x | 40.37% | ★★★★☆☆ |

| Seeing Machines | NA | 2.8x | 45.33% | ★★★★☆☆ |

| Troax Group | 31.7x | 2.8x | 25.59% | ★★★☆☆☆ |

| A.G. BARR | 19.9x | 1.9x | 45.10% | ★★★☆☆☆ |

| Yubico | 33.4x | 4.8x | -13.81% | ★★★☆☆☆ |

| NOTE | 21.7x | 1.5x | -10.72% | ★★★☆☆☆ |

| Oxford Instruments | 43.5x | 2.3x | 0.53% | ★★★☆☆☆ |

| WithSecure Oyj | NA | 1.4x | -0.97% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

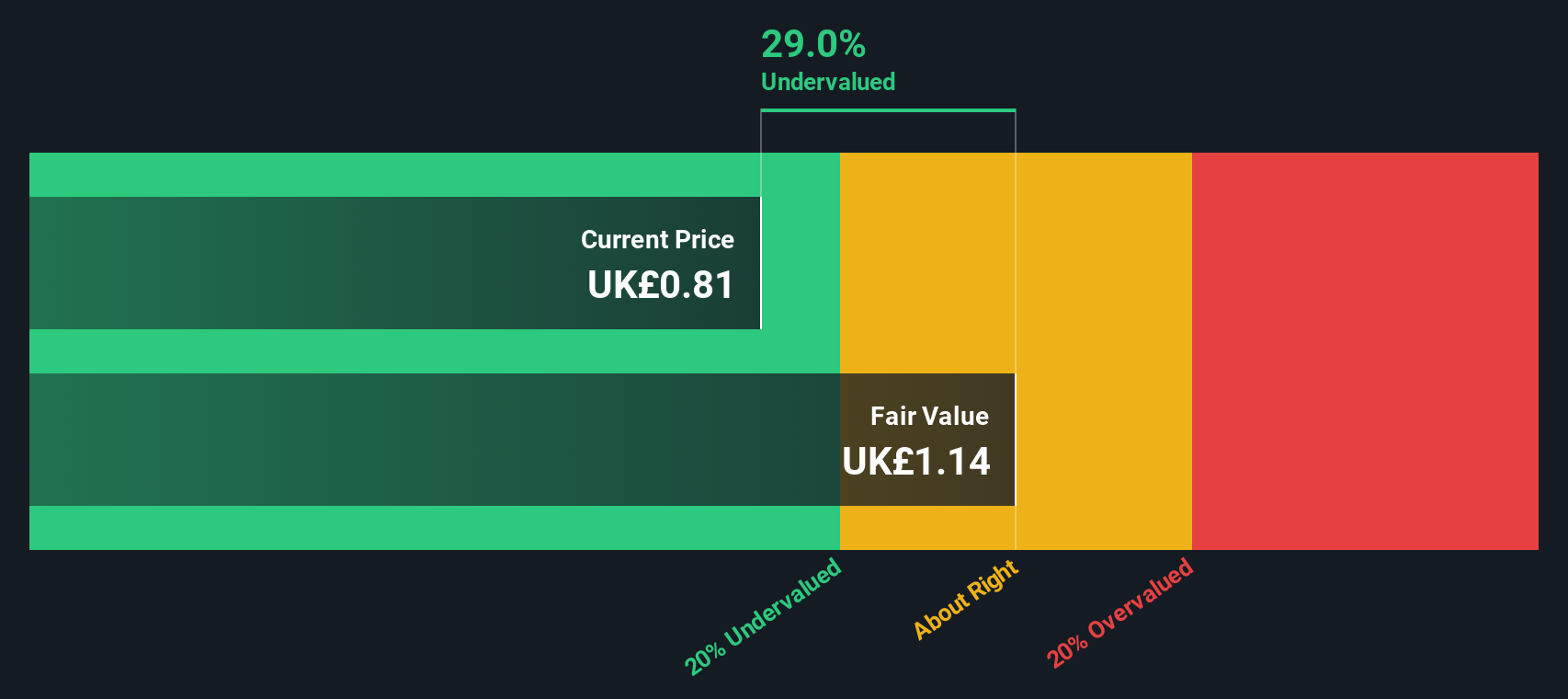

Coats Group (LSE:COA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Coats Group is a global leader in industrial thread manufacturing, serving the apparel, footwear, and performance materials sectors with a market capitalization of approximately $1.19 billion.

Operations: The company generates revenue primarily from three segments: Apparel ($775.30 million), Footwear ($405.20 million), and Performance Materials ($321.80 million). Over the analyzed periods, the net income margin showed an upward trend, reaching 7.23% by mid-2024 before slightly decreasing to 5.58% in mid-2025. The cost of goods sold (COGS) consistently constitutes a significant portion of expenses, influencing gross profit margins which have fluctuated over time, peaking at 37.13% in mid-2024 before settling at 36.87% by mid-2025.

PE: 23.3x

Coats Group, a small company in Europe, shows potential with forecasted earnings growth of 27.56% annually. Despite recent share dilution through a £242 million equity offering on July 17, 2025, insider confidence is notable as insiders have been purchasing shares. The company's financials reveal sales of US$705 million for the first half of 2025 and consistent dividends with an increase to 1 cent per share. However, its debt coverage by operating cash flow remains insufficient.

- Click here to discover the nuances of Coats Group with our detailed analytical valuation report.

Gain insights into Coats Group's historical performance by reviewing our past performance report.

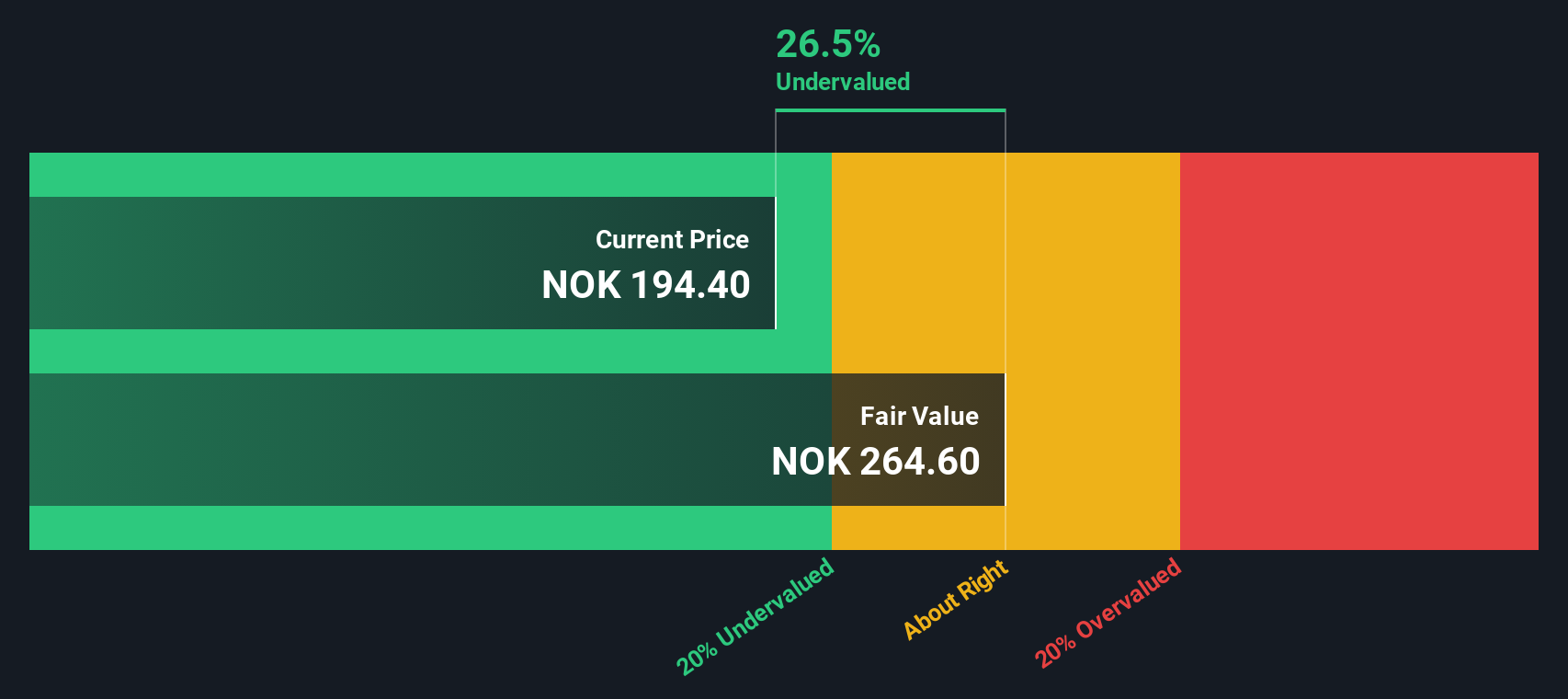

Borregaard (OB:BRG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Borregaard operates as a biochemicals company specializing in bio-based products derived from wood, with a market cap of approximately NOK 11.68 billion.

Operations: The company generates revenue primarily from Bio Solutions, Bio Materials, and Fine Chemicals, with Bio Solutions being the largest contributor. The gross profit margin shows a notable trend, reaching 64.52% by March 2025. Operating expenses include significant general and administrative costs.

PE: 22.2x

Borregaard, a European small-cap company, recently reported second-quarter sales of NOK 2,045 million and net income of NOK 255 million, showing consistent growth from the previous year. Insider confidence is evident as Tove Andersen purchased 2,000 shares valued at approximately NOK 375,840 in June. This indicates potential optimism about future performance. Despite relying entirely on external borrowing for funding—considered higher risk—the company expects earnings to grow by over 11% annually. With strong agricultural sales driving volumes and a leadership change imminent in August with Erik Foss-Jacobsen as CEO, Borregaard remains an intriguing prospect amidst evolving market dynamics.

- Delve into the full analysis valuation report here for a deeper understanding of Borregaard.

Review our historical performance report to gain insights into Borregaard's's past performance.

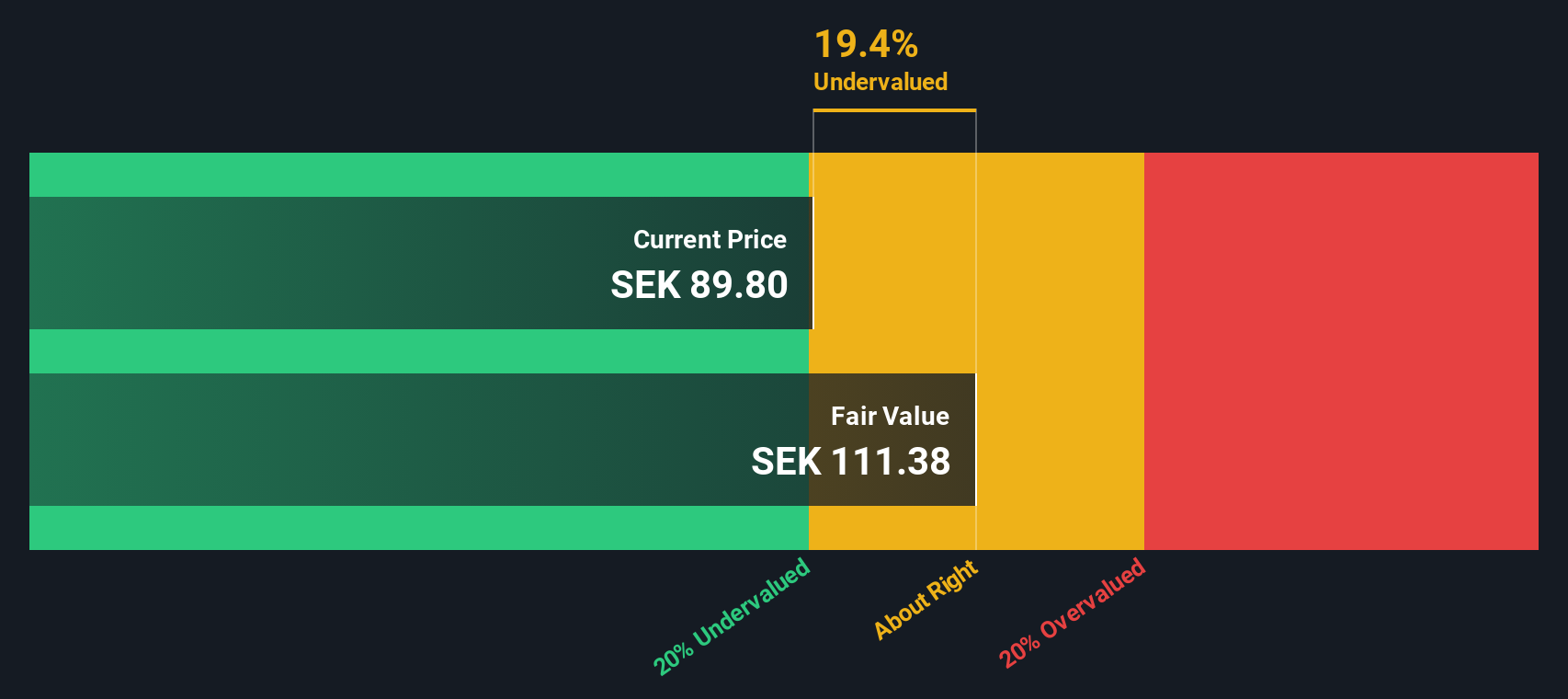

Hanza (OM:HANZA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hanza is a manufacturing solutions provider that offers comprehensive services in product development, sourcing, and production, with a market cap of approximately SEK 2.45 billion.

Operations: Revenue primarily comes from operations with a significant cost of goods sold (COGS) component, impacting the gross profit margin, which was 44.06% as of September 2024. Operating expenses are substantial and include general and administrative costs, which reached SEK 1,613 million in the same period. The net income margin has shown variability over time but stood at 2.74% during this period.

PE: 31.7x

Hanza, a European company with a smaller market cap, has shown significant growth potential despite its reliance on external borrowing. Recent earnings reports highlight impressive sales growth, reaching SEK 1.5 billion in Q2 2025 from SEK 1.2 billion the previous year, and net income rising to SEK 52 million from SEK 6 million. Earnings per share also increased notably. Insider confidence is evident through recent share purchases by insiders over the past few months, indicating positive sentiment towards future performance amidst forecasts of substantial earnings growth at over 34% annually.

- Take a closer look at Hanza's potential here in our valuation report.

Examine Hanza's past performance report to understand how it has performed in the past.

Where To Now?

- Gain an insight into the universe of 54 Undervalued European Small Caps With Insider Buying by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:COA

Coats Group

Engages in thread manufacturing, structural components for apparel and footwear, and performance materials worldwide.

Undervalued with high growth potential.

Market Insights

Community Narratives