- Sweden

- /

- Electronic Equipment and Components

- /

- OM:FING B

Investors Don't See Light At End Of Fingerprint Cards AB (publ)'s (STO:FING B) Tunnel And Push Stock Down 71%

Unfortunately for some shareholders, the Fingerprint Cards AB (publ) (STO:FING B) share price has dived 71% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 93% loss during that time.

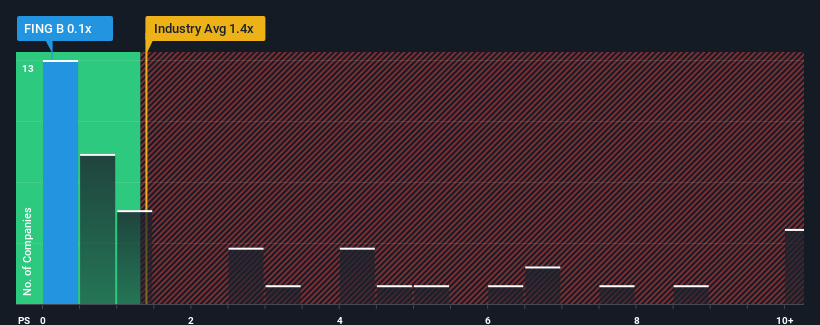

Since its price has dipped substantially, Fingerprint Cards' price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Electronic industry in Sweden, where around half of the companies have P/S ratios above 1.4x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Fingerprint Cards

How Has Fingerprint Cards Performed Recently?

Recent times have been advantageous for Fingerprint Cards as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Fingerprint Cards' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Fingerprint Cards?

Fingerprint Cards' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 43% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 39% as estimated by the only analyst watching the company. That's not great when the rest of the industry is expected to grow by 7.7%.

With this in consideration, we find it intriguing that Fingerprint Cards' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Fingerprint Cards' P/S Mean For Investors?

The southerly movements of Fingerprint Cards' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Fingerprint Cards maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Fingerprint Cards has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FING B

Fingerprint Cards

A biometrics company, engages in the development, production, and marketing of biometric systems in Sweden, France, Hong Kong, China, the United States, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives