As the pan-European STOXX Europe 600 Index remains relatively flat amid ongoing U.S. and European trade talks, major stock indexes in Europe show mixed results with Italy’s FTSE MIB gaining slightly and Germany's DAX and France's CAC 40 Index remaining stable. In this environment of cautious optimism, identifying high-growth tech stocks in Europe involves looking for companies that can leverage technological innovation to capitalize on emerging market opportunities while navigating economic uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We'll examine a selection from our screener results.

Valneva (ENXTPA:VLA)

Simply Wall St Growth Rating: ★★★★☆☆

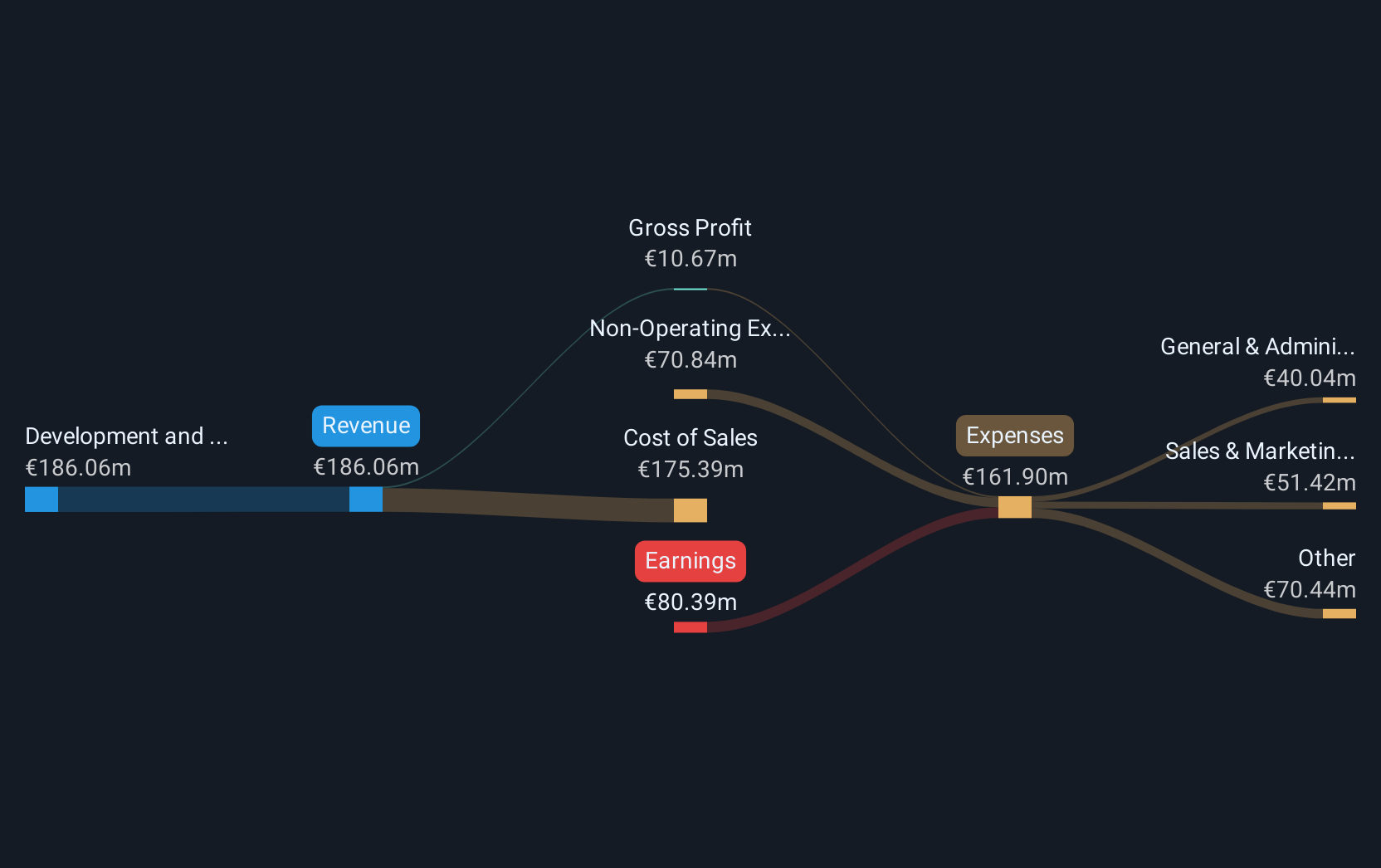

Overview: Valneva SE is a specialty vaccine company focused on the development, manufacturing, and commercialization of prophylactic vaccines for infectious diseases with unmet needs, and it has a market capitalization of €511.89 million.

Operations: Valneva SE generates revenue primarily through the development and commercialization of prophylactic vaccines, with reported revenues of €186.06 million. The company's focus on addressing infectious diseases with unmet needs positions it uniquely within the vaccine industry.

Valneva SE, a European biotech firm, recently announced a strategic partnership with CSL Seqirus to enhance the distribution of its vaccines in Germany, marking a significant step in its commercial strategy. This move comes alongside positive regulatory developments as the European Medicines Agency (EMA) lifted restrictions on Valneva's chikungunya vaccine IXCHIQ for older adults, reinforcing its safety profile and market potential. With product sales hitting EUR 48.6 million in Q1 2025 and projected annual growth to EUR 170-180 million, Valneva is navigating towards robust financial health driven by innovative vaccine solutions. These developments not only bolster Valneva’s position in the high-growth biotech landscape but also underscore its commitment to addressing global public health challenges through groundbreaking medical advancements.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★☆

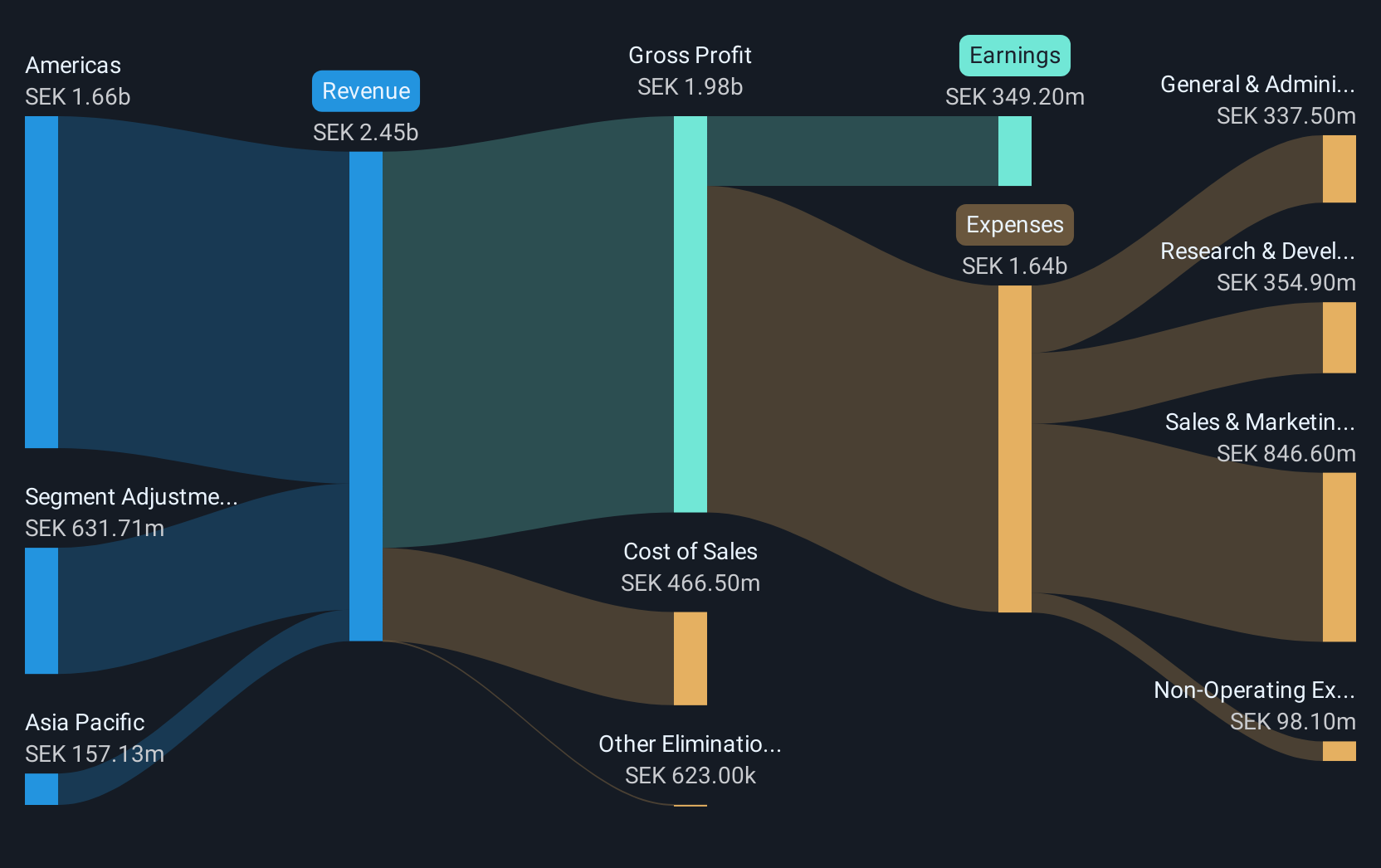

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK11.66 billion.

Operations: Yubico AB generates revenue primarily through its Security Software & Services segment, which reported SEK2.45 billion in sales. The company's focus is on providing authentication solutions across various digital platforms.

Yubico, amid its recent expansion of YubiKey as a Service across the EU, has demonstrated an agile response to the growing demand for robust cybersecurity solutions. This strategic rollout enhances accessibility and simplifies the adoption of phishing-resistant multi-factor authentication, crucial in today’s digital landscape. With first-quarter sales rising to SEK 623.1 million from SEK 498.9 million year-over-year and a net income of SEK 51.3 million, Yubico is not just increasing its market footprint but also reinforcing its financial stability. Moreover, their innovative approach in service delivery and product development positions them well within Europe's high-growth tech sector despite a slight dip in net income compared to last year.

- Click to explore a detailed breakdown of our findings in Yubico's health report.

Understand Yubico's track record by examining our Past report.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

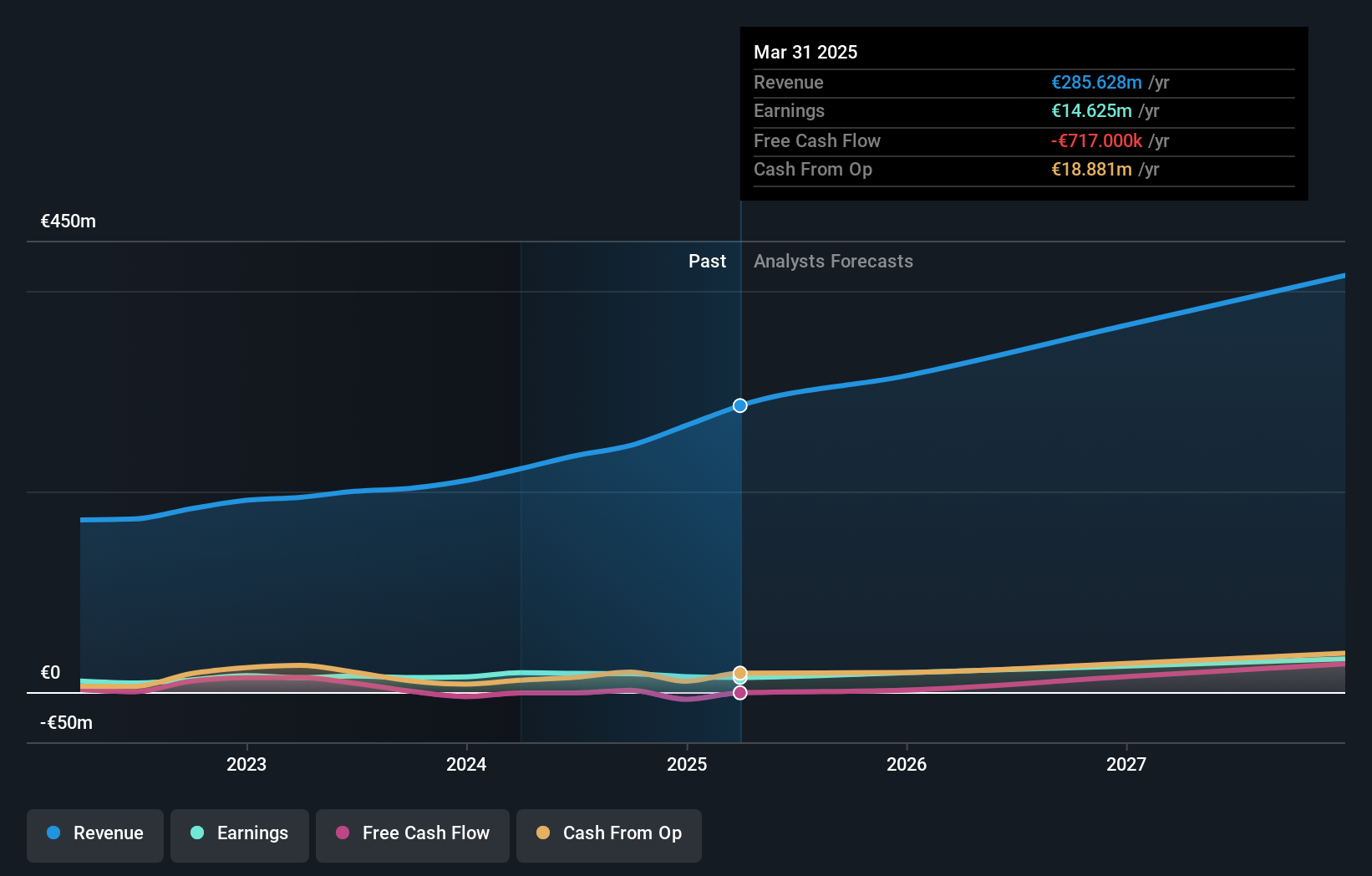

Overview: init innovation in traffic systems SE, along with its subsidiaries, offers intelligent transportation systems solutions for public transportation globally and has a market cap of €424.67 million.

Operations: The company generates revenue primarily from its wireless communications equipment segment, which accounts for €285.63 million. The business focuses on providing intelligent transportation systems solutions for public transportation worldwide.

Init innovation in traffic systems SE, amidst a dynamic European tech landscape, recently raised its 2025 fiscal year guidance following a significant $60 million boost from the MARTA Board for the AFC 2.0 project. This adjustment projects revenues to hit between EUR 340 million and EUR 370 million, with EBIT expected to range from EUR 32 million to EUR 35 million. Despite this revenue uplift, earnings impacts remain tempered due to outsourced construction costs. The firm's strategic involvement in high-profile public transport projects not only underscores its pivotal role within the sector but also reflects a robust growth trajectory with an annual revenue increase of 13.7% and earnings growth forecast at an impressive rate of 29.2% per year, outpacing Germany's average market growth significantly.

Where To Now?

- Discover the full array of 229 European High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives