Truecaller (OM:TRUE B) Margin Compression Challenges Bullish Profitability Narratives

Reviewed by Simply Wall St

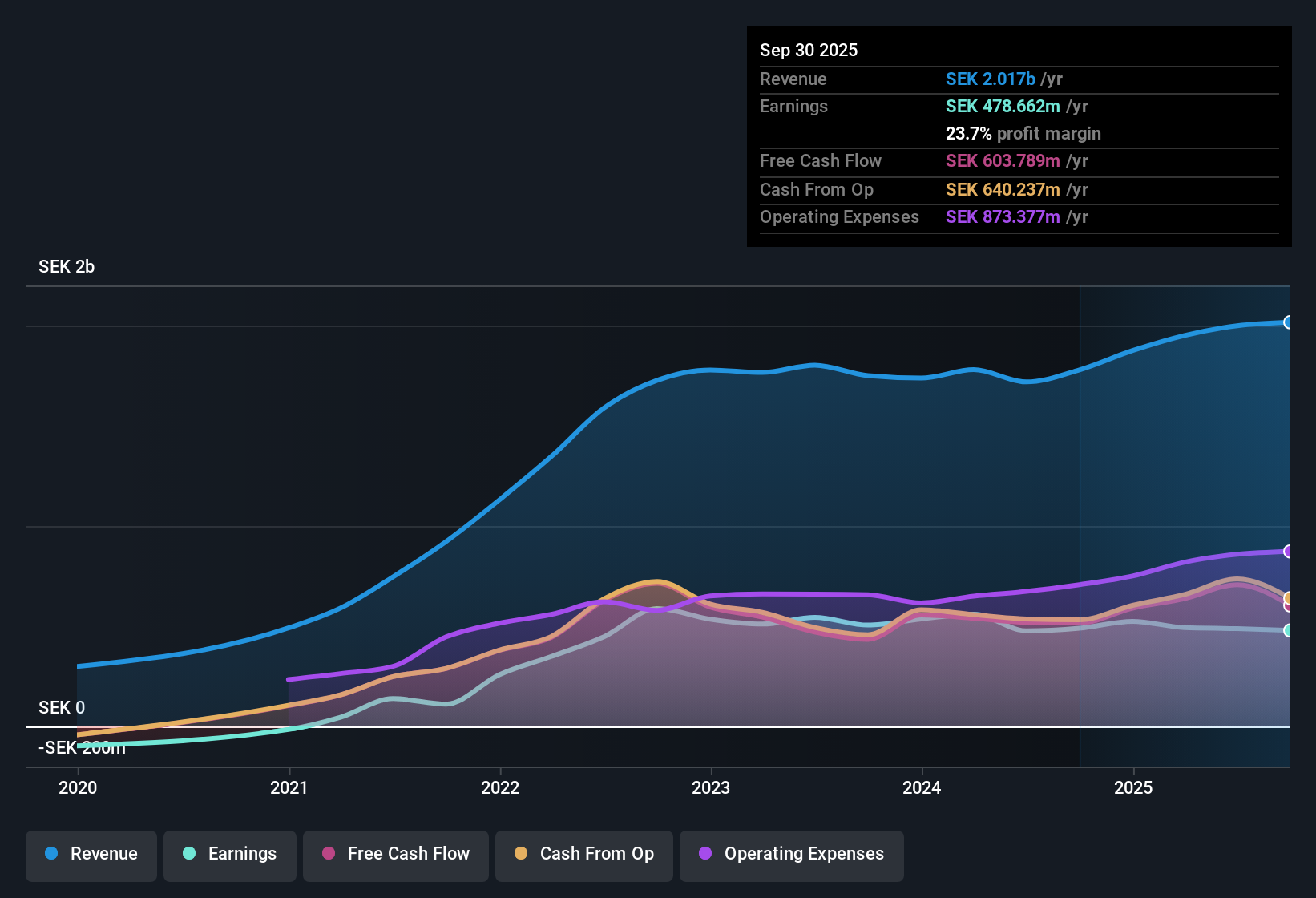

Truecaller (OM:TRUE B) posted a net profit margin of 23.7%, down from last year’s 27.6% as margin compression weighed despite ongoing profitability. The company has delivered strong annual earnings growth of 23.6% over the past five years and is expected to maintain momentum, with forward earnings projected to rise 17.8% per year and revenues forecast to increase 16.4% annually, easily outpacing the Swedish market’s averages. Although the recent dip in margins may grab attention, Truecaller’s consistently positive earnings and robust outlook put the spotlight on its growth drivers for investors this season.

See our full analysis for Truecaller.Next up, we will see how these headline figures compare with the prevailing narratives and investor expectations in the market. Some stories might gain support while others could face fresh scrutiny.

See what the community is saying about Truecaller

Margin Pressures Outpace Analyst Hopes

- Net profit margin dropped to 23.7%, down from 27.6%, representing a notable decline even as overall profits remain positive.

- According to the analysts' consensus view, expectations for margin expansion are high, with models forecasting a rebound to 31.6% in three years.

- Consensus narrative notes heavy investment in B2B and subscription revenues may offset recent compression, but continued exposure to higher tax rates in India stands to dampen future net profit margins despite product innovation and user growth.

- While premium subscription growth is robust, actual margin results have yet to prove the full upside that long-term bulls forecast, and the timing of any profit recovery remains uncertain for cautious investors.

- For a balanced look at whether these margin trends support sustained growth or create new risks, uncover the full story in the consensus narrative. 📊 Read the full Truecaller Consensus Narrative.

Valuation Discounts vs. Peers Stand Out

- Truecaller’s price-to-earnings ratio of 20.8x trades at a steep discount to the Swedish software industry average of 30.8x and peer average of 55.9x, while current share price (SEK29.02) remains well below both the DCF fair value (SEK57.18) and analyst target (SEK64.00).

- Analysts' consensus view maintains that several supporting factors, including a forecasted earnings growth rate of 17.8% annually and revenue set to grow 16.4% per year (vs. market’s 3.7%), justify this valuation upside.

- However, consensus also highlights disagreement over the degree of premium justified, with more cautious estimates suggesting that future profit growth could be less robust if ad sales stall or tax rates climb further.

- The narrative points out that for investors to anticipate upward re-pricing, they must believe share performance will eventually catch up to the company's strong forecasted fundamentals, not just low multiples.

Revenue Diversity Buffers Market Cycles

- Truecaller is shifting from heavy dependence on low-margin ad revenue toward recurring subscription, B2B, and direct ad sales, with proprietary formats now making up roughly 10 to 15% of total ad revenues.

- Consensus narrative observes that while diversified income streams and community-powered network effects enhance long-term stability, challenges remain.

- The company’s 85 to 90% reliance on third-party programmatic advertising still exposes results to abrupt swings when macro headwinds or advertiser pullbacks hit the digital ad market.

- With the majority of earnings recognized internationally, mainly from India, future currency movements and local tax burdens continue to pose unpredictable risks, despite ongoing product and platform development.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Truecaller on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the figures from a unique angle. In just a few minutes, you can transform fresh insight into your own narrative: Do it your way

A great starting point for your Truecaller research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Truecaller's strong growth outlook, its reliance on volatile ad revenue and recent margin compression could mean uneven returns if conditions shift.

If you want stocks offering steadier expansion year after year, check companies with stable growth stocks screener (2122 results) and put consistent performance at the center of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)