- Italy

- /

- Personal Products

- /

- BIT:ICOS

3 Elite Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets experience a divergence, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs amid a rally in growth stocks, investors are keenly observing the performance of companies that manage to stand out in such a mixed environment. In this context, growth stocks with significant insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best, potentially aligning management's interests with those of other shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Let's dive into some prime choices out of the screener.

Intercos (BIT:ICOS)

Simply Wall St Growth Rating: ★★★★☆☆

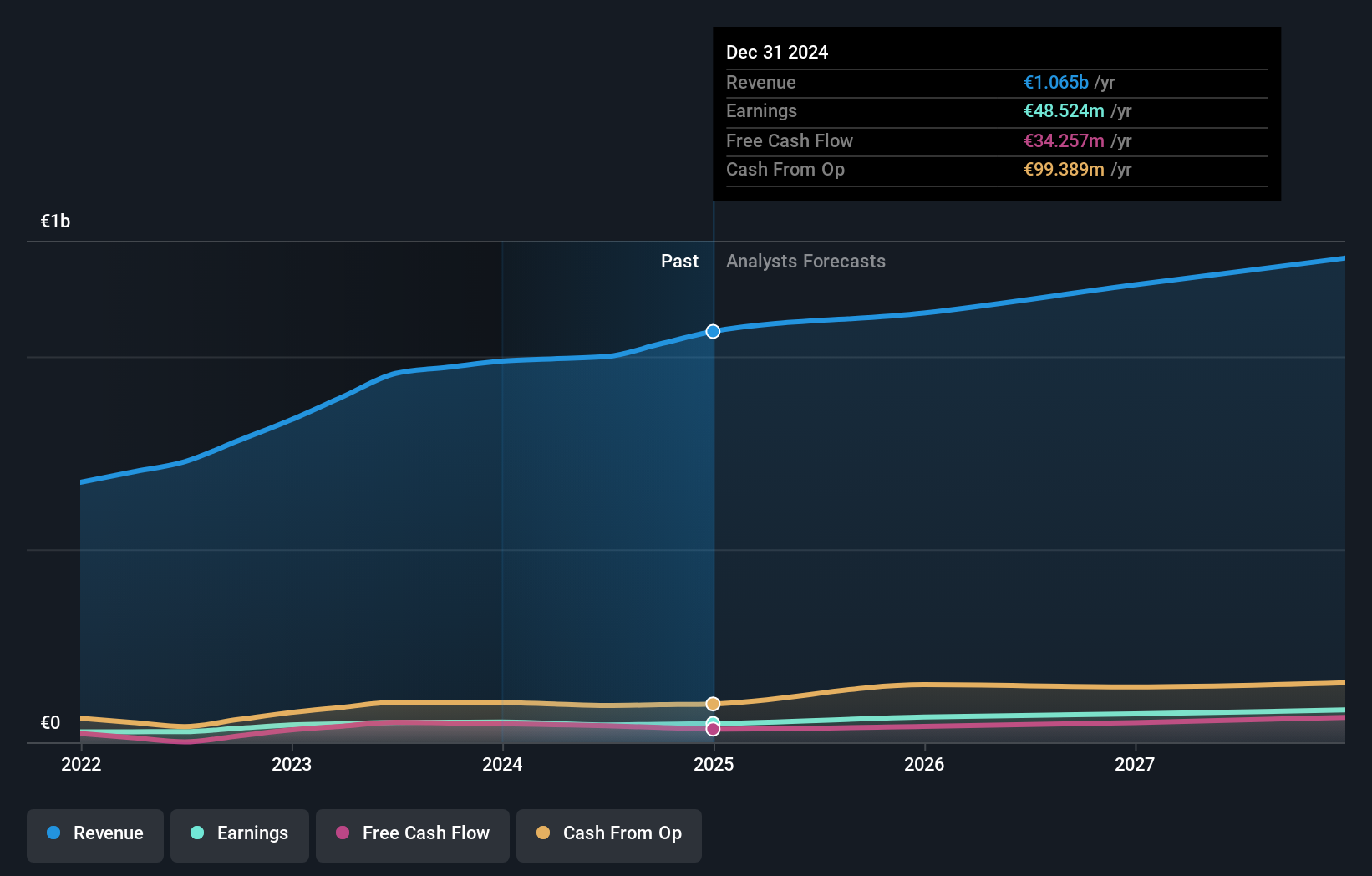

Overview: Intercos S.p.A., along with its subsidiaries, is engaged in the creation, production, and marketing of cosmetics and skin care products on a global scale, with a market capitalization of €1.38 billion.

Operations: The company's revenue segments comprise €578.55 million from the Make up Line, €168.48 million from the Skin Care Line, and €252.73 million from the Hair & Body line.

Insider Ownership: 32.2%

Earnings Growth Forecast: 22.6% p.a.

Intercos exhibits strong growth potential with earnings projected to rise 22.6% annually, outpacing the Italian market's 7.1% rate. Despite a forecasted low return on equity of 14.5%, analysts agree on a potential stock price increase of 24.6%. While revenue growth at 7.9% lags behind high-growth benchmarks, it still surpasses the broader market's pace, reflecting solid prospects for this company with substantial insider ownership influence and alignment with shareholder interests.

- Navigate through the intricacies of Intercos with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Intercos implies its share price may be too high.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK10.62 billion.

Operations: The company's revenue segments are comprised of SEK6.43 billion from Sweden, SEK2.39 billion from Norway, and SEK2.41 billion from other markets.

Insider Ownership: 10.2%

Earnings Growth Forecast: 20.6% p.a.

Rusta's earnings are projected to grow significantly at 20.6% annually, surpassing the Swedish market's average of 15.2%. Although revenue growth is slower at 8.6%, it still exceeds the market rate of 0.3%. Recent expansions, including new stores in Sweden and Norway, align with its growth strategy. Despite a recent decline in quarterly net income to SEK 58 million, Rusta trades well below its estimated fair value, indicating potential for future appreciation amidst high insider ownership influence.

- Take a closer look at Rusta's potential here in our earnings growth report.

- Our valuation report here indicates Rusta may be undervalued.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥191.43 billion.

Operations: The company generates revenue primarily from its Platform Business, amounting to ¥27.09 billion.

Insider Ownership: 23.8%

Earnings Growth Forecast: 74% p.a.

freee K.K. is set to become profitable within three years, with earnings projected to grow at 73.97% annually, outpacing the market's average growth. Revenue is expected to rise by 18.3% per year, faster than the Japanese market but below 20%. Despite high share price volatility recently and trading at 41% below its estimated fair value, robust insider ownership could influence strategic decisions positively as it approaches profitability.

- Click to explore a detailed breakdown of our findings in freee K.K's earnings growth report.

- In light of our recent valuation report, it seems possible that freee K.K is trading behind its estimated value.

Seize The Opportunity

- Access the full spectrum of 1511 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ICOS

Intercos

Intercos S.p.A., together with its subsidiaries, creates, produces, and markets cosmetics and skin care products worldwide.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives