In the wake of a significant political shift in the U.S., global markets have experienced notable gains, with major benchmarks like the S&P 500 and Nasdaq Composite reaching record highs. This optimism is fueled by expectations of accelerated earnings growth and regulatory changes, creating an environment ripe for investors seeking opportunities in companies poised for expansion. In such a market, stocks with strong growth potential and substantial insider ownership can be particularly appealing, as they often indicate confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Underneath we present a selection of stocks filtered out by our screen.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of approximately SEK10.78 billion.

Operations: The company's revenue is segmented as follows: SEK2.39 billion from Norway, SEK6.43 billion from Sweden, and SEK2.41 billion from other markets.

Insider Ownership: 10.2%

Earnings Growth Forecast: 20.7% p.a.

Rusta AB demonstrates strong growth potential with earnings expected to grow significantly, outpacing the Swedish market. Recent expansions, including new stores in Sweden and Norway, align with its long-term growth strategy. Despite trading at a substantial discount to estimated fair value, Rusta maintains high insider ownership without recent substantial insider trading activity. The company's revenue is forecasted to grow faster than the Swedish market but slower than 20% annually.

- Delve into the full analysis future growth report here for a deeper understanding of Rusta.

- In light of our recent valuation report, it seems possible that Rusta is trading behind its estimated value.

S Foods (TSE:2292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related food products with a market cap of ¥85.99 billion.

Operations: S Foods Inc. generates revenue through its operations in manufacturing, wholesaling, retailing, and food servicing of meat-related products in Japan.

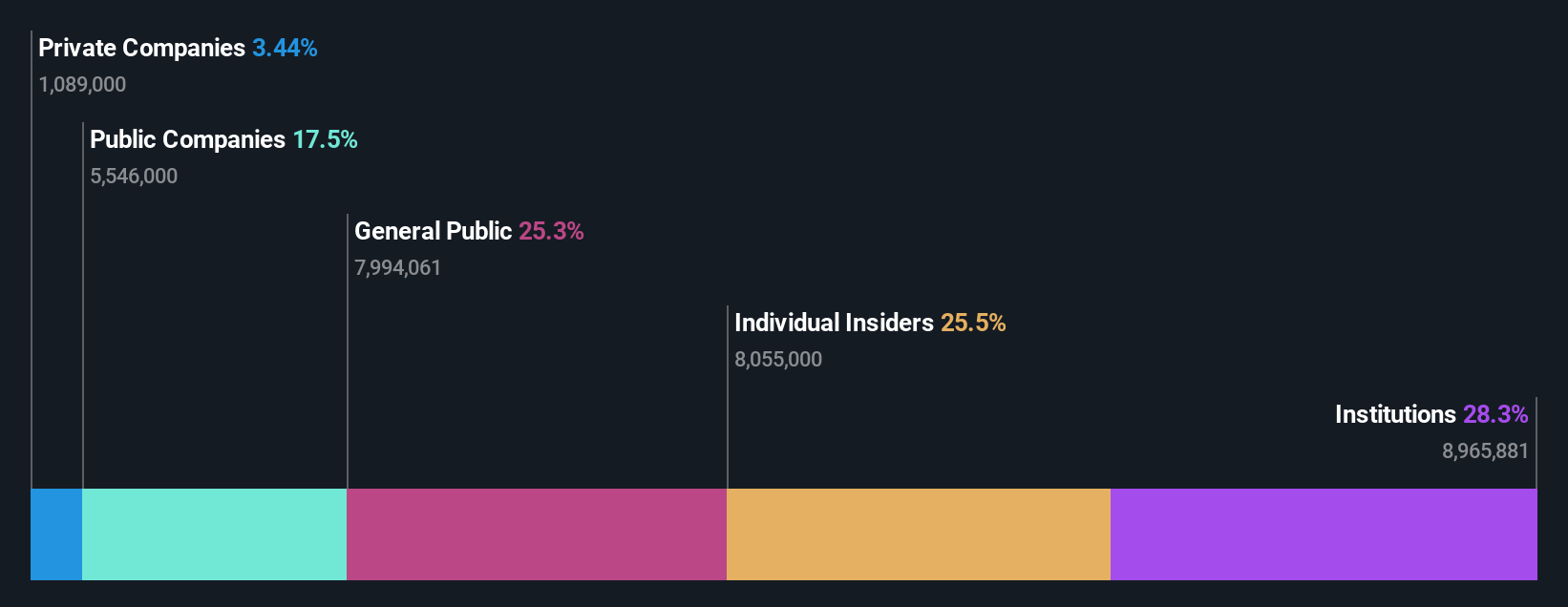

Insider Ownership: 25.5%

Earnings Growth Forecast: 28.4% p.a.

S Foods Inc. is poised for growth, with earnings projected to increase significantly at 28.4% annually, outpacing the Japanese market. Despite trading at a notable discount to its estimated fair value, challenges include low profit margins and a dividend not well covered by earnings or cash flows. Recent guidance anticipates net sales of JPY 445 billion and operating profit of JPY 7.3 billion for fiscal year ending February 2025, supporting its growth trajectory amidst high insider ownership.

- Dive into the specifics of S Foods here with our thorough growth forecast report.

- Our valuation report unveils the possibility S Foods' shares may be trading at a premium.

Fullcast Holdings (TSE:4848)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fullcast Holdings Co., Ltd. and its subsidiaries offer human resource solutions in Japan, with a market cap of ¥50.64 billion.

Operations: Fullcast Holdings Co., Ltd. generates revenue through its provision of human resource solutions in Japan.

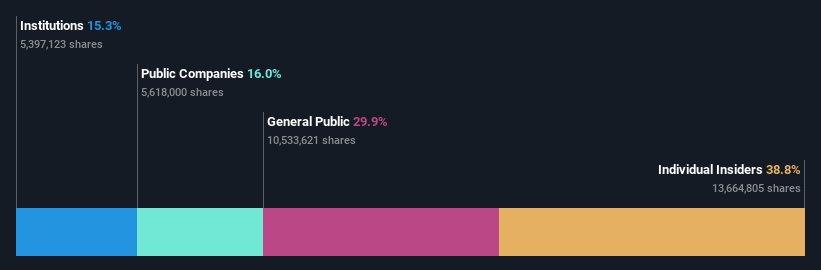

Insider Ownership: 38.8%

Earnings Growth Forecast: 12% p.a.

Fullcast Holdings demonstrates potential for growth, with earnings forecasted to rise at 12% annually, surpassing the Japanese market's average. The company trades at a significant discount relative to its estimated fair value and shows favorable valuation metrics compared to industry peers. However, revenue growth is projected at a modest 7.3% per year. While the dividend track record remains unstable, recent dividend increases indicate management's commitment amidst high insider ownership levels.

- Navigate through the intricacies of Fullcast Holdings with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Fullcast Holdings' share price might be on the cheaper side.

Taking Advantage

- Click this link to deep-dive into the 1528 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Rusta, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives