- Poland

- /

- Specialty Stores

- /

- WSE:OPN

Undiscovered Gems In Europe To Explore This April 2025

Reviewed by Simply Wall St

As European markets navigate the challenges of new U.S. trade tariffs and fluctuating consumer sentiment, investors are keenly observing how these dynamics impact small-cap stocks across the region. With economic indicators showing a mixed outlook, identifying companies with strong fundamentals and growth potential becomes crucial for those exploring opportunities in Europe's diverse landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -2.06% | -8.96% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

SIMONA (DB:SIM0)

Simply Wall St Value Rating: ★★★★★☆

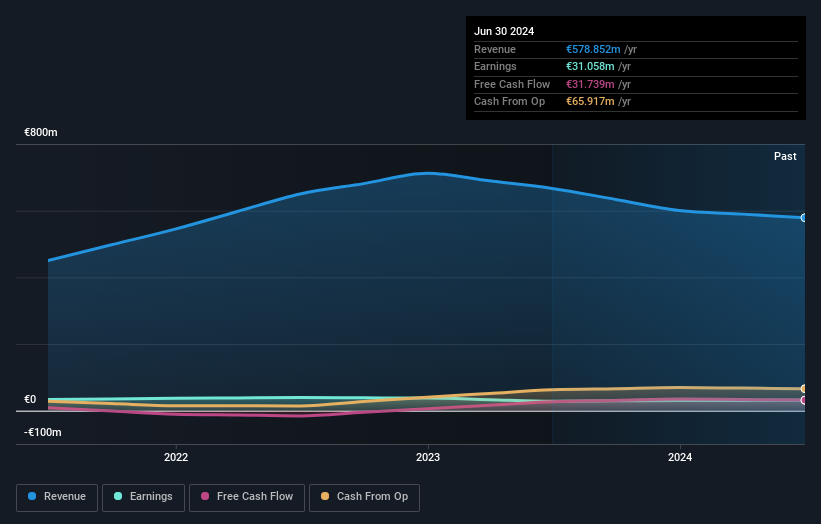

Overview: SIMONA Aktiengesellschaft is a company that specializes in the development, manufacturing, and marketing of semi-finished thermoplastics, pipes, fittings, and profiles on a global scale with a market capitalization of €294 million.

Operations: SIMONA generates revenue primarily from its semi-finished plastics, pipes, fittings, and finished parts segment, totaling €578.85 million. The company's financial performance is influenced by various cost factors associated with production and distribution within this segment.

With earnings growing 9.6% annually over the past five years, SIMONA appears to be a promising player in its sector. The company's debt-to-equity ratio has risen from 9.6% to 17.9%, yet it maintains a satisfactory net debt-to-equity ratio of 0.8%. Trading at an attractive valuation, it's currently priced at 73.7% below estimated fair value, suggesting potential upside for investors seeking value opportunities in Europe. While its interest payments are comfortably covered by EBIT at a multiple of 22 times, the share price has shown significant volatility recently, which could present both risks and opportunities for investors.

- Click to explore a detailed breakdown of our findings in SIMONA's health report.

Evaluate SIMONA's historical performance by accessing our past performance report.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

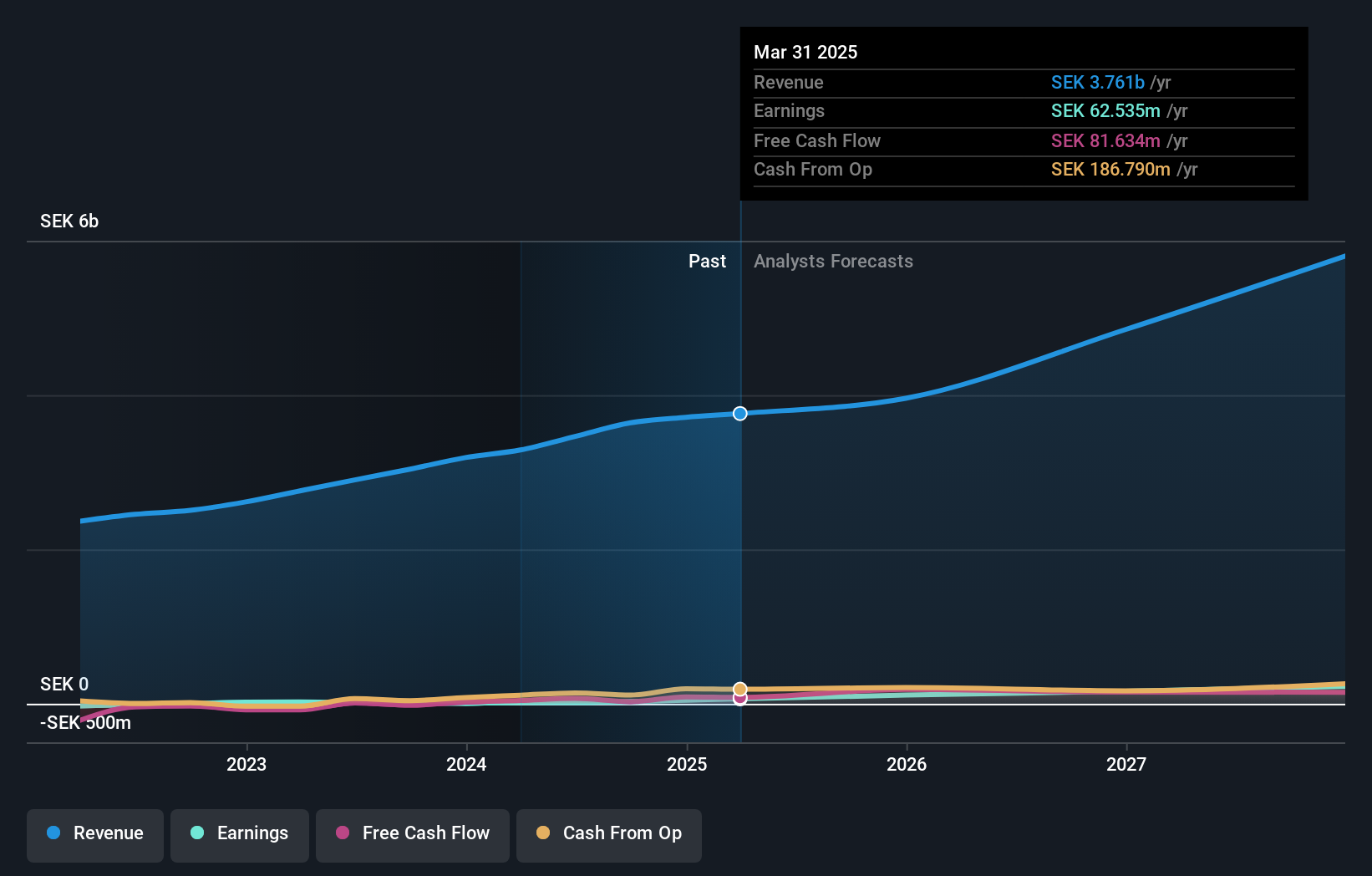

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products, operating across Sweden, Norway, the rest of Europe, and the United States with a market cap of approximately SEK2.92 billion.

Operations: Haypp Group generates revenue primarily from three segments: Core (SEK2.62 billion), Growth (SEK989.69 million), and Emerging Market (SEK71.12 million).

Haypp Group, a nimble player in the specialty retail sector, has shown impressive momentum with earnings surging 793% last year, far outstripping the industry's modest 3.2% rise. The company's debt management appears prudent with a net debt to equity ratio of 10.5%, reflecting satisfactory financial health over the past five years as it decreased from 17.8% to 15.8%. Trading at nearly 89% below its estimated fair value, Haypp's stock presents an intriguing proposition for those eyeing potential undervaluation opportunities amidst its robust interest coverage and high-quality earnings profile.

Oponeo.pl (WSE:OPN)

Simply Wall St Value Rating: ★★★★☆☆

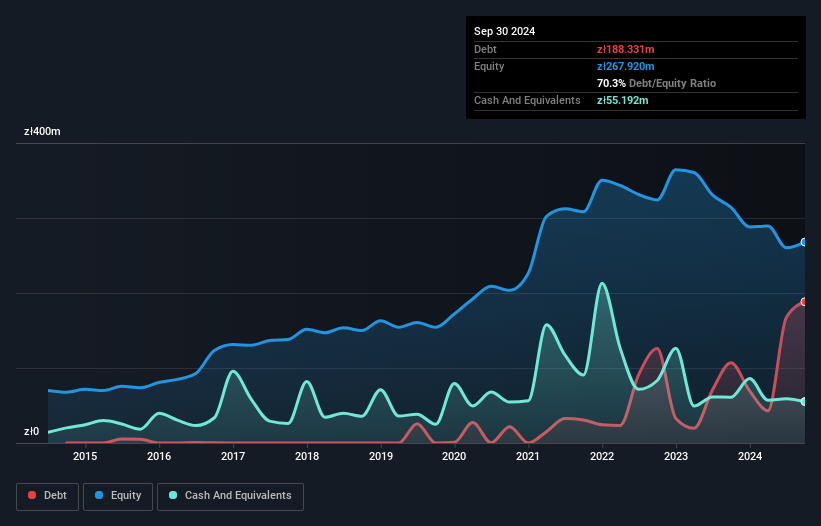

Overview: Oponeo.pl S.A. operates as an online retailer specializing in tires and wheels for motor vehicles, serving both the Polish market and international customers, with a market cap of PLN 1.09 billion.

Operations: Oponeo.pl generates revenue primarily from car accessories, contributing PLN 1.69 billion, and bicycles and bicycle accessories, which add PLN 271.55 million. The tools segment accounts for PLN 91.02 million in revenue. Segment adjustment is noted at -PLN 53.98 million.

Oponeo.pl, a notable player in the European specialty retail sector, has demonstrated impressive earnings growth of 166.1% over the past year, significantly outpacing the industry’s -22.6%. Despite its high net debt to equity ratio of 49.7%, which could be a concern for some investors, the company's interest payments are well covered by EBIT at 17 times coverage. The firm is trading slightly below its fair value estimate by 0.6%, suggesting potential undervaluation in the market. With revenue expected to grow annually by over 10%, Oponeo.pl appears poised for continued expansion within its niche market space.

- Click here and access our complete health analysis report to understand the dynamics of Oponeo.pl.

Review our historical performance report to gain insights into Oponeo.pl's's past performance.

Seize The Opportunity

- Dive into all 349 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:OPN

Oponeo.pl

Engages in the online retail of tires and wheels for motor vehicles in Poland and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives